5 Lessons Investors Can Learn from Sports Stars

With the thrilling emergence of Emma Raducanu, and the enduring pre-eminence of Cristiano Ronaldo, it’s evident it takes a special kind of magic to succeed and remain at the highest level. But are there lessons investors can apply as we take inspiration from the achievements of leading sports stars?

Building resilience

Developing an iron-clad resilience is essential for any athlete who wishes to remain competitive. It helps them prepare for inevitable shocks, to bounce back when events don’t go exactly as planned. Witness the persistence of basketball legend Michael Jordan (dropped from his high school basketball team), or the record-equalling revival of cyclist Mark Cavendish in 2021’s Tour de France (after illness almost ended his career in 2017).

Investors also benefit by being able to successfully endure the unavoidable peaks and troughs of investing over time. Things won’t always go your way. But you can learn to overcome inaction and effectively manage your money so you can cope with short-term distress and be prepared to achieve long-term fortitude.

Ability to focus

For a competitor to get to the top of their game is difficult enough, requiring extraordinary skills and learning to focus despite constant distractions. It’s even harder if they become a well-known face and must negotiate amplified traditional and social media scrutiny.

Investors, too, can be distracted from their objectives by short-term and sometimes persistent disruption. For example, many popular investment narratives are clouded by noise but it is possible to establish the fundamentals. Uncertainty around investing can also cause anxiety but understanding the root causes of your unease can help you to cope better.

Humility

Robust egos are generally in no short supply on the running track or in top-flight locker rooms. Yet the sports stars whose careers endure often possess a strong sense of humility, recognising it is often a combination of factors (including luck, staying injury-free) that allow them to reach their peak.

While humility may not be an obviously beneficial trait when investing, it may present us with the chance to reflect when we are successful (often due to a rising tide which lifts all boats) and to put returns into context during less impressive years.

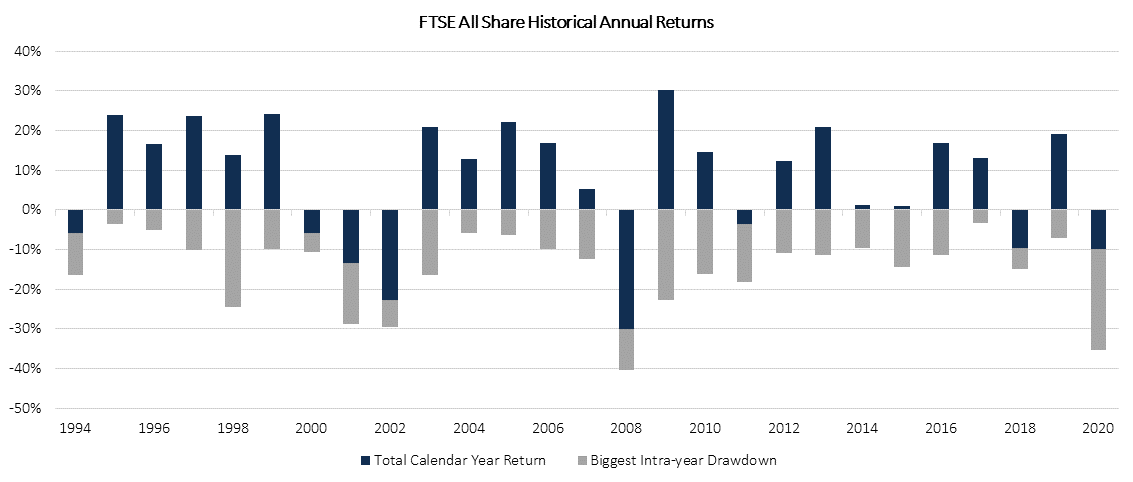

As we can see below, while there are historically more positive than negative years of equity market returns, even in good years there may be considerable declines over the 12 months. Therefore, rather than taking excessive risk to recoup losses, perhaps the best approach may be to take confidence from the knowledge that stock market investments usually come good over the long term.

Managing emotions

Few titles are won by physical prowess and skills alone – being able to govern your emotions is often seen as an equally important attribute to succeed. When opponents of similar ability compete, those who don’t allow their emotions to derail their strategy will often prevail.

It’s not unusual for your feelings to take control (for example, fear or anxiety) and make irrational decisions around your money which can affect your financial outcome. This is why it is important to be aware of some of the most common biases (such as overconfidence, loss aversion and herd behaviour), the effects they can have and how to better prepare for their impact.

A long-term outlook

Only the rarest of athletes maintain a remarkable level of success year in, year out – most are likely to experience relatively fallow years without winning a championship or tournament and typically learn to manage their expectations while extending their career as long as possible.

The parallels with investing are clear. While you will likely have shorter-term goals to fund such as a holiday or upgrading a car, a long-term strategy gives your money the chance to grow and reap the value of compounding returns throughout your life. It is crucial therefore to ensure your long-term personal objectives – such as retiring comfortably – are aligned with the financial means to achieve this.

One of the biggest factors in enabling this freedom is to examine what you pay in fees. Especially over the long term, paying less to have your money managed for you adds up – and can make your pension pot last substantially longer as you can see here.

Why not aim to do better?

The stars of the sporting world are usually in a class of their own. They have something special that sets them apart and powers their performance.

While emulating their success when investing may seem a bit of a stretch, it is possible to harness some of the traits which help certain athletes do better than others. It may be useful, too, to have an experienced partner who offers more than simply cheering you on – who can give you more control and help you to maximise your potential. Why not get in touch?

Please note, the value of your investments can go down as well as up.