After a lost decade, assessing the potential for UK commercial property

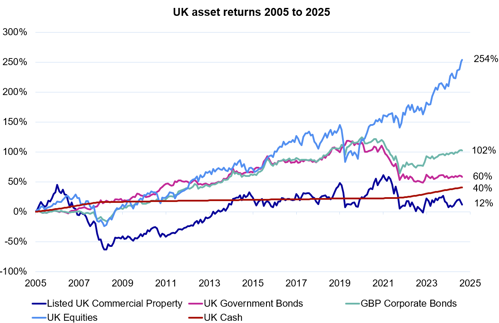

Investors in commercial property have had a more difficult time over the past 20 years compared to many other markets. Returns have barely reached positive territory, and lagged behind shares, bonds and even cash rates – but could this shortfall offer investment potential now?

The sector has been in a perfect storm, with expensive starting valuations from the boom years of the mid 2000s hit by a sequence of financial, political and health crises since then. These events all hit confidence in the sector hard, and the more recent challenge of inflation-provoked high interest rates has yet to subside.

At Netwealth, we haven’t explicitly owned any property in client portfolios to date, but our view now is that a lot of bad news has been absorbed by the market – and looking ahead, property could play more of a role in portfolios in the next decade than in the last.

Source: Bloomberg with Netwealth calculations. Returns shown in GBP terms to 15th August 2025

What do we mean here by property, and why has it struggled?

Commercial property investment can focus on a range of sub-sectors such as offices, retail, industrial and more recently areas such as logistics and data centres. A diversified strategy will capture all of these, along with their nuanced characteristics. These can be quite different than those that drive the performance of the pure residential property market.

The Global Financial Crisis of 2007-09 was triggered by the intersection of US real estate, financial engineering and leverage, to ruinous effect; the NAREIT Developed Market UK index (a UK-focused property index) rose by 40% in 2006 before losing 75% of its value through March 2009, thanks to high vacancy rates and climbing defaults seen in a deep, global recession.

After an arduous recovery, the Brexit referendum – and ensuing uncertainty around trade terms with EU countries – and political paralysis in the UK held back confidence and investment. The Covid-19 pandemic hit the commercial real estate market hard, especially in retail, hospitality and office sectors, while logistics and industrial properties saw increased demand.

These unique circumstances morphed into a more familiar sequence of rising interest rate increases to battle stubborn inflationary pressure. All of which hindered property prices from responding to post-pandemic uncertainty for office occupancy rates and a more discerning rental market on location and building quality.

ESG factors

Real estate has possibly been more widely impacted by the advent of ESG (environmental, social and governance) factors than any other asset class. Even if investor sentiment around the importance of socially and environmentally aware investing has waxed and waned, demand within the property market trends clearly towards assets with low carbon impact. This understandable preference left some existing buildings at risk of being ‘stranded’ (an asset that has become less viable) given the cost of required refurbishment to meet rental demand.

Importance of the economic cycle

Like most investment asset classes, the economic cycle matters to the property market, as it can drive the fundamentals of the underlying assets and just as importantly, investor behaviour. If we characterise the cycle as four phases (expansion, overheating, downturn and recovery), we can outline the expected behaviour of property investments in each one.

Expansion – favourable conditions with rising economic activity, low unemployment and confident businesses and consumers. This is typically a good backdrop for property investment with positive rental reviews.

Overheating – economic growth rates peak alongside climbing inflation and interest rates. Rising property values can feel vulnerable with liquidity concerns at the forefront of investors’ minds.

Downturn – a contracting economy often characterised by high or rising unemployment rates. Struggling businesses reduce investment, resulting in high vacancy rates and low rental values. The number of property transactions also often fall, reflecting difficult financing conditions.

Recovery – economic activity first stabilises, then grows presenting opportunistic investors with undervalued assets and strong potential returns once wider confidence returns.

Where are we now?

The domestic economic cycle has been severely disrupted over the past 10 years, so it is harder than usual to pinpoint where we currently stand. Alongside much of western Europe, economic growth in the UK is anaemic and consumer sentiment is nervous despite low unemployment rates and more recent growth in real wages. Undoubtedly there is still uncertainty about the prospects for the property market, with domestic and global factors both playing a role.

At home, the outlook for interest rates in the short term will depend on the interaction of inflation and growth prospects. A divided Monetary Policy Committee at the Bank of England is hesitant to reduce rates when services inflation is still elevated. Interest rates look set to ease, albeit not at the pace at which the market hoped earlier this year. Corporate fundamentals are still reasonably robust but the outlook for company earnings growth in the UK market looks unexciting.

Internationally, investors are looking closely at the impact of US trade policy at a granular level.

Compounding this is UK real estate’s role at the heart of repeated crises: this makes it equally difficult to pick apart the cyclical from structural challenges faced.

Why has our outlook for property changed?

Broadly, we think lower uncertainty for property will highlight some of the attractive valuation characteristics relative to other asset class prices. Tightening London office space supply suggests that the current recovery in occupancy and rental yields will continue. Meanwhile, the growth in data and distribution centres offer a positive balance to offset the structural, but well known, difficulties in retail.

The potential tailwind from a gradual easing in interest rates and then longer bond yields from current levels may also change the market’s mind on property values, given the time the sector has had to work through its different challenges. A positive international tailwind of rising property values in the US also bodes well.

On the other hand, we see a more uncertain outlook for wider economic growth in the UK. Consumer sentiment remains fragile and the broader macro picture is mixed. We expect the government will be tempted to address fiscal fragility by increasing the tax burden which will do little for growth expectations. This ‘muddle-through’ economy accompanied by residual inflation risk might be a better backdrop for property as attractive yields offer a cushion against economic volatility.

After strong performance from UK equities and corporate bonds this year, the excess yield expected from listed commercial property against these assets has become stretched – indeed, the gap with the wider equity market has rarely been wider.

Summary

Previously a ‘real asset’ (those with an inherent physical worth) mainstay of institutional and discretionary investment portfolios alike, property was relied on for its yield and some inflation resistance. A series of crises in the past 15 years has seen a stark change in fortunes, with material underperformance compared to other assets.

Relative valuations are now attractive in property. There is always uncertainty in investing, but in our view this is well accounted for in listed commercial property assets, which currently stands in contrast to areas of optimism in equities and complacency in corporate bonds.

If you want to find out more about our investment approach, and how we can help you to achieve your goals, please get in touch.

Please note, the value of your investments can go down as well as up.