Why Currency Matters

The US Dollar

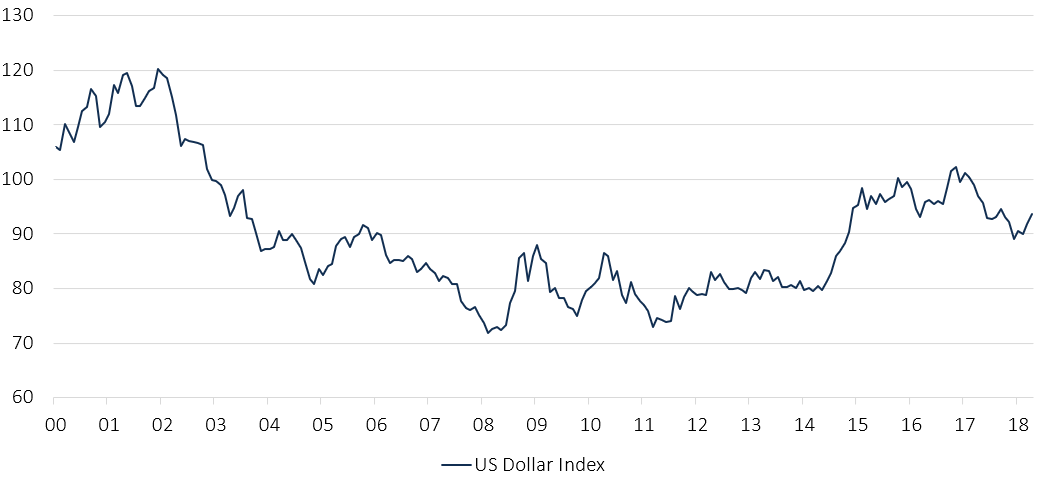

First, let’s consider the key current focus for markets: the dollar. There are many factors driving a currency’s performance. In terms of the dollar, an important one since the election of Donald Trump has been the apparent different policy approach of the President towards the dollar. Traditionally, the currency policy of recent previous Presidents - as articulated largely through his Treasury Secretary and sometimes in the past through his economic adviser - has been to talk of a strong dollar. The Trump approach however was largely the opposite, with the market concluding the President favoured a weaker currency in order to boost competitiveness and support his trade agenda. From the beginning of last year to this spring, the dollar trended lower, in broad, overall terms.

However, there has been a significant shift in market behaviour over the last two months. The dollar, perhaps, was oversold. In addition, the upward trend in both US policy rates and yields has added to the dollar’s attraction. Indeed, the Fed’s tightening and the clarity of its message that it intends to tighten further - albeit in a gradual way that is dependent upon the data - has meant that interest rate differentials between the US and other major economies are now dollar supportive.

This is perhaps best illustrated by the extent to which the dollar has appreciated versus the yen. The Bank of Japan is sticking with its policy of keeping interest rates and also ten-year bond yields pegged to zero. Also, a political scandal overhanging the Prime Minister is also weighing on the yen as it casts doubts on his survival and on future economic policy.

Source: Bloomberg

The rally in the dollar also has wider implications. Alongside the upward trend in oil prices it may add to inflationary expectations across markets, albeit from a low level. Also, there has also been a noticeable increase in debt levels across the world since the 2008 financial crisis. A stronger dollar has contributed to markets focusing more on the ability of some countries to service or roll-over that debt. Here it is important to not over-react and also to differentiate, as the bulk of debt is domestic in origin. Nonetheless, as we are seeing, certain vulnerable emerging economies, particularly Argentina, where an overvalued currency has suffered because of wider economic worries, or Turkey, which has a current account deficit. Their currencies have fallen and in Argentina interest rates have risen sharply to limit capital flight.

With the US Fed set to raise rates further and the US economy growing steadily, the dollar can gain further. But, to reiterate a previous point we have made, the resilience of economies and sensitivities of markets as monetary policy is tightened needs to be closely monitored, as this could change and impact currency prospects.

The Euro and UK Impact

Indeed, some of these tensions have already been apparent in the euro area, where German and French growth slowed in the first quarter and also where there is now considerable focus on the new Italian coalition government, with a proposed radical policy agenda. Across the euro area, the economic recovery has been heavily helped by the European Central Bank’s (ECB) cheap money policy. And as we have seen recently an open debate is taking place as to the timing and pace of future ECB tightening.

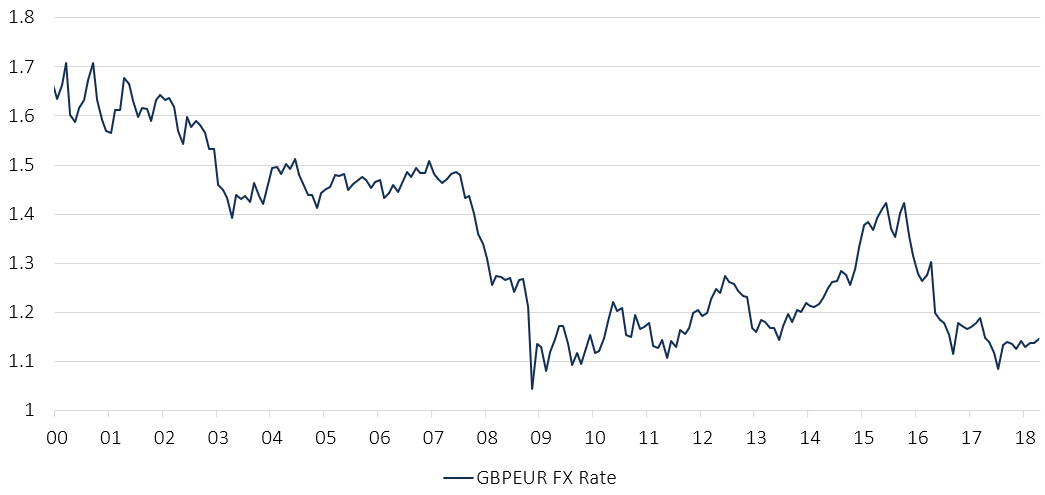

As for sterling, we are entering an interesting phase. During the global financial crisis there was a necessary fall in sterling, which triggered a temporary rise in inflation. This was repeated, following the referendum, as we have previously discussed, with sterling falling sharply.

This century, sterling has ranged from $1.20 (in January 2017) to $2.11 (August 2011) versus the dollar, averaging $1.61. Currently it is $1.35 and has weakened recently as the dollar has rallied. Meanwhile, versus the euro, the range has been from just under €1.71 (April 2000) to €1.04 (December 2008). The average being €1.32. It reached a low of €1.07 last August.

Currencies can often overshoot, and the markets seemed to conclude that was the case for sterling, as the economy continued to perform better last year than the market had previously expected and as the currency benefited from portfolio and investment inflows.

Source: Bloomberg

However the UK has a large trade and current account deficit, which is weighing on the pound. More particularly its immediate outlook is likely to be influenced by many factors, not least by expectations of the economy, interest rates and also by how politics plays out, in turn impacting investor flows.

In the wake of weak first quarter growth figures, the market is already cautious about growth this year, expecting growth around the 1.4% outlined last week by the Bank of England, or the 1.5% that is the current consensus forecast. But, a rebound in Q2, stronger consumer spending reflecting the buoyant jobs market, the likely creep up in wages and the deceleration in inflation, plus steady export growth could see growth come in above expectations.

The economy has performed pretty much as we had expected in this post referendum phase. Growth has been steady. However, sterling still contains a political risk premium because of the Brexit negotiations - for instance there is still much to be agreed between the UK and EU regarding the Irish border and future trading relationships where a range of options still exist. Also, it is still not clear whether the EU Withdrawal Bill will be brought to Parliament before the summer recess; instead it could be delayed until the final months of this year as part of a wider Bill, which also includes the terms of the EU departure. Such uncertainty may hold sterling back and leave it vulnerable still to unexpected events.

In addition, and as we discussed last week on these pages, there is uncertainty over the path of monetary policy, despite what appears to be a bias towards tightening at the Bank of England.

Overall, we appear to be in a phase of dollar strength which would have global significance were it to continue, and we are still in a period where sterling faces political, economic and policy uncertainty.