How to Plan an Effective Retirement Approach

Many of our professional clients (eg, accountants, lawyers, architects) take pride in helping their clients by taking a logical and measurable approach to challenges and finding the best outcome for them. It therefore stands to reason that a similar numerical rigour can also be used by professionals to potentially boost their own outcome for retirement.

Time is your friend

If you’re in your 40s or 50s you will benefit from having a decent amount of time to further grow any assets you have already accumulated. It’s well recognised that to meaningfully increase your investments’ value you must take some risk – a longer timeframe helps you to ride through the up and downs of yearly volatility and allows you to benefit from the tremendous effects of compounding.

Yet compounding can work to your detriment, too. Consider the fees that you pay as a normal part of having a portfolio managed for you. Whatever you pay in fees over, say, a 10 or 20 year timeframe will add up and meaningfully eat into your pot during this period.

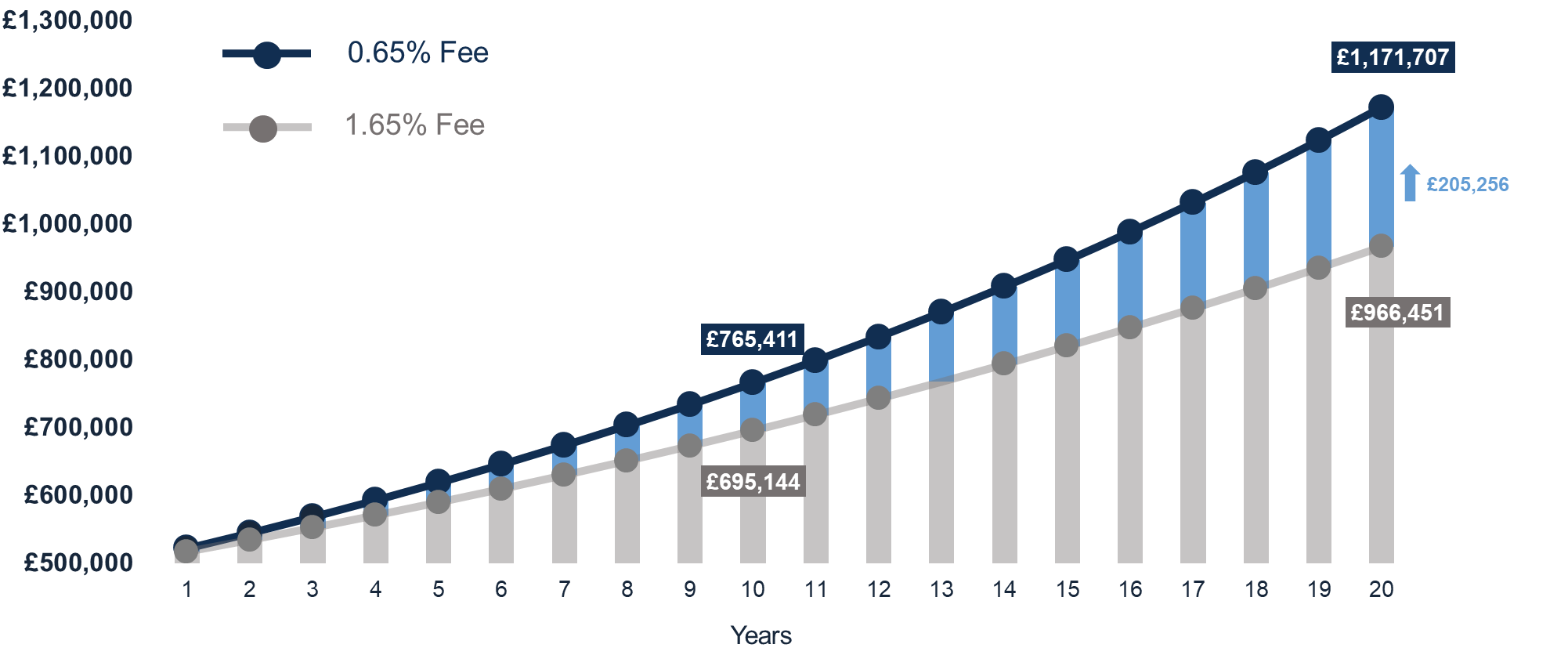

Obviously paying zero fees would be ideal, but realistically you will pay some. Yet paying just 1% less in fees makes a considerable difference over time. How much? For a £500,000 portfolio, growing at 5% a year, and with a fee difference of 0.65% vs 1.65%:

- In 10 years you would accrue over £70,000 extra by paying 1% less in fees.

- In 20 years you would amass over £200,000 extra with a fee difference of 1%.

Simulated future performance numbers should not be relied upon as an indicator of future performance.

Source: Netwealth. Returns based on a £500,000 portfolio over 20 years, assuming an example portfolio with a growth rate of 5% a year and fees of 0.65% vs 1.65%.

So it’s worth assessing how much you may be paying now to have your money managed for you – you may find you could take a higher income in retirement and enjoy a pot that lasts longer with the potential savings you could make.

Being appropriately diversified

It also makes sense to scrutinise how diversified you might be. While it’s common knowledge that a diversified portfolio sensibly spreads risk, you should gauge whether your investment mix is fit for purpose today. For example, our head of portfolio management, Iain Barnes, explains some changes we made recently to reflect the current environment.

So you should ensure your portfolio can adapt but also that it is truly diversified and optimally constructed. Yes, bonds may be a good idea, but US Treasuries or UK gilts? Corporate bonds or emerging market debt? Finding the right mix requires careful investigation and appropriate action. If you invest mainly in equity income funds or developed world equities, you may not have enough diversification to suit your future needs.

Tax considerations

Most readers will hardly need to be reminded of the benefit of tax wrappers such as ISAs and pensions. How you assign your capital each year (by making the most of your allowances) will help you to maximise your outcome later. It’s worth asking some questions to help you stay on the right track:

- Are you making the most of a whole family’s ISA allowance each year? Even over 10 years, the difference between being inside of the wrapper and outside is quite significant.

- Will you likely approach the pensions lifetime allowance (LTA) at some stage? If so, what steps can you take to mitigate the potential impact?

- To ensure your finances are even more efficient, are you making the most of your annual capital gains tax allowance? We can help you to stay on top of this by providing an annual capital gains harvesting service for you.

It's important to keep track of the interplay between how much you set aside in either a pension or ISA – and even more so in retirement to calculate from where and what time you should draw from your investments. By putting an effective strategy in place earlier you can reap considerable rewards when you come to retire.

Crunching the numbers

Your retirement investment strategy will either add up, or you may need to revisit your sums. Professionals are often well placed to assess the anticipated value of their holdings and to do the right thing to secure a pot that meets their needs and wishes.

Yet a little help doesn’t hurt – especially if it makes it easier to determine whether you should make some changes to your plans. At Netwealth we offer powerful online tools to help you gain a clearer picture of your finances over time and to see how they could change.

You can model for various scenarios to see if, for example, planned pension contributions are sufficient to help you reach your goals. You can change variables such as tax rates, risk level, contributions and withdrawals to create a useful impression of how your finances could unfold.

However, there are situations when you could benefit from a more specific level of insight and nuance. We work with many clients who face similar challenges: who want advice on how best to address the LTA for their own circumstances, who value a sharp analysis of complex pension rules or to better understand how to assign capital both in and outside of tax wrappers.

For assistance on these topics and many more – with outcomes you can measure – please get in touch.

Please note, the value of your investments can go down as well as up.