Family Fortunes How ISAs Boost Household Wealth

Recognising the benefits of an ISA for individuals in helping them achieve their savings goals is easy enough. Yet when a whole family makes the most of their ISA allowances each year, we can see that the impact is truly powerful.

A meaningful sum for a child

The Junior ISA (JISA) allowance is now £9,000 a year. So if parents or grandparents can afford to invest the full amount for 18 years on behalf of a child, and it returns 6% per annum, the JISA would be worth around £275,000 when the child reaches 18. It will also be outside of the parent’s estate, but you should note that the funds cannot be accessed until the child is 18 and then only by them.

The benefits for a family of four

The amount an adult can save into an ISA remains at £20,000 a year, £40,000 for a couple. When you add the maximum JISA allowances for two children (at £9,000 a year), a family of four can now shelter £58,000 each year from the taxman.

Not surprisingly, this sizable sum can lead to a substantial pot of money in ten years – and the tax-free benefits of ISAs come into their own.

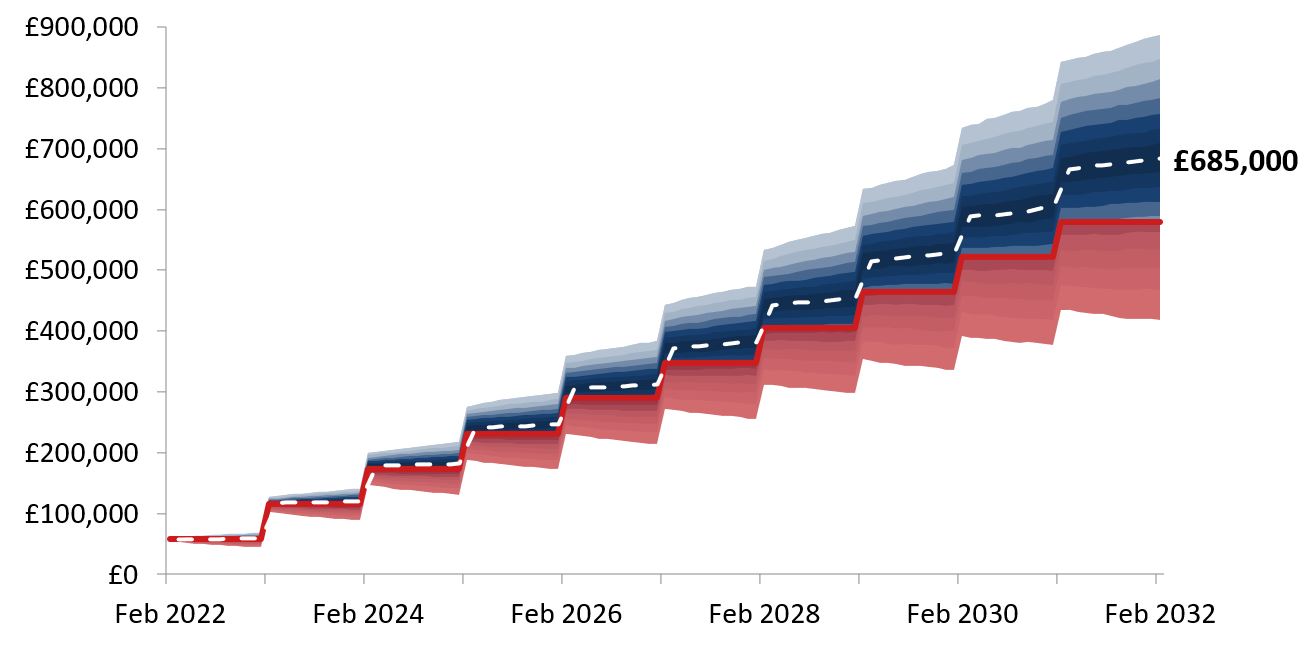

For example, if £58,000 a year is invested in a Netwealth Risk Level 7 portfolio through a general investment account (GIA) and subject to higher-rate tax, it would reach £685,000 after 10 years in the average scenario (with returns of 3% a year after tax and fees).

Simulated historic and future performance numbers should not be relied upon as an indicator of future performance.

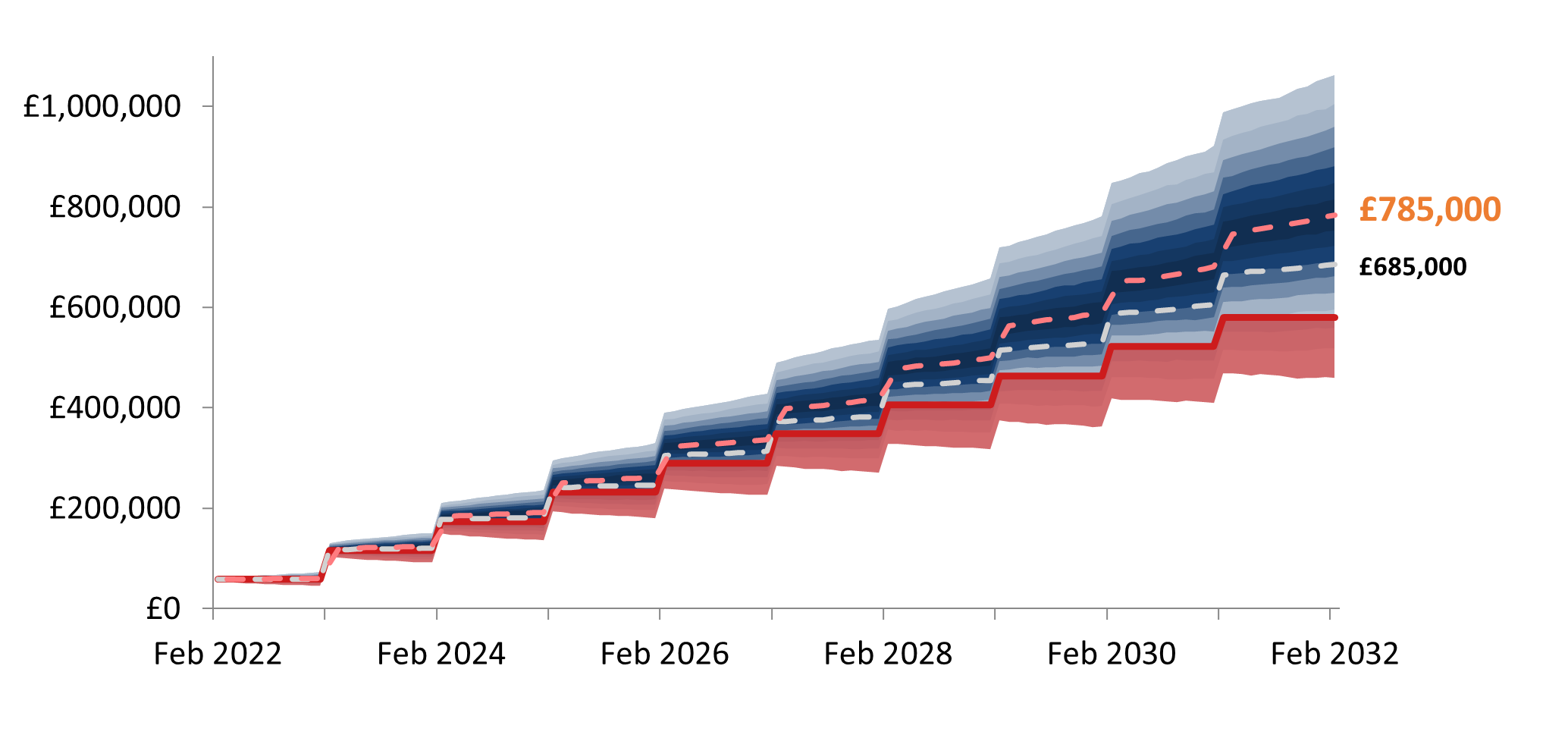

Conversely, if £58,000 a year is subscribed to ISAs for a family group each year, the sum invested could attain £785,000 after 10 years, in an average scenario (with a higher return of 5.4% after fees and no tax). In only 10 years, utilising the ISA allowances would result in an increase of £100,000 in the end portfolio values, as shown below:

Simulated historic and future performance numbers should not be relied upon as an indicator of future performance.

If you exceed your tax-free allowances, it’s still better to invest the rest

Some families may find they have cash to spare after they exceed their ISA and JISA limits. While it may be tempting to place that extra money in the safe confines of a bank deposit account, this apparent security is an illusion.

Putting money to work even outside of a tax shelter is a far better option than not investing it at all. Inflation is, of course, a concern this year but the impact of even fairly muted inflation over the long term can be highly damaging: to the value of the capital you are hoping to build up and to the length of time your accrued funds may last in retirement. You should always be aware of inflation’s erosive effects – and plan accordingly.

Using the tax benefits of ISAs – just one of the things you can control

The benefits for a whole family when using ISAs is indisputable. And while there are several things we do as a wealth manager to mitigate uncertainty – as we explain here – there are also a number of other factors that you can control to potentially improve your outcome whatever the investment and economic environment.

Focusing on tax wrappers such as ISAs is a good start, with the benefits amplified even further when you consider all of the ‘controllables’ in unison as part of an overall investment strategy. To find out about how we can help you define such an approach – and maximise your potential – please get in touch.

Please note, the value of your investments can go down as well as up.