How technology can help you better manage your investments

Modern technology can bring extraordinary benefits for investors today. It provides terrific clarity and transparency, gives you more control over how, where and when you invest, and perhaps most importantly, can help you to make better decisions as you aim to achieve your long-term goals.

Of course, we should state from the outset that technology is no substitute for the rigour and certitude of a seasoned team. It is the combination of technology and team – and how one compliments the other – that makes the difference for next level money management.

We should also clarify that when we invest on behalf of our clients, human oversight is essential. At no point do algorithms or any kind of ‘robo’ inputs make crucial decisions. These evaluations will always be made by professionals, who much of the time, are investing on behalf of their own families, too. They have skin in the game.

Let’s look at how applying leading technology can be a game changer for investors.

Technology that helps you plan ahead

By simply registering with us (you don’t need to fund an account), you can take advantage of a range of powerful online tools that give you a good idea of how your financial situation could evolve over time. You may wish to assess, for example, whether you will likely have enough to retire comfortably.

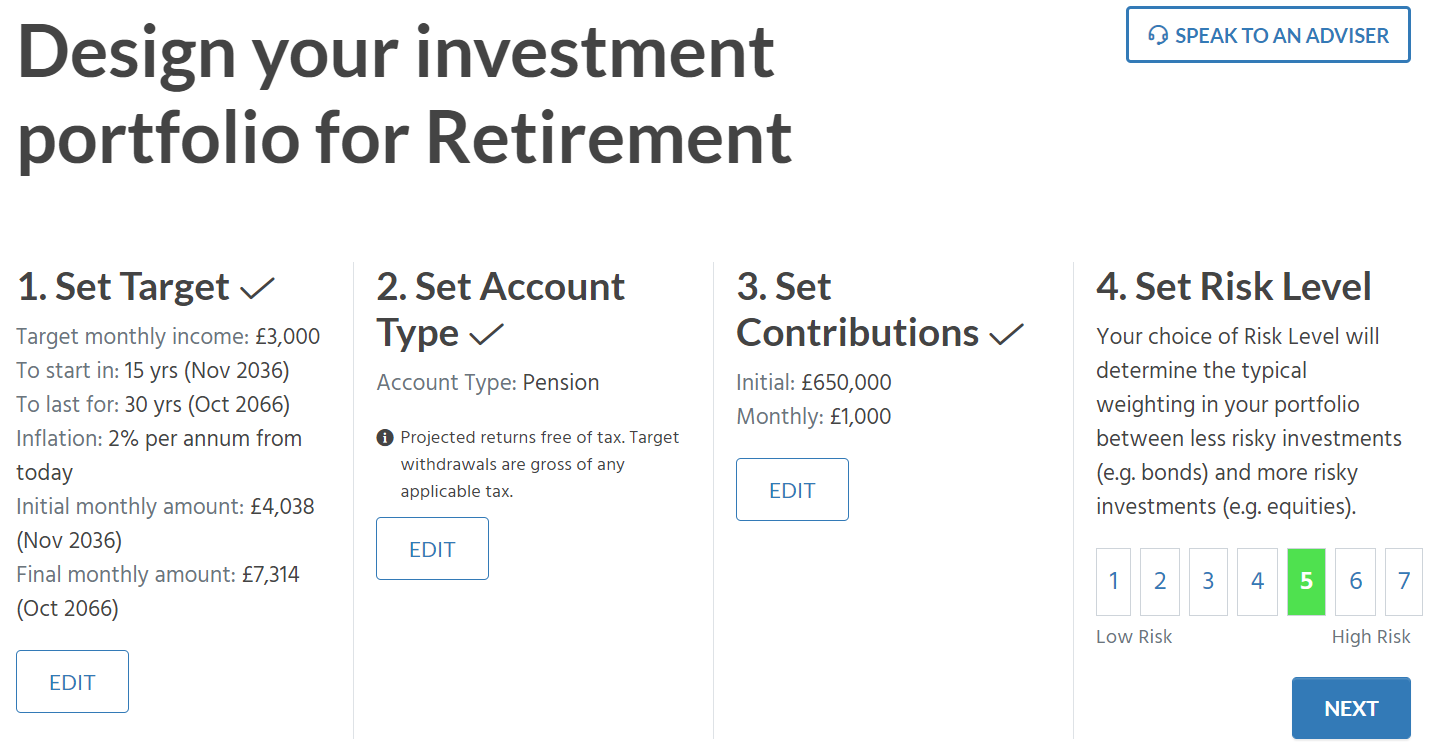

Before you set up a retirement investment portfolio you can model for a number of factors – including a target monthly income and duration of retirement, inflation rate, initial and monthly contributions and the risk level you are comfortable with and are able to take. All these factors can be customised according to your precise needs so you can understand your wealth in the context of what you are trying to achieve.

We can bring these concepts to life through a worked example. Let’s assume an investor:

- Has a target monthly income of £3,000

- Is aged 50 and wishes to retire in 15 years, then plans a 30-year retirement

- Faces inflation of 2% per annum (their initial monthly income will actually be £4,038 to allow for this)

- Invests in a pension account with an initial sum of £650,000 and monthly contributions of £1,000

- Chooses risk level 5 (very close to the traditional 60/40 account of equities and bonds)

These inputs look like this in the Netwealth modelling tool:

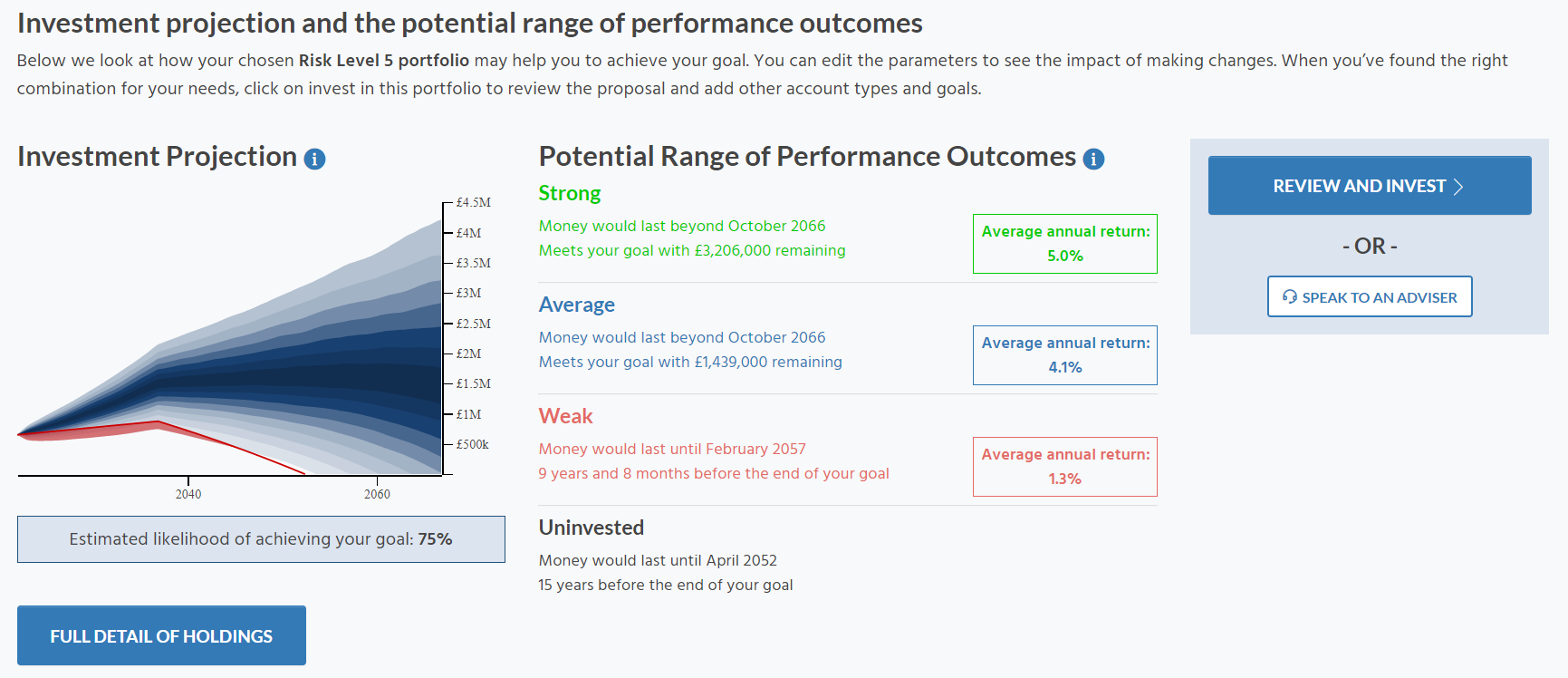

Now we can run the simulation and see what the potential outcomes might be.

Simulated future performance numbers should not be relied upon as an indicator of future performance.

As you can see from the screenshot above, there is a range of potential outcomes, depending on how well the investments perform. Yet even if we project an average annual return of 4.1% (net of fees), their money would last beyond October 2066 by a comfortable margin. Tellingly, if the money is not invested at all we can see it would be depleted 15 years before the end of their goal.

This above simulation is based on the figures in the assumptions above, but they can be changed with ease. Maybe you plan to retire at 70, have £500,000 to invest, plan monthly contributions of £400 and choose risk level 7. You can calculate that outcome, and numerous other variations, effortlessly.

The important thing to note is that each scenario can be tailored exactly towards your circumstances – using an ISA or JISA, pension or general investment account. The underlying technology gives us the power to offer this visibility.

Technology that gives you more transparency

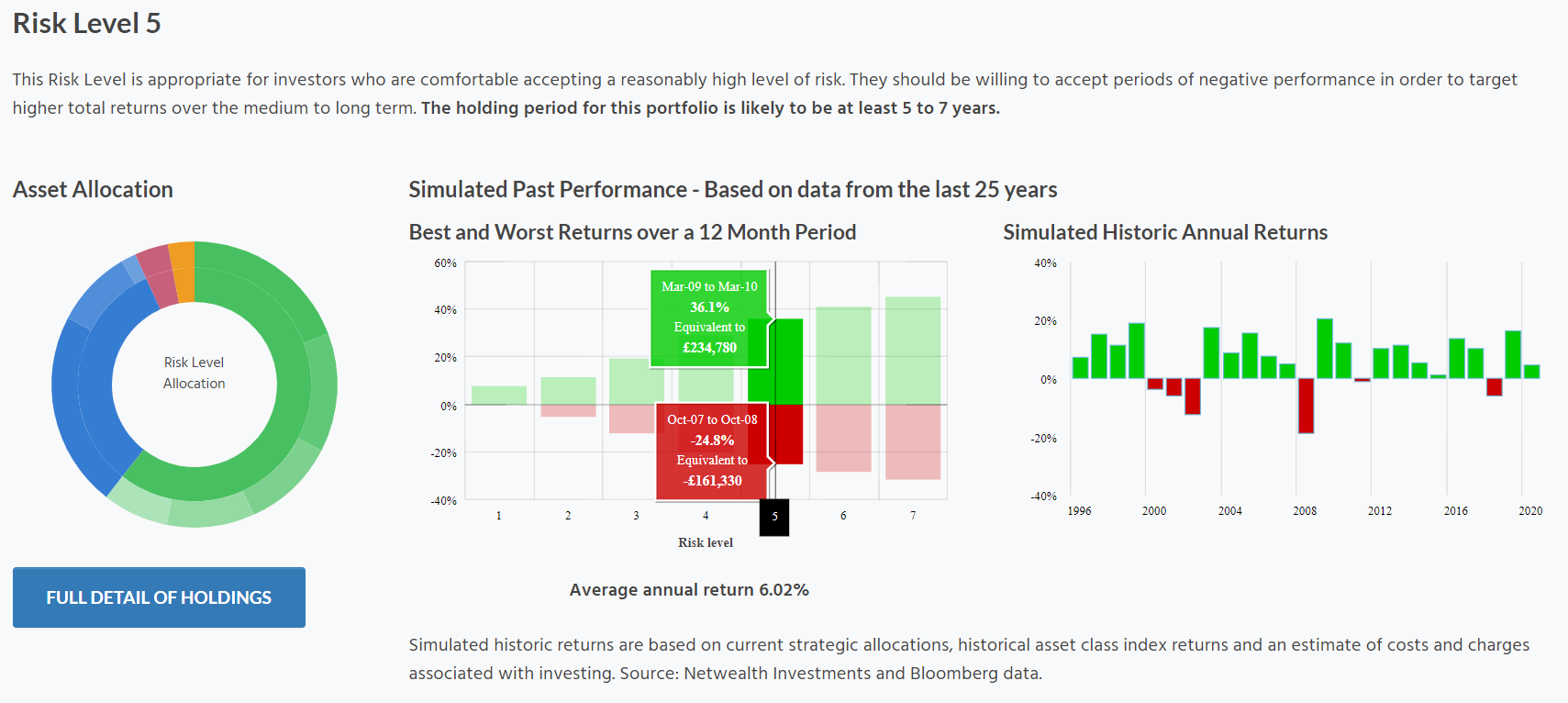

Transparency is a key part of the overall Netwealth offer, and technology also allows us to zoom in to an even greater level of detail. For example, when you are choosing your risk level you can get a much clearer idea of how a portfolio like this would have performed over time – see risk level 5 in the example below.

Simulated historic performance numbers should not be relied upon as an indicator of future performance.

The graphics above, based on data from the last 25 years, give you an idea of the variation in returns for each risk level by showing the best and worst returns over a 12-month period. This is the level of volatility you could expect to experience as an investor, and you can compare that with the simulated historic annual returns over the same timeframe.

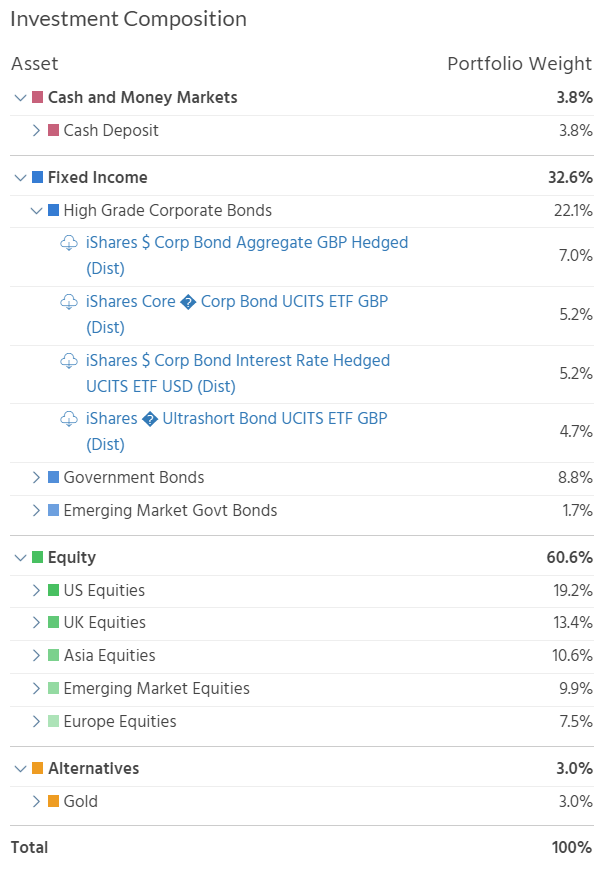

Investors can also get transparency in exactly where we invest. When you click on the Full Detail of Holdings button above this is an example of what you will see:

By clicking on any of the assets in the tool (we have expanded High Grade Corporate Bonds here) you can see exactly which funds or ETFs we invest in on your behalf, and the percentage of your overall pot we allocate to that investment.

This transparency is across the board throughout Netwealth, including in the fees we charge. Try our fee calculator to see how much better off you could be with our investment services. The latest technology allows us to eke out greater efficiencies and offer these low fees, which can make a substantial difference to how much money you have to enjoy in the long run.

Technology that gives you more control, and a better experience

Over half of the Netwealth team are developers. They spend their days improving the client experience and maintaining the reliability of our entire ecosystem.

The result is more daily control for investors and a better investment experience. You can benefit from such useful features as automated transfers from your general investment account to your ISA, and can make the most of your annual capital gains tax allowance through our annual capital gains harvesting service. You can get an up-to-date view of where you stand at any time, investment visibility wherever you are and interact seamlessly with your account when you log on or use the Netwealth app.

Technology gives you more control – and helps you make better decisions.

Better tech even facilitates what may sound like an arduous task: moving from one provider who is not fit for purpose (and too expensive) to one who could help you make more of your money. Our head of client service, Rachel Willox, explains why the process is easier than you might think.

In the meantime, you can see for yourself how technology makes a difference by watching this webinar.

And to find out more about how our technology and expert team combined could make a meaningful difference to your finances, please get in touch.

Please note, the value of your investments can go down as well as up.