Enhancing passive investing through active allocation

A modern investment approach should proactively take advantage of current trends and be able to adapt when necessary to a changing environment – while remaining cost effective. This is why we combine the efficiencies of passive investing with active allocation.

Here we explain what this strategy means (you can also watch this webinar) and why it underpins what we do – and how it helps us to deliver growth for clients efficiently and in a highly diversified way.

Passive investing is not enough in itself

Passive investing usually implies that you are trying to follow the performance of a particular benchmark or market – such as the FTSE 100 in the UK, or the S&P 500 in the US. This task is relatively easy if you are just talking about following single asset classes, such as equities.

Multi-asset discretionary portfolios (comprised of equities, bonds and selected alternative investments such as commodities) need more thoughtful decisions around how portfolios are built. Nuance is required, and is often rewarded. This is because portfolios need to be diversified to capture different growth opportunities and to provide some level of protection when the market environment is volatile. And tellingly, they still need to be put together for as low a cost as possible.

We set up our investment team to allow us to invest efficiently at scale – by keeping costs down we can pass on higher returns to our clients. Crucially, it is the combination of the two approaches (passive investing and active allocation) that has enabled us to outperform our peers consistently over a number of years.

An enduring investment approach for all seasons

Three key pillars form the basis of our investment approach.

Building strategic allocations: This is where we decide the long-term (7-10 years) mix of assets to drive your portfolio’s returns. Our belief is that time in the market is crucial, so we prefer to remain invested over the long term with a diversified portfolio to give you the best chance of meeting your investment goals.

Instrument selection: We then drill down to choose what investments we should include in our portfolios. While they are usually passive funds and ETFs, we must ensure we are picking the best instruments to get the look-through market exposures just right. Saving on costs doesn’t mean you have to use blunt tools. We provide broad diversification in a cost-effective way, focusing on efficient implementation. Saving money here means that more of our clients’ money is invested, generally leading to higher returns.

Adopting cyclical positions: Managing our portfolios is an ongoing process by our experienced investment team, with regular formal Investment Committee meetings harnessing the day-to-day research and analysis. Here we consider any potential changes to portfolio positions to address specific economic or market risks that may knock their performance off-track. However, these changes will never be of the magnitude where they disrupt the conviction of our strategic allocations.

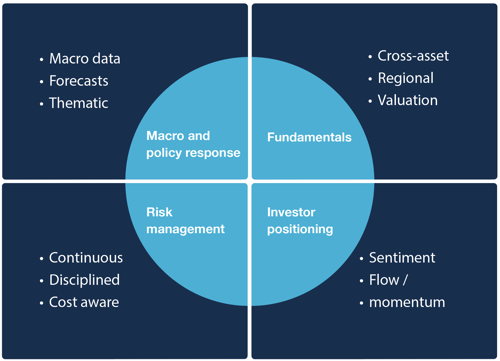

Let’s focus a little further on the drivers that might affect our cyclical positions – which generally reflect a 6-12 month outlook. We look at four areas to determine our responses to various scenarios.

- Macroeconomic environment and policy response. While a positive backdrop for economic growth usually means a good environment for stocks (less favourable for bonds), how central banks and governments respond to environments – through the actions they take – can be instructive for market performance and further inform our decisions.

- Fundamentals. This helps us assess the underlying quality of different investment assets. For example, for equities, are profit margins solid and expected to grow? Are companies stable with resilient balance sheets? Do these companies then represent good value or are they too expensive? We examine multiple factors to assess the strength of the overall fundamentals.

- Investor positioning. How do other investors generally feel about a region or assets? Has consensus already reached the same conclusion as us? How long are current themes likely to be sustained?

- Risk management. As you might expect, this is a continuous undertaking. We monitor for several factors (including market, portfolio and event risk) that enable us to promptly address risk without compromising our long-term strategic goals. Confidence in daily liquidity is a prevailing priority across our investment strategies.

Within this framework, why ETFs and passive investing?

ETFs and a passive investment approach have distinct advantages that allow us to help clients achieve their objectives with a good degree of confidence.

Breadth of market: ETFs give us tremendous choices, a universe that expands daily. We need wide-ranging access to markets such as the UK, US, Europe, Asia and developing countries – and to buy and sell assets within these regions efficiently.

Flexibility: We can gain access to these markets quickly, so we can choose when to enter and when to leave, and we can adapt sharply to the multiple factors we have described above that may need a response.

Higher returns: Passive investing usually delivers better value after fees. It’s widely evidenced across different markets that active fund managers rarely outperform markets consistently over the long term, and it is difficult for them to adapt to different environments as needed. Lower fees directly translate into more bang for your buck, and therefore higher returns compounded over time through more money being put to work.

An example of our approach

The US market is a good example of the benefits of actively managing passive investments. The concentration of returns in the US has been a little skewed for some time – especially through what’s known as the Magnificent Seven stocks (Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, with Broadcom recently replacing Tesla). These successful companies now represent an outsized allocation of any pure passive approach to the US, such as via the S&P 500 Index.

At Netwealth, we still believe in the investment case for the US despite current heightened volatility, due to strong fundamentals and profitable, dynamic companies. So, to get access to a wider set of opportunities here we chose to complement our existing S&P 500 investment with two additions: an ETF designed to allocate equally to the same stocks of the S&P 500 rather than according to current size, and another one that focuses only on medium-sized US companies with their different market drivers.

This approach, and rationale (we explain in more detail in this article), allows us to still support our conviction in the US as an investment destination but provides more nuance – and potentially less risk – in how we achieve our goals here.

Summary

Keeping all these plates spinning is a challenging task, and difficult for individual investors to achieve at a cost that would make a meaningful difference to returns – not to mention the time and discipline needed to keep an eye on the multiple moving parts.

While our main focus is on our strategic outlook – our long-term approach – it’s crucial for us to be able to adapt to certain scenarios to protect our portfolios or to respond to potential growth opportunities as they arise.

The approach we have outlined – actively managing passive investments – may seem innovative, and in a sense it is. It’s certainly efficient. Yet taking an approach that allows us to capture the returns that investment markets offer in a risk-managed way aligns well with what we set out to achieve: to responsibly deliver expert advice and investment management through much lower fees.

Get in touch if you want to know more about how our investment approach could help you reach your goals.

Please note, the value of your investments can go down as well as up.