Europe: a changing landscape and a new opportunity in small-caps

European equities have been among the best-performing regions globally this year, surprising many investors who remained concentrated in the US, which has lagged in relative terms. For international investors not hedging currency risk, the outperformance has been even more pronounced, as the euro has appreciated against most major currencies year-to-date, whereas the US dollar has broadly weakened. While our relatively large European allocation — driven by our diversified approach — has been a strong contributor to portfolio returns, we now see a broader opportunity emerging within the region’s small-cap equities.

European equities have outperformed due to a combination of attractive valuations and a shifting narrative. This includes increased fiscal flexibility across the region, a growing scepticism towards the dominance of US tech, and a broader reassessment of geopolitical risk. Early signs of a more pragmatic policy shift are evident, notably Germany's relaxation of its fiscal stance and the mobilisation of public investment in strategic sectors like defence, energy, and digital infrastructure. Furthermore, amid moderating inflation, more supportive monetary policy from the European Central Bank (ECB) who continue to lower interest rates, provides room for further economic support.

However, while these tailwinds have played out constructively, it is important not to overlook Europe’s persistent fundamental challenges. Weak productivity, fragmented regulation, and adverse demographics continue to weigh on the region's long-term potential. The recent Draghi report underscores these issues, highlighting the critical need for deeper integration, renewed investment, and structural reforms to address Europe's competitiveness gap.

We remain positive on the cyclical European story; however, many of these factors are now increasingly reflected in market pricing. Valuations and investor positioning in large-cap European equities appear elevated. In response, we have moved some of our European equity investment from large-caps into what we see as a compelling opportunity in European small-caps, which have not appreciated to the same extent.

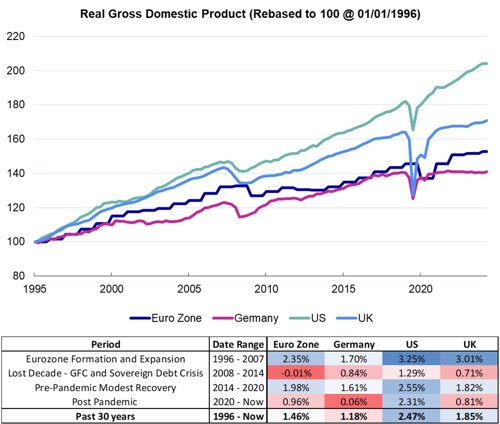

A mixed legacy: Europe’s growth challenges

Europe’s long-term growth trajectory has consistently lagged that of developed market peers such as the US and UK. This gap has become more apparent since the Global Financial Crisis, as the eurozone has struggled to regain momentum amid a series of structural headwinds. Regulatory fragmentation, labour market rigidity, and underinvestment in innovation remain major challenges. The services sector remains particularly constrained by barriers to scale.

Europe vs peers: real GDP growth over last 30 years (Rebased to 100 as of 31/12/2004)

Source: Bloomberg, June 2025

Demographic pressures compound the problem. A shrinking and ageing workforce threatens long-term output and public finances, particularly in the absence of productivity gains or flexible immigration policies. The Draghi report underscores these challenges and the urgency of coordinated reform.

Fiscal conservatism has also played a role. The eurozone’s strict fiscal rules, which aim to tightly manage debt, have often curtailed counter-cyclical stimulus (designed to counteract the effects of the economic cycle), particularly during downturns. In contrast, the US and UK have tended to respond more aggressively with expansionary fiscal measures, such as increasing government spending or cutting taxes, supporting growth at critical junctures.

Germany, long viewed as the region’s economic engine, has stalled in recent years. Since the pandemic, the combination of a self-imposed constitutional "debt brake," ageing infrastructure, and bureaucratic drag has left the economy effectively flatlining. The absence of scalable domestic demand and limited innovation policy support has only reinforced this slowdown.

Winds of change: defence, trade, and policy dynamics

Despite persistent challenges, the European landscape is undeniably shifting. Geopolitical realignments, the rise of industrial policy, and trade fragmentation are propelling Europe into a more central global role. This transition is underpinned by a notable departure from strict fiscal orthodoxy towards a more pragmatic stance, accompanied by a significant ramp-up in investment across defence, energy, and digital infrastructure. These political and macroeconomic shifts are materially altering Europe's investment backdrop, with the renewed focus on fiscal and defence spending proving particularly significant.

The re-election of Donald Trump has acted as a major catalyst. One of the key themes of his second term has been renewed pressure on NATO allies to meet defence spending commitments, following years of criticism that Europe had relied too heavily on US military support. In response, NATO members – including Germany – have stepped up. Germany’s suspension of its long-standing debt brake marks a decisive shift away from fiscal restraint, paving the way for broader public investment across defence, infrastructure, and strategic industries.

This shift comes at a time when concerns over the US investment narrative are intensifying. Question marks around the sustainability of large-cap tech valuations and discomfort with the Trump administration’s policy direction have led investors to reassess relative exposures. European assets – supported by a stronger euro and rising fiscal momentum – have emerged as beneficiaries of this recalibration.

Crucially, these developments are unfolding alongside a more supportive macro backdrop. Eurozone inflation has moderated meaningfully, aided by falling energy prices and softer global goods demand. This has provided the ECB with the flexibility to maintain an easing monetary policy stance (through lowering interest rates), thereby creating a supportive environment for domestically focused and rate-sensitive sectors.

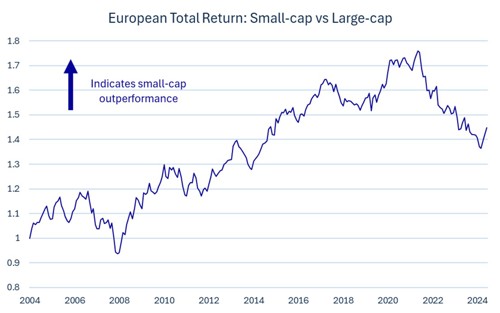

Small-caps positioned for a catch up

European equities have clearly benefitted from this improved backdrop, with strong performance in sectors such as financials, industrials, and energy. Much of the upside, however, has been concentrated in large-cap stocks – particularly banks – which were key beneficiaries of elevated interest rates and improved margins.

Positioning in these areas has become increasingly crowded, and valuations now reflect the more optimistic outlook. As policy and macro dynamics evolve – with rate cuts, fiscal stimulus, and changing trade relationships – we see the performance broadening and a move towards previously overlooked parts of the market.

Europe total return small cap vs large cap (Rebased to 100 as of 31/12/2004)

Source: Bloomberg, June 2025

In contrast, European small-caps have lagged meaningfully in recent years, underperforming since early 2022. Yet this underperformance has created a compelling entry point, and we believe the conditions are aligning for a period of relative catch-up:

· Accommodative central bank: As interest rates decline, and the growth narrative broadens, market leadership may move towards cyclical and domestically oriented sectors, where small-caps are more prominent.

· Attractive valuations: Small-caps currently trade at a historically wide discount to large-caps – levels only seen during periods of significant market stress.

· Fiscal boost: Smaller firms stand to benefit more directly from the new wave of fiscal investment – particularly in Germany, where the lifting of the debt brake is set to unlock substantial public spending across defence and infrastructure.

· Lower trade risk exposure: Given their more domestic orientated revenue profiles, small-caps are less exposed to the risks posed by US-EU trade tensions and global supply chain disruptions.

Beyond fundamentals, adding small-caps also enhances diversification at the portfolio level – mitigating concentration risk in heavily owned large-cap names and broadening exposure as leadership within European markets begins to shift.

Conclusion

Europe’s improving macroeconomic and policy environment has been a clear boost for portfolios this year, and our proactive positioning has enabled us to capture that upside. As market dynamics evolve, so too must the allocation of assets within investment portfolios.

Our recent shift into European small-caps reflects this forward-looking mindset. Initiated in late May, our investment was driven by compelling valuations and a strengthening backdrop – and it is already beginning to perform constructively, lending early validation to our thesis.

While we remain mindful of Europe’s structural challenges, we also recognise the potential for selective opportunities amid change. This move aligns with our broader investment philosophy: one rooted in diversification, valuation discipline, and risk mitigation. We will continue to monitor developments closely and adjust positioning where needed, always with the goal of delivering resilient, long-term outcomes for our clients.

If you want to find out more about our investment approach, and how we can help you to achieve your goals, please get in touch.

Please note, the value of your investments can go down as well as up.