Losing its shine? Rethinking the risks and rewards on US assets

For decades, the United States has benefited from an ‘exorbitant privilege’ rooted in the dollar’s status as the world’s primary reserve currency. This unique position has placed the US at the heart of the global financial system, enabling it to fund large and persistent trade deficits with relative ease. US assets – from equities and Treasuries to the dollar itself – have long been seen as high quality, liquid, and fundamentally safe.

Admittedly, at the end of last century, in times of market stress, international investors sought out the Deutsche mark, Swiss franc or yen as safe-havens and not the dollar, but since the 2008 global financial crisis, the dollar has also become an accepted safe-haven. In times of global stress, the US dollar has served as the world’s de facto refuge.

However, recent market behaviour and shifting geopolitical dynamics suggest this longstanding assumption is being reassessed. Investors appear to be demanding a higher risk premium for holding US assets – that means they need to receive a higher yield on US Treasuries to hold or to see the dollar or other US assets weaken before they are tempted to buy. It is a development that could carry profound implications for investors deploying their funds globally and managers of foreign exchange reserves.

Rethinking US assets: a higher risk premium emerging

The recent behaviour of the US dollar amid ongoing developments in US trade policy has been striking. When regarded as a “safe-haven” asset, the dollar has typically exhibited an inverse relationship with traditional risk assets (such as equities, foreign currencies and high yield bonds). It therefore tends to appreciate during periods of market stress, as investors seek refuge in US dollar assets, particularly US Treasuries.

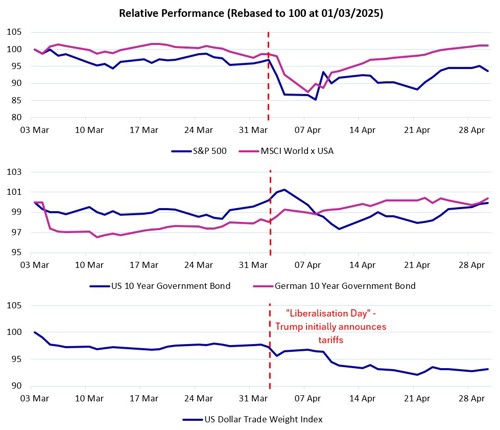

However, recent policy announcements — notably the aggressive tariff measures unveiled by the Trump administration in early April — triggered a notable bout of market volatility, during which US equities, the dollar, and even Treasuries came under pressure simultaneously. This synchronised weakness temporarily challenged the conventional defensive appeal of US exposure and raised broader questions around the reliability of US assets during episodes of stress.

The episode underscored a growing discomfort around US-specific risks, particularly those emanating from unpredictable policy shifts, cracks in previously strong fundamentals and rising geopolitical tensions.

Recent relative performance of US assets (in local currency terms)

Source: Bloomberg

There has been a partial stabilisation since, on the back of policy shifts. US policymakers appeared to take heed of the market’s reaction. In a notable shift, President Trump announced a 90-day pause on reciprocal tariffs (excluding China) and implemented a uniform 10% tariff rate – a meaningful step back from the previously proposed, more punitive measures.

Market participants also interpreted subsequent remarks on progress on trade deal negotiations and prospects of a significantly lower effective tariff rate on China as a signal of pragmatism and responsiveness to investor concerns. As a result, equities have staged a partial rebound, and the dollar and Treasuries have regained some composure.

Nonetheless, the episode itself remains instructive. It revealed a heightened sensitivity of global markets to US-specific policy risk and demonstrated that the cherished "safety" of US assets can be undermined by policy uncertainty. In particular, the fact that both domestic and international investors appeared willing to temporarily rotate away from the dollar – even in the face of heightened global uncertainty – is a significant behavioural shift worth noting.

More broadly, this volatility underscores a deeper reassessment of US risk premia. With fiscal deficits remaining structurally high and concerns about political polarisation intensifying, investors are beginning to demand a greater premium for holding US assets – whether in the form of higher Treasury term premia (which we touch on here), lower equity valuations, or reduced reserve allocations to the dollar.

Geopolitical diversification: the rise of strategic hedging

Parallel to the market’s evolving perception of US risk is a visible trend in reserve diversification by major geopolitical actors. Central banks across emerging markets, particularly in countries like China, Russia, and even India, are reducing their reliance on the dollar-based financial system. This shift is partly a response to what many perceive as the weaponisation of the US financial architecture – a concern crystallised by the use of sanctions and the freezing of foreign exchange reserves.

A defining characteristic of this shift is the growing prominence of gold in official reserves (a trend we explored last year). Central banks have been acquiring gold at an unprecedented rate, with purchases surpassing 1,000 tonnes for the third consecutive year in 2024 – a trend poised to persist in the coming years. For context, an unprecedented record of 1,136 tonnes of net purchases by central banks was set in 2022 – before this the yearly average in the previous decade was c.500 tonnes per annum.

The move reflects a desire for politically neutral assets that are not subject to counterparty risk or the jurisdiction of a single state. Gold’s physical and apolitical nature makes it an attractive alternative in an increasingly fragmented geopolitical landscape, particularly for nations seeking to insulate themselves from dollar-linked vulnerabilities.

China, in particular, has become a focal point. The country has been reducing its holdings of US Treasuries – now at their lowest level since 2009 – and increasing settlement of trade in renminbi, especially with nations like Russia and key commodity exporters. These efforts form part of a broader strategy to internationalise the yuan and build parallel infrastructure outside the dollar system. Russia, similarly, has pivoted decisively towards alternative reserves, with an accelerated build up in gold and non-dollar currency reserves. Markets have paid attention, and gold breached record prices this month.

Gold’s stellar run – global uncertainty sees new highs

Source: Bloomberg

Towards a multipolar reserve system?

The collective result of these shifts is a potential move towards a more fragmented and multipolar global monetary system. While the dollar still accounts for nearly 60% of global reserves and retains immense institutional support, its share has been declining steadily. The rise of regional currency arrangements, bilateral trade agreements denominated in non-dollar currencies, and expanding cross-border payment systems outside of SWIFT (such as China's CIPS) all point to a world diversifying away from dollar dominance – but at an incremental pace.

To be clear, no single currency appears poised to displace the dollar in the near term. The euro, yen and yuan all face structural limitations as global reserve currencies – whether due to political fragmentation, deflationary dynamics, or capital controls. However, what is emerging is not a unipolar replacement, but rather a more pluralistic system where reserve holdings are more evenly distributed across a basket of alternatives by not maintaining the previous pace of US asset purchases, in what we describe as ‘passive diversification’. This fractional reserve order could be more volatile and fragmented, but it may also offer a more neutral balance of economic power.

Investment implications: embracing a diversified philosophy

While the current reassessment of the US investment landscape is notable, it is important to underscore that US assets continue to offer compelling characteristics – depth, liquidity, innovation, and institutional strength – which remain attractive to long-term investors. However, being cognisant of these merits does not imply complacency, particularly about the extended valuations of some of the US’s most exceptional companies.

Our investment philosophy has long recognised the importance of diversification – across geographies, currencies and asset classes. This principle has proven particularly valuable amid this year’s heightened volatility, where markets have punished concentrated exposure and rewarded adaptability. A globally diversified approach not only mitigates idiosyncratic risk but also allows us to capture relative value opportunities as macro narratives evolve.

While we remain attuned to the underlying structural shifts in the global monetary and geopolitical landscape, we do not foresee a wholesale or imminent displacement of the US dollar’s reserve status. The institutional foundations supporting the dollar remain robust, and the absence of a viable single alternative reinforces its continued centrality. That said, we do expect the gradual diversification trend to persist, and potentially accelerate, particularly among foreign exchange reserve managers and geopolitically aligned blocs seeking greater autonomy.

In this context, maintaining a dynamic, flexible, and globally diversified allocation strategy will remain central to delivering resilient outcomes in an increasingly multipolar financial world.

Find out more about how our investment approach can help you to meet your long-term goals.

Please note, the value of your investments can go down as well as up.