How Family Perceptions Impact Inheritance Outcomes

A stark lack of clarity on the topic of inheritance increases financial confusion for families, our new survey reveals. This can have a significant impact on family financial planning and create serious issues over the short and longer term – unless different generations learn to communicate more effectively with each other.

Uncovering the differences

The report, Generation game: Financial Tribes in Family Finance*, is produced in association with Emma Maslin, financial coach and founder of personal finance education website, The Money Whisperer. Its findings reveal the gulf in understanding between parents and young adults about their families’ finances and, in particular, the often highly sensitive subject of inheritance.

The study highlighted seven ‘financial tribes’ that describe the varying approaches individual family members can have to finance, and the added psychological complexities these attitudes bring to how families deal with money matters.

A combination of poor communication between generations, plus these tribal characteristics, can significantly impact effective family financial planning and amplify critical short and long-term concerns.

Wide press coverage of the report’s findings – including in the Financial Times, the Daily Telegraph and numerous other national titles – suggests the report is relevant to many readers, and may be useful if the findings prompt families to discuss the various aspects of inheritance earlier.

A generational discrepancy

The research found that almost half (47%) of parents do not intend to split their wealth equally between children. This may come as a surprise to many young adults – while 66% of parents believe their children have a clear understanding of their plans, only 39% of young adults agree.

There are many reasons why parents might choose to distribute different amounts of money to their children, as we can see below.

There is a clear discrepancy, therefore, between what the two generations think about the realities of inheritance.

This divergence may also occur because the subject of money, and especially inheritance, is often taboo in families. Only 23% of young adults have had open conversations with their parents about their inheritance.

“While there is no one-size-fits-all approach to family financial planning, open communication early on is an absolute priority,” says Netwealth CEO Charlotte Ransom. “There’s a tendency for parents to assume that their children are aware of their inheritance plans but our research shows that too often this isn’t the case.”

“By breaking down the taboo of speaking about money, parents can provide helpful clarity for the future and enable everyone to make more informed financial decisions, both as individuals and as a family. This also allows disagreements or issues to be discussed and potentially resolved rather than leaving the next generation the task of tackling difficult decisions made by their parents.”

Risks are short term as well as long

A lack of communication between parents and their grown-up children could have an immediate impact, given two thirds (65%) of parents plan on making meaningful wealth transfers in instalments over several years rather than in one lump sum when they die.

This approach could make a significant difference to a young adult’s short-term financial decisions, such as whether they should save for a deposit on a house or invest their money for the future. Yet only a quarter (28%) are aware of their parents’ plans and are therefore having to plan their futures without the information that could help them make better choices.

Family ‘financial tribes’ further complicate wealth transfer

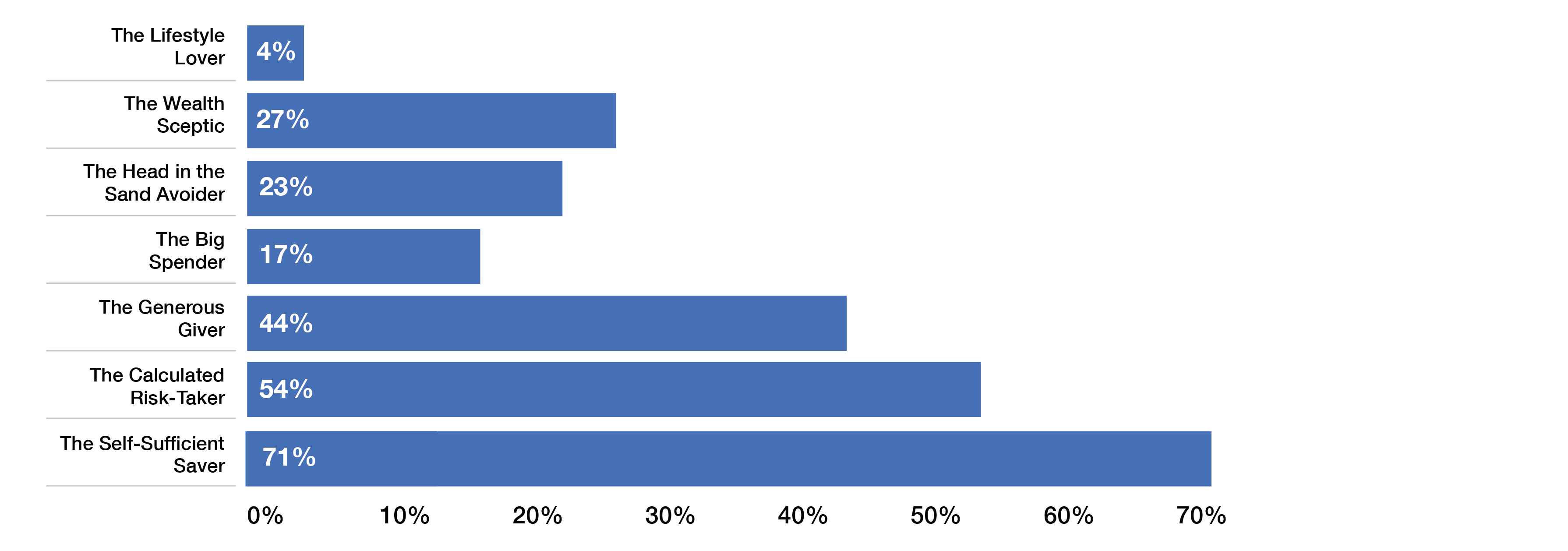

The study also explored the impact different ‘financial tribes’ can have on these significant decisions within families. According to the findings, parents who identified as Lifestyle Lovers or Big Spenders** were less likely to split their wealth equally among their children (4% and 17%). They instead preferred to provide greater support to those who were not as confident with money to ensure they were taken care of.

At the other end of the spectrum, those identifying as Self-Sufficient Savers were the most likely to split their wealth straight down the middle (71%).

We can see below which parents are more likely than others to distribute their wealth equally among their children – depending on which financial tribe the parents associate most with.

The main reasons given by the 47% of parents who do not plan to distribute their wealth equally among their children include a wish to even up previous financial support provided (15%), or because they felt certain children had different financial responsibilities and therefore a greater need for support (14%). Trust is another significant factor, with 13% of parents saying the child they trust with money will get more.

“Every life opportunity we face is filtered through the lens of our unique money personality – or ‘financial tribe’ – but we often assume that others think about money in the same way that we do,” says Emma Maslin. “Add to this a lack of communication between generations and there is a lot of room for misunderstanding and potential surprises later down the line.”

“By taking the time to really understand our individual and respective family members’ ‘financial tribes’ we can leverage the positives of our different money personas to benefit ourselves and the overall family unit when planning for the future.”

Talking to the right people, at the right time

Many elements of effective financial planning can be complex but greatly overcome through open conversations about your wealth and your ability to achieve your goals in life. Ensuring finance is a topic discussed within the family unit can help educate and build confidence in the next generation.

“By having these transparent conversations, family members are empowered to make financial decisions that will stand them in good stead for the future,” says Charlotte Ransom.

You may also benefit from having a conversation with a financial expert who can help you to successfully navigate through the various stages in your life – from planning ahead for a comfortable retirement to making the most of the wealth you leave behind. To find out how we could make a difference to your financial future, please get in touch.

Please note, the value of your investments can go down as well as up.

* This report, Generation game: Financial Tribes in Family Finance, uses insights from consumer research conducted by Instinctif Partners on behalf of Netwealth by Censuswide. 2,000 people were surveyed, made up of 1,000 25-35-year-olds and 1,000 parents of 25-35-year-olds with at least £50k of investible assets, who are planning on or open to transferring wealth to their children in the future. Drawing on Netwealth’s own experience, survey questions were developed and analysed with leading financial coach Emma Maslin. More information on methodology can be found on p.15 of the report.

** A breakdown of the different ‘financial tribes’ and descriptions of their key traits can be found on p.3 of the Generation game: Financial Tribes in Family Finance report.