Investment update: adapting to an evolving environment

The investment environment has been rather quiet in recent weeks and months. Few market-moving events have occurred, which is not always the case in summer months as liquidity tends to dry up somewhat and markets can become slightly more volatile. So let’s take a closer look to see what’s going on.

Essentially, the market seems to be in a holding pattern. We are waiting to see how the health picture evolves in different countries and regions, what that might mean for the growth and inflationary picture and how these feed into different policy decisions – and then how they, too, affect the future outlook for investors.

Looking at UK growth – a trajectory which is similar in many regions – and we can see that after the huge drop in economic activity last year, the UK GDP had grown by 22% to the end of June this year. That sounds like a considerable rebound, and it is, but it is still 2% below the economic output of February last year – a reasonably significant downturn in a normal environment.

Inflation and employment

Meanwhile, the inflation picture has been the biggest topic of debate in recent months. The focus is on what could be the tangible outcomes in terms of pricing as a result of the pandemic and policy decisions around it – and, again, how those decisions will feed into the future outcome.

In the US, the key word around inflation has been ‘transitory’, as policymakers at the US Federal Reserve (the Fed), try and assess whether current inflationary pressures will persist for a short period of time or become permanently entrenched. In the most recent release of US inflation data, the Consumer Price Index rose by 5.4% over the preceding 12 months. Stripping out the volatile contributions from food and energy prices and inflation rose 4.3% – still high, but markets were reassured that they were within the bounds of expectations from forecasters.

While reassuring, the figure has done little to settle the debate as to whether inflationary pressures will prove transitory or not. Ultimately, the Fed, led by Jerome Powell, will look at the US labour market for guidance on this because it will be the strength of the labour market and the level of wage pressure that may dictate whether inflationary pressures are sustained.

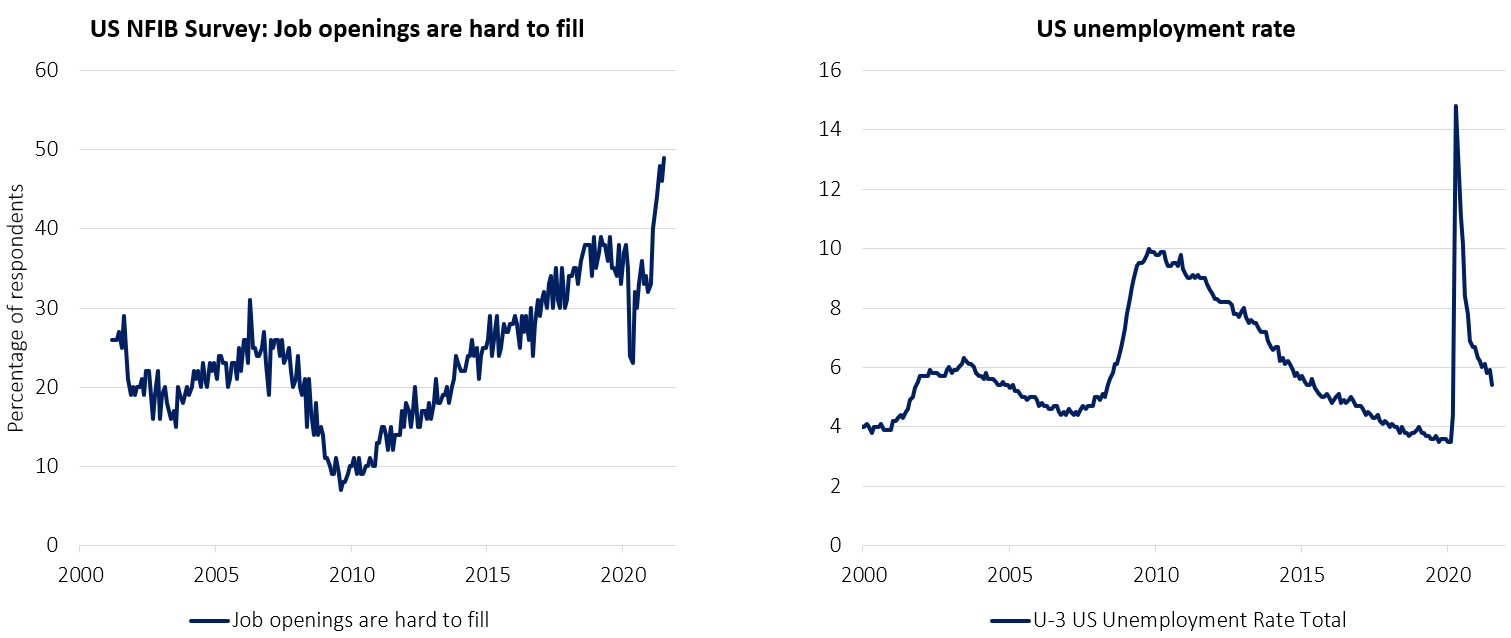

Speaking to this, a survey of small businesses in the US revealed that job openings are as hard to fill as they have been in the past 20 years. Vacancies are difficult to fill throughout the country and there is plenty of anecdotal evidence of wage increases in sectors such as retail, fast food and through to the financial sector. This is taking place even as the overall level of US unemployment is still at levels that could be considered a little concerning.

There is therefore a level of uncertainty as to what the US labour market is really telling us, so where does that lead us?

Changing interest rate expectations

Markets are generally changing their expectations of where interest rates will be in the future. Previously markets were anticipating that interest rates would remain at the current super low levels for the foreseeable future. More recently, US and UK investors are starting to anticipate slightly higher interest rates ahead.

Notably, the Bank of England could start to move a bit faster than in the US. The minutes that came out from their most recent meeting suggested that they are looking at changing interest rate policy and indeed, the level of what's known as quantitative easing in the coming year.

So, the market is expecting some sort of change in the UK interest rate picture, probably between February and May of next year. At the end of the two-year horizon, markets expect that there will be at least two interest rate hikes in the US and one in the UK, with European interest rates to stay around zero.

How our investment process is built to adapt

We aim to build sensible portfolios of efficient market exposures in what we call liquid capital markets – those which are easily accessed and traded. We try to keep our costs down and invest to make sure the market returns we gain feed through quickly into client portfolio returns.

Our investment process is chiefly realised through three components:

- Strategic allocations – these are the bedrock of each of our seven risk level portfolios where we define the asset class exposures, the mix of asset classes we think is the most appropriate. This component drives between 80 to 90% of each portfolio’s risk and returns.

- Instrument selection – this is how we take exposure to each region or asset class that we use as a building block to make up portfolios, using predominantly passive instruments to do so.

- Cyclical positions – these are actions that we take as a portfolio management team to mitigate any particular risks that we can identify within those strategic allocations to try and smooth the path of returns for each client portfolio.

Let’s now analyse the application of combining these components and how that has affected the composition of our portfolios recently.

Responding to uncertainty

At the start of this year there was a great deal of macroeconomic uncertainty, which warranted sizable changes in our portfolio composition. We therefore made strategic changes to reflect changes in valuations and the long-term outlook for various asset classes. We also adopted various cyclical positions – with a shorter-term focus – to benefit from perceived mispricings as we emerge from the pandemic.

Consider longer dated bonds: typically this asset class exhibits a greater sensitivity to long-term inflation expectations. Emerging from the pandemic at the back end of last year we felt that an excessive amount of concern had been priced into this asset class as people perceived future inflation to be much higher than it's been in recent history. Hence, we decided to allocate a much greater proportion of our fixed income allocation to an ETF that holds US Treasury bonds with a maturity of greater than 20 years.

Our rationale was driven by the fact that longer dated bonds deliver a greater yield, there is the potential for greater capital appreciation if US yields follow their European and Japanese counterparts lower, and finally, in times of equity price reversals they may provide a greater degree of portfolio protection than shorter term bonds. The result has been a meaningful contribution to portfolios as inflation expectations have retrenched somewhat, despite equity markets being sanguine. This reinforces our conviction that when things are more turbulent, bonds still have a role to play in portfolios in protecting and mitigating the downside in equity sell-offs.

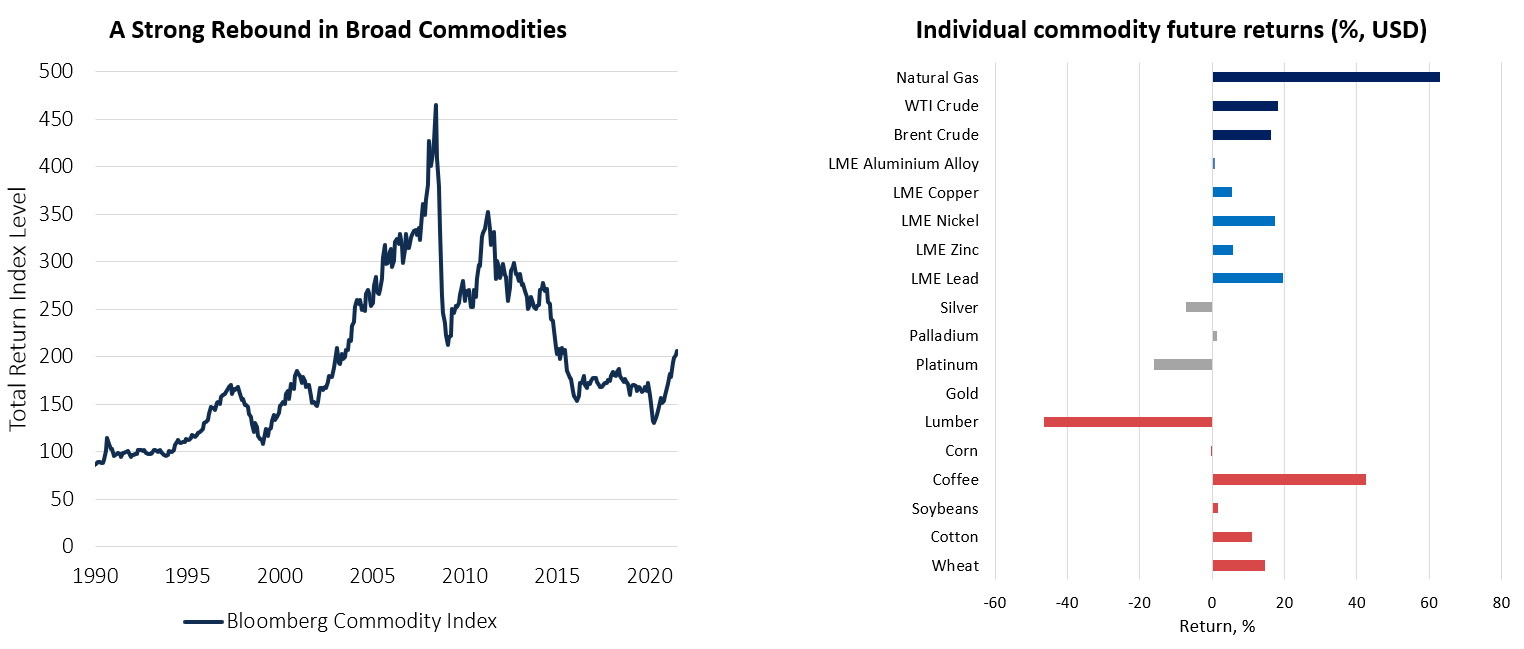

Another asset class that we added in the first quarter was exposure to a broad basket of commodities. Our analysis shows that the best environment for commodity performance is when both growth and inflation are accelerating.

This is the macroeconomic environment we anticipated through 2021 as pent-up demand outstrips supply. We're still seeing evidence of bottlenecks in supply chains, while consumers have also wanted to spend the cash they have saved over the previous 18 months. Adding commodities to portfolios historically has improved their risk and return characteristics.

The Bloomberg Commodity Index has continued to appreciate this year despite uncertain growth expectations – but as there has been, and can be, a lot of variation underneath the surface we prefer to own commodities on a diversified basis through an ETF that tracks the broad index, which has done pretty well in 2021 in this recovery environment.

While we invest in gold on an individual basis – with our rationale explained here earlier in the year – gold has recently lagged the performance of other asset classes. It’s a situation we monitor closely, and as with all of our investments, we frequently assess whether to add further to positions or explore whether other opportunities might better suit our evolving allocations.

Which brings us neatly to UK equities.

Positive signals from the UK

It's worth reiterating the arguments for owning UK equities within our portfolios. Most UK stocks are cheap. Looking at various different valuation metrics on an absolute basis and on a relative basis with other markets, the valuation signals are quite strong.

UK markets have been unloved for many years, particularly from international investors who shunned UK stocks mainly due to Brexit concerns that lingered for some time. In the first quarter, we chose to allocate more of our UK equity exposure towards UK domestic stocks, at the expense of the more multinational FTSE 100 index.

We did this because in Q1, we thought that the strong initial vaccine rollouts would support domestic earnings. Also, the cyclical recovery would strengthen the pound, which we know has a negative impact on the international revenue streams of the large, multinational companies of the FTSE 100 index.

Nevertheless, we saw a slowdown through the summer as the increase in the number of Covid-19 cases caused by the delta variant slowed down economic activity and subsequently slowed down the outperformance of the UK domestic stock index, the FTSE 250, against the FTSE 100.

Now, looking forward, we're quite positive on the UK domestic stock outlook, as the link between cases and hospitalisations appears to have been severed. Also, more than three quarters of the nation have been vaccinated and we're seeing more sectors continue to re-open, if tentatively.

We therefore have a strong belief that the domestic economic recovery can accelerate, with consumer spending strength persisting. These factors will continue to support domestic stocks versus the FTSE 100, which supports our analysis to consider increasing our exposure in this section of the market.

If you have any questions about how we can help you to invest, please get in touch.

Please note, the value of your investments can go down as well as up.