Assessing the inflation challenge

This week we learned that the annual rate of consumer price inflation rose to 3.2% in August. A year ago, in August 2020, the annual rate of inflation was only 0.2%. The continued rise in inflation vindicates our commentary on this topic over the last year. What is accounting for this rise in inflation, what will happen next and what are the implications for policy?

There are many factors that have contributed to higher annual inflation.

It is worth noting the challenge of comparing data over recent months with the same period last year, when the UK and world economy were still suffering from the consequences of the first wave of the pandemic. As the economy fell into recession in spring last year, prices fell across the board, and even though the UK economy bottomed in May last year, disinflationary pressures persisted.

But even allowing for this data challenge, the picture is one of rising inflation pressure. As economies recovered, cost pressures have risen, with higher transport costs, supply bottlenecks, as well as higher oil and commodity prices compared with a year ago. In turn, many firms have either passed on their higher costs or increased their profit margins. Wage growth has increased, too.

The pick-up in inflation is perhaps better captured by the monthly rate of change of consumer prices in the UK. In the first quarter of 2021, the monthly changes were -0.2%, 0.1% and 0.3%. Then, in the second quarter monthly inflation rose by 0.6% (April), 0.6% (May) and 0.5% (June). These were sizeable increases. But in July there was no change in monthly inflation, before it rose 0.7% in August.

Prices also high in the US

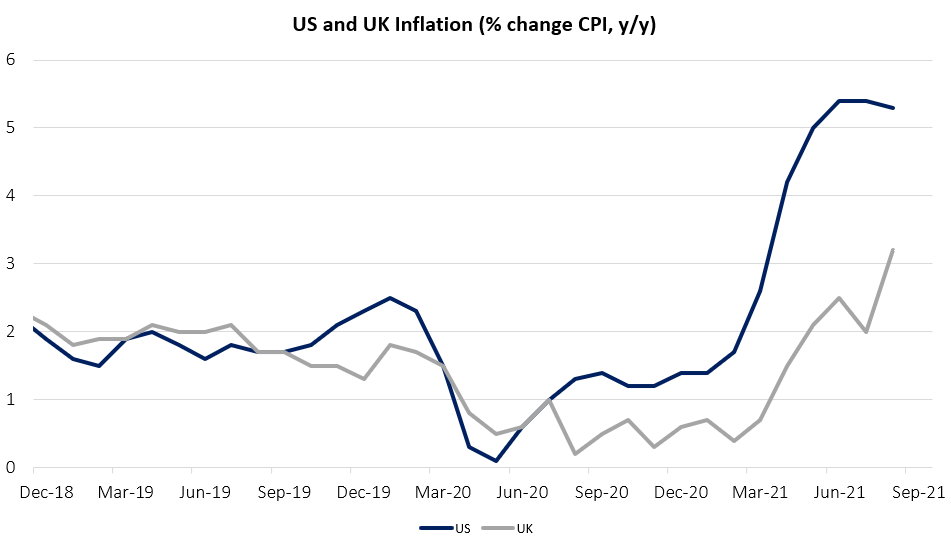

The US, too, has also seen much higher inflation and events there set the tone for financial markets. Data over the last week, however, showed the annual rate of US consumer price inflation easing from 5.4% in July to 5.3% in August. This is still high. But there too, core inflation – which excludes food and energy prices – has risen significantly this summer, compared with other countries including the UK.

Thus, there was some relief in financial markets over the last week, when the latest monthly data showed the core rate of inflation easing off. On a monthly basis, the core rate of US consumer price inflation rose significantly in the second quarter: up 0.9% in April, 0.7% in May and 0.9% in June. But in July the rise was only 0.3% and 0.1% in August.

The chart here demonstrates the recent sharp rise in US and UK consumer price inflation.

What kind of inflation are we facing?

As we have stressed in recent months, whether in the US or UK, one of the key issues is which “P” is it? Will this rise in inflation pass-through quickly, persist or become permanent?

Central banks – led by the US, but echoed here in the UK and elsewhere – have called the rise temporary and so do not believe that it is permanent. I would agree.

However, by claiming it is temporary central banks have given the impression that they do not need to act. I think that is wrong. They have not differentiated between inflation passing-through or persisting, and it is how monetary policy responds that could have a critical bearing on this.

In recent decades a combination of factors has contributed to low inflation.

In the wake of the inflationary 1970s there was a shift towards keeping inflation in check. This was seen here in the UK in terms of the anti-inflationary policies of Mrs Thatcher, and in the US under the Chairmanship of Paul Volcker at the US Federal Reserve (the Fed). Anti-inflationary policies became entrenched.

In addition, the economic environment shifted to reinforce a disinflationary environment. This was highlighted by intense competition arising from the rise of China, increasing globalisation and from technological change, which in turn contributed to the sluggish growth of wages across western economies, outside of high-skilled sectors. This environment resulted in the share of wages in national income remaining low.

Now, post pandemic, it is possible that some of these contributory factors to low inflation could change. While globalisation will remain an important influence, more slack may be built into supply chains, and driving costs lower may not be as dominant an influence on where firms locate, although it will likely still be significant.

In addition, the green agenda, while important, may have an unintended consequence of restraining investment in the production of dirty commodities, and also hydrocarbons, in which case their prices could be firmer. A possible indicator of this may be higher oil prices over the next year.

Paying attention to the risks

Inflation risks being posed to the UK and US economy need to be taken seriously. Central banks focus heavily on inflation expectations and on output gaps, the latter giving a gauge of spare capacity, to help guide their inflation thinking. However, measures of output gaps have been shown to have not always been accurate.

An additional challenge is that at times of a change in the inflation climate, expectations may be slow to adjust. This was certainly true in the early 1970s when both the US and UK saw a shift from low to high inflation and also in the early 1990s, when disinflationary pressures and the policy climate contributed to a move towards low inflation.

Recently, in both the US and UK, inflation expectations have crept higher. This makes sense. UK inflation looks set to trend higher and could reach around 4.5% by year end.

The question is what happens to policy now? Will it accommodate this increase in inflationary pressures that we are witnessing?

The policy approach

Since the spring there has been an evolution in the focus of financial markets: from a focus on strong growth and rebound; to fears about rising inflation; and then, more recently, to concern about a deceleration in growth, partly because of new variants of Covid and rising cost pressures and, in turn, feeding fears that western economies may not be able to sustain strong growth once policy stimulus wears off.

During this pandemic monetary policy has been relaxed significantly. This was understandable when economies were collapsing. Remarkably, though, the Bank of England (the Bank) and US Fed have continued to relax policy – through asset purchases – as the economy has recovered and inflation has risen.

Low policy rates mean that markets are not pricing properly for risk, while central bank purchases of government debt mean that longer-term yields are heavily influenced by non-commercial buyers. This runs the risk of feeding financial market instability.

Should the Fed or the Bank tighten through higher rates, taper by reversing asset purchases and quantitative easing, or tolerate rising inflation by continuing with both low rates and QE? As we have seen in previous episodes, tapering can spook markets if not expected or if it takes place at too rapid a pace. For the moment, the actions of the Bank and the Fed suggest they will tolerate higher inflation.

The Fed is expected to taper first, indicating soon and possibly at its forthcoming FOMC meeting that it will reduce its asset purchases. This is not before time. Tapering will be gradual, with tightening via higher rates unlikely before 2023.

In the UK, meanwhile, the Bank’s inaction could allow inflation pressures to persist. I would favour a gradual, predictable and imminent shift in reversing QE, with higher policy rates left until the economy is on a firmer footing. The economy and markets may find it hard to handle a double whammy of higher rates and tapering via reversing QE, thus it will have to be phased.

I certainly do not think that inflation will rise permanently. Indeed, in a recent interview for the FT Adviser podcast, I was asked whether inflation was the biggest medium-term problem facing the UK and my response was “no” – it is the need to raise productivity and the trend rate of growth.

The latter, that growth supersedes inflation and debt, was a message in my recent column in The Times. But in saying this, it is important to not underestimate the current inflation challenge, and that it may persist rather than pass-through quickly.

The Monetary Policy Committee’s (MPC) approach to the sequencing of monetary policy tools was outlined in August, in the Monetary Policy Report: “Weighing the above factors together, the MPC intends to begin to reduce the stock of purchased assets, by ceasing to reinvest maturing assets, when Bank Rate has risen to 0.5% and if appropriate given the economic circumstances.”

The MPC judges that the reduction in the stock of purchased assets should initially occur through “ceasing the reinvestment of maturing assets”, to allow the reduction to occur at a gradual and predictable pace.

Please note, the value of your investments can go down as well as up.