Why transparent investing – and transparent advice – matters

For too long investors have suffered from a lack of evidence and transparency regarding claims made by the incumbent wealth management industry. This primarily comes down to assertions about what they do, and the value they provide – and these claims are often accompanied by high costs to investors.

A recent in-depth Financial Times report, Choosing a wealth manager in the post-Covid world, examined the landscape for investors as they “face a maze of performance claims, service promises and fast-changing technology options”.

It’s true – declarations by many traditional wealth managers are often opaque and it can be extraordinarily difficult to find out how much you might be paying for a service and to make like-for-like comparisons. Accurate comparisons are only feasible if every wealth manager offers the same services for an identical set of fees and costs, which is never the case.

As the FT report recognises: “Making a choice remains hard: despite recent improvements in transparency, many investors still struggle to compare fees, investment performance and quality of service.” Choice overload may also play a factor, especially when it is hard to distinguish between countless similar providers.

Wealth management is an inherently personal business. But because it is tricky to put a value on the various intangible aspects of a service (even if they are valuable to you), it is always worthwhile looking at the factors you can quantify.

What you pay

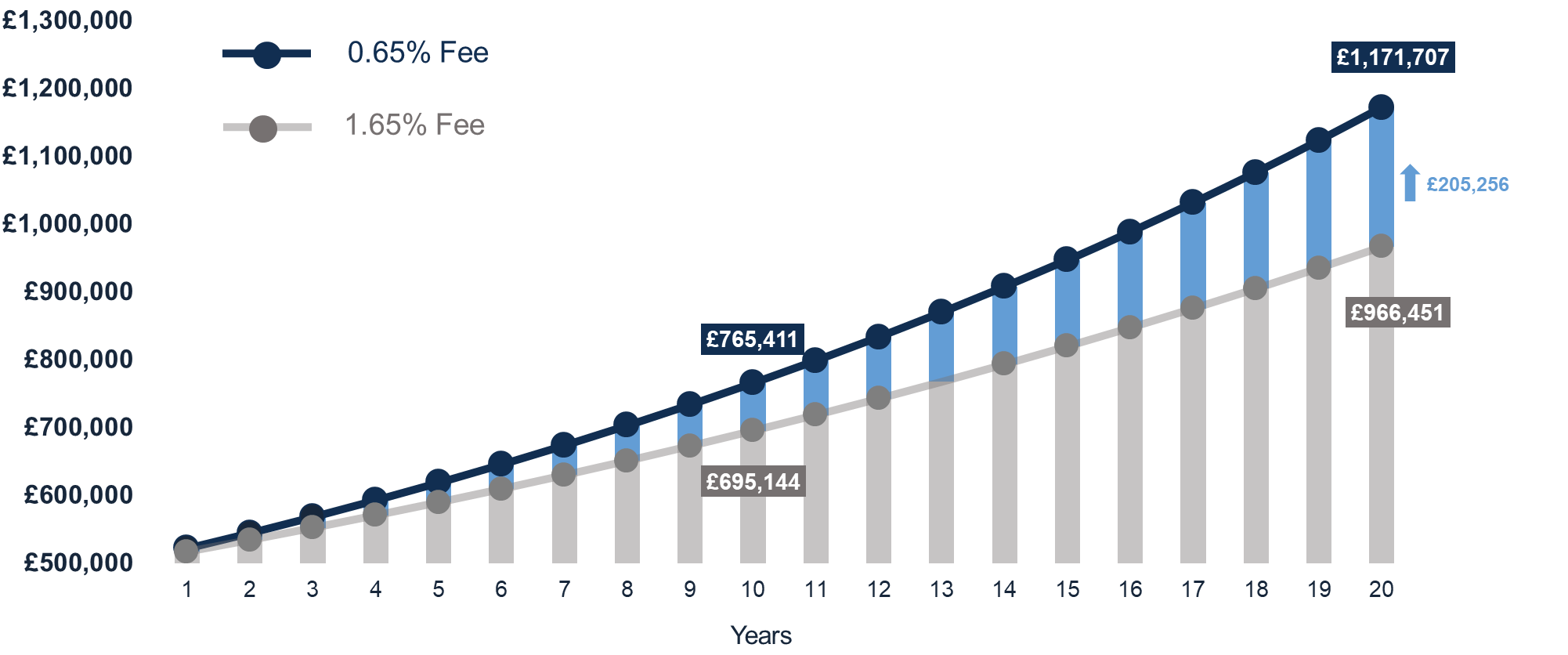

The facts are irrefutable over time: lower fees enable higher returns. We can evidence this simply by comparing the outcomes of two £500,000 portfolios with a fee difference of 1% (0.65% vs 1.65%) over 20 years.

Source: Netwealth. Returns based on a £500,000 portfolio over 20 years, assuming an example portfolio with a growth rate of 5% a year and fees of 0.65% vs 1.65%.

Simulated future performance numbers should not be relied upon as an indicator of future performance.

More and more commentators are highlighting the need for providers to address increasing demands for lower fees among investors. We examine a few recent analyses here, including one in which the Sunday Times reported:

“Fees are a key consideration when investing. Paying too much can

potentially wipe thousands off your returns over time. Check

how much you are paying and don’t be afraid to move.”

There is a clear link between what you pay in fees and how much you get in return from your investments.

How your investments perform

Active asset and wealth managers frequently defend their high charges by asserting that their skills will outperform the wider market and therefore they deserve to be paid more. The evidence does not support these claims.

While it is true that some active managers may outperform their passive counterparts over a short timeframe, it is exceptionally rare to do so consistently. Analysis from Morningstar shows that in the 10 years to the end of 2020, “only 23% of all active funds topped the average of their passive rivals” – a figure that slumped to 4.1% for the highest cost US large cap blended funds (which hold a mix of growth and value stocks).

Nor is it uncommon for active funds to make somewhat ambitious claims about outperforming in a downturn. Yet there is little, if anything, to support this assertion. As the most recent downturn took hold last year, the FT reported that US equity funds underperformed equivalent passive funds by 1.44%, net of fees in the first quarter of 2020, the worst showing in four years.

We highlighted these figures in this article which also showed that the lack of outperformance was no anomaly – and followed similar failures by active managers in the previous two downturns.

Since we are discussing performance, it would be remiss not to include what we have achieved over the last five years – aided by the rigorous efficiencies of technology – and we encourage you to take a look here.

The value of advice

We can draw a correlation between taking financial planning advice and getting better returns over time. A 2017 study by the International Longevity Centre found that those who received financial advice in the 2001-2007 period did much better by 2012-14 than an equivalent group who did not receive such advice.

Investors who took expert advice accumulated on average £12,363 (or 17%) more in liquid financial assets than the non-advised group, and £30,882 (or 16%) more in pension wealth – so those who didn’t receive advice were, on average, a total of £43,245 worse off in that timeframe alone.

Similarly, a Vanguard report from 2019 suggested investors who get advice could be better off by up to 3% a year – and, as we have seen above, even an extra 1% a year can have a considerable impact on your finances.

So there is good evidence to suggest that financial advice is worthwhile, even if it sometimes does the job of telling you what you should avoid when making financial decisions.

Yet advice, too, can be more expensive than you realised and you may not need financial advice every year but instead at certain times of life when there are important decisions to be made. It needn’t be wrapped into a high fee and applied annually for helping you to make quite rudimentary decisions – such as subscribing to your ISA every year.

We don’t charge clients for helping them to take up their annual ISA allowance – in fact, that can all be automated online so investors don’t even have to worry about the race to the tax year-end deadline. We also provide modern online tools to help you gain a clearer picture of your finances over time and to see how they could change.

You can model for various scenarios to see if, for example, planned contributions are sufficient to help you reach your goals. You can change variables such as tax rates, risk level, contributions and withdrawals to create a useful impression of how your finances could unfold – all without the need for advice, and to help you make better decisions yourself.

However, there are situations when you will want expert advice and could benefit from a more specific level of insight and nuance. You may want a qualified adviser on hand to discuss the impact of tax changes. You may need a sharp analysis of complex pension rules. You may be interested to understand how to counter the effects of inflation and seek sensible ways to assign capital both in and outside of tax wrappers.

In instances like these, getting the right advice at the right time, and at the right price, can lead to a meaningful and quantifiable outcome. There is supportive evidence, as we have highlighted above in the International Longevity Centre and Vanguard studies.

For a recent profile of Netwealth in The Times, our vision was described as creating “a firm combining the best elements of human face-to-face advice but using the kinds of technology that could dramatically reduce the need to charge the high fees redolent of the traditional industry.”

Unlike many incumbents in the industry we believe that a high quality ‘people + technology’ powered service can be provided at a low cost for investors. Being client led and technologically adept are not mutually exclusive factors.

Find out more about how we strike that balance, and let us know how we can help you.

Please note, the value of your investments can go down as well as up.

Netwealth offers advice restricted to the services provided, and does not provide independent advice across the market. Netwealth does not provide advice in relation to tax, insurance or estate planning.