Currencies: to hedge or not to hedge?

Delivering sustainable portfolio performance over the medium-to-long-term gives our clients the best chance of meeting their investment goals. When building portfolios, naturally the proportions we invest in each asset class is key, and we also consider factors such as currency hedging – but what impact can different hedging approaches have on investment portfolios?

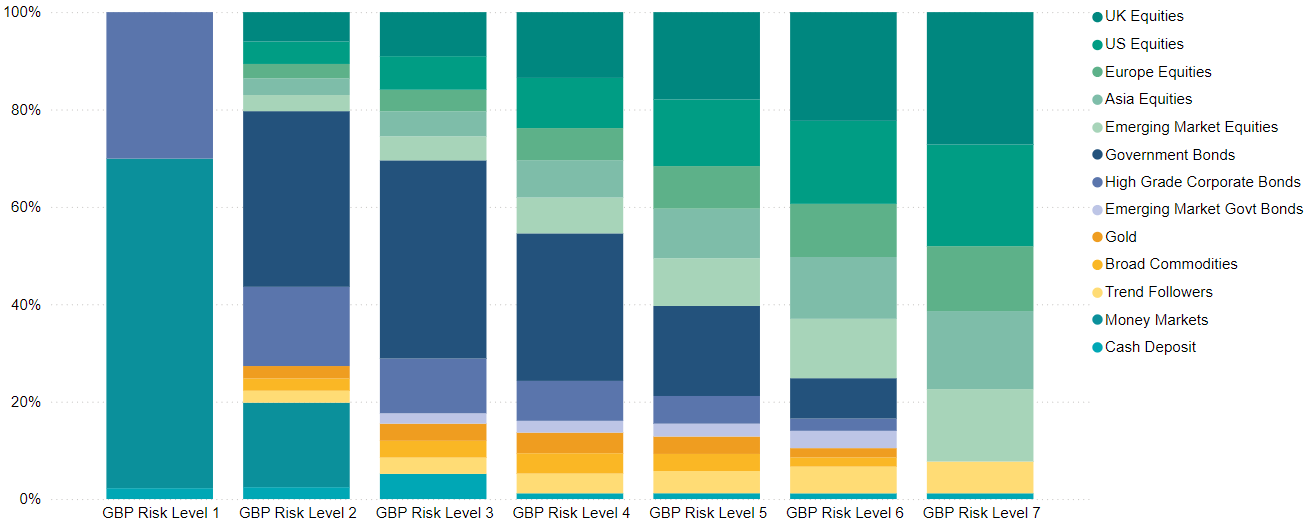

When investors take more risk (to aim for potentially higher returns) it generally means investing in assets such as equities, which are typically higher risk than assets such as bonds. To highlight a Netwealth example, as you move further up our risk spectrum (from Risk Level 1 to 7) our portfolios are increasingly invested in riskier assets like equities.

As this graphic below shows, we have also been increasing our allocations to alternative asset classes – such as gold, commodities and trend followers.

Where we invest: our current asset allocation

However, deciding on currency exposures of portfolios is another key component of our investment approach – and where we use what is known as currency hedging.

Currency hedging can help to minimise the risks associated with exchange rate movements. For example, the exchange rate between the US dollar and the Japanese yen will fluctuate daily, as will the exchange rate between the euro and sterling, and practically between every currency in the world.

When we experience outsized exchange rate fluctuations, it can have a material impact on investment portfolios. Therefore, investors such as Netwealth seek to mitigate these effects by implementing their own approach to currency hedging.

Generally, there are three possible hedging approaches:

1. Do nothing (portfolio is fully unhedged)

The total return on an international asset is composed of the local return – its performance in its home country – and the foreign exchange (FX) return. For example, consider a UK investor using sterling and buying a US equity ETF which tracks the S&P 500 Index.

Let’s say they invest $100 when the US dollar to pound sterling FX rate was $1.25 (£1 buys $1.25). Over the investment period, if the dollar price of the ETF trades up to $114 and the exchange rate moves to $1.50, the total effect on the portfolio in GBP (sterling) terms is a loss of £4.

For those interested in the calculations we can show how this loss was realised:

- At the start, market value = $100, or £80

- At the end, market value = $114, or £76

- Total return = (1 + local asset return %) * (foreign exchange profit/loss) -1

The total return in dollars equals $14 (or +14%), but in GBP terms this equates to a loss of £4, (or -5%) due to the movements in the exchange rate.

2. Hedge all currency risk

Generally, investors that choose to hedge will do so either because:

- They believe the international currency will weaken versus their domestic currency.

or

- They do not wish to endure the added volatility of currency markets.

In this instance, the investor uses derivative contracts (so-called currency forwards) to offset exchange rate fluctuations embedded in the first example. There is a cost to hedging, which is driven by the interest rate differentials between the two currencies.

Hedging return = ((1 + domestic interest rate)) / ((1 + foreign interest rate)) -1

So, continuing the example above, if we assume the Bank of England’s Bank Rate was 4% and the US Federal Funds Rate was 6% (and expected to stay constant), the total effect on the portfolio in GBP terms is a gain of £11.85.

We can show how this gain was realised:

- Total return = (1 + local asset return %) * (1 + hedging return %) -1

- Which equates to (1 + 14%) * ((1 + 4%) / (1 + 6%)) – 1 = +11.85%

Therefore, the impact of hedging is a lower return than in local (US dollar) terms ($14 as before), but greater than the unhedged return (which was a loss of £4).

3. Take an active decision to currency hedging – the Netwealth approach

We consider currency risk on an independent basis from the underlying asset exposures for all international investments. We aim to ensure that overall portfolio returns are not dominated by unintended currency movements – and benefit instead from considered management to deliver better risk-adjusted returns than both a naïve fully hedged or fully unhedged approach.

In particular, from a sterling investor standpoint, we think there are strategic benefits to owning US and Japanese assets on an unhedged basis as those currencies often tend to strengthen during downturns. In other words, we like their counter-cyclical properties and the diversification benefits they bring to portfolios.

The opposite is true for investments in euro dominated assets, where our decision to fully hedge has been rewarded. Finally, we invest in emerging market assets on an unhedged basis – there are structural reasons why EM currencies appreciate over the long-term, and due to their relatively higher interest rates, the cost of hedging can be punitive.

Additionally, we may choose to alter our currency positioning on a cyclical basis, too. These decisions can be driven by factors such as:

- extreme valuations

- the relative macroeconomic outlook

- the mispricing of relative monetary policy paths

- more attractive yield or carry (the cost of hedging), in either the home currency or internationally

- idiosyncratic risks

For example, in the very early years of the Netwealth portfolios, we maintained a lower-than-normal position in sterling, due to what we perceived was a mispricing surrounding the Brexit referendum. This benefited investment returns as sterling weakened sharply.

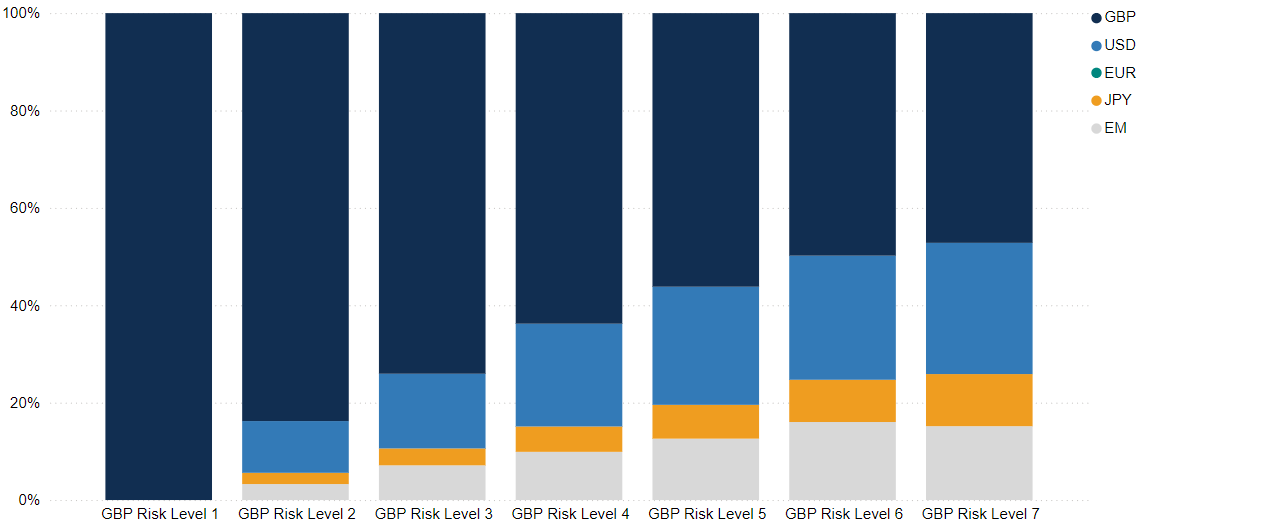

Our current currency allocations across our portfolios

We maintain an overweight position in the US dollar against the Japanese yen via a Japanese equity hedged to USD ETF. There are several structural reasons why the yen might continue its weakness, despite recent intervention. The large current interest rate differentials between Japan and the US means that the cost of hedging (the carry) is extremely favourable.

We maintain strategic allocations elsewhere, too. This means we have exposure to emerging market currencies from equity and fixed income holdings, but zero allocations to the euro on our GBP portfolios.

To find out more about how our investment approach could help you to protect and grow your wealth, please get in touch.

Please note, the value of your investments can go down as well as up.