Can the Bank of England Actions Align with the Chancellor Vision?

This week the Bank of England raised its policy rate for the third successive meeting, increasing it from 0.5% to 0.75%. This now returns the policy rate to its pre-pandemic level. But what are the future options for the Bank – and can they align with those of the Chancellor to keep the economy on track?

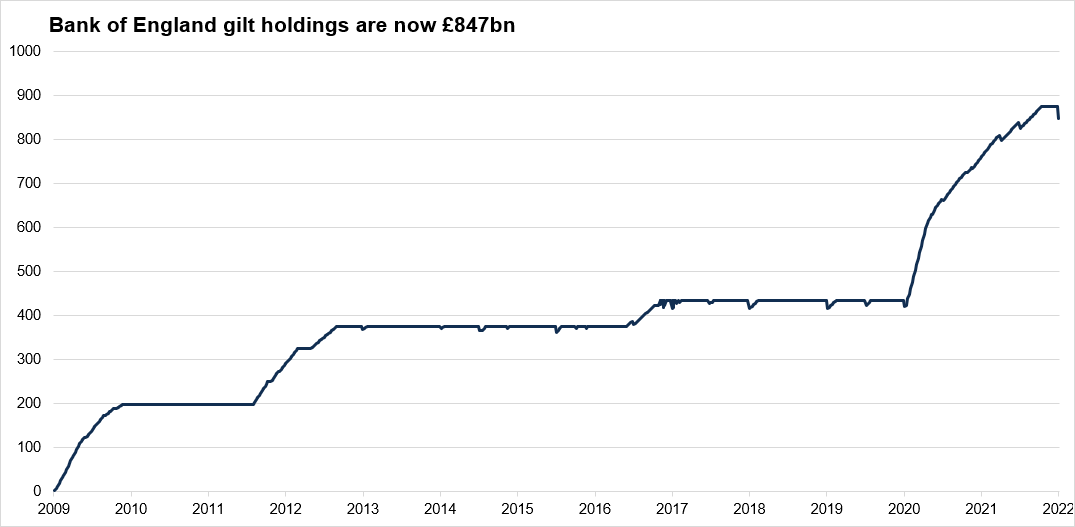

The total stock of assets held on the Bank’s balance sheet because of previous quantitative easing (QE) dipped from its peak of £875 billion to £847 billion. Thus, we are in a tightening phase for monetary policy, but interest rates are still very low and the Bank’s balance sheet still sizeable.

Further monetary tightening appears inevitable, both because policy has been far too lax for so long, and as inflation pressures are now rising. This points to both higher rates and to quantitative tightening, which reverses QE.

However, while this direction of monetary policy appears set, the speed and scale of tightening is far from clear. This is because the economy looks set to slow significantly from the second quarter onwards, as a cost-of-living squeeze hits. Higher energy prices, rising inflation and tax increases will all combine to squeeze disposal income and dampen consumer spending.

It is possible that the UK economy could fall into recession over the next year, although a more likely outcome is a significant slowdown in growth.

A complicated path for the economy

There are many recent features of economic activity in the UK that have been strong and as a result, growth in the first quarter should be robust. One of the most interesting features has been the fall in unemployment to 3.9% alongside a rise in vacancies to 1.3 million.

While employment has rebounded as we have emerged from the pandemic, there has also been a reduction in the workforce, and thus there are still just over half a million less jobs than before the pandemic. It is an indication that while the economy is recovering, there are many nuances in the data.

Likewise, a healthy corporate balance sheet and a still high personal savings rate (although well below the peak seen during the pandemic) are likely to disguise the fact that the finances of many firms and many people are not so secure. Indeed, the latter may also help explain the recent softness in consumer confidence (even before the Ukraine conflict), as energy prices rose and as there has been increased focus on the imminent cost of living squeeze.

Underlying private sector regular pay is growing by around 4% to 4.5%, according to the Bank, and while this is higher than pre-pandemic, when it was 3% to 3.5%, it is dwarfed by the rise in the annual rate of inflation, which reached 5.5% in January. Inflation has been rising for some time, and well before the conflict.

The latest guesstimate from the Bank of England is that inflation will rise to around 6% in February and March, and then to around 8% in April, remaining close to that in following months, but even the Bank now acknowledges that it could rise further later this year.

A likely slowdown in growth

The prospect of a slowdown helps explain the market’s reaction to the Bank’s rate hike: bond yields dipped and sterling was weaker. In part this was because the market feared the Bank could be more hawkish in its voting. Last month, the vote was 5-4 to hike rates by 0.25% but four members then wanted to increase by 0.5%. This time the vote was 8-1 to increase rates by 0.25% but the dissenter was in favour of no change in rates.

Sterling’s performance also reflected the market’s concern that tighter monetary and fiscal policy may slow growth, with a weaker pound then having to be the economy’s shock absorber. Unlike the US Federal Reserve, which this week raised rates by 0.25% and then gave a clear direction to the market about future hikes (with another six quarter point moves expected this year), the Bank failed to give clear guidance to the market.

Thus, the market, correctly perhaps, sensed that it was in two minds, with higher inflation now being followed by softer growth, which the Bank expects, alongside an easing of supply-chain pressures, to allow inflation to fall in future years.

The options for fiscal policy

What then lies ahead for fiscal policy? On Wednesday 23rd March the Chancellor unveils his spring statement. Alongside the autumn Budget this is one of the two planned flagship fiscal events of this year. The Office for Budget Responsibility will also release new economic forecasts, which in turn will influence the Chancellor’s fiscal stance.

The budget deficit this fiscal year is already coming in far lower than previously expected. But it was already improving when the decision was taken last autumn to rise national insurance contributions this spring. Along with the already announced freezing of income tax allowances, this points to a significant tax increase, which will weigh further on consumer spending.

In my view, the Chancellor needs to provide context, actions and vision in his statement.

Context is important, so that people can understand the present economic environment, and that, hopefully, the hit to their incomes may be short-lived.

Actions will be needed, though, as many people simply will not have the ability to pay bills – the Chancellor has already unveiled some help recently. The three “t’s” should be on his mind: the need for timely, temporary and targeted help.

Ideally, he should postpone or reverse the national insurance tax hike, but a delay may be the best we can expect. Another option is raising the threshold at which national insurance is paid, bringing it into line with the income tax threshold, as one way to target help to those on lower incomes. Some action seems inevitable; the Chancellor showed during the pandemic his willingness to act when needed.

In terms of vision, I would expect the Chancellor to reiterate some of the messages from his recent Mais lecture, including measures to encourage investment, boost skills and to create scope for future tax cuts.

There is always a need for consistency between monetary and fiscal policy, and the actions taken in the spring statement will clearly have a bearing on the future direction of interest rates, and on how the economy copes with the cost-of-living squeeze and the contagion from the war.

Please note, the value of your investments can go down as well as up.