Portfolios prepared for diverse market conditions

It’s not an overstatement to say it has been a challenging start to the year for investors. Surging inflation, interest rate hikes, slowing growth and the conflict in Ukraine all make it a difficult environment to invest and feel reassured. But it should encourage you to know we have the experience and expertise to help guide your investments through difficult times.

Being prepared: people and portfolios

Persistent volatility threatens stability, and it’s only natural if you feel concerned. Yet the level of risk for various assets ebb and flow over time – it’s normal for stock and bond valuations to fluctuate throughout the year. This is why an experienced team matters: to keep a cool head and respond effectively to changing investment conditions.

All the senior Netwealth team members have witnessed many market downturns and testing environments. We have managed money through challenging and prosperous times – learning lessons which help us to focus on the right outcome for clients, whatever lies ahead.

Globally diversified portfolios also help us to be prepared. We invest across different regions and assets (including equities, bonds and commodities) – and fine tune to adapt. For example, we may evaluate the merits of ultrashort vs longer dated bonds, analyse the benefits of developed or emerging market economies, and assess whether investing in gold may be appropriate to combat stock market weakness.

Nuance makes a difference: being able to assess multiple scenarios and drill down to the right flavour of asset (eg, US Treasuries vs UK gilts) within an asset class is crucial.

Yet there is no silver bullet for hedging against inflation pressures nor is there an investment guaranteed to do well whatever dominates the news. We must therefore be both responsive and measured. We need to cautiously prepare for disparate events and unpredictable outcomes, and boldly invest during uncertainty – because a completely calm environment is never likely to persist.

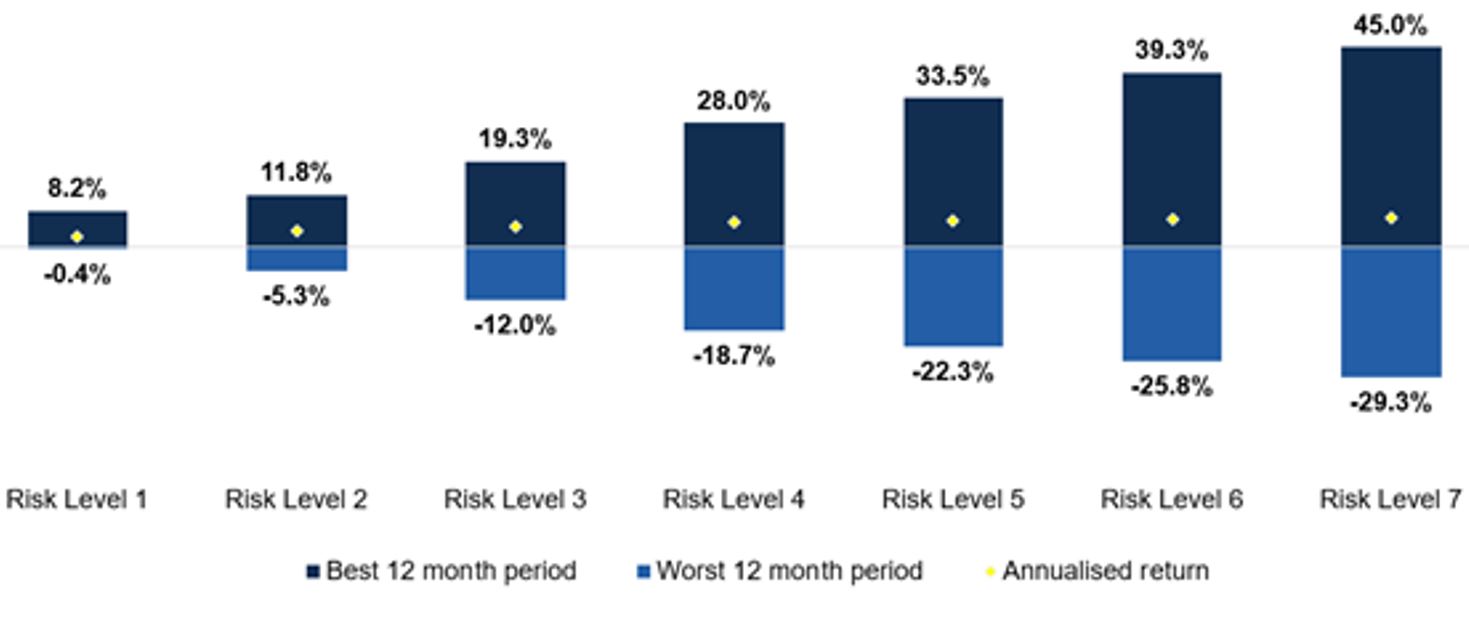

It's important to note, therefore, that even though there will be periods of market stress (most likely every year), taking investment risk over the long term is typically rewarded. The chart below shows that returns can be weak at times (the light blue bars show what would have happened in the past, and thus is likely to occur again), but it is the average return through time that matters, and remaining calm and invested according to your chosen risk level – unless your circumstances or objectives have changed.

Portfolio returns in the context of 25-year history

Source: Bloomberg and Netwealth. Returns shown net of all fees to 31st December 2021.

Simulated future performance is not a reliable indicator of future results.

Putting recent performance into context

Most investors have not done particularly well since the start of this year. It’s never pleasant to experience a temporary decline, but it’s worth recognising that markets typically rise over the long term.

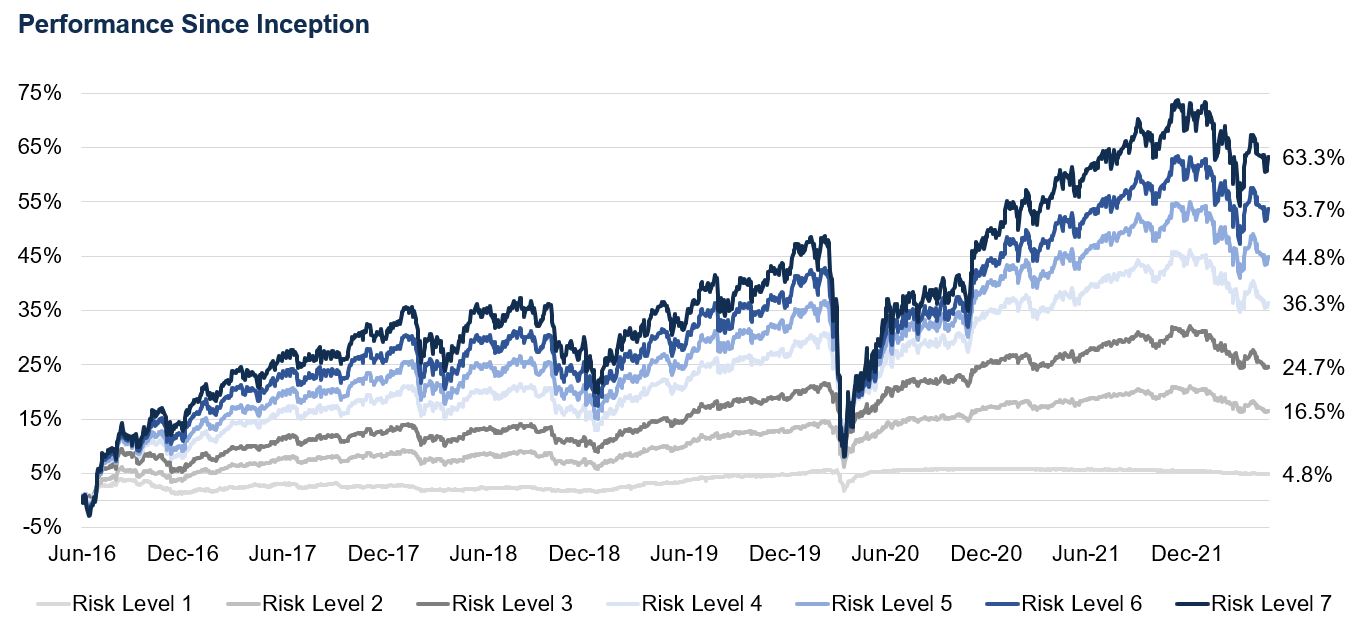

We can demonstrate this by reminding you of our own performance – and to show that even in the face of considerable market turmoil, like the pandemic, markets do tend to recover over time.

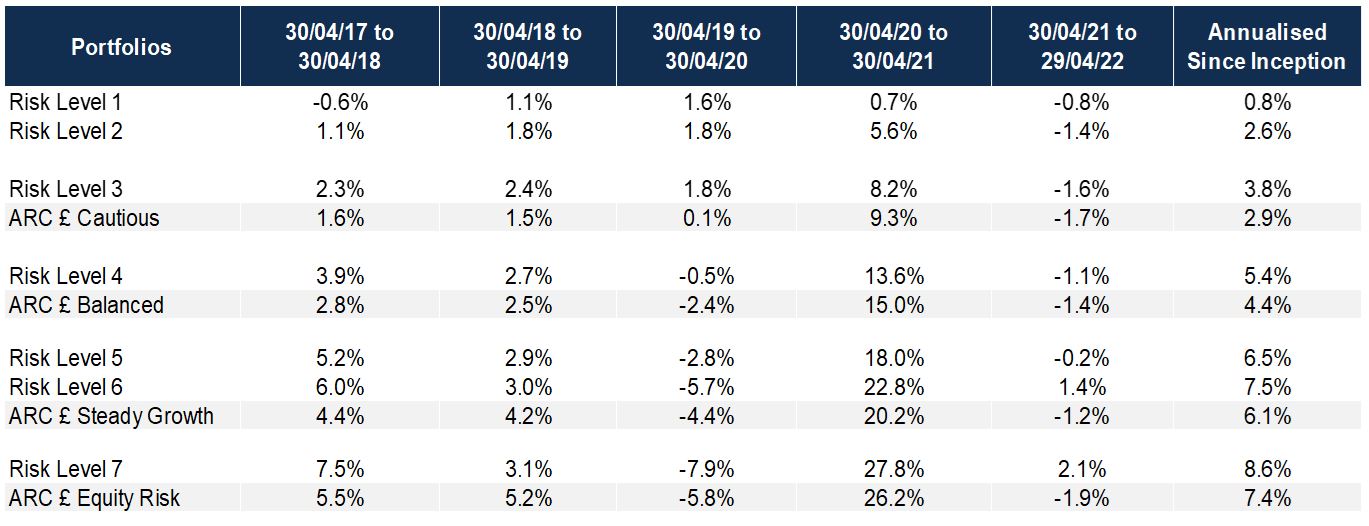

Below we show the performance of our seven risk portfolios, and below that a breakdown of our 12-month returns over the past five years.

Netwealth GBP portfolios performance (as at 30th April 2022)

Source: Bloomberg & Netwealth. Returns shown net of all fees to 30th April 2022

Returns shown are of indicative live portfolios in each Risk Level, using the market prices at which purchases and sales took place. Returns are shown net of (i) all charges associated with the underlying fund investments and (ii) a Netwealth fee of 0.35% per annum covering management, trading, custody and administration charges. Netwealth fees range from 0.65% - 0.35% pa depending on account size. The data shown is from inception in May 2016 and as such there is no data available for prior periods.

These figures refer to the past, and past performance is not a reliable indicator of future results.

Netwealth GBP portfolios 12 month returns (as at 30th April 2022)

Source: Bloomberg, Asset Risk Consultants & Netwealth. Returns shown net of all fees to 30th April 2022. ARC data contains estimates for peer groups for April 2022.

Returns shown are of indicative live portfolios in each Risk Level, using the market prices at which purchases and sales took place. Returns are shown net of (i) all charges associated with the underlying fund investments and (ii) a Netwealth fee of 0.35% per annum covering management, trading, custody and administration charges. Netwealth fees range from 0.65% - 0.35% pa depending on account size. The data shown is from inception in May 2016 and as such there is no data available for prior periods.

These figures refer to the past, and past performance is not a reliable indicator of future results.

Troubling times may demand a response, or a conversation

As daunting as wrestling against the effects of inflation may seem, you really should do all you can to mitigate against its impact. Even relatively benign inflation, closer to 2%, can severely dampen the value of your cash holdings over time, so a level significantly higher – even over a shorter timeframe – is naturally concerning.

When you choose to invest with a wealth manager like Netwealth you are entrusting the safe stewardship of your wealth to deeply experienced and seasoned professional investors. Yet you still might wish to talk. So please do get in touch if you have any concerns or feel you would like expert advice to help better address your own circumstances.

Meanwhile, you can rest assured we are deploying all our skills and experience to ensure we maintain our growth trajectory for our clients.

Please note, the value of your investments can go down as well as up.