MyNetwealth – quick start guide: Wealth Tracker and Wealth Planner

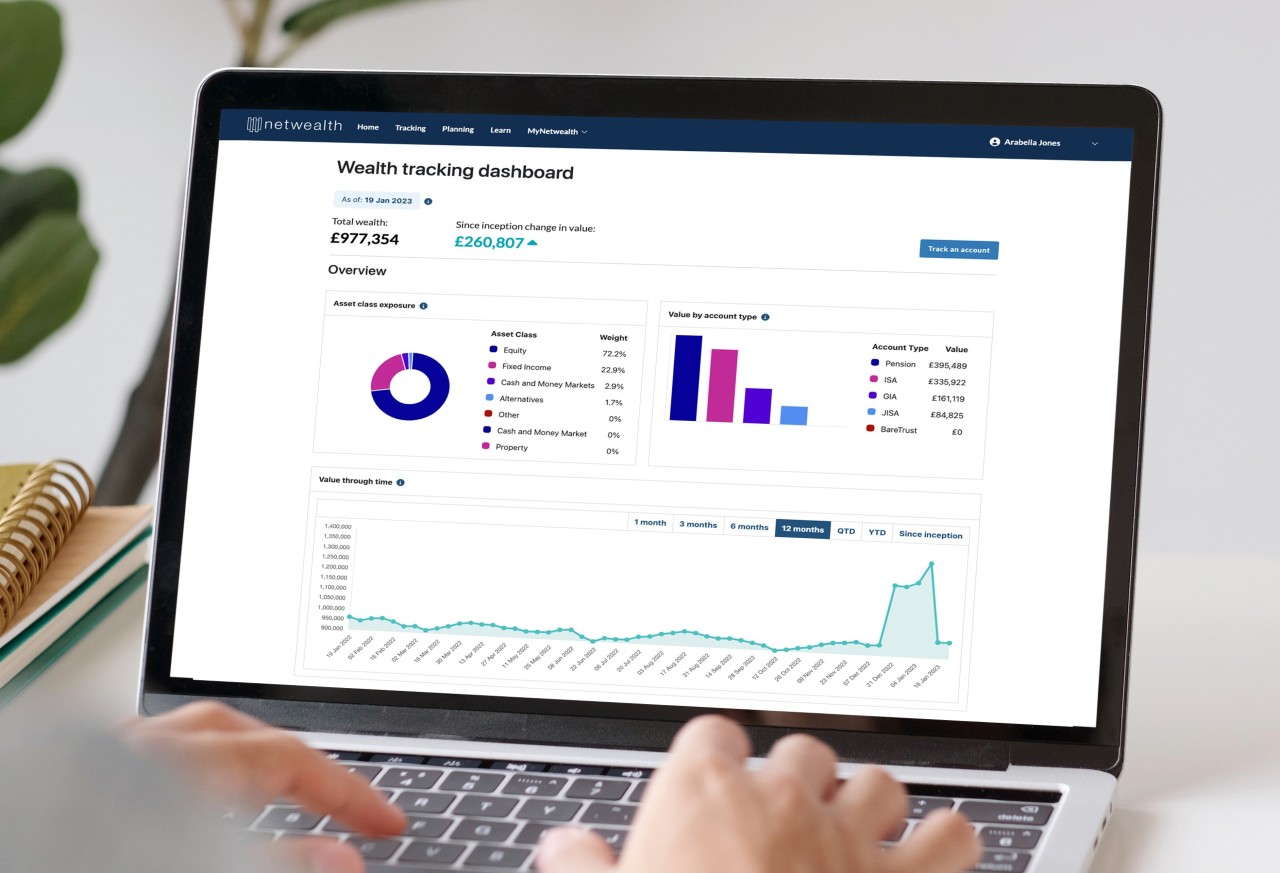

Wealth Tracker

See how your money is performing by visualising all your accounts in one place – with daily automatic updates.

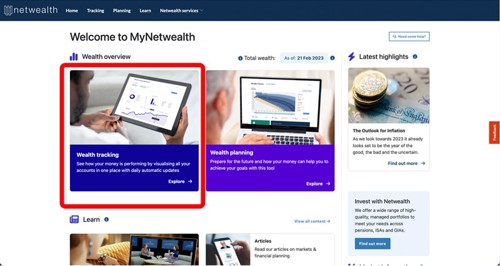

Step 1 - On the homepage, select the wealth tracking tool.

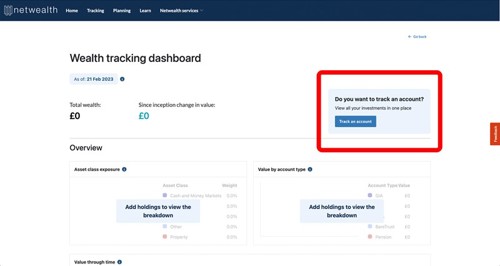

Step 2 - On the Wealth Tracking Dashboard, click on “Track an account” button.

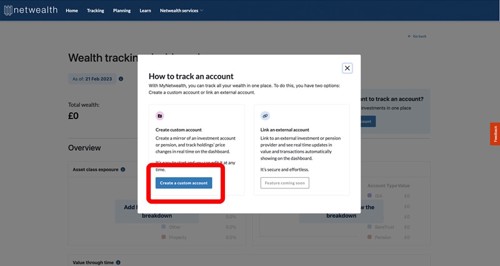

Step 3 - Choose a method.

Custom accounts allow you to add your holdings, with the values of each holding then automatically updated daily. You can also see the asset class exposure and performance over time. You need to manually add, edit or remove holdings whenever needed.

Linking an external account will automatically import data directly from your provider. It shows asset class exposure, performance over time and daily changes in the value. This feature will be released soon.

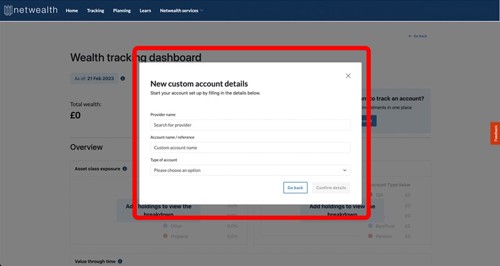

Step 4 - Creating a custom account.

We have an extensive list of providers, but you can still add a new one if your provider is not on our list. You can have multiple accounts under the same provider.

The account name is a free text field. It doesn’t need to have the same account name that your provider has given it.

You can track ISAs, Pensions, General Investment Accounts (GIA), as well as Junior ISAs and GIAs.

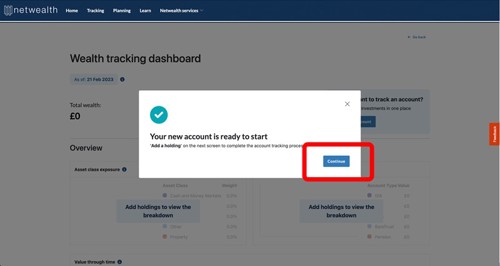

Step 5 - Start to add holdings.

Your account is ready. So click on “Continue” to start adding your holdings. You can come back and do it later as well.

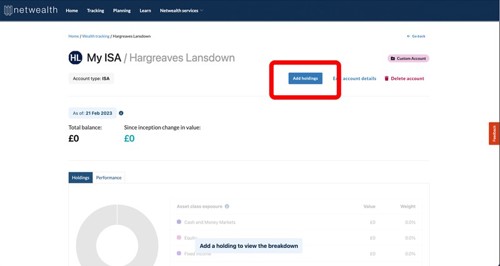

Step 6 - Click on “Add holdings” to be taken to the holdings search.

This is your account drill-down page. You can see your account breakdown and performance. You can also add and edit your holdings.

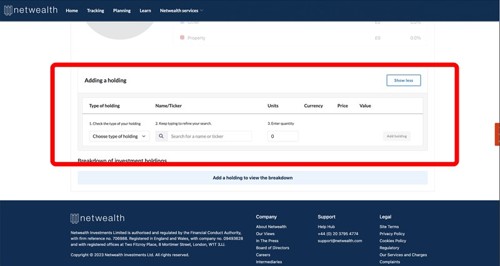

Step 7 - Search for your holdings.

To add a holding, follow these steps:

- Select the type of holding

- Search for the name or ticker

- Enter the units

- Click on “Add holding”

Now you can repeat this step until you have entered all your holdings.

Wealth Planner

This tool helps you to better understand your money and how it can help you achieve your goals.

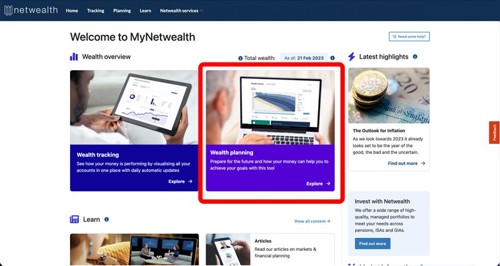

Step 1 - On the homepage, select the wealth planning tool.

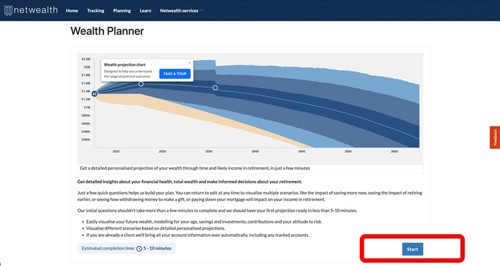

Step 2 - Complete the wealth wizard to see your initial projection.

The wealth wizard asks for an overview of your retirement goals and what accounts you have. If you have tracked accounts, they automatically appear here. And you can add more later.

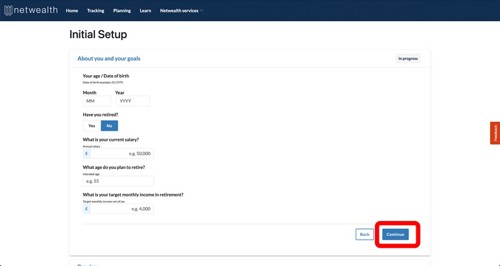

Step 3 - Enter information about you and your retirement goals.

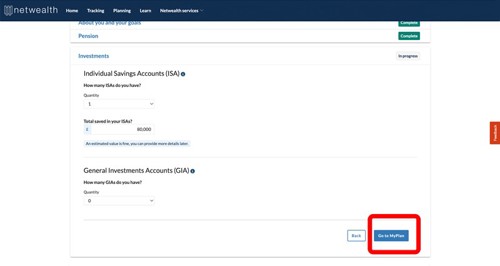

Step 4 - You can enter an estimate of your pension and investment pots.

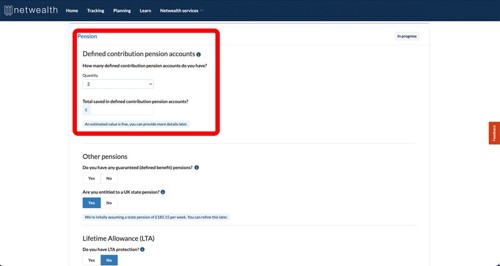

In the wizard, you can build an initial view of your accounts. You can enter an estimated number of accounts and a total value for:

- Defined contribution pensions

- ISAs

- GIAs

You can also inform the tool of any defined benefit pensions, state pension and if you have LTA protection. You can add more detailed information relating to each account later.

If you have tracked or Netwealth accounts, these details will be filled in automatically and you can also add more information later.

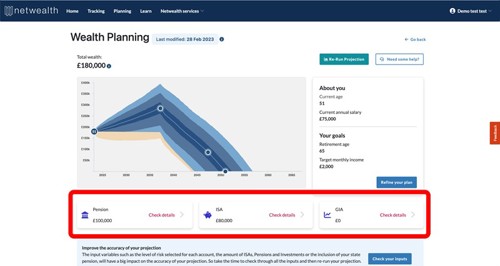

Step 5 - After your initial projection, you can add more precise information about your investments.

Your initial projection is unlikely to offer a complete view of your current wealth until you add further information in the refinement pages.

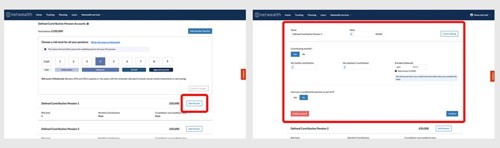

Step 6 - You can include more details and add new pension and investment accounts.

As you refine your details you can change the information you told us about in the initial set-up wizard, such as your intended income and retirement age. This includes any future contributions or new accounts to Pensions, ISAs and GIA. You can also give details about your Lifetime Allowance and any Defined Benefit accounts.

If you have also used the Wealth Tracker, your accounts will automatically update and appear here as well.

As a Netwealth client, your accounts with us also appear automatically (excluding Junior ISAs).

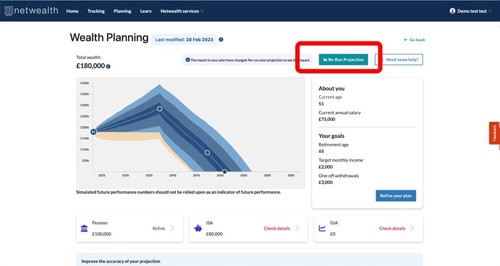

Final step - Rerun your projection to include your new inputs.

When you make changes to your financial information and goals, your plan doesn’t automatically update until you are ready. Once you want to do it, select “Re-Run Projection”.

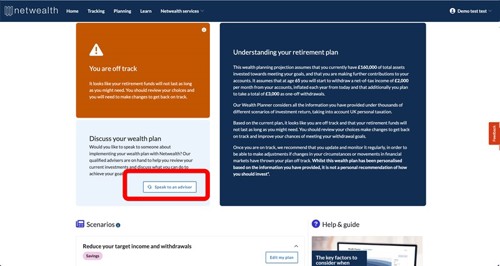

Tip: You can speak with our qualified advisers to discuss your plan.

If you want to know more about whether you are on track to meet your goals, or how better to achieve them, you can talk to an adviser.

Both the Wealth Tracker and Wealth Planner form the core of our free MyNetwealth service.

Our CEO Charlotte Ransom recently explained the benefits and how it has the potential to transform financial lives by giving users an extraordinary view of their money and empowering them to make better decisions for their future.

Please note, the value of your investments can go down as well as up.

Netwealth offers advice restricted to our services and does not provide independent advice across the market. We do not offer advice in relation to tax compliance, personal recommendations with regards to insurance and protection, or advise upon the transfer of defined benefit pensions.