Should You Invest or Leave Your Money in a Bank Account?

It’s a perennial question among those who have the means – should I invest or leave my money tucked away in a bank account? And it’s not always obvious what the answer should be. But dig a little deeper and you’ll see the arguments for investing now are still robust – and crucially, proven to stand the test of time.

- Cash savings are not a viable long-term option for your money

- Interest rates are high now, but for how long?

- Investing is the best proven option to grow your money over time

- But how do you balance risk and ensure you don’t miss out on market gains?

Are you looking further ahead than 2 years?

Bank interest rates are now at their highest since 2008. It’s not unusual to see headline rates of 5% or more being offered to consumers. Of course, there are often caveats, like for how long a deal may last (often a year) and you may face constrictive limits – but now is a good time for savers and higher rates could last for up to another couple of years.

If that is your timeframe, if you have no plans or wishes for your money after that, seeking out a high savings account rate for at least some of your wealth could be suitable for you.

However, if you have longer-term plans – such as saving for retirement or for other major financial goals – you should explore what is typically the best thing to do with your money. (Remember, too, that saving into a pension qualifies for tax relief of at least 20%, an annual boost you don’t get if you simply park money in a savings account.)

Interest rates should start to fall in time, especially as inflation comes under control. Are you prepared to help your wealth achieve your objectives when cash savings are not a long-term solution?

A compelling argument to invest – and why cash fails to deliver

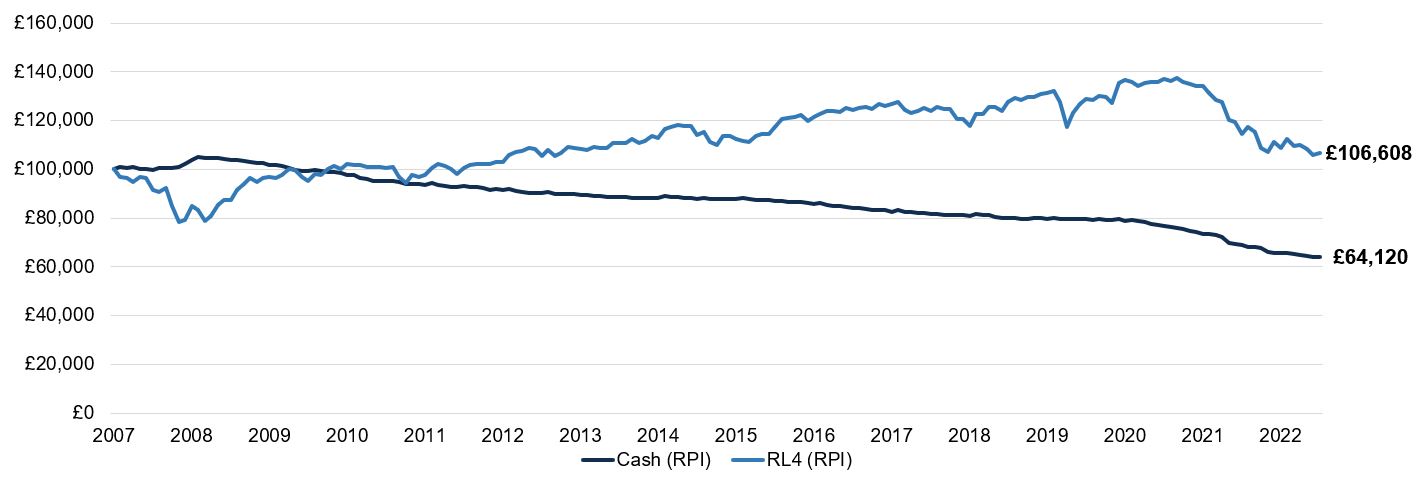

The simplest way to highlight why cash returns are a poor relation to investing is to show what would have happened to £100,000 in the 15+ years to the end of June 2023. We have chosen this timeframe as it covers the crash of 2008 (and the pandemic), to show that markets do typically bounce back and to underline that there will be periods of volatility. Nonetheless, the findings are clear – investing in a mixed portfolio beats cash savings hands down over the long term.

For this example, we have chosen a medium risk portfolio (a higher risk portfolio would typically provide an even greater investment return). This invests in a mixture of global stocks and bonds to provide valuable diversification.

Over the period, cash returns – in real terms – have suffered immensely due to the impact of inflation. The investment return below also takes inflation into account and would comfortably have given you much higher returns in this timeframe.

The effect of inflation on cash and medium risk investments

Simulated historic performance is not a reliable indicator of future results

Source: Netwealth and Bloomberg. The values represent £100k invested in 1 month Libor (a wholesale interest rate) and an example Netwealth Risk Level 4 portfolio minus UK RPI (a measure of inflation). Data to 30 June 2023.

Navigating the crucial factors of timing and risk

While over the long term, investment returns are likely to be positive, in the short term it’s almost impossible to know what level of returns financial markets will give you. It’s also not feasible to predict when markets may go up or down, so we recommend you stay invested for the course rather than trying to time markets.

If you do try and time the market, there is a real risk you miss out on a strong period of market returns – these can often be short but sharp and are the periods a portfolio needs to capture. These phases of strong market returns can also occur when a downbeat narrative prevails around the domestic or global economic situation – this is because there is often a disconnect between what’s going on in an economy and how markets behave.

Importantly, you should choose the level of risk for your portfolio that is appropriate for your circumstances. This means you should consider your objectives, how long you are planning to invest and your ability, willingness and need to take risk. These attributes of risk are important because how much risk you take is key to determine how much your investments can grow over time. We can sum them up briefly as:

- Risk ability

Your ability to take risk is driven by your overall financial circumstances and for how long you wish to invest.

- Risk willingness

Your willingness to take risk represents the level of fluctuations you are willing to accept in the value of your investments and in the size of a potential short-term, medium-term and permanent loss.

- Risk need

Your risk need is the amount of risk you may need to take to achieve the returns required to meet your goals.

Whatever your attitude and ability to take risk, our powerful online planning tools help you to see your possible financial outcome more clearly. You can try multiple permutations of risk, money invested and timeframes to see how a wide variety of potential outcomes could occur. You can also take formal advice to help you decide which portfolio is best for you.

While we don’t encourage you to time the market when investing, we would make a similar recommendation about timing how long you hold considerable cash balances. Using cash to benefit from current higher rates could coincide with a stronger period for financial markets, because markets are forward looking and tend to see beyond the immediate gloom.

Your outlook and actions should therefore align with taking the right level of risk appropriate for your personal goals and timeframes.

A viable long-term approach for your money

While we are also averse to timing markets, we do proactively adopt cyclical positions (investing in certain assets for the short term) where we see value in specific areas of the market. For example, in early 2021 we reduced the bond duration (by holding 2-year instead of 10-year bonds) on account of their low income yields and this helped protect client portfolios for the large falls in bond prices in 2022.

We therefore do this to try and smooth the path of returns for clients – reducing volatility by diversifying further.

Investors who are wary about investing now can choose to drip feed money into their investments over time and we also offer high interest options for those who prefer to invest only when they are comfortable, as we explain here.

Will interest rates stay high? Perhaps you shouldn’t bet on it. Typically, you should avoid taking a punt when it comes to your money. And let’s not forget that interest rates soared chiefly because of extraordinary events: the pandemic, and the war in Ukraine.

Extraordinary events occur with some frequency (before the pandemic was the great financial crisis in 2008, before that the dotcom crash in 2001), but leaving your money in a bank account is clearly not the ideal way to prepare for them and overcome their impact.

A long-term solution (or objective, such as saving for retirement) requires a proven long-term approach. Investing your money – and making peace with the various gyrations along the way – is the best strategy to grow your money and help you achieve your goals over time. Please get in touch if you would like to know how we can help you.

Please note, the value of your investments can go down as well as up.

Netwealth offers advice restricted to our services and does not provide independent advice across the market. We do not offer advice in relation to tax compliance, personal recommendations with regards to insurance and protection, or advise upon the transfer of defined benefit pensions. When investing, your capital is at risk.