Understanding recent market activity and looking ahead

Despite the ongoing uncertainty around health and policy in 2021, the year represented a good one for equity investors. The UK equity market continued its rebound from the volatility of 2020, while the US maintained its dominance over all other markets, delivering its 12th year of positive returns in the 13 years since the Global Financial Crisis of 2008, when measured in sterling terms.

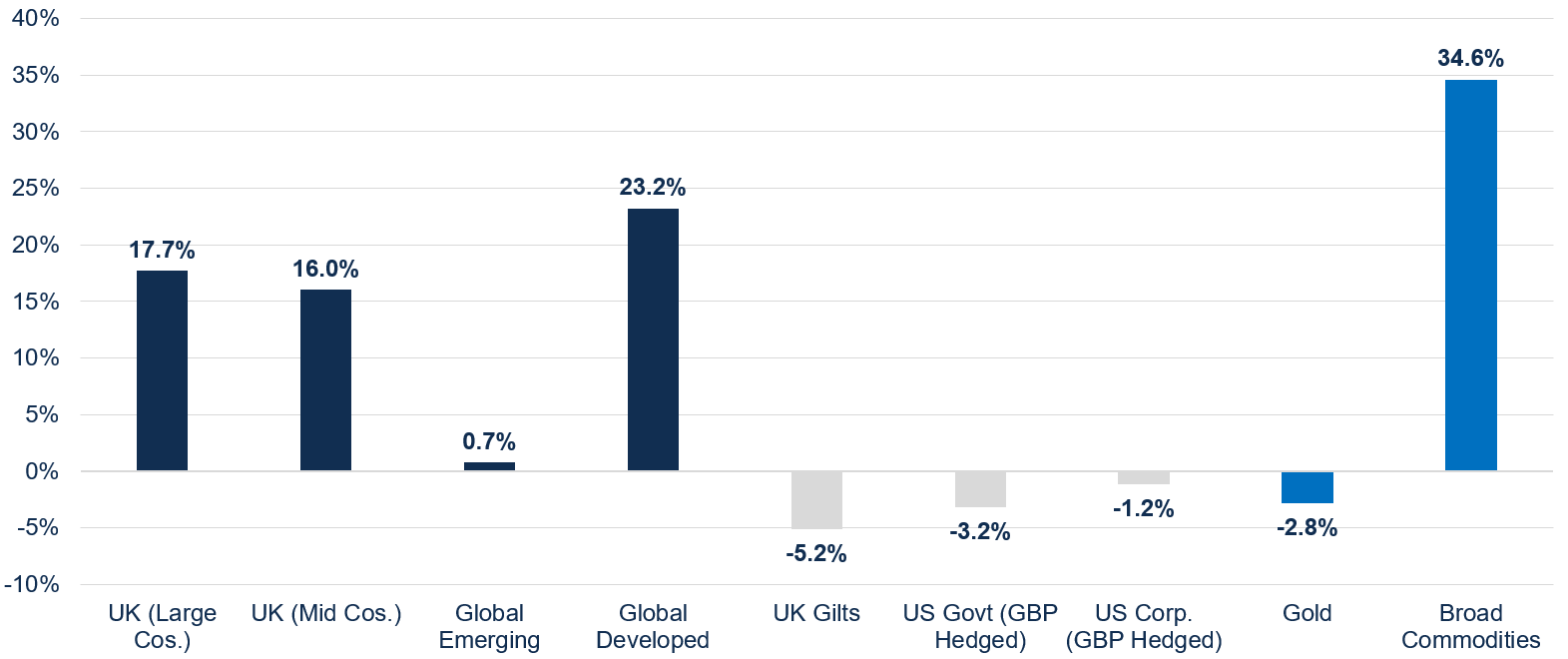

Returns from fixed income markets were weaker, as investors considered initially how inflation might eat into future cashflows, and then what central bank actions to control this inflation might mean for interest rates in the coming months. The price of gold was quite muted, but resurgent oil, natural gas and industrial metal prices led broad commodity returns higher.

Key asset market returns in 2021

Source: Bloomberg, in GBP terms unless stated

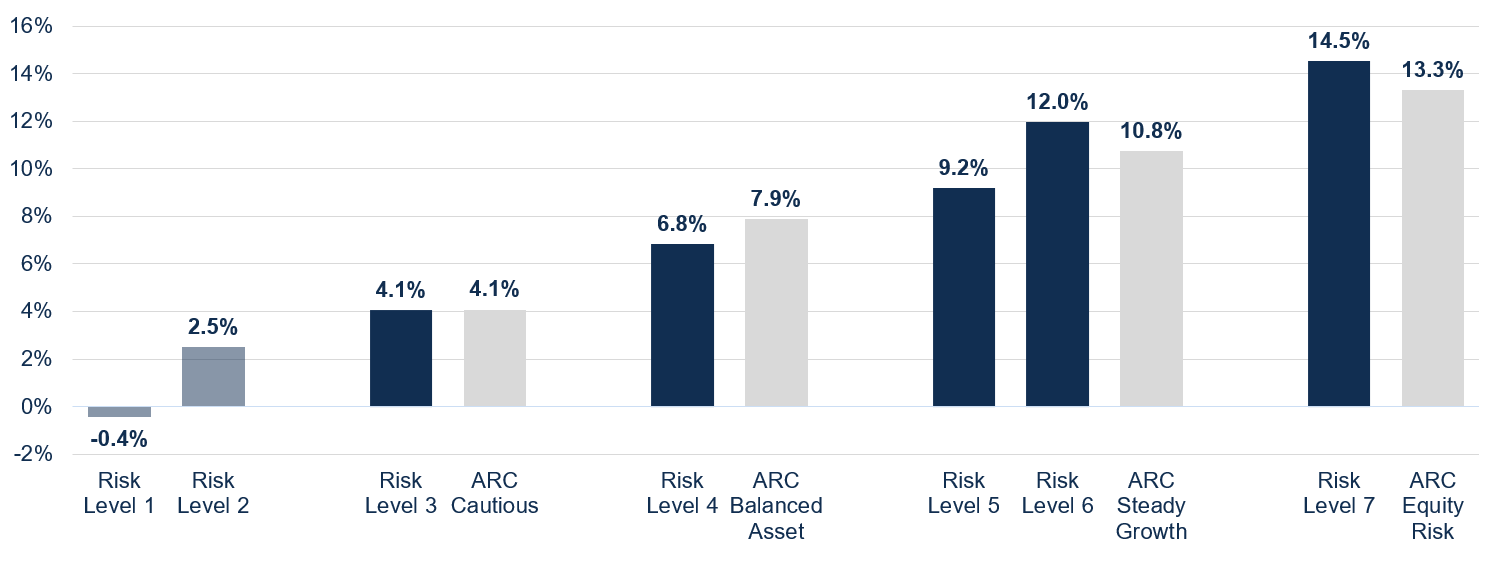

The Netwealth portfolios benefited from the improving economic outlook, and from the strong momentum in corporate earnings being generated – particularly in the US and Europe. Interest rates anchored at record low levels meant that the outcome for Risk Level 1 portfolios invested in money market funds and ultra-short dated corporate bonds remained challenging.

However, all other portfolios offered positive returns for clients, and were competitive with their respective peer groups represented by the Asset Risk Consultant (ARC) Private Client Indices.

Netwealth performance in 2021 compared to peers

These figures refer to the past, and past performance is not a reliable indicator of future results.

Source: Bloomberg, Asset Risk Consultants & Netwealth. Returns shown net of all fees to 31st December 2021. ARC data contains estimates for peer groups for October, November and December 2021.

Returns shown are of indicative live portfolios in each Risk Level, using the market prices at which purchases and sales took place. Returns are shown net of (i) all charges associated with the underlying fund investments and (ii) a Netwealth fee of 0.35% per annum covering management, trading, custody and administration charges. Netwealth fees range from 0.65% - 0.35% pa depending on account size.

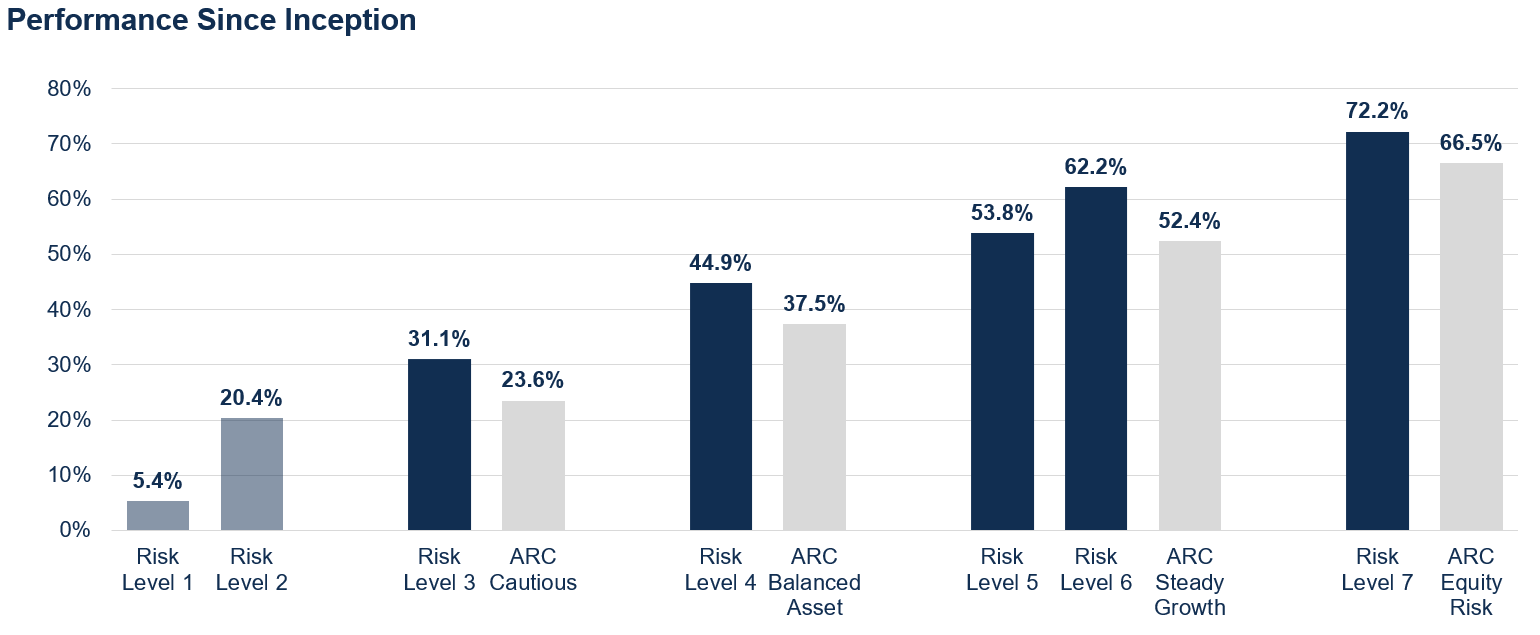

At Netwealth, we always emphasize the importance of efficiency in constructing portfolios, and this approach has again helped to compound returns from markets at a better rate than many traditional wealth managers. Since the launch of our sterling portfolios in May 2016, this has been a significant tailwind to performance contributing to a sustained advantage.

Netwealth performance since inception compared to peers

These figures refer to the past, and past performance is not a reliable indicator of future results.

Source: Bloomberg, Asset Risk Consultants & Netwealth. Returns shown net of all fees to 31st December 2021. ARC data contains estimates for peer groups for October, November and December 2021.

Returns shown are of indicative live portfolios in each Risk Level, using the market prices at which purchases and sales took place. Returns are shown net of (i) all charges associated with the underlying fund investments and (ii) a Netwealth fee of 0.35% per annum covering management, trading, custody and administration charges. Netwealth fees range from 0.65% - 0.35% pa depending on account size. The data shown is from inception in May 2016 and as such there is no data available for prior periods.

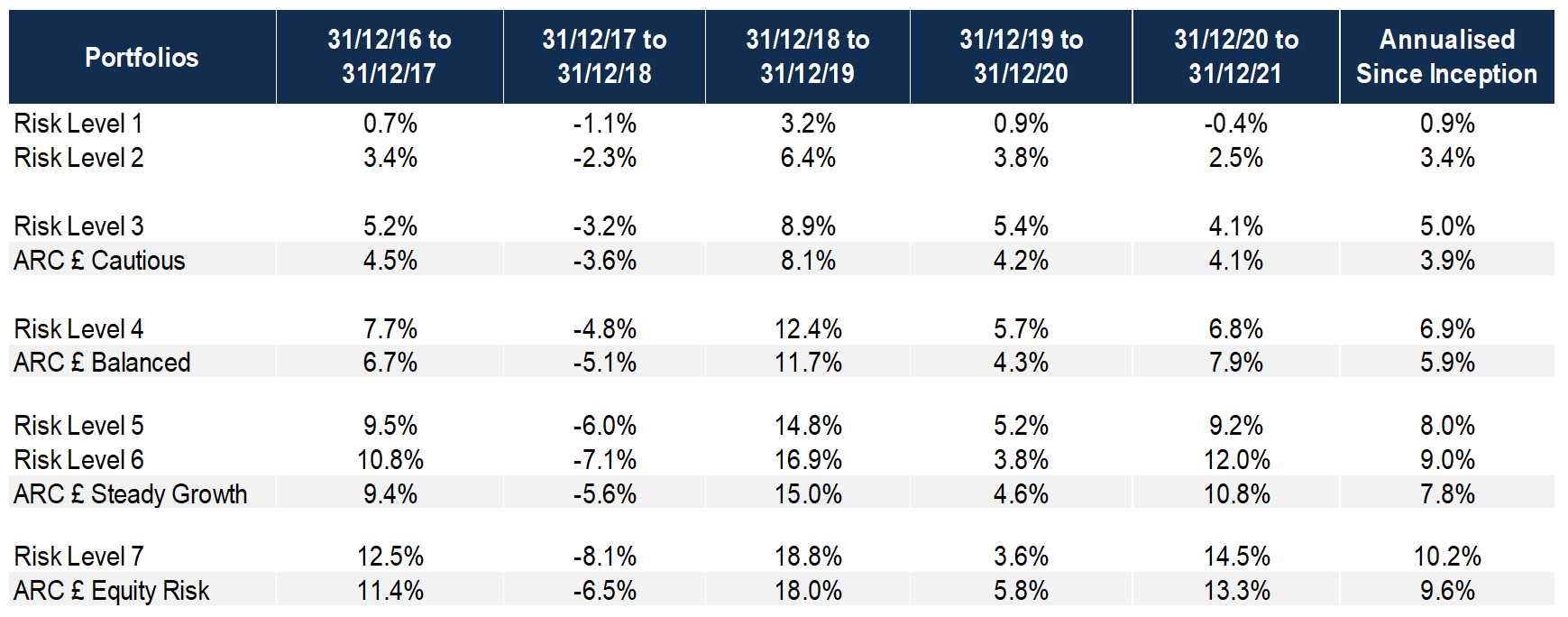

These figures refer to the past, and past performance is not a reliable indicator of future results.

Source: Bloomberg, Asset Risk Consultants & Netwealth. Returns shown net of all fees to 31st December 2021. ARC data contains estimates for peer groups for October, November and December 2021.

Returns shown are of indicative live portfolios in each Risk Level, using the market prices at which purchases and sales took place. Returns are shown net of (i) all charges associated with the underlying fund investments and (ii) a Netwealth fee of 0.35% per annum covering management, trading, custody and administration charges. Netwealth fees range from 0.65% - 0.35% pa depending on account size. The data shown is from inception in May 2016 and as such there is no data available for prior periods.

Looking ahead

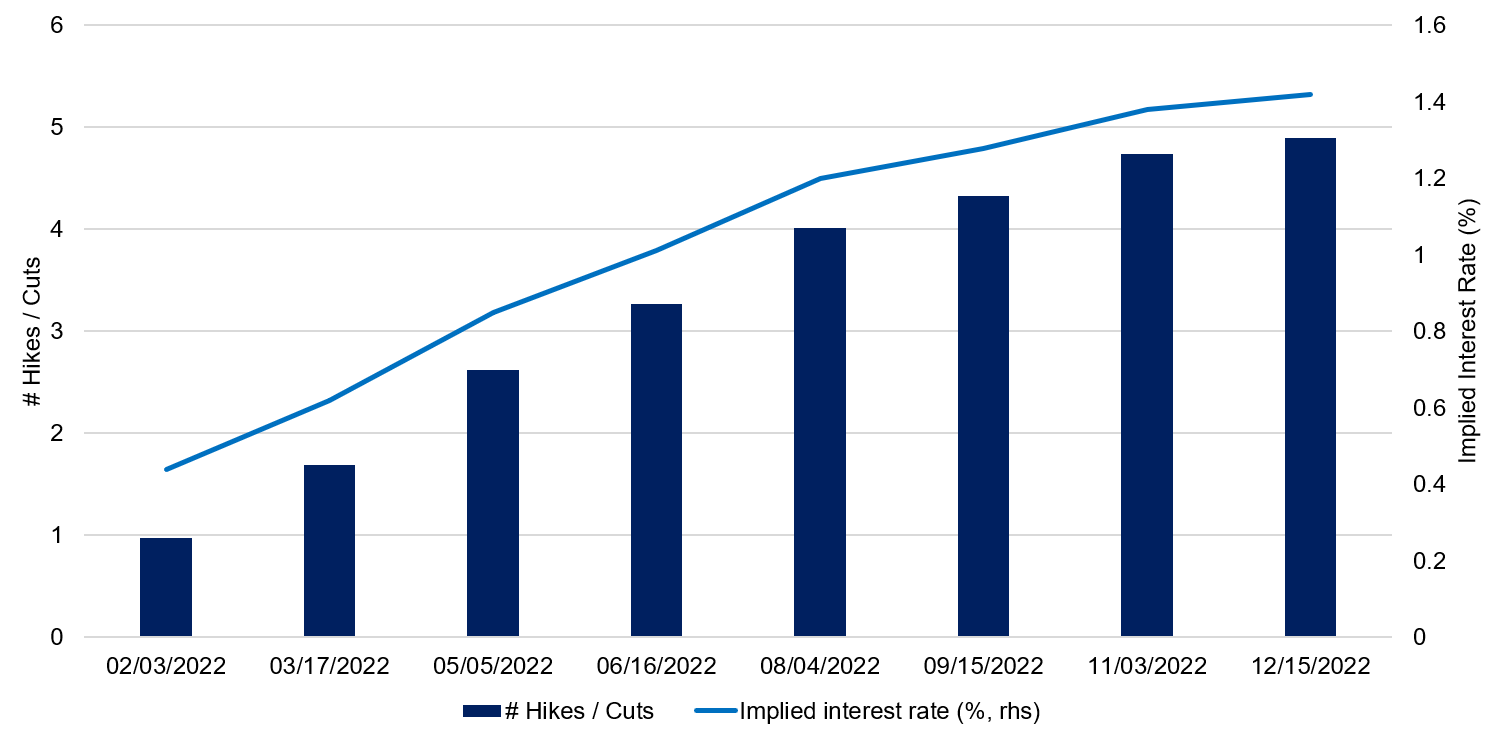

The uncertainty seen in bond markets in the final quarter of the year has continued into January, with markets pricing in increasingly aggressive forecasts for changes in UK and US interest rates. The market consensus has become more hawkish in recent weeks and now the view is for four to five hikes from the Bank of England, taking the rate up past 1.25%.

UK interest rates outlook

At this stage, bond prices suggest that the market expects the central banks’ efforts to constrain inflation to be successful, with yields on longer-dated bonds remaining more firm than shorter maturities. The cost of hedging against future inflation over the long term has also stabilised in the US, suggesting that investors are not convinced a regime change to pricing is underway.

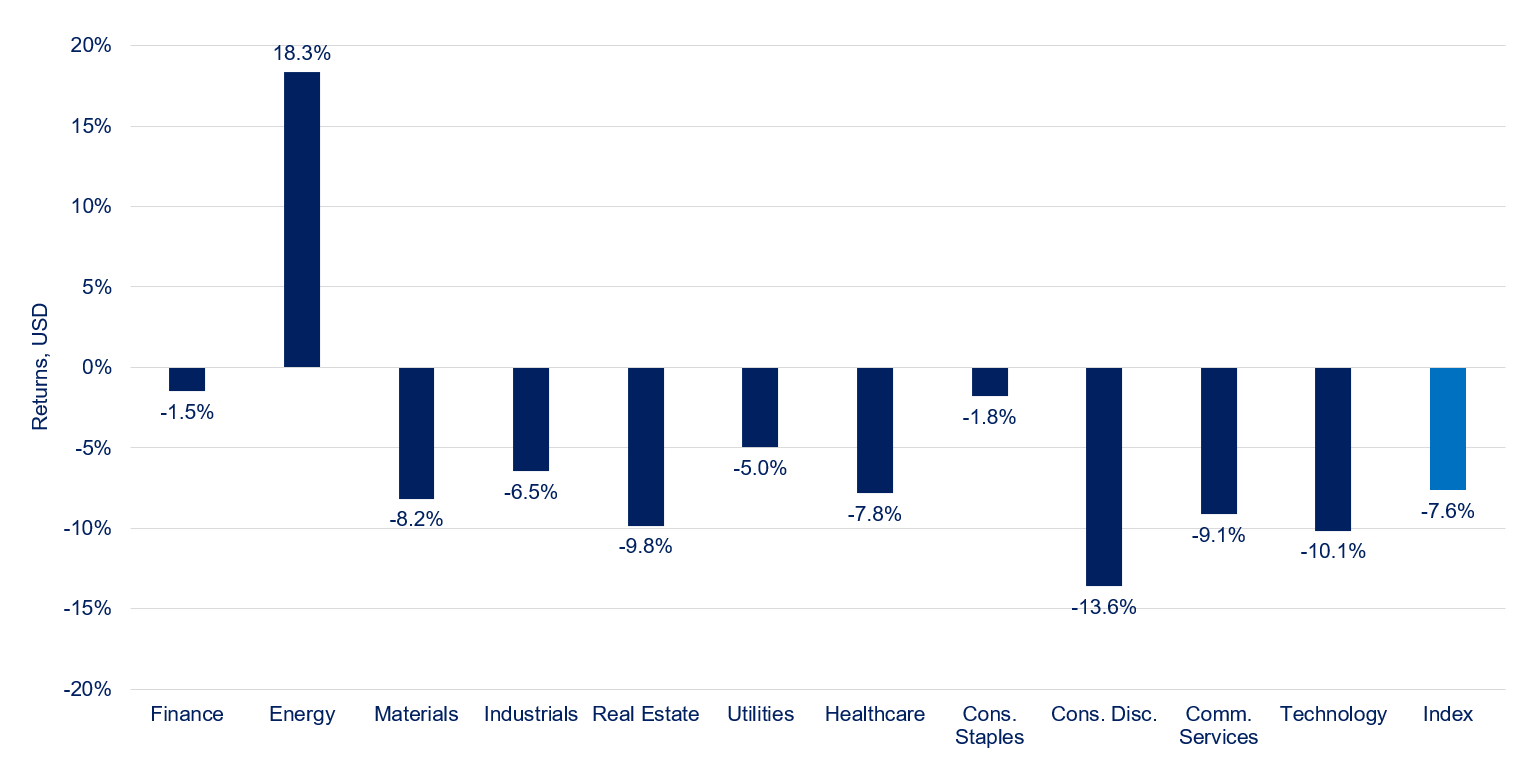

Equity markets have seen a significant change in mood, emphasizing the importance of a diversified approach. At the headline level, there has been some visibly weaker performance. In itself, this shouldn’t be alarming, as equity investors are often reminded of the need to withstand volatile periods to reap the benefits that investing can bring. Perhaps more important is what has been happening below the surface.

For several years, the cohort of US consumer technology stocks delivering strong profit growth regardless of the economic backdrop have led market returns, while other regions and sectors have often struggled. In 2022, the prospect of higher interest rates has been the catalyst for the market to reappraise the path to profitability of more speculative stocks, which in turn has dampened enthusiasm for ‘growth’ stories everywhere.

As a result, technology names have not provided shelter from market volatility as has previously been the case, and the tech-heavy Nasdaq Index has lost nearly 15% from its peak. Instead, the smallest losses have been in financials, which are helped by higher interest rates, and sectors perceived to have more staid cashflow streams such as utilities or consumer staples. Clear market leadership has come from the energy sector, buoyed by high oil prices.

2022 MSCI USA Index returns to date

Source: Bloomberg, MSCI with Netwealth calculations. Returns in US dollars to 28th January 2022.

This market rotation has had a notable impact beyond the US, as the FTSE 100 Index is currently the leading performer of the year. Netwealth portfolios have had higher than strategic allocations to the dominant US market in recent years, but with the market’s change in focus to reward cheaper stocks, the UK looks more attractive as it is cheap compared to history on most metrics.

The large energy allocation of the FTSE certainly helps, but cheap valuations in ‘old economy’ stocks also offer support when rates are rising.

This focus on value has further ramifications around the world. Emerging markets had a difficult year in 2021 as Covid-19 constraints and less generous fiscal packages held back economic performance. A rising dollar and geopolitical issues could yet provide a challenging backdrop, but so far borrowing costs have not been too much of a problem for most emerging economies.

An inflection point in policy may unlock some value in these markets, too. We believe a truly global approach will serve investors well in the coming months should the reliable earnings momentum from US stocks be questioned.

One area where valuations have changed is in currency markets. Emerging market currencies appear broadly to have stabilised. Sterling has risen strongly against the euro, and now sits at a post-referendum high, thanks to a widening gap between forecast interest rates.

Both currencies are arguably still cheap against the dollar, but we are not convinced that conditions are such that the UK can progress on its path to higher rates without policymakers in Europe also having to address their own combination of ultra-low rates and asset purchases. As such, we intend to adapt portfolio currency hedges to reflect this.

Please note, the value of your investments can go down as well as up.