The case for investing in gold

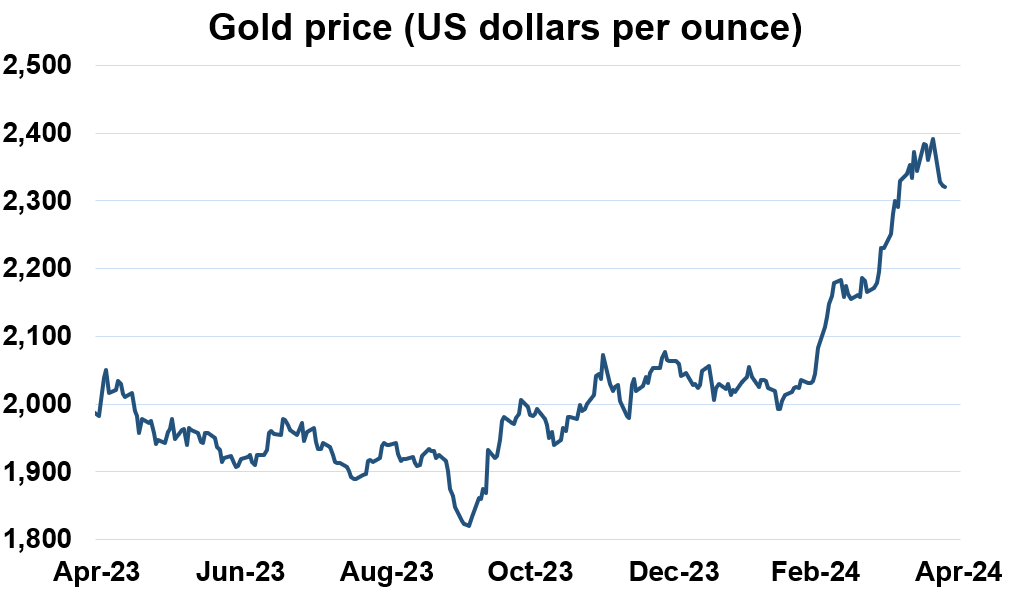

The price of gold increased sharply in the last few months, with many factors being attributed for its rise, before falling back almost as abruptly. We look at the different reasons that can cause its price to climb, highlight our own holdings and explain why we think it has merits as part of a diversified portfolio.

Factors that typically affect the gold price

We believe that gold performs well under the following conditions at different times, many of which may be coincident or inter-dependent. Valuing the precious metal or thinking about future returns is always difficult, as it doesn’t produce any cashflows and has fewer industrial uses than other commodities. It tends to perform best when unexpected events occur or there is heightened uncertainty, rather than offering ongoing, reliable performance.

- Heightened inflationary fears

- Severe risk aversion

- Low/falling real yields

- Financial repression (driving concerns around fiat currency debasement)

- Rising geopolitical fears

Gold enthusiasts claim that the movement in the gold price is often attributable to the market ’sniffing out’ concerns across the wider environment that aren’t necessarily visible elsewhere. In this way, our view is that there is often an element of ‘back-filling’ explanations behind price moves.

Given the broadly benign market environment across the other asset classes we invest in, it is therefore surprising to see gold perform as strongly as it has recently.

Source: Bloomberg

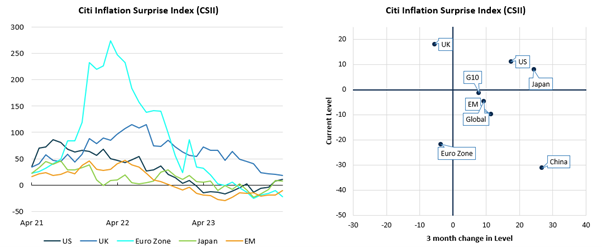

Heightened inflationary fears

Inflation volatility has been tapering back to more muted levels as the inflation spike of 2021-22 subsides. Even if inflation remains stickier than central bankers hope and expect, which has been hitting bond prices, the volatility of inflation is broadly falling across the world.

Source: Bloomberg with Netwealth calculations

Severe risk aversion

The broad recessionary fears in late 2023 have subsided in the USA. In the UK and eurozone recessionary episodes are now seen as more short-lived and shallower than previously feared. The growth picture, therefore, is not one that should induce severe risk aversion, as evidenced by strong equity market returns over the past six months. We don’t believe that the gold price offers any further insight here vs the movements of other, more mainstream assets.

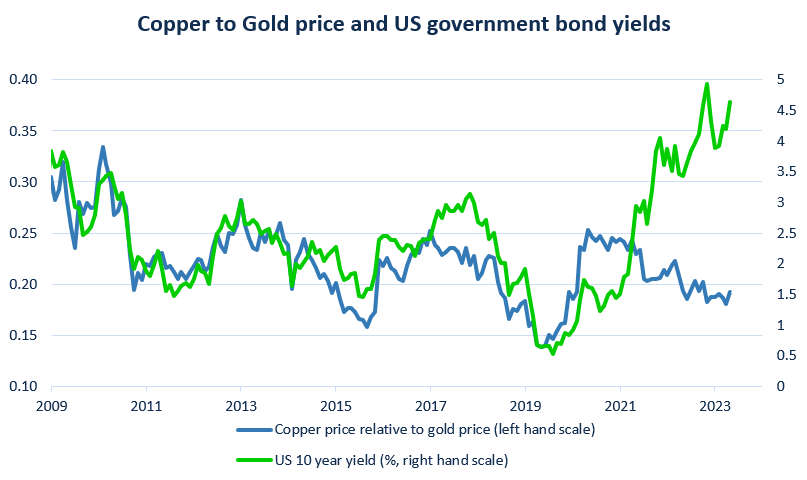

Low/falling real yields

Having plunged lower at the outbreak of the pandemic, the yields of government bonds once expected inflation has been taken into account (known as real yields) moved back into positive territory in 2022, and peaked at +2.5% for US 10-year Treasury bonds in September 2023. The gold price eased somewhat in that episode, before then rallying hard. The moves in real yields have since stabilised closer to 2%. An environment where investors can lock in a 2% yield above inflation levels from the highest quality government bonds is not usually when you see rising prices of a yield-free asset.

Also surprising has been the relative outperformance of gold vs other commodities in an environment when nominal yields (the future returns of bonds disregarding the impact of inflation) have been rising – ie, in an environment often associated with increasing confidence around growth. Nominal yields have risen this year as the market reassesses the likely timing and magnitude of interest rate cuts, pushing them back due to economic resilience.

We think this is related specifically to China: Chinese demand for gold has been increasing while its consumption and expected demand for more productive industrial metals such as copper has been waning, thanks to its stumbling economic performance (relative to previous episodes).

Source: Bloomberg with Netwealth calculations

Financial repression

Historically, investors have wondered if weakness in the US dollar would automatically trigger a corresponding increase in the gold price, given its dollar quote. Moreover, concerns persist over the US fiscal position against a backdrop of a very stimulative stance in an election year. With neither US presidential candidate seen as likely to increase taxes meaningfully, there’s an expectation that the US Treasury’s bond issuance will only increase.

Of course, the dollar itself has seemingly been a beneficiary of the perception of weaknesses around other global currencies: part of its so-called ‘exorbitant privilege’ as the world’s reserve currency.

Looking at gold’s price increase in different currencies, one can see the fear of financial repression around the world (where interest rates are thought to be kept artificially low) writ large:

Source: Bloomberg with Netwealth calculations

Rising geopolitical fears

Most people will have their own take on domestic and international politics. While it is easy and tempting to identify lots of potential political risks, it’s much harder to assign any of these as being a definitive catalyst for gold price rises. There are obvious areas of concern, which we can and do discuss at length in our internal deliberations at Netwealth – but the sharp recent moves in gold have not necessarily correlated to specific political events.

Perhaps a wider sense of nervousness permeates across assets, but that’s closer to conjecture than analysis.

What about China?

Central banks are key buyers of gold – notably internationally, to reduce the dependence on the dollar. According to ING, China’s appetite for gold has been particularly strong, with the People’s Bank of China purchasing gold for its reserves for the 17th month straight in March. Its gold reserves now amount to one third of global central bank reserves.

China’s official reserve assets in March rose to the highest since November 2015. Indeed, Swiss exports to China – usually a good indication of Chinese demand for gold – more than doubled in January from December to 77.8 tonnes.

In our view, this is an interesting sidenote, rather than anything transformational.

Will gold’s potential persist?

At Netwealth, we introduced gold to our portfolios (risk levels 2-6) as a modest strategic position in March 2021, when it was priced at around $1,700 per ounce. This was done for portfolio construction reasons – to raise exposure to real assets as we anticipated inflation volatility and to further diversify our defensive assets away from low-yielding bonds.

Since that point, the position has delivered nearly 50% in GBP terms (a 14% annualised return, which isn’t bad for an asset with no productive value!) and outperformed all other major asset classes (except our basket of broader commodities) in the process.

Should we therefore lean into gold’s strong price trends to enhance the benefits to client portfolios? Or has the price increase been so marked that we should be removing the allocation from portfolios altogether?

Without an anchor from valuations, it is often harder to assess gold’s potential compared to other assets – especially given its tendency to be driven by different factors at different times. Ultimately, it should act as disaster insurance for spikes in inflationary fears, risk aversion or when tempers between nations become frayed.

Yet questioning an asset’s viability is a continual process at Netwealth. We actively manage our allocations in each portfolio, while retaining a consistent level of overall risk.

With gold trading at an unusually elevated level, we are maintaining our position and imagining it just as a form of rising portfolio insurance costs. However, other defensive assets are becoming more attractive, so we will seek to optimise the blend to ensure that each portfolio reflects conviction around risks and opportunities.

Please note, the value of your investments can go down as well as up.