Build Your Smart Financial Plan in 7 Steps

A sound financial plan will go a long way to help you better achieve your goals in life. While such an initiative may sound daunting, there are specific steps you can take to get started and navigate successfully along the way.

1. Where do you stand today?

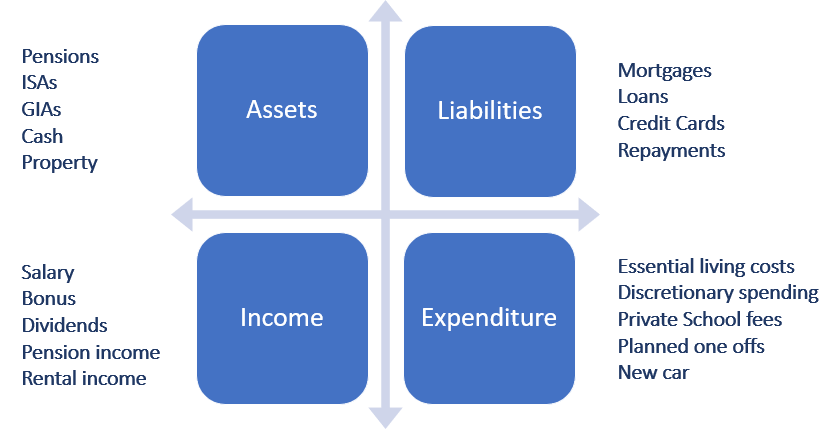

Before you start planning you should work out the value of all your assets – these might be savings, property, a pension, ISAs and general investments. You may also have one or more sources of income: this could include a salary, dividends, or an income from a pension.

On the other side of the balance sheet are your liabilities, things you are paying for, such as mortgages, loans and credit card repayments. You must also factor in your living costs and the various other things you decide to spend money on, such as school fees, your lifestyle or renovating a home.

So the first thing to do is to think carefully about the figures which populate these four boxes to get an accurate view of where you stand today.

2. Setting your financial goals

Try and understand what your financial goals might be. For many of us that may mean multiple goals, but typically they will fall into one or two types:

One, is to save up to fund regular future outgoings. For example, if you are in your 50s now you may think about a regular sum you’d like to receive in retirement, or you may be facing school fees that you may need to fund for some time.

Two, you may also have a particular purchase in mind, or want to build a rainy-day fund. It could be for something specific or something you don’t yet know about – but either way you are deliberately trying to achieve a certain level of savings for the future.

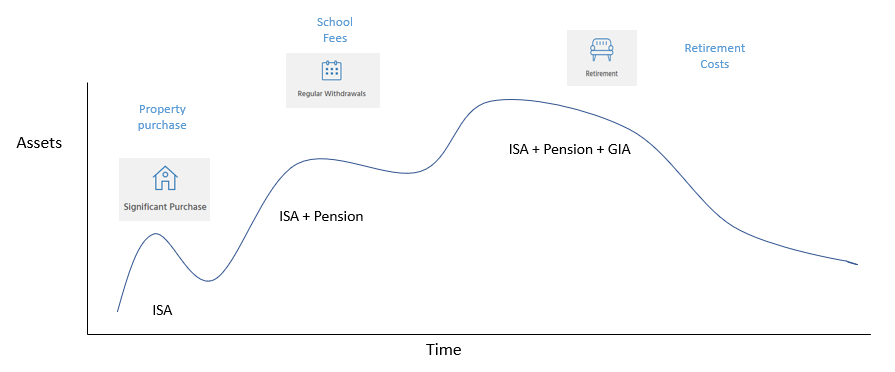

Importantly, your financial goals will also evolve with you, as exemplified in the graphic below. Over time, your needs change, and the investments you must make to support those needs change as well. When you are young you will likely start to save a little, so you may want to take advantage of an ISA tax wrapper. Over time you may contribute to your pension, giving you two lots of tax-efficient savings, and you may also grow your general investments outside of a tax wrapper.

Your expenditure will change, too – you could be saving for a property when you are younger, then perhaps have to pay out for school fees, before funding a retirement later in life. Setting clear financial goals gives you a greater sense of control and helps you to effectively meet your objectives.

3. Set your time horizon

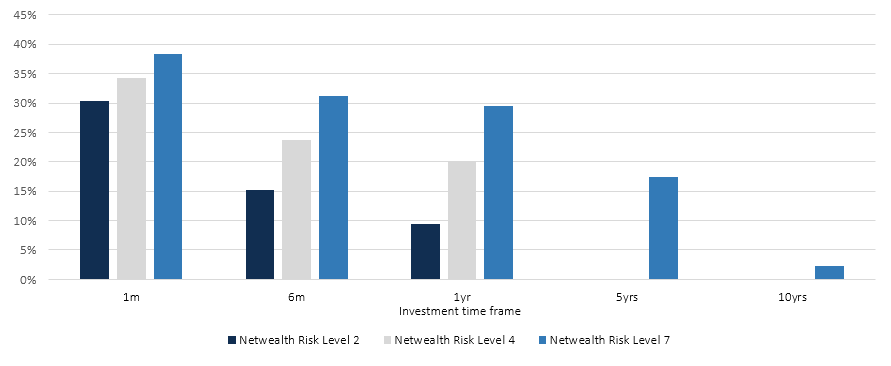

You should also think about the time horizon for the goals you have – the longer you plan to invest for each goal, the more risk you can take to achieve them.

If you have a reasonable timeframe, it allows you to take on more market risk because the potential for volatile outcomes, particularly negative outcomes, is reduced and typically outweighed by positive outcomes over a period. Shorter periods, such as a year, are much more likely to be volatile and increase the chance of lower returns. We can illustrate this by looking at the potential outcome for our Risk Level 2, 4 and 7 portfolios, and seeing how a longer timeframe can accommodate more investment risk.

Proportion of negative return scenarios for different investment horizons

Source: Bloomberg and Netwealth. Percentage number of total periods a negative return would have occurred for an investment over the relevant time period. Monthly data from the beginning of 1995 to end of 2020, based on example asset allocations for Netwealth Risk Level portfolios 2, 4 and 7.

Simulated historic performance is not a reliable guide to future performance.

Therefore, knowing what your timeframes are, and acknowledging they may be different for different goals, is such an important part of planning.

4. How much risk should you take?

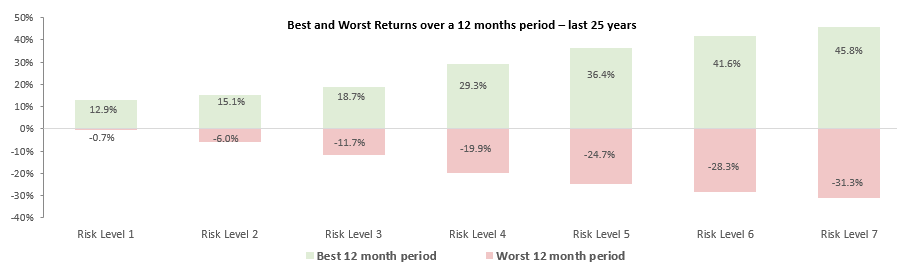

We offer our clients a choice of seven risk levels. What you can see from the chart below is the best and worst returns for each risk level over the last 25 years. We show this to give you an idea of the extremes you may face and to help you understand more about the real implications of taking risk – both from a positive and negative standpoint.

Source: Netwealth. Based on example asset allocations for Netwealth 1-7 Risk Level portfolios for the 25-year period to the end of 2020.

Simulated historic performance is not a reliable guide to future performance.

You may also think about the concept of risk in different ways:

Your ability to take risk is driven by your overall financial circumstances and the time horizon over which you are investing.

Your willingness to take risk is often driven by your emotional reactions to how markets are performing. For example, some people remain confident and are happy to accept that over any timeframe there will be negative periods – it’s just a fact of investment life – and they can live with that volatility.

How much risk do you need to take is often dependent on your timeframe, too. It may be if you have a long enough timeframe you don’t need to take as much risk as you are either able or willing to take. Sometimes we talk to clients about perhaps going down a level or two, simply because they do not need to take that much risk because of the goals they have in mind.

5. How much to allocate and contribute to each of your goals

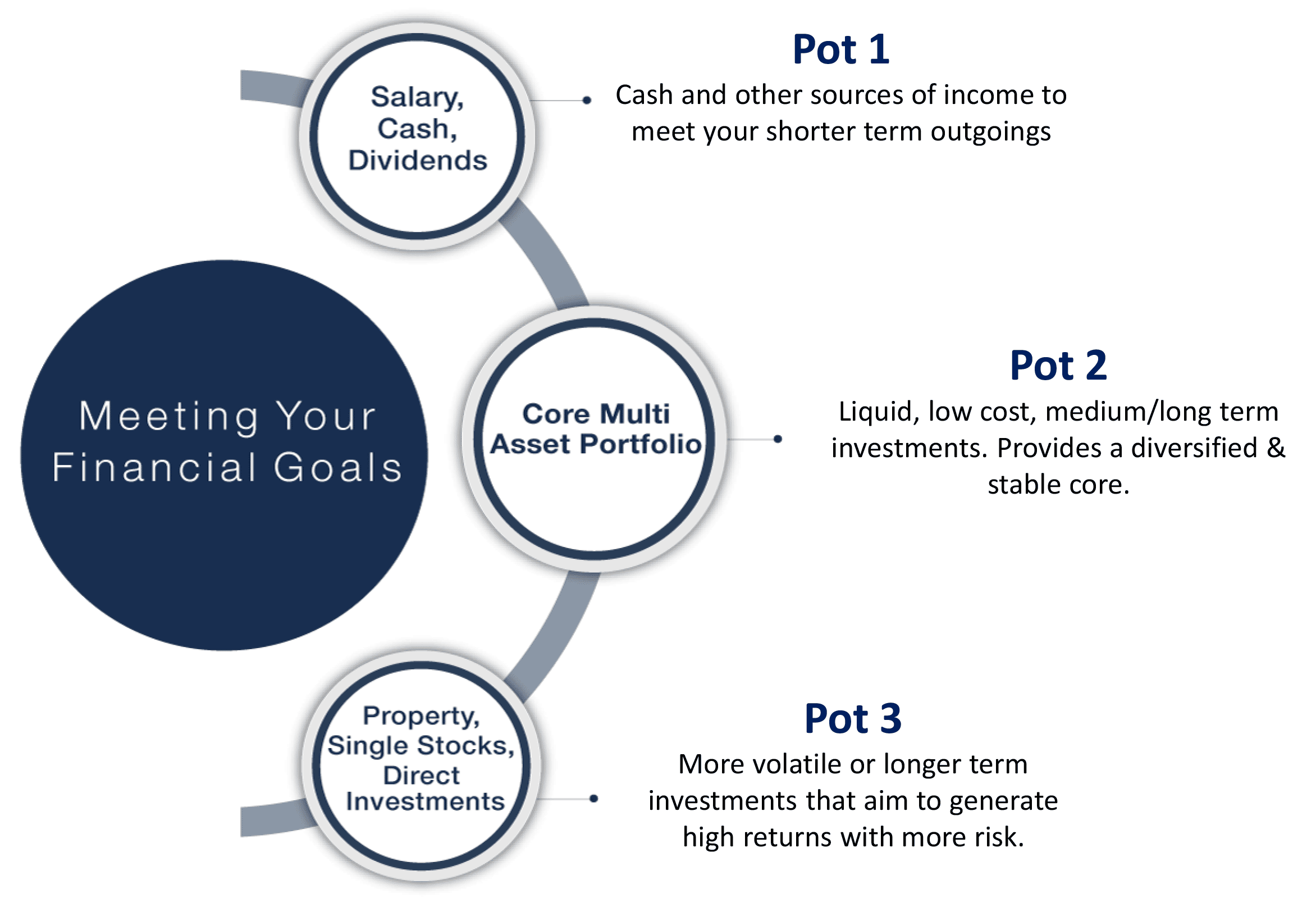

Managing your money effectively can be difficult, but our Three Pot Theory™ is a useful way to think about investing and how to apportion the different pots of money we have in our lives.

Taking Pot 1, we would consider that to be the liquid pot – for such income as your salary, dividends and rental income. It is also from where money comes out, for everyday expenses, meals out, trips to the theatre and holidays and so forth, so you need regular and easy access to these funds. Conceptually, it is a little like a current account.

At the opposite end of the spectrum is what we call Pot 3, or the illiquid pot. In the UK that almost always starts with property, but it may have other things as well which are less liquid or riskier. For example, this could be single stocks, direct investments in companies, or private equity – but they will tend to be less transparent, more costly to buy and sell and generally need a longer timeframe to deliver what you hope will be quite significant returns.

Pot 2 is what we like to think of as a home for your ‘sleep well’ money. It acts as a core to the satellite investments you hold in Pot 3. And for it to be representative of what we believe the core should look like, we think it should be low cost, transparent and flexible. While this money is professionally managed, you also have the freedom to allocate between the three pots in a way that best suits your individual investment goals.

As an example, and in practice, too many people consider funding school fees or care home costs from Pot 1, believing that fast access to your money is the most important factor. But if you invest the money, get your timing right and your goals set up the right way, you can put your money to work harder in Pot 2 and still draw from your investments as you need to cover these costs.

“Why invest at all?” may therefore be a reasonable question to ask, especially if you are considering the security of the funds needed for important future events. The answer is that holding too much cash over the long term is a bad idea, because inflation will erode the real value of your capital, so you need to think carefully how you allocate the mix in your three pots.

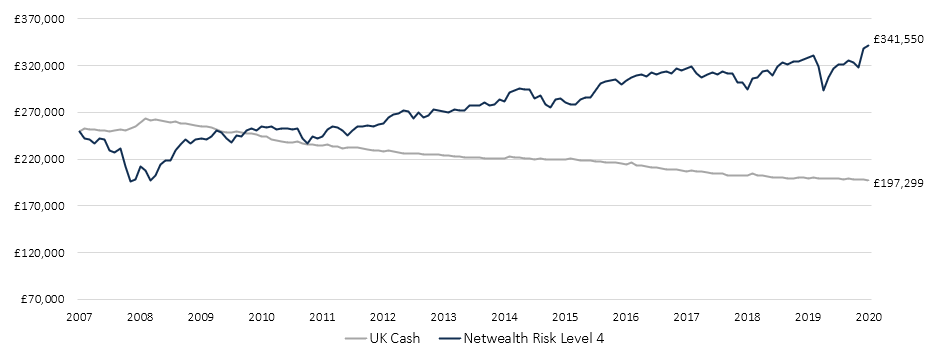

In the example below we take a sum of £250,000 invested from 2007 and see the outcome by the end of 2020. We chose that timeframe to take in the financial crash of 2008 and give a more accurate portrayal of how markets can behave in difficult times, too.

Inflation erodes the real value of your capital if you hold cash for too long

Source: Netwealth & Bloomberg. The values represent £250k invested in 1 month Libor and an example Netwealth Risk Level 4 portfolio minus UK RPI.

Simulated historic performance is not a reliable guide to future performance.

After the crash it would have been tempting to move all of our assets into cash, to take advantage of the implied security. But as you can see this security is a false indicator, because after the initial downturn for a balanced portfolio holding stocks and bonds, it more than recovered compared to the effect of inflation on a cash portfolio over the duration.

So it is important to get the balance between those pots right, and it is crucial to stay invested, even when it seems a tough ask to do so.

6. Check that your plan makes sense

Having set up your goals, and having thought about the timeframe and risk attributes, you should think about whether these objectives are achievable. Our online planning tools can help you to gain a clearer picture of your finances over time and see how they could change.

For example, you can model for various scenarios to see if your planned contributions could help you to reach your goals. You can change variables such as tax rates, risk level, contributions and withdrawals to create a useful impression of how your finances could unfold.

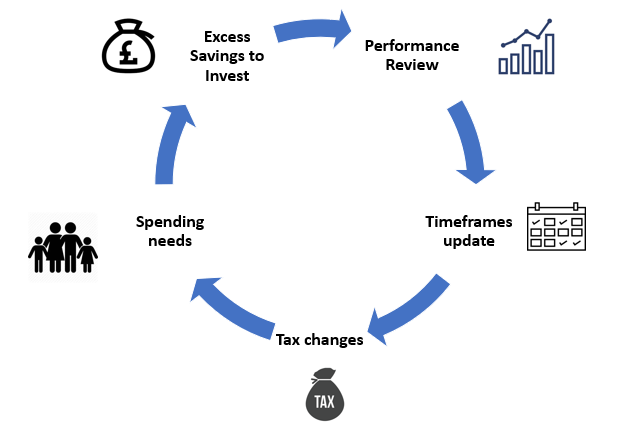

7. Review your plan regularly

Planning effectively for your future is not a static commitment, it’s important to review your plan regularly – annually is ideal. You should assess such factors as your investment performance, whether your timeframes are still appropriate, if you have been impacted by tax changes and whether your spending needs have changed.

Check whether you are on track to meet your goals, at least annually

You also may have excess savings from time to time, so it may be appropriate to move them from Pot 1 to Pot 2, where your money can work a little harder. Whatever the ins and outs of your specific plan, being adaptive and open to evolve with your circumstances will help you to ensure your goals are achieved.

If you need to refine your plan or want to know more about how we can help you to make the most of your money for the future, we encourage you to get in touch.

And if you’d like to learn about the 7 steps in more detail, you can watch the webinar here.

Please note, the value of your investments can go down as well as up.