Seeking nuance among US opportunities: is investment grade credit still worth it?

Being an analytical and proactive investor is key to maintaining consistent returns. Sometimes our analysis leads us to swim against the tide of convention. Here we examine the current risk/reward trade-off of high quality US corporate bonds, known as investment grade (IG), outlining why we now think a switch to US Treasury Bonds may be more appropriate.

Treasuries, backed by the US government, traditionally offer a safe haven with reliable, albeit lower, returns. In contrast, IG corporate bonds offer investors the allure of potentially higher yields but come with the added risk of the issuer defaulting on their debt. Let’s explore whether the potential for these higher returns justifies the additional risk involved, given the current macroeconomic backdrop and fundamentals.

The macroeconomic backdrop

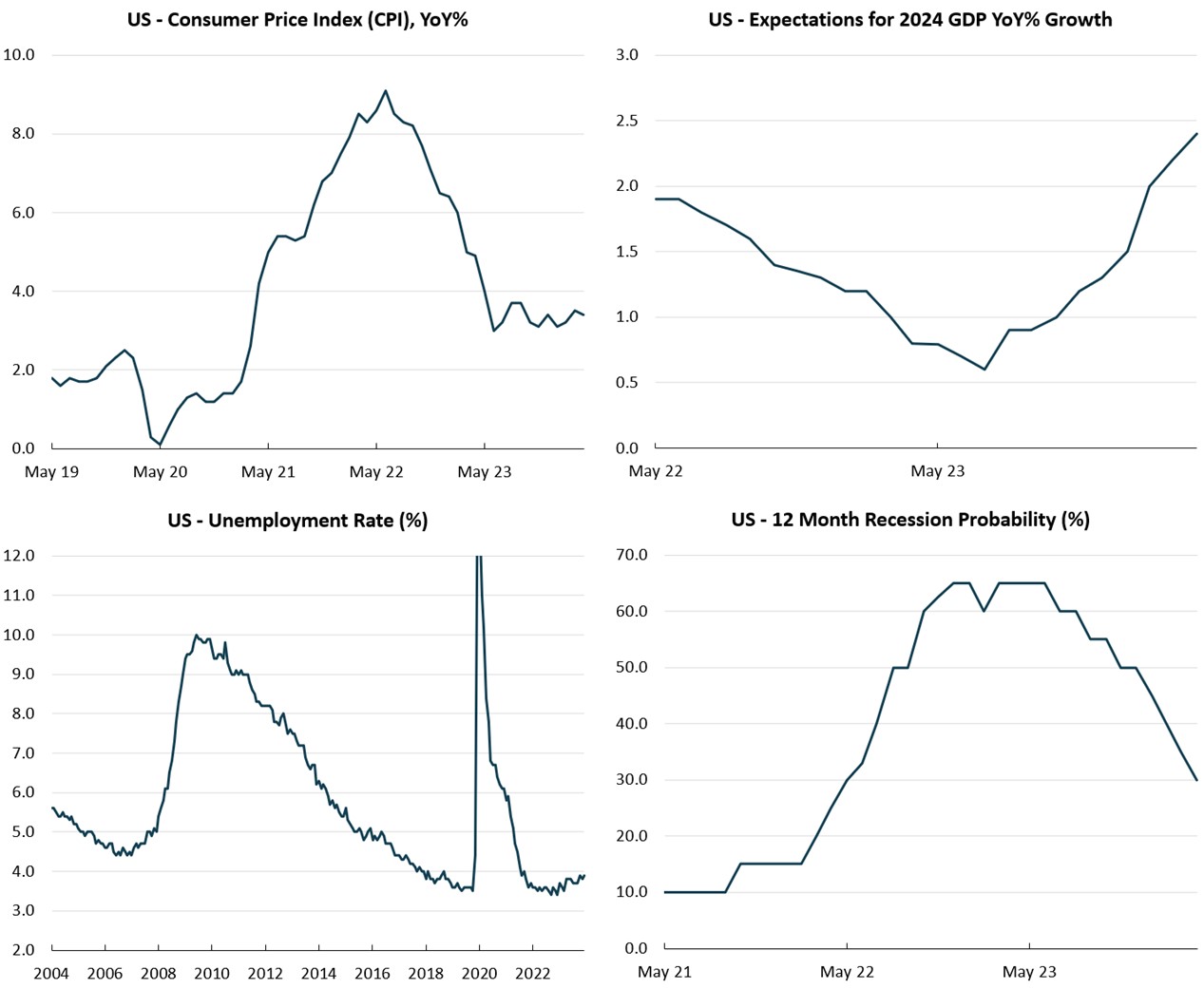

The US economy has again defied expectations. What once seemed like an inevitable recession has given way to a surprisingly positive scenario. Healthy growth, significantly tempered inflation concerns, and robust corporate earnings paint a rosy picture.

This stark contrast follows a period of intense anxiety as central banks across developed economies undertook an unprecedented – in speed and magnitude – interest rate hiking cycle to combat rampant inflation in the aftermath of the pandemic. While their actions (plus the reopening of supply chains) successfully moderated inflation, what truly surprised markets was the resilience of the US labour market and economic activity.

This positive environment has fuelled a surge in investor optimism, driving down the spreads (the extra yield received by owners of corporate bonds compared to risk-free Treasuries of equivalent maturities) of US IG corporate bonds.

US inflation has moderately significantly, while the economy has remained resilient

Source: Bloomberg

Credit fundamentals – enjoying a sweet spot

The IG credit market is currently enjoying a sweet spot, with strong fundamentals, relatively high all-in yields (credit spread plus yield of risk-free Treasuries) and buoyant investor confidence. Previous concerns about the US handling of higher interest rates have given way to a strong belief that the earnings rebound will evolve into something more longstanding and fundamentally solid, reassuring investors about the future creditworthiness of the issuing companies.

This positive environment has boosted the quality of IG credit, reflected in an increased level of credit rating upgrades. Earnings growth remains healthy, and profit margins have improved recently as relatively high inflation on costs moderates. While debt levels are high, this is caveated by the fact balance sheet debt is relatively cheap (for now). Companies were strategic in locking in low borrowing costs during the low-interest-rate period.

This, combined with their ability to earn more on investments with rising rates, strengthens their net interest expense position. Interest coverage (affordability of interest expenses) has been trending lower as corporates are forced to refinance at current higher interest rates, but remains in line with historic norms. Cash balances are high relative to history. Overall, corporate borrowers are currently in a good financial position.

Investor sentiment is bullish, driving record issuance of US IG corporate bonds to meet growing demand. This positive sentiment is expected to drive the strongest net flow into US dollar IG corporates since 2017.

Valuation – priced for perfection?

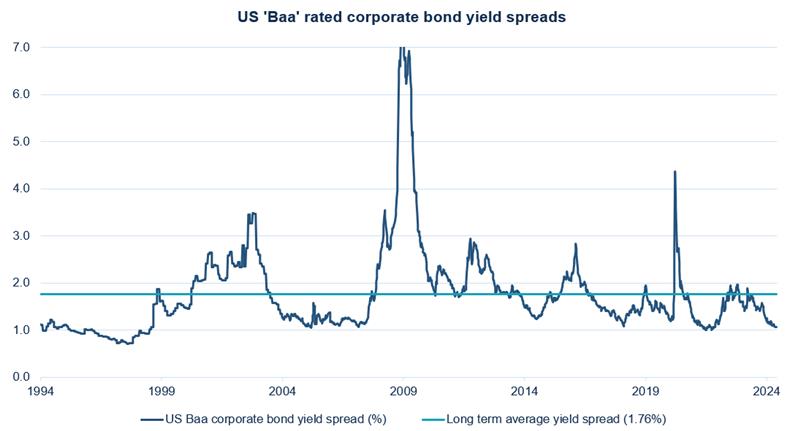

A favourable macro backdrop and healthy fundamentals have driven credit spreads to near record lows. Since the US banking crisis scare in March 2023, credit spreads have steadily tightened for the past 14 months.

Source: Bloomberg

Spreads on the Bloomberg Baa corporate index (the part of the market made up of the lowest quality corporate bonds still classified as investment grade) sits at a mere 1.06% (historic average is about 1.76%), indicating historically extremely tight spreads. To put this into context, spreads have only been tighter 2% of the time in the past two decades. Only the mid-1990s saw lower spreads for a sustained period.

This suggests valuations are currently expensive. Despite all-in-yields (credit spreads + risk free rates) increasing to attractive levels, the proportion of total yield coming from credit spreads is also close to all-time lows (2nd to 5th percentile depending on the index chosen).

In simpler terms, while investors are enjoying high returns today, there's little room for further upside, and very little cushion from future disappointment.

The picture is a little different in the UK market and across Europe, where spreads are also tight, but not yet prohibitively so. In this way, the story of more attractive European valuations is similar to equity markets.

Looking forward – limited upside and potentially meaningful downside

While credit may continue to perform well if the current sanguine macro environment persists, we believe the potential upside is limited given that tight credit spreads offer little room for further improvement. In such positive scenarios, other areas of our portfolio, namely equities, would be better suited to capture more upside.

At the same time, there are early signs of other plausible, less favourable scenarios materialising. We believe these would prompt a widening of credit spreads, and credit underperforming US Treasuries:

- Deterioration in economic growth: A slowdown in economic growth would see credit fundamentals also deteriorate and credit spreads widen. Some potential early signs of cracks in the robust US growth story have emerged. Recent data points such as disappointing GDP, consumer sentiment, retail sales and rising unemployment numbers all point to the prospect of exuberance in US growth expectations waning. From a strong starting point, a more negative narrative could take hold.

- Inflation proves stickier than expected: While the US Federal Reserve was initially viewed as ahead of the curve in its fight against inflation, CPI in the US is currently stubbornly hovering above 3% as the “last mile” service sector inflation proves sticky. If this dynamic continues, we would expect a more hawkish response from the Fed, which would mean that policy rates remain higher for even longer. In such a scenario a higher proportion of corporate debt would need to be refinanced at higher levels of interest rates, increasing interest expenses, and all else being equal, deteriorating credit profiles.

Similarly, specifically regarding the credit fundamental picture, there are also early signs of cracks: defaults from lower quality bonds, a decrease in interest coverage ratios (affordability of interest expenses), rising leverage, the outlook for earnings growth being seen as too optimistic and low recovery rates.

We believe current tight spreads do contain a certain level of complacency, reflecting the current market perception of minimal risks associated with these bonds.

While we acknowledge corporate bonds are currently in a bright spot, we believe the positive tailwinds are now very much reflected in current valuations. While some credit specialists are excited by the attractive all-in yields, as multi-asset investors, we see little additional benefit of owning IG credit now in our portfolios. Our belief is that the risk-reward profile of holding credit currently is negatively balanced and therefore we have begun the process of shifting away from credit in favour of US Treasuries.

Please note, the value of your investments can go down as well as up.