Combating High Fees and Rising Inflation

Our latest research reveals the combined destructive power of two forces on pension pots: high fees plus higher inflation. But it’s worth noting that one of these factors you can control, while it is vital you plan for the effects of the other.

Different scenarios, different outcomes

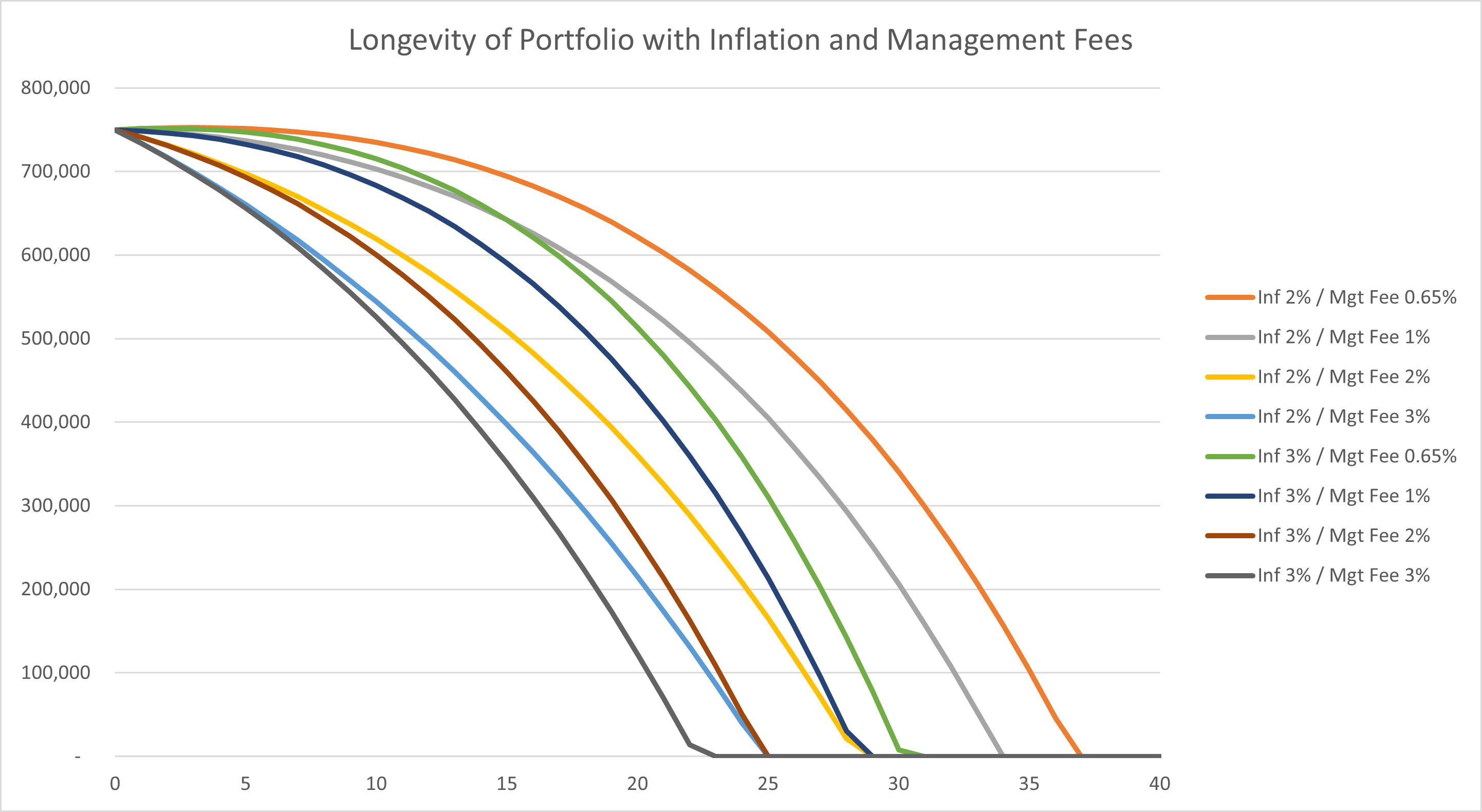

If you start retirement with a £750,000 pot and expect to draw down £30,000 a year – with 2% inflation and a 0.65% all-in-fee (the current Netwealth fee) – your pot should last 37 years.

Yet for many the pension pot they have nurtured could be under severe pressure. Because if you add an extra 1% in fees and a further 1% in inflation, your pot would last 26 years – 11 years less in which to enjoy your pension. This scenario is not an unusual situation for many investors now.

The difference is that you can control one of the variables – how much you pay in wealth management fees, while you can’t control the other – inflation. If you save money in fees you can offset partially, if not totally, the negative effect of inflation on your investments over time.

Look at it another way: if you are paying 2% in annual fees and higher inflation kicks in for the period, say from 2% on average to 3%, your pot would only last 25 years.

However, by using a modern wealth manager who charges less than 1%, say 0.65%, then the pot may last 30 years, even in a higher 3% inflation scenario. So you actually manage to fund five more years of retirement, despite the higher inflation.

By looking at the different permutations below – with varying inflation and fee figures – you can get an idea of how long your pension pot could last for your own situation.

Source: Netwealth

Simulated future performance numbers should not be relied upon as an indicator of future performance.

The benefits of being in control

Controlling what you pay for a wealth management service is just one aspect of what we call the controllables. As well as fees, you can also control such factors as how long you invest, using tax wrappers to their full potential and being suitably diversified.

The combination of controlling all these factors can be very powerful over time, and can make a significant impact on your financial outcome.

Preparing for even mild inflation

The impact of higher inflation is being felt by most of us now. And while the rate of inflation is outside of your control, you can – and should – plan for its effects. While we don’t expect very high inflation to be permanent, higher inflation than usual is likely to persist, before gradually coming down.

But as we show here, you should even factor in the impact of relatively low inflation, like the 2% average we experienced for many years. Failure to do so could result in you having fewer years of a comfortable retirement pot than you might expect.

Don’t avoid taking action

We recently conducted a survey among retirees and pre-retirees, to learn from their experience and find out what they might have done differently when planning ahead. Many had regrets.

Notably, as this article illustrates, 43% wished they had been better prepared for later life care costs and only 50% of pre-retirees have a clear idea of how much money they need to live comfortably. The findings suggest, “people often realise they are unprepared for later life only once it’s too late”.

It makes sense, therefore, to try and control costs as much as you can in the years pre-retirement, and to seek advice if you need it to ensure your finances are as resilient as they can be.

Your next step

Higher inflation is troubling, but apart from planning for its effects, there is not much you can do about it. And combined with high fees for investing it can have a truly destructive impact on your future retirement potential. But you can – and should – do something about the fees you pay.

We can help. We offer lower fees to help mitigate against a higher cost environment, an expert team who have experienced many economic and market scenarios, and powerful online tools to give you a clearer picture of your potential financial outcome.

Please get in touch if you want to start making a meaningful difference now.

Please note, the value of your investments can go down as well as up.

Our advisers offer restricted advice that relates to Netwealth’s products and services and does not consider the whole market. Netwealth does not provide tax or legal advice and does not advise on transfers of pensions with safeguarded benefits.