Why Pay More When Active Managers Keep Underperforming?

How much longer should investors be misguided by advocates of the active fund management industry? Yet again, the latest research reveals that active fund managers are not justifying their high costs. For most investors, the numbers just don’t add up.

In recent years, more and more investors have chosen passive funds – attracted to lower fees and informed by better transparency around the long-term underperformance of active managers. Yet champions of active management still claim that active managers’ skill will ultimately prevail; that they should be able to outperform during a downturn and deliver sustained outperformance over the long run.

Once more, the evidence indicates this is not the case.

Disruptive markets over the past couple of years – fuelled in turn by the interconnected factors of the pandemic, rising inflation and interest rates, as well as the war in Ukraine – have created an environment where active managers should potentially do rather well. After all, uncertainty should provide opportunities for skill to be rewarded.

However, exchange traded funds, or ETFs, which passively track their respective benchmark indices have consistently beaten the peer group of active funds whose sole purpose is to beat those same indices. This holds true for each of the five main regions of equity markets we look at: the UK, the US, the eurozone, Japan and Global Emerging Markets, which together constitute more than 90% of a global index’s market capitalisation.¹

Strikingly, as of June 30th this year, we found that ETFs have beaten the average managers in a given sector on a year-to-date, one and five-year basis in each market. There have only been a couple of exceptions over the three-year period – and even then the results were close.

Which strategy has performed better, ETFs or the average active manager?

These figures refer to the past, and past performance is not a reliable indicator of future results.

Source: Bloomberg, Investor Association, with Netwealth calculations. Returns in GBP, after fees. Data as of 30th June 2022.

This is why we invest primarily on a passive basis – using exchange traded funds as building blocks for portfolio construction. Once again in 2022, this approach has given a positive tailwind to clients’ portfolio performance among falling markets.

Don’t just take our word on it though.

The analysis is reinforced by recent data highlighted in the Financial Times that shows “European active fund managers failed to outperform their benchmarks during the markets turmoil that followed the start of the Covid-19 pandemic” and cited that active managers “were generally not nimble enough” to adapt to the rapid turn of events.

The latest exhaustive SPIVA research (from S&P Dow Jones Indices) also shows active managers have not captured opportunities from the turmoil, nor outperformed when they might be expected to do so.

The SPIVA research, which captures long-term trends in the world’s major economic regions and territories to the end of last year, shows a consistent picture: active managers have consistently lagged their passive counterparts, in good times and bad.

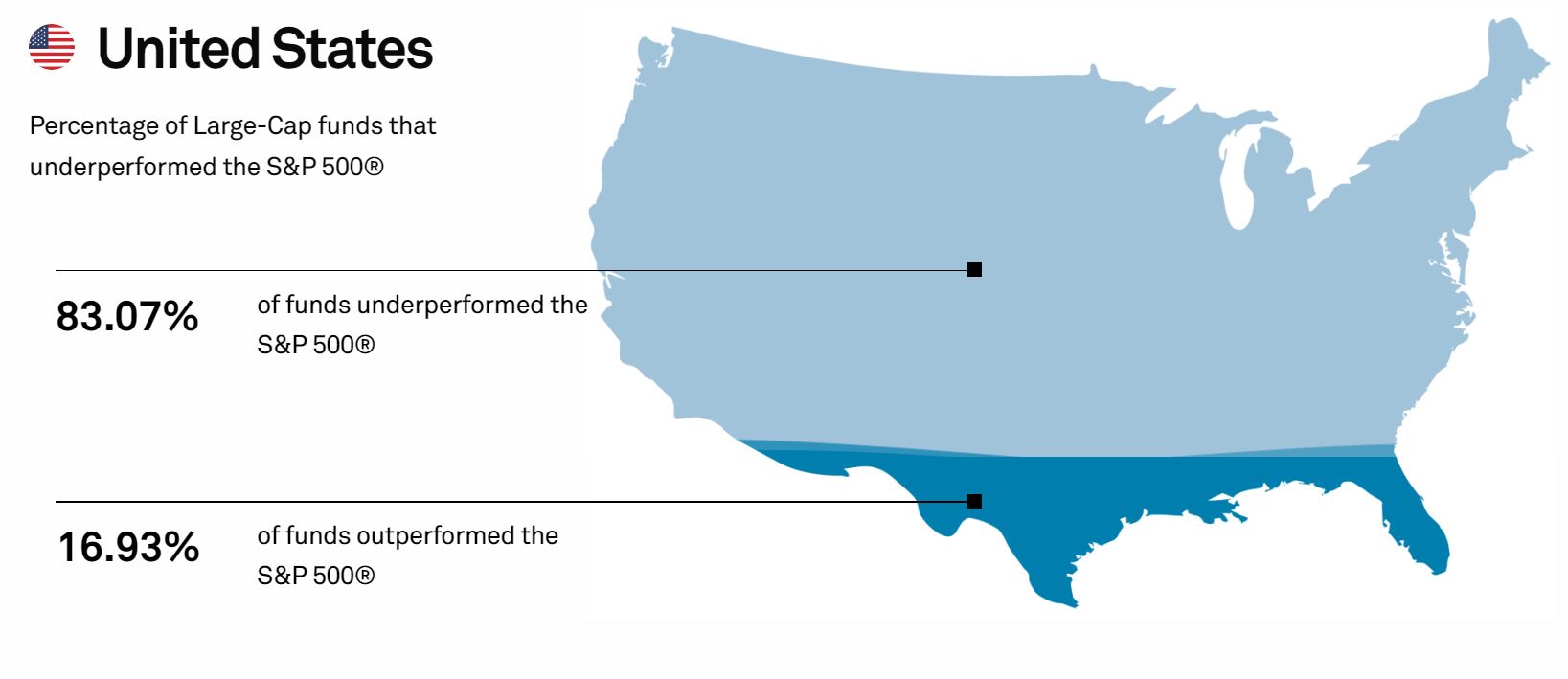

For instance, 83.1% of US large cap funds underperformed the S&P 500 in the 10 years to December 31st 2021. In Europe, 83.2% and in Japan 81.9% underperformed compared to their respective indices. Even in areas where expert knowledge and research might be expected to be more fruitful, such as the Middle East and North Africa (MENA), only 10.26% of funds outperformed the S&P Pan Arab Composite Index over the same timeframe.

Source: SPIVA (S&P Dow Jones Indices) 10-year figures to end December 2021.

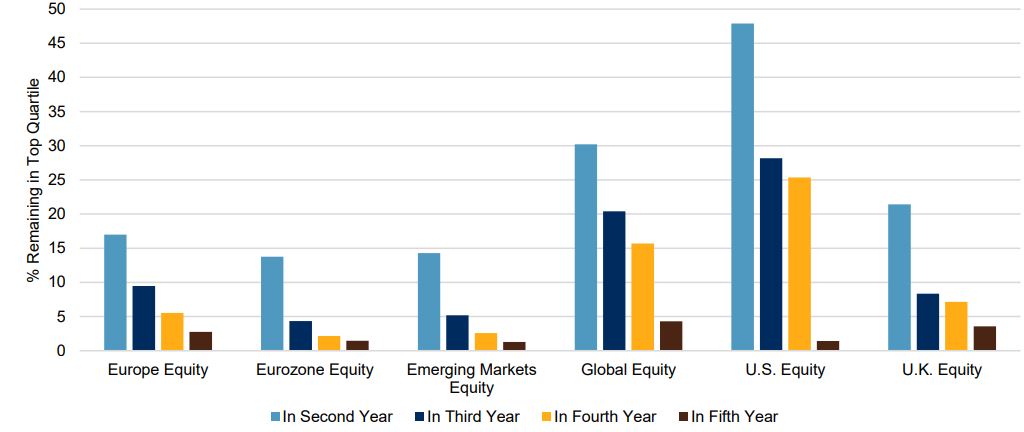

We believe that the ongoing failings of active management are based on more than the headwinds of higher costs, however. Further research from the group also highlights performance consistency – or a lack of it. The Persistence Scorecard shows how many of the best managers running funds available for sale in Europe are able to consistently outperform their peers and their benchmark – a true differentiation of skill vs luck.

While the analysis criteria are slightly different, the results are again crystal clear – the ability for the best performing active fund managers in a given period to remain in the top quartile of performance diminished significantly in subsequent years, even if their initial efforts showed promise in the US market.

In the UK, fewer than 25% of the best performers in 2017 were able to repeat the feat in 2018. Fewer than 10% of these stars were still ranked outstanding in 2019.

It seems past performance really is no guarantee of future returns in active fund management, especially when their mettle is tested over 3-4 years and beyond. This is because even skilled managers find it difficult to adapt their investment process to changing market conditions – so it may be through no fault of their own that a manager finds their efforts being punished by the market after a period of success.

Percentage of equity funds consecutively remaining in top quartile of performers

Source: S&P Dow Jones Indices LLC, Morningstar. Based on funds performing in top quartile of respective category in 2017 calendar year. Data as of Dec. 31, 2021.

Past performance is no guarantee of future results.

None of the above findings are news to our regular readers. We have covered the failure of active managers to consistently beat passive funds previously, including during the early days of the pandemic – but it’s a message worth repeating. The machinations of the active management sector obscure an uncomfortable truth: you pay more to receive less.

The outcome for investors is clearcut: you will have much less growth – and much less to live on – over the long term when you pay higher fees. How much? In this article we highlight a fee difference of just 1% when preparing for and being retired. The investor who pays 1% less could have £600,000 more to leave to loved ones at the end of their retirement.

Even when you recognise you may be getting a bad deal, the vice grip of both a long-term relationship with an active manager and the deceptive solace of inertia can prevent us from breaking free. Gathering the impetus to move investment provider (even when the maths is staggeringly in favour of doing so) can be challenging.

Although it is not as onerous as you might think, as our head of client services explains here, showing how we do much of the heavy lifting for you.

Prices everywhere are soaring; you can’t control what happens in markets nor how high inflation will get. But you can reign in some of the costs of preparing for your future. If you want to find out how you can take much more control of your financial outcome, please get in touch.

Please note, the value of your investments can go down as well as up.

¹ MSCI All Country World Index weights as of 30th June 2022.