Why Investment Markets Struggled in 2022 & How We Responded

It has been a very difficult first half of the year for most investment markets (some worse than others), with the US S&P 500 Index down 17% and the tech heavy Nasdaq Index down more than 25% in US dollar terms. Stocks in Europe have also fallen sharply, and to a lesser extent, in Asia. Only the energy and resources-laden FTSE 100 has offered resistance, with returns close to 0%, albeit in sterling terms.

Many bond indices are also posting double digit falls, thanks to current and future inflation fears and central bank actions on interest rates.

Why it is happening

Surging inflation, and an acceleration of interest rate increases in response, combined with slowing growth and the uncertainty from war in Ukraine have all contributed to the difficult investment environment this year. Taking prominence has been inflation, which has knock-on effects for the actions of central banks around the world – putting further pressure on equity markets. It’s a cycle that could persist for a while, at least until inflation is lower and more stable.

The annual rate of UK consumer price inflation reached 9.1% in May, with a 0.7% month on month increase. In the US, Jerome Powell (Chair of the Federal Reserve) has indicated his number one priority for the US economy is tackling inflation, over employment and growth.

But it’s not unusual for markets to be stressed every so often – sometimes it is only the source of the stresses that are uncommon – but over time they typically do reward us for being invested.

How we have responded

We adapted our portfolios to the prospect of a more uncertain inflationary outlook at a strategic review last year, making significant changes to the sensitivity of bond price moves.

For medium risk portfolios, for example, this meant a meaningful reduction in overall portfolio duration and more targeted exposure to our preferred parts of the US and UK yield curves as well as investing in selected credit instruments. Funding this was a reduction in broad investment grade corporate bonds which we suspected would face volatility from different directions. We have also avoided owning any lower quality corporate bonds, known as high yield.

A number of traditional safe havens have performed poorly this year, most notably as the market’s perception of central bank reactions has changed dramatically in the past couple of months, and momentum towards higher interest rates intensified. It’s important to note that despite recent performance we still believe strongly that fixed income has a role to play in portfolios. More recently, as markets have continued to weaken, we have added exposure to short term UK government bonds and to local currency emerging market bonds where appropriate.

Commodity price increases have been both a component and reflection of this more inflationary environment. Having successfully held broad commodities on portfolios last year, we have been surprised by the strength in momentum in 2022, acknowledging the impact of the war in Ukraine. In recent weeks commodity prices have fallen sharply, led by industrial metals such as copper which tend to anticipate slowdowns in economic activity. Our portfolio allocation to gold has resisted much of the volatility seen by other ‘safe’ assets.

Within equity allocations, this year we have reduced exposure to European and the small and medium-sized UK stocks that are most sensitive to the prospects of UK growth. We have also broadened our US exposure to strategies which are less dependent on the large high growth consumer technology stocks in case they continue to suffer under the pressure of higher rates.

Our investment horizons are possibly longer than others and our process focuses on sensible portfolio diversification and efficient implementation. We also believe that wealth managers often make too many changes to portfolios – particularly in periods of volatility.

Our outlook

In recent weeks, the market has changed its mind about how aggressively central banks will fight inflationary pressures this year, disregarding the carefully constructed forward guidance approach to policy. This has been the biggest challenge for bond prices, reflecting lower confidence in central bankers’ future actions. This change in expectations has had broad impact beyond the volatility in bond markets.

With a tighter policy environment, seemingly at the expense of employment prospects, the outlook for growth has deteriorated. Western Europe, including the UK, appears hamstrung by the drag of expensive energy costs amplified by weak currencies, and the Bank of England and the European Central Bank are both facing up to credibility challenges.

The outlook for consumers looks difficult, but this in itself gives us confidence that fixed income returns should stabilise from here. Significantly, inflationary surprise has moderated in recent months rather than accelerated, with the market pricing of protecting against future inflation (known as breakeven rates) falling in-step.

While investing in equity markets has been painful this year, they have now factored in a lot more bad news. Valuations are certainly more attractive, particularly as corporate profit expectations have remained strong. That is starting to change, and the magnitude and duration of market falls will depend on the ability of companies outside of the energy and resources sectors to pass on their higher costs to a stretched customer base.

Find out more about our investment approach.

Putting recent portfolio performance into context

Most investors have not done particularly well since the start of this year. It’s never pleasant to experience a temporary decline, but it’s worth recognising that consistently investing in markets brings rewards.

We can demonstrate this by reminding you of our own performance – and to show that even in the face of considerable market turmoil, like the pandemic, markets do tend to recover over time.

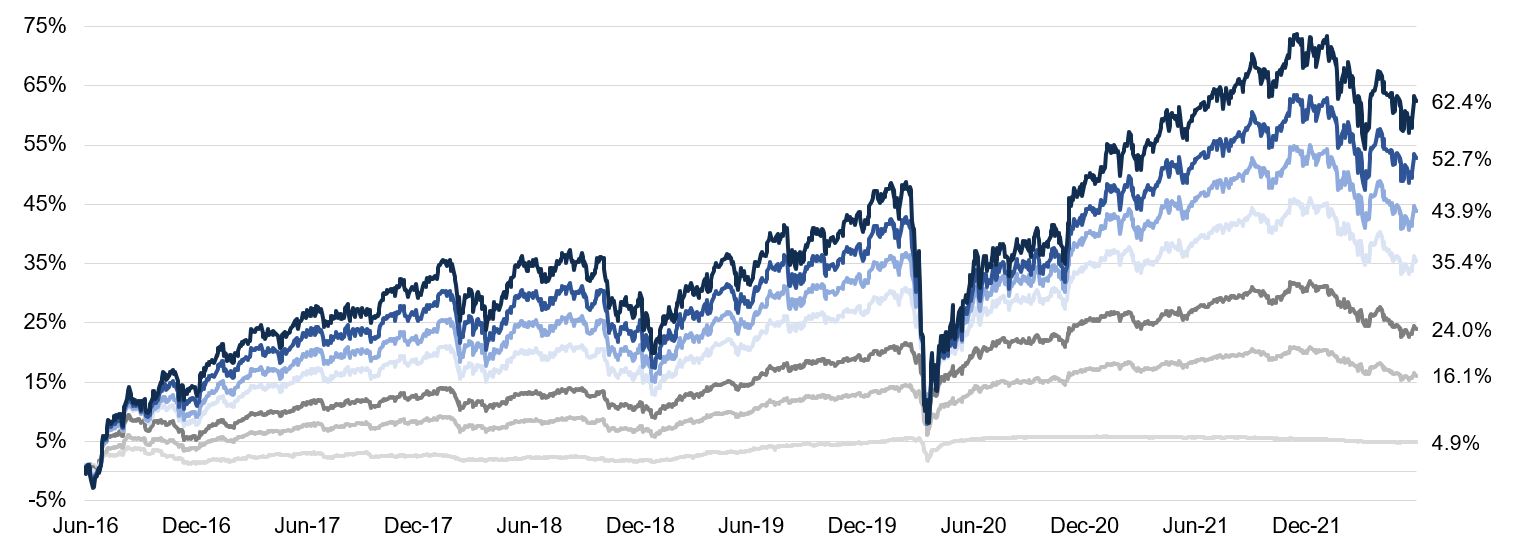

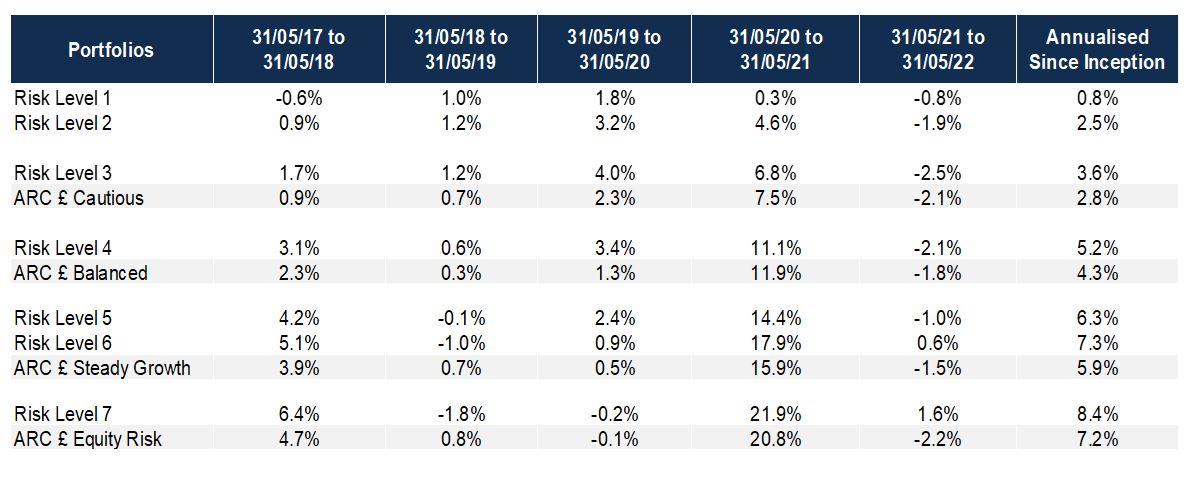

Below we show the performance of our seven risk portfolios, and below that a breakdown of our 12-month returns over the past five years. (Read more about how we prepare for diverse market conditions.)

Netwealth GBP portfolios performance (as at 31st May 2022)

These figures refer to the past, and past performance is not a reliable indicator of future results.

Source: Bloomberg & Netwealth. Returns shown net of all fees to 31st May 2022

Returns shown are of indicative live portfolios in each Risk Level, using the market prices at which purchases and sales took place. Returns are shown net of (i) all charges associated with the underlying fund investments and (ii) a Netwealth fee of 0.35% per annum covering management, trading, custody and administration charges. Netwealth fees range from 0.65% - 0.35% pa depending on account size. The data shown is from inception in May 2016 and as such there is no data available for prior periods.

Netwealth GBP portfolios 12 month returns (as at 31st May 2022)

These figures refer to the past, and past performance is not a reliable indicator of future results.

Source: Bloomberg, Asset Risk Consultants & Netwealth. Returns shown net of all fees to 31st May 2022. ARC data contains estimates for peer groups for April and May 2022.

Returns shown are of indicative live portfolios in each Risk Level, using the market prices at which purchases and sales took place. Returns are shown net of (i) all charges associated with the underlying fund investments and (ii) a Netwealth fee of 0.35% per annum covering management, trading, custody and administration charges. Netwealth fees range from 0.65% - 0.35% pa depending on account size. The data shown is from inception in May 2016 and as such there is no data available for prior periods.

Don’t overreact by changing your risk level unnecessarily

When markets are volatile, we may be tempted to think about changing the amount of risk we take. It’s not unusual to consider reducing risk when asset values are declining – but how active should we be in changing our risk level to cope with market events or economic news?

When we think about investing it is useful to think about it in terms of risk: how much we should take, and how much can we afford to take to reach our goals. We always urge careful deliberation when considering changing your risk level, because you will be altering the long-term mix of assets in which you invest – and the expected characteristics of your portfolio as a result.

In other words, if you change your risk level to respond to short-term events, you may not then be on track to achieve your long-term objectives. To find out when it may be appropriate to change your risk level and the implications of doing so you can read this article.

We are a safe pair of hands, monitoring and making any necessary changes

An experienced team matters: to keep a cool head and respond effectively to changing investment conditions.

All the senior Netwealth team have witnessed many market downturns and testing environments. We have managed money through challenging and prosperous times – learning lessons which help us to focus on the right outcome for clients, whatever lies ahead.

There is no investment guaranteed to do well whatever dominates the news. As an investment team, we must therefore be both responsive and measured. We need to cautiously prepare for disparate events and unpredictable outcomes, and boldly invest during uncertainty – because a completely calm environment is never likely to persist.

If you would like to know more about how we can help you, please get in touch.

Please note, the value of your investments can go down as well as up.