The ins and outs of a Junior ISA

The qualities that make ISAs so attractive are very similar for their junior counterparts, but there are some differences.

- As with a regular ISA, growth is tax free in a JISA. Proceeds are also eventually paid tax free.

- For the 2020/21 tax year, up to £9,000 can be invested in a JISA.

- You cannot access the money in a JISA until the child is 18, unlike other forms of children’s savings.

- However, a JISA can be easily converted into a regular ISA at age 18, allowing the child to benefit from further tax-free growth as an adult.

- Lack of early access can have a significant positive impact. If you use the full allowance annually for 18 years, a sum of £279,000 (calculations below) could be available for a child at age 18.

This accrued sum could be used as a significant deposit for a property, or could be used to fund the entirety of a university education.

An ideal long-term preparation for your children’s future

The benefits of compounding plus the tax-free benefits in a JISA make a big difference if you want to ensure your child has a reasonable (or even substantial) lump sum at age 18. When you consider how much less you must pay out compared to gifting a lump sum, a JISA makes perfect sense.

For example, if you invest the annual limit of £9,000 each year for 18 years you could build up a sum of £279,000 – for an outlay of £162,000 in total. Compare that to gifting the larger sum to your child in 18 years to use as a deposit for a house.

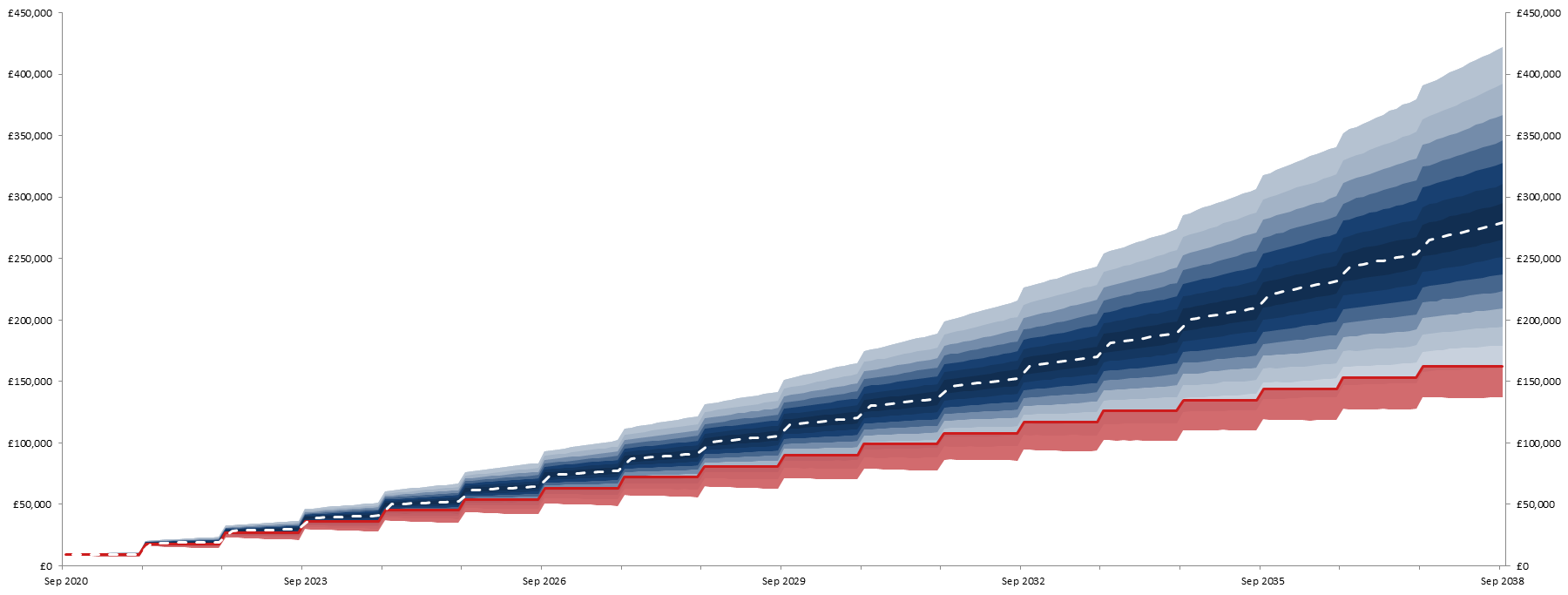

How a JISA pot can build up over time

Simulated future performance numbers should not be relied upon as an indicator of future performance. The illustration above shows the potential portfolio value for a JISA portfolio that is contributed to for 18 years, with the white line representing the average return scenario from a Netwealth Risk Level 7 portfolio. The net projected rate of return in this case is 5.5% per annum.

A JISA could also prove to be a smart route to help mitigate inheritance tax issues. For example, contributions to JISAs by parents could be counted as regular gifts out of excess income and so the capital would be outside of their estate for inheritance tax purposes immediately. Contributing £9,000 to a JISA for 18 years would therefore remove £162,000 from your estate and save up to £64,800 in inheritance tax.

Remember, like all ISAs your annual allowance must be used each year, or it is lost. If possible, you should fund your JISA at least partly each year so you don’t lose that allowance for good.

JISAs: today’s answer to a significant sum saved tomorrow

The long-term benefits of a Junior ISA are considerable – especially if your goal is to achieve a sizable sum saved for a child when they reach 18. There are other options to save for a child’s future, but they are rarely as efficient or offer the potential for a child’s pot to grow as much.

Even better, a JISA can be easily converted to an adult ISA once the child reaches 18, therefore continuing the savings habit – and helping them to perhaps achieve an even greater goal.

Please remember that when investing your capital is at risk.