How UK Savers Can Find Lost Assets and Manage Money

Affluent savers throughout the UK are losing track of tens of thousands of pounds – across SIPPs, ISAs and general savings. This shortfall shows the value of being able to view and manage your different accounts and pensions in a single, accessible place.

The challenges of tracking all your wealth

Our new research (conducted with Opinium¹) shows that many savers in the UK are failing to monitor where all their assets are held. For those who have lost track of a SIPP, ISA or savings account, more than 40% have lost track of more than £30,000 – with 28% of respondents who have lost track of a SIPP losing track of £50,000 or more. In total, 60% of respondents have lost track of and failed to recover a financial asset.

We discovered that, typically, affluent savers accumulate four different money pots in their lifetimes. Many lose track of historic assets that have been set aside and are unsure how to go about accessing them.

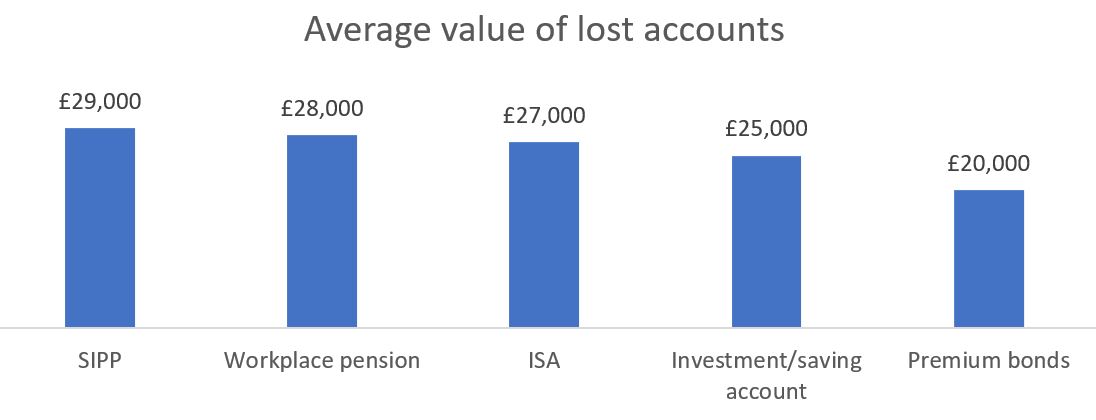

Our findings (published in MoneyWeek and International Adviser, among others) show that on average, an affluent saver in the UK has lost access to between £20,000 and £30,000 – the top end of this range being almost equivalent to the annual UK average salary of £33,000 (Source: ONS).

Source: Opinium, Netwealth.

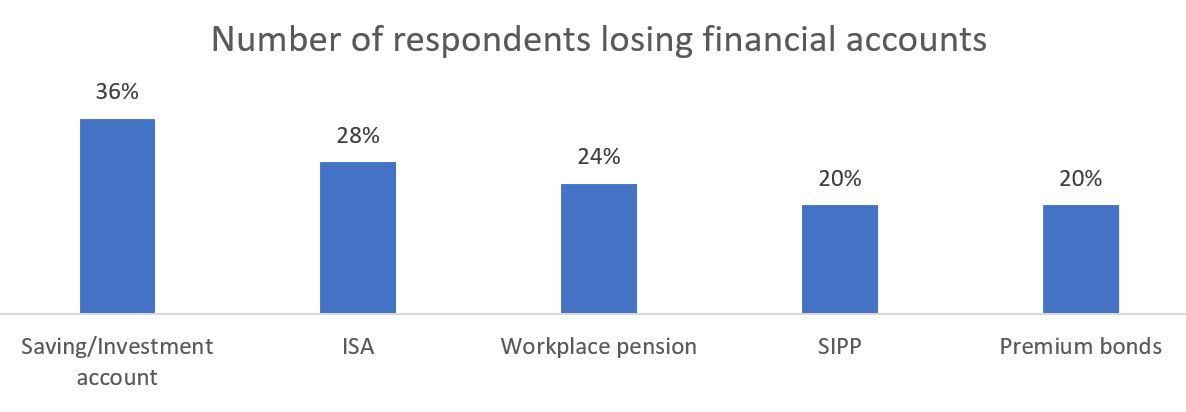

We can also see which accounts UK savers are most likely to be missing.

Source: Opinium, Netwealth.

Finding lost assets

Taking the trouble to locate lost assets could be hugely rewarding – for example, it could pay for the annual average household energy bill of £2,500 for 10 years (Source: UK Parliament domestic energy prices), or you could put the money to work and grow it further. Please note, we don’t trace missing assets at Netwealth, but the links below could come to the rescue.

- Find pension assets – if you know your pension provider you can contact them, or try the government’s free pension tracker

- Find lost savings and ISAs – the British Banker’s Association operates the My Lost Account service to help you track dormant bank and savings accounts

- Find premium bonds – you can use My Lost Account above or the National Savings and Investments dedicated tracing service

- Find investments – if you are missing share certificates you can contact a company registrar such as Equiniti or Computershare, while investment funds can be traced though the Investment Association’s Unclaimed Assets Portal

How to better manage your assets in future

Once you find your lost assets, you can cement your good fortune by keeping a closer eye on them in future. We developed the free MyNetwealth service to help savers and investors track and manage all their investments in one place – wherever they are held.

The Wealth Tracker lets you easily see the changing values of your assets. You can view the total percentage you have invested in each asset class across all your accounts, and get a breakdown by account type (eg, ISAs, pensions and general investment accounts).

You can then plan ahead with more certainty. MyNetwealth’s Wealth Planner can be used to provide a detailed personalised projection of your wealth through time and your likely income in retirement – in just a few minutes. These tools and charts provide valuable clarity, to help you make more effective financial decisions and give you a better chance of achieving your long-term goals.

You may need further help

Whether you locate missing assets, inherit money or have any queries about how to improve your financial situation, we can help.

Our investment service is designed for those who want an expert team to efficiently manage money on their behalf – and if you need advice our qualified advisers are on hand to help you navigate often complex challenges with a personalised approach. Please get in touch.

Please note, the value of your investments can go down as well as up.

Netwealth offers advice restricted to our services and does not provide independent advice across the market. We do not offer advice in relation to tax compliance, personal recommendations with regards to insurance and protection, or advise upon the transfer of defined benefit pensions.

¹ Consumer research was conducted by Opinium on behalf of Netwealth. 1,000 UK adults were surveyed (who had at least £100k of investable assets excluding property and pensions) from 20/03/23 – 03/04/23.