An update on portfolio changes for the year ahead

Markets are wobbling on geo-politics, but recovering on fundamentals

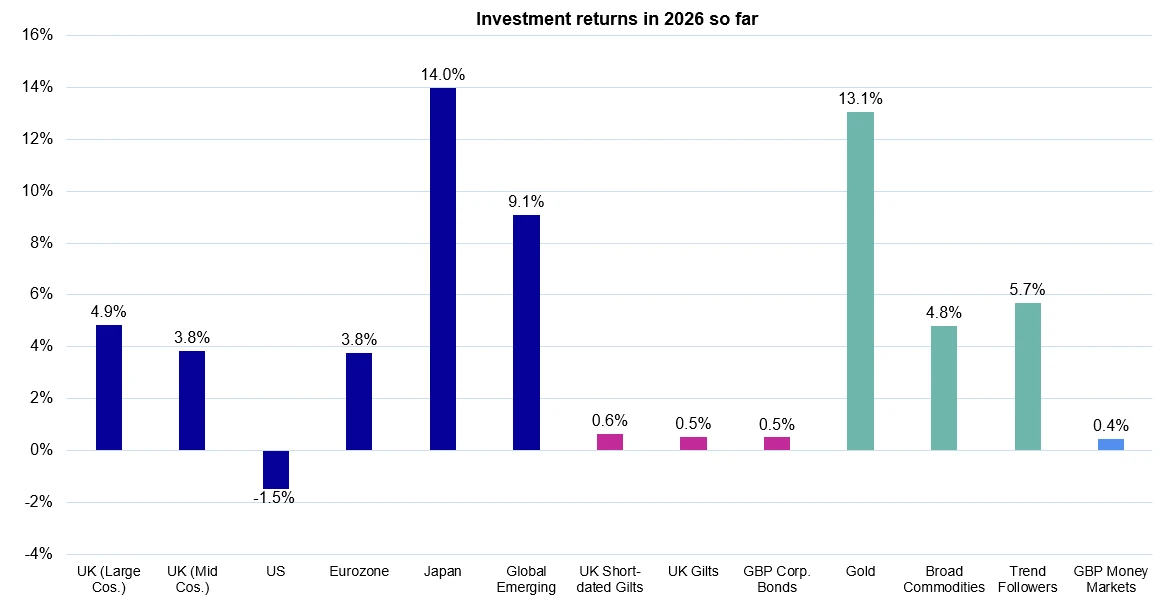

We have seen a strong start to 2026 for most equity and bond markets based on solid corporate fundamentals and resilient economic performance, albeit punctuated by episodes when geo-political risk has become more prominent. Due in part to the threat of Artificial Intelligence, measures of market volatility are also shifting a little higher again, having been dormant over the past six months.

We are always mindful of political events intervening in the market environment. However, our focus is considering where longer term investment opportunities will be driven by fundamentals, before considering whether shorter term, cyclical factors might also play a role.

In some ways, markets have continued the story from last year, with most international equity markets leading the US, bonds eking out positive returns as intended, and precious metals contributing performance ahead of expectations.

Source: Bloomberg, with Netwealth calculations. Returns shown in GBP terms to February 12th 2026

We highlighted last year the likelihood of unpredictable policy from the US. This was manifest across economics and politics globally, with immediate impact on capital markets. Longer term, structural forces are in flux: de-globalisation and the acceleration of technological advances through Artificial Intelligence are pulling the relationships between capital and labour in different directions. It’s also driving corporate investment and fuelling growth in some sectors while threatening the future existence of others.

Government bond markets: strained, not shattered

Against this backdrop, long term predictions feel harder than ever, but our expectation is that one result of this dynamic will be to keep the level (and variability) of inflation higher than during the first 20 years of the century.

In our view however, forward-looking government bond returns reflect attractive headline real yields, once the impact of expected inflation has been taken into account. Clearly this a result of the painful re-setting of bond prices from the zero-interest rate environment five years ago and assumes that economies can ultimately navigate a higher inflation backdrop. The fiscal picture for key governments remains strained, but not shattered.

Our base case is that governments are creditworthy, but that we will see bouts of volatility test investor confidence, as their status as safe assets remains in question. We have been gradually increasing sensitivity to bonds back closer to pre-pandemic levels, as we expect that investors will continue to be rewarded for putting their money to work there, despite the expected and no-doubt unexpected risks that lie ahead. In case inflation is much stickier than expected, portfolios have an explicit allocation to index-linked bonds, and our holdings in liquid alternative assets are designed as a further backstop against market dislocation.

In our view, corporate bonds still face the opposite challenge to government equivalents, in that strong fundamental qualities look very fully priced. Owning high quality corporate bonds may offer some interesting opportunities in their own merit, but they bring little to the prospects of portfolios in aggregate.

Strategic equity allocation changes

We have been making some changes to portfolios in recent weeks, with our relative preferences shifting slightly after a strong period of returns for many markets.

In the past 15 years, the US equity market has grown to dwarf all others. Investors have put great store in its deep liquidity, strict governance and regulatory structures and, most importantly, the exceptional profits growth from its dominant technology sector and other world-class companies. This confidence in the US means it currently trades at a significant valuation premium relative to its own history and, for several years now, relative to other markets too. Last year however, the performance of the US market was only driven by the strength of profits, as valuations stayed constant, if still stretched.

Other markets have played catch-up on valuations, anticipating better conditions in the future due to shifting economics and investors’ sectoral preferences. This improved investor sentiment has made other markets less cheap compared to the US, and more expensive relative to their own histories.

Our portfolios will always be globally diversified, and we currently still believe that the best long-term returns for investors will come from markets outside the US, as valuation gaps narrow. However, we think that investors may be temporarily becoming a little over-excited about the prospects of markets like Japan as explored here. We have trimmed a hefty starting strategic position in Japan, and rebalanced back into the US. On the plus side, deflation is no longer the defining feature of the Japanese economy, corporate behaviour has improved materially, and the market is supported by the strongest fundamentals in a long time. However, the next phase looks more complex. Inflation dynamics remain uncertain, policy constraints are tighter and valuation upside is more limited.

Maintaining portfolio balance through ETF selection

We have spoken before about the different characteristics that our various equity allocations bring to the overall portfolio mix at Netwealth. We believe that regional building blocks of exchange traded funds (ETFs) are the most cost-effective way to invest a diversified portfolio, but it is often the characteristics under the surface of a given market that are most important for performance rather than their regional focus.

Holding an S&P 500 Index ETF for US exposure has been a great starting point for portfolio returns over the past 9 years, given the well-known challenges faced by active stock-pickers. However, as risk managers, we recognise that choosing a pure passive-only allocation in this key market can now actually introduce risk to portfolios, given the extreme size and concentration of the index in its largest constituents. In addition to the core S&P 500 Index exposure and an existing allocation to the S&P Midcap 400 Index of medium-sized companies, we have introduced a new ETF, the Invesco FTSE RAFI US 1000 UCITS ETF, which weights holdings according to key fundamental characteristics, rather than size alone.

Markets have started the year by picking through the vulnerabilities of previously dominant companies to the threat of AI, with the US software giants firmly in focus. This looks set to be an ongoing theme with different sectors rotating in and out of favour. A more diversified, and better value exposure to US stocks is designed to weather conditions more comfortably.

Stabilising global macro backdrop amidst political noise

The picture for global growth is one of resilience. With economic activity picking up, a solid labour market and no nasty inflation surprises, the ever-important US looks in good shape. Expectations of further fiscal and monetary support ahead of the mid-term elections in the Autumn are priced in, but investors will remain wary of the potential for policy surprises that created the market volatility last Spring. The incoming Federal Reserve Chairman’s mettle will likely be tested at some point, and we will keep an eye on bond markets’ view of whether the combination of policy choices are too much.

Happily, a measure of confidence has also returned to other economic regions, supported by ample liquidity conditions. In the UK there are signs that an uninspiring outlook has been fully digested, and we believe patient investors will be rewarded by maintaining allocations. For now, the key feature of Netwealth portfolios is still the emphasis placed on international markets where we see better growth prospects at reasonable valuations.

As always, if you want to find out more about how our investment approach can help you achieve your goals, please get in touch.

Please note, the value of your investments can go down as well as up. This article is provided for information purposes only and does not constitute personal financial advice. Investment decisions should be based on your individual circumstances.