Japan: Reassessing The Opportunity Amidst Shifting Winds

Summary

Japanese equities have been among the strongest performers since the pandemic, with 2025 adding further momentum as the market delivered a total return of around 25% in local currency terms. This strong performance reflects a combination of improving macroeconomic conditions, supportive policy settings and meaningful improvements in corporate behaviour. Long standing reforms aimed at improving governance, capital utilisation and shareholder returns have played an important role, making Japan a valuable contributor to portfolio returns.

Following our annual strategic review, we have slightly reduced our allocation to Japanese equities and reallocated a small portion to the United States. This should not be seen as a loss of confidence in Japan. The market is structurally stronger than at any point in recent decades. However, after a strong run, valuations are higher, policy regimes are evolving and the scope for further outperformance has narrowed. As a result, expected returns are now more balanced, which justifies a measured adjustment while still maintaining a relatively large allocation compared to global benchmarks.

Japan is no longer defined by persistent deflation or stagnant growth. At the same time, it has not yet moved into a fully self-sustaining, demand driven expansion. The economy is in a transition phase, with policymakers balancing inflation, interest rates, public finances and currency stability. How this transition unfolds will be important for investment returns in the next phase.

Macroeconomic backdrop: progress made, but still fragile

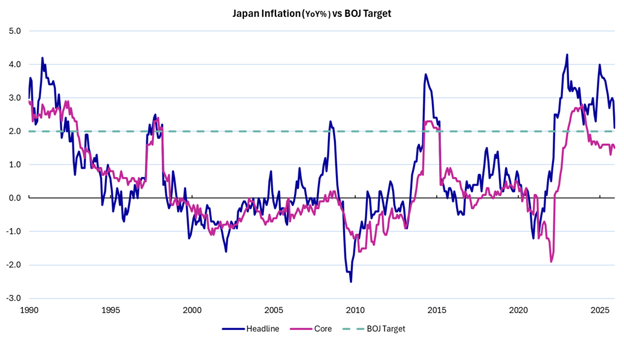

After decades of suffering from deflation and anaemic growth, Japan has finally experienced a sustained period of stronger nominal economic activity. Inflation has remained above the Bank of Japan’s (BOJ) 2% target for close to four years, an outcome that would have appeared highly improbable for much of the previous three decades.

Japan’s first sustained inflation overshoot in 30 years

Source: Netwealth, Bloomberg as of January 2026.

The foundations for this shift were laid under Prime Minister Shinzo Abe’s “Abenomics”, introduced in 2012 to combat deflation through a combination of his “three arrows” of ultra‑loose monetary policy, fiscal stimulus and structural reform. However, the decisive catalyst instead came from the pandemic shock, amplified by Japan’s decision after the pandemic not to follow other major economies into aggressive interest tightening. This policy divergence drove a pronounced depreciation of the yen, which pushed up the cost of imported goods such as energy and food.

Crucially, this shock triggered a behavioural shift. Companies that had long resisted price increases began passing higher costs through to consumers, and households gradually adjusted to an environment where prices no longer consistently fell.

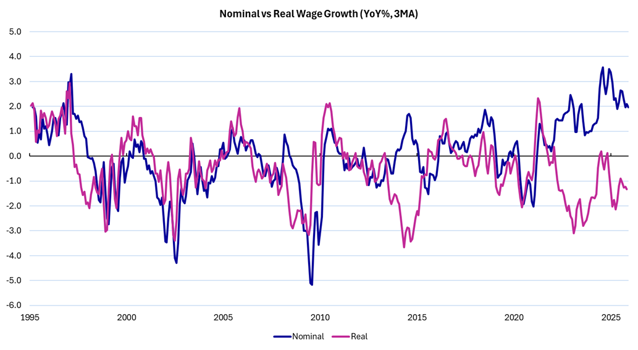

That said, the nature of inflation still matters. Much of the increase in prices has been driven by higher costs and currency effects rather than strong domestic demand. Wage dynamics illustrate the point. Nominal pay has improved, with recent annual “Shunto” wage negotiations delivering the strongest increases in decades (over 5% in both 2024 and 2025). However, real wage growth has remained weak, as inflation initially outpaced pay. Wages have been catching up with inflation, rather than leading it. This is different from a typical demand led expansion, where rising real incomes support stronger and more durable consumer spending.

Real wage growth remains weak

Source: Netwealth, Bloomberg as of January 2026.

Encouragingly, longer‑term inflation expectations have moved closer to the BOJ’s target. What remains unclear is whether this reflects confidence in a lasting domestic recovery, or simply an acceptance that higher imported prices will persist for longer than previously expected. This distinction will be important for future policy decisions and market outcomes.

Monetary policy quandary: cautious normalisation amid competing constraints

Unlike most other central banks, the BOJ responded to the rise in inflation after the pandemic with deliberate patience rather than urgency. After decades of below target inflation, policymakers judged the greater risk to be another false dawn, where tightening policy too early could push the economy back towards deflation. Also, this caution was reinforced by the perception that early post‑pandemic inflation was transitory, reflecting supply‑side pressures, weak real wages and subdued longer‑term expectations.

Thus, the BOJ chose to delay tightening policy, tolerating a prolonged period of inflation running above its target, in the hope of re‑anchoring price‑ and wage‑setting behaviour. In the Bank’s view, sustainable inflation requires durable wage growth and a virtuous, demand‑led cycle, not simply higher prices.

With longer‑term inflation expectations now showing signs of stabilising, policy has begun to normalise, but cautiously. The BOJ continues to face several binding constraints:

- Inflation credibility: Confidence that inflation is being sustained by domestic economic strength, not currency weakness alone. This is a high hurdle in an economy shaped by decades of entrenched deflationary behaviour.

- Growth fragility: Nominal output has improved materially, with annualised growth over the past five years closer to 4% compared with near zero over the preceding 25 years. However, consumer confidence remains cautious as real incomes have yet to recover convincingly.

- Fiscal realities matter: Public debt is very high (240% Gross debt to GDP), making the economy sensitive to rising yields and limits how aggressively policy can be tightened.

- BOJ’s balance sheet: is exceptionally large size, reflecting its long-standing support for the government bond market, which reduces the scope for rapid policy shifts without causing market disruption.

- Currency stability: Some yen weakness has supported earnings and inflation, but excessive or disorderly depreciation risks destabilising inflation expectations and undermining confidence.

Taken together, these factors suggest a central bank signalling direction rather than urgency. Policy normalisation is therefore likely to occur gradually, through managed repricing of interest rates and the currency. The priority for policymakers is not to prevent yields from rising, but to avoid destabilising changes that could damage confidence and derail a still‑fragile recovery.

Fiscal policy and Politics: supportive, but complicating

Fiscal policy has taken on a more prominent role under Prime Minister Sanae Takaichi. Her government has articulated an expansionary agenda aimed at sustaining nominal growth, supporting household incomes and increasing public investment, particularly in defence, energy transition and industrial policy. With approval ratings strong, the decision to call a snap general election (February 8th) appears designed to secure a clearer electoral mandate to pursue this agenda.

While this supports growth, it also increases attention on the already concerning public finances picture. Expectations of higher government borrowing has contributed to pressure on longer dated bonds and renewed weakness in the yen.

Some adjustment in yields is natural following the removal of extraordinary monetary measures. However, investor unease around fiscal discipline has also played a role. Sustained increases in yields would quickly raise debt servicing costs, tighten fiscal constraints and increase the likelihood that the BOJ would need to intervene to stabilise markets, complicating the path of policy normalisation. The interdependence between fiscal and monetary policy has increased, narrowing the margin for error and raising the risk of volatility in rates and currency markets.

Japanese equities: strong foundations, but narrowing margin of outperformance

Japanese equities’ strong performance in recent years reflects a confluence of supportive forces, several of which represent genuine and lasting improvements:

- Favourable economic backdrop: Financial conditions have remained accommodative, even as inflation picked up, and nominal economic growth has returned after decades of stagnation. This has improved the environment for company revenues and profits. A weaker yen has also helped earnings, particularly for Japan’s large export focused companies that dominate the market.

- Structural reforms: Meaningful improvements on corporate governance, capital utilisation and shareholder value. Excess cash is increasingly being put to work, balance sheets are more efficient, and shareholder returns have risen meaningfully, with buybacks an increasingly visible signal of change.

- Thematic tailwinds: Japan offers high quality exposure to long‑term technology and industrial investment themes. World‑class manufacturers embedded in global supply chains continue to benefit from secular tailwinds linked to automation, semiconductors and artificial intelligence

That said, some limits are becoming clearer. Domestic consumers remain highly price‑sensitive, and confidence in sustained real revenue growth under a durable inflation regime is still tentative. Importantly, the earnings benefit from a weaker currency has become less powerful over time, as Japanese firms increasingly produce and reinvest overseas. Moreover, there are levels of currency weakness and rising bond yields at which valuation pressures and capital flows could begin to offset earnings strength.

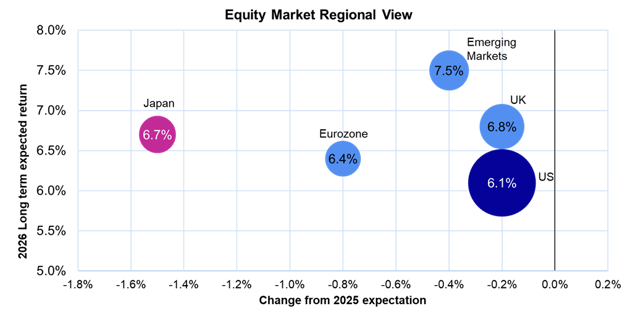

After a strong run, equity valuations have risen meaningfully above long‑term averages. While still reasonable relative to many developed peers, the scope for further expansion appears more limited. Starting valuations matter for long‑term returns, and this has lowered our expected return outlook for Japanese equities.

Expected returns cut most in Japan, yet remain relatively attractive

Source: Netwealth, Bloomberg as of January 2026. Circle size represents current strategic allocation. This presentation contains forward-looking statements based on current assumptions and available data. These projections are uncertain and may change due to economic or market developments

As a result, we have modestly reduced our Japanese equity exposure to 16.5% of our equity allocation, from 18.5%. This remains well above Japan’s c.5% weight in global indices, reflecting our continued confidence in the market’s long term prospects and diversified approach.

Currency considerations

Currency movements remain an important consideration for overseas investors. A weaker yen has supported company earnings but has reduced returns for sterling-based investors when exposure is unhedged. Over the long term, we continue to view the yen as a useful diversifier, typically acting as a ballast during periods of global market stress, and therefore prefer to leave exposure largely unhedged. It is also important to note that Japanese authorities have historically intervened, when yen weakness is viewed as excessive or destabilising, which can limit tail risks around extreme depreciation. That said, we remain pragmatic. Periods of excessive currency moves, or heightened uncertainty can create opportunities to manage exposure more actively, and selective tactical hedging of yen risk in recent years has been accretive to portfolio returns.

Conclusion

Japan has come a long way. Deflation is no longer the defining feature of the economy, corporate behaviour has improved materially, and the equity market is on much stronger footing than in the past. However, the next phase is likely to be more complex. Inflation dynamics remain uncertain, policy constraints are tighter and valuation upside is more limited after a strong run.

Our recent adjustment reflects these realities. Japan remains an important component of diversified portfolios, but with a narrower margin for outperformance, a disciplined moderation is now appropriate.

If you want to find out more about our investment approach, and how we can help you to achieve your goals, please get in touch: https://www.netwealth.com/contact-us/.

Please note, the value of your investments can go down as well as up. This article is for information purposes only and does not constitute investment advice.'