Should we be concerned about investing now?

The conflict in Ukraine, global inflation and the attempts to control it are primary causes of worry now. But it’s unusual to have a period when there are no concerns whatsoever, so investors should plan for multiple scenarios and try to prepare portfolios which are resilient.

Markets have been volatile recently. Investors can take some reassurance, however, that a considered, long-term approach can help to mitigate short-term instability and ensure their investments can adapt to deal with whatever happens.

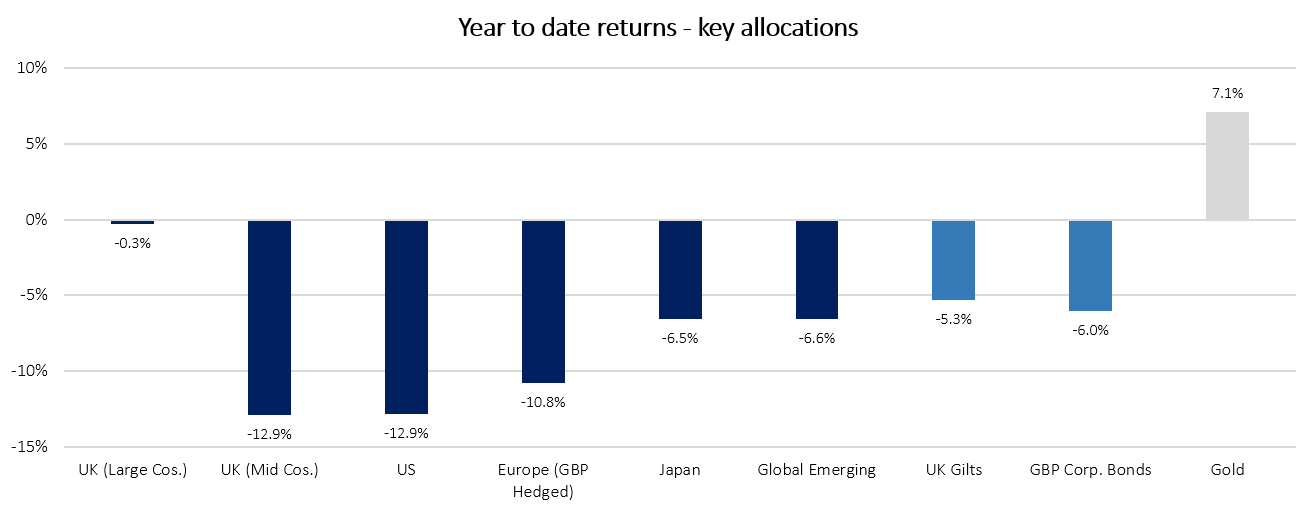

Source: Bloomberg with Netwealth calculations. Returns shown in GBP terms to the morning of 24th February, 2022.

While the returns above are indeed challenging, we provide more context below as to what the potential outcome might be for investors who take a longer-term view.

A proven approach to investing

When we invest – as we describe in detail here – we take an approach that is based on Modern Portfolio Theory. We use historical data as a starting point for future risk and return behaviour from different assets, then adjust for the current market environment and how that may impact returns in the future.

Because we understand that a degree of uncertainty is baked into any of our assumptions, we frequently stress-test the expected characteristics and relationships between the assets we invest in. This helps us to be prepared when markets become more volatile, for whatever reason.

Our team is concerned about risk – and acts to manage it

Risks are inherent in investing, which is why we pay so much attention to the various ways they can take hold. These can include risks associated with markets, events, specific assets and liquidity. Each of these is carefully monitored and managed by our Investment Committee, who decide if any action needs to be taken.

Outside of the Investment Committee forum, we consider continuously the potential effects of any economic, political or social risks and assess how they could potentially affect investments.

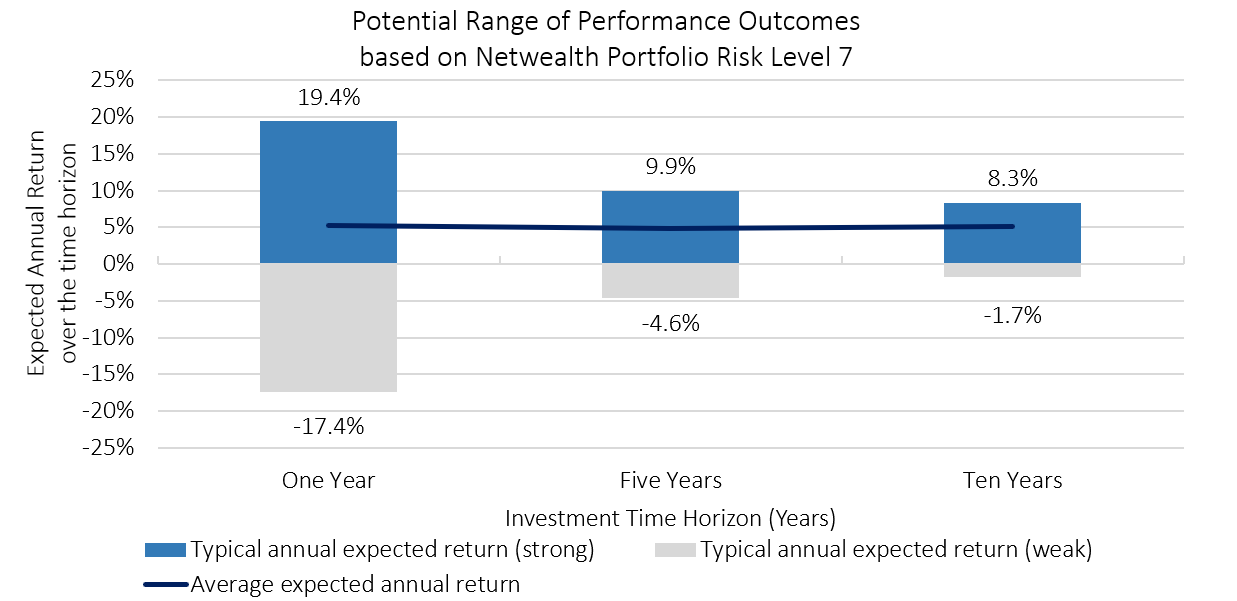

However, as the graphic below shows, we expect the extremes of market performance to diminish when viewed over time. So, the longer the time horizon an investor has, the more the effects of immediate risks are reduced. As long as an investor calibrates their investment horizon accurately, the shorter-term market rallies and falls become less important to the end outcome. We can monitor and manage portfolio risks, but we can’t negate market behaviour.

Source: Netwealth

Simulated future performance numbers should not be relied upon as an indicator of future performance.

Responding cautiously to uncertainty

Uncertainty sometimes demands action, but it pays not to jump the gun. We are firm believers in staying invested and history shows this is usually the best course of action, as this article examines.

A similar measured approach should also be applied when it comes to evaluating whether you should change your risk level. In general you shouldn’t need to, because changing the long-term mix of assets in which you invest will impact your portfolio’s chances of meeting your long-term performance objectives.

However, you may want to change your risk level if your circumstances change – like if you have a child or are retiring. Here we examine the implications of taking such a course of action, and what it might mean for your investment outcome.

Managing behavioural biases

Because uncertainty can have a strong emotional and cognitive effect, this may affect our ability to think rationally and make the most of our money. We explain some of the more common effects here – such as herd behaviour, loss aversion and status quo bias.

Our investment team has a wealth of experience in handling the biases that investors typically face. They always look to objectively assess the difference that taking an action, or not acting at all, will make.

Despite uncertainty, we remain focused on the long term

Our emotions and troubling market commentary can cause us to feel overwhelmed by uncertainty. Fears over the economy, and the political and social landscape can often affect both our wellbeing and how we manage our money.

But we believe, and the evidence shows, that it pays to be patient – and that the negative impacts of events or news usually recede over time. We therefore manage investments, and uncertainty, by taking a long-term approach, despite paying close attention to more immediate factors.

Uncertainty – and fears about conflict and inflation – won’t vanish any time soon. But we can alleviate its effects by impartially interrogating facts and using the resulting insights to protect your interests and consistently grow portfolios over time.

Please note, the value of your investments can go down as well as up.