Diversification Is the Only Free Lunch in Investing

The Nobel Prize laureate, economist Harry Markowitz, is reported to have said, “Diversification is the only free lunch” in investing. This assertion has been shown to have stood the test of time and is one that we incorporate into our investment approach. In some respects, it is part of “controlling the controllables” that investors and savers can adhere to.

Our asset allocation approach looks to diversify by investing in assets across geographies, asset classes and currencies to reduce the risk within your portfolio and enhance your returns over the long term.

Understanding correlation and how it works in practice

When investing, the concept of correlation is key – the statistic that measures the degree to which two assets move in relation to each other.

Correlations are measured on a scale of minus one to one. A figure of zero indicates zero correlation. A figure above zero implies a positive correlation and the closer to one the measure gets, the stronger the correlation. For instance, a figure around 0.8 or above would imply two assets are highly correlated. In contrast, 0.2 would imply low positive correlation.

Correlations can also be negative, implying that two assets move in opposite directions. This can be evident in price moves following a shock – or unexpected event – that boosts the prices of one asset, while seeing the price of another fall.

For instance, when the pandemic hit, economic activity collapsed in many western economies, including the UK. This triggered a collapse in equity prices. In contrast, government bond prices rose. The correlation between equities and government bonds at the start of the pandemic was negative.

Correlations are not only evident across asset classes – such as bonds and equities – but can be seen across countries. For example, the movement in US Treasury bonds and UK Gilts – and also across sectors within the same equity market.

A popular proxy for a medium risk diversified portfolio is one that contains a 60/40 mix of equities and bonds. Some have questioned whether the 60/40 is under threat. The argument is based on the logic that stocks and bonds are no longer negatively correlated (and due to the seemingly meagre yields on offer from many safe bond markets).

At Netwealth, we do not believe in this thesis and believe bonds still have a role to play in portfolio construction. At points of stress, they can provide a level of portfolio protection. What is undeniable is that bond yields – the return that can be realised on bonds – have come down over the last three decades. You might therefore need to take on more risk to achieve the same level of returns as in the past from this market.

The chart below shows the performance of a long duration (20-year +) US government bond index versus the S&P 500, an index of US large cap stocks. Between January 2018 and December 2019, the investment returns of both were identical. Then, of course, the pandemic struck which impacted both indexes in different ways.

Following the dramatic decline of the S&P 500 in March 2020, it rebounded strongly in the months that followed and by January 2021, investment returns were equal again with the long-dated US government bonds. So over three years, we see equal investment returns, but two very different paths to achieving those returns.

Investors benefitted from the negative correlation (-0.33) of the two assets over the period – with the most obvious periods exhibiting negative correlation highlighted by the red ovals in the graph below. This illustrates how owning a multi-asset portfolio can smooth the ride for investment returns over time and reduce your overall portfolio risk.

Source: Bloomberg

Historic performance is not a reliable guide to future performance.

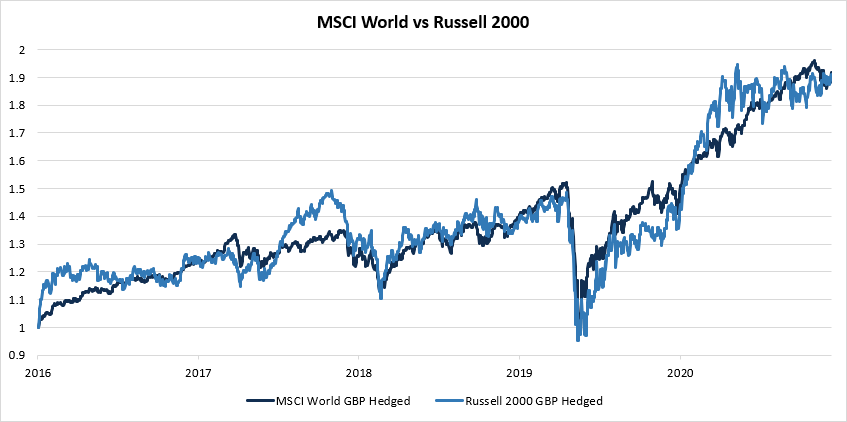

The benefits of diversification are not only felt when looking across asset classes, the same is true within an asset class. The below graph shows the performance of the MSCI World and the Russell 2000 equity indices, both hedged to GBP to avoid currency impacts on the outcome.

The performance over the five-year period is nearly identical – just 0.57% difference. However, the Russell 2000 – which is made up of US small cap companies, experiences greater volatility in its path to reaching the same returns profile as the globally diversified MSCI World Index.

Source: Bloomberg

Historic performance is not a reliable guide to future performance.

The alternative to taking a diversified approach is to take concentrated positions in the hope that your call will prove correct. Rewards can be great when these calls are right, but we speak about the dangers of this approach both here and here. Diversification really is the only logical approach.

Diversification is evident throughout our portfolios. Equities typically experience greater volatility – and the potential for greater returns – than bonds. Consequently, portfolios in the higher risk levels that we manage at Netwealth have greater exposure to equities. On the other hand, bonds tend to be less volatile, and returns are generally more subdued.

Currency factors are also relevant in global portfolios. Currency exposures are greater in higher risk levels, as are exposures to emerging markets and lower rated fixed income, which yields a higher return than more strongly rated fixed income.

The biggest risk for portfolios is that historic relationships such as asset class correlations change – and as a result an investor might not have the level of diversification they intended. For this reason, we place an emphasis on stress testing portfolios in different environments.

In 2021, monitoring the performance generated by different assets has been as important as ever. We added exposure to assets like gold and broader commodities to improve portfolios’ resilience to a wider range of economic and market conditions.

When you decide on the risk level for your investment portfolio, we typically advise that you maintain this level, unless there is a change in: your investment time horizon, your attitude towards risk and your personal financial goals.

A longer time horizon increases your ability to take risk. Personal attitudes towards risk will go some way to deciding where on our risk spectrum you would like to invest your money. Your personal financial goals relative to the amount of wealth you have accumulated will help you understand – alongside our powerful modelling tools – the amount of risk that you have the capacity to take.

Time is critical, too. The phrase “time in the market”, as opposed to timing the market, reflects the importance of not trying to pick turning points but instead illustrates the importance of trends, and underlying structural movements, particularly in economies.

Our job when you invest with us, is to actively manage your diversification according to your risk profile. We ensure your portfolio adapts to the changing economic and market environment to help you reduce risk, while aiming to enhance your potential returns over the long term. Please get in touch to find out more.

Please note, the value of your investments can go down as well as up.