What's the Biggest Mistake Investors Make?

Rather than individual investors trying to pick the right stocks, the best investment vehicle or most promising region, they should instead focus on an aspect of investing that could make the biggest difference to long-term returns: staying invested.

It’s tempting to try and second-guess the market. We frequently take a view on when stock markets have had enough of a run, or we may be propelled by instinct to make a move. Yet dipping in and out of the market in this way – fuelled by our gut, misinformed by market noise and riddled with biases – will typically lead to serious underperformance.

This sequence of behaviour is heightened when there is increased market volatility or greater uncertainty. We sense we should act to counter what we can’t predict. But we could do well to take our cue from a phrase that has been attributed to both Clint Eastwood and the politician Adlai Stevenson: “Don’t just do something, stand there”.

Instead of acting rashly, it usually pays to take a step back and evaluate a situation.

The irrefutable benefits of staying invested

There is clear evidence of the cost of moving in and out of the market at different times over a long period – a trend that is replicated across asset classes and around the world.

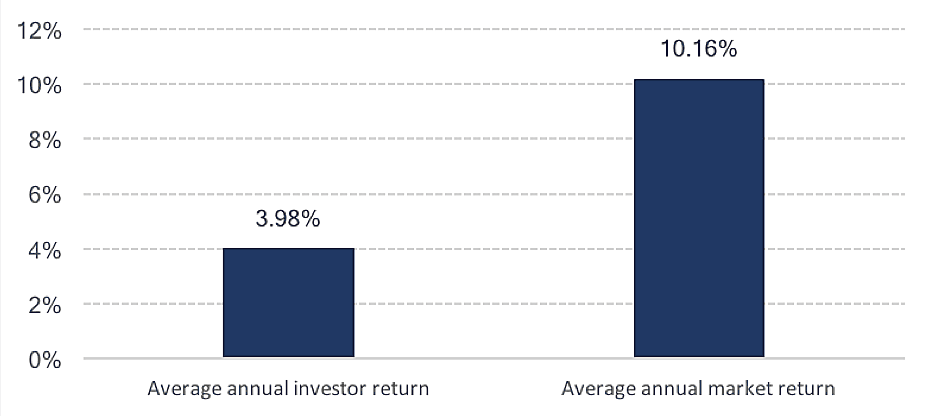

A leading study by Dalbar Associates found that over the 30 years to the end of 2016, the average investor in US stocks received a return of less than half the broader market return per annum (3.98% for the investor vs 10.16% for the market). This shortfall is due in part because they have repeatedly chosen the wrong points to trade in and out of the market.

It means that such investors have to invest more of their money, for longer, to reach the same outcome.

Comparison of 30 year average annual investor and

market returns in US equities

Source: Dalbar Associates. Returns from 1st January 1987 to 31st December 2016, in US dollars.

This study was reinforced by findings reported in the Winter 2016 edition of The Journal of Portfolio Management.1 By comparing actual investor time weighted returns to reported ‘buy and hold’ mutual fund performance, their analysis showed meaningful shortfalls, which is predominantly attributed to poor market timing.

The deficit was apparent across all mutual fund styles (-1.92% difference), but interestingly it was particularly evident across index funds (-2.72% difference). Perhaps this suggests, paradoxically, that while index fund investors acknowledge the evidence that active managers struggle to persistently outperform their benchmark after fees2, they themselves believe they can ‘time the market.’

The lesson, again, is to stay invested for significantly higher returns over time.

How biases serve to heighten our losses

We’re not cut out to consistently make accurate predictions about the market. Various psychological biases mean we tend to place a greater importance on our instincts, instead of the facts – even if we are not aware that we do so.

For example, loss aversion, a tendency first identified by the behavioural economists Daniel Kahneman and Amos Tversky in 1979, proposed that the pain of losing is psychologically about twice as powerful as the potential pleasure of a gain. This bias, therefore, may cause us to sell assets too early. Overconfidence, on the other hand, is where confidence in our ability is greater than the impartial accuracy of our judgements. It’s not surprising, then, that we may take a decision to act without supporting data to corroborate our views.

Another notable example is herd behaviour, where we thoughtlessly follow the actions of others – it is common to witness an irrational selling spree if poor economic or company news emerges.

Don’t just do something, stay invested

The case against moving in and out of the market – commonly known as trying to ‘time the market’ is clear. The numbers don’t add up.

Our role as a discretionary wealth manager is to navigate client assets through uncertain times as well as when conditions are calmer. We look for diversification when building client portfolios to protect against uncertainties, because every investment will probably go through a period when it underperforms.

Further, our clients have the best chance of meeting their investment goals when we take a longer-term attitude with their capital and avoid hasty reactions to events.

1 The Journal of Portfolio Management by Hsu et al – “Timing Poorly: A Guide to Generating Poor Returns While Investing in Successful Strategies” http://jpm.iijournals.com/content/42/2/90

2 Fleeting Alpha: Evidence From the SPIVA and Persistence Scorecards https://us.spindices.com/documents/research/research-fleeting-alpha-evidence-from-the-spiva-and-persistence-scorecards.pdf

Please remember that when investing your capital is at risk.