South Korea’s political reset: a case for active EM allocation

It’s not unusual to invest in emerging markets (EM) through a single fund that tracks or tries to beat the MSCI Emerging Markets index. While this provides easy access and broad diversification, it also treats a highly diverse set of economies and markets as a single, homogenous block. In reality, EM is anything but uniform so it pays to be able to understand and benefit from the nuances – the drivers of growth, policy and valuation that can differ sharply between countries.

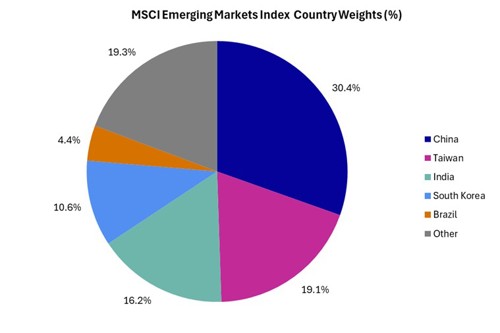

Our investment process recognises these differences, and this informs how we build portfolios and allocate assets. In our longer-term strategic allocations, we separate China from the rest of the emerging markets to reflect the importance of the world’s second largest economy. In our shorter‑term cyclical positioning we take active views on the largest markets, including China, Taiwan, India, South Korea and Brazil, which together account for around 80% of the investable EM equity universe. This gives us the flexibility to adjust allocations based on country‑specific opportunities and risks rather than being tied to index weights.

Chart 1 – MSCI Emerging Markets weights as of August 29th 2025

Over the past year we have taken targeted country‑level positions reflecting both long‑term structural views and shorter‑term cyclical opportunities as the investment landscape has evolved. Last September we invested more in China on the view that an untenable domestic economic situation would prompt favourable policy decisions, creating a catalyst for performance catch‑up from an undervalued market. That position boosted portfolios and was closed earlier this month after the strong performance of Chinese indices in August left valuations and positioning elevated.

Our most recent EM trade, still active, is an overweight (greater than the index) investment in South Korea, which was initiated in mid-June. This was funded by trimming our strategic investments in EM outside of China exposure, therefore investing less in India and Taiwan where valuations remain extremely high relative to history.

Why Korea? From undervalued to opportunity

South Korea had been on our radar as undervalued for some time, having lagged other Asian emerging market peers such as India and Taiwan. However, we needed a clear catalyst before taking a more constructive stance on the market. Its underperformance was well‑warranted: political uncertainty, poor demographics and external pressures had all weighed significantly on growth prospects.

Policy paralysis under former conservative President Yoon Suk Yeol, whose agenda was repeatedly blocked by a liberal opposition‑controlled National Assembly, created a prolonged stalemate. This escalated into a failed coup attempt in December 2024, resulting in Yoon’s impeachment and a six‑month leadership vacuum. Political risk surged, dampening consumer, business and investor confidence, which in turn contracted investment and triggered capital flight.

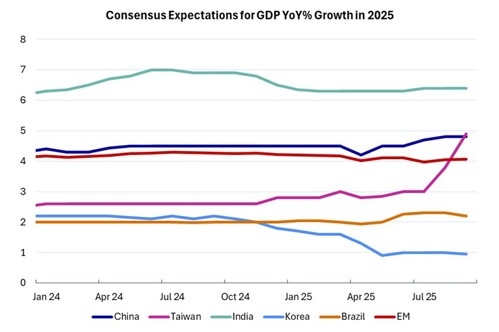

Structural headwinds compounded the problem. Korea has the world’s lowest birth rate at just 0.72 children per woman and a rapidly ageing population that is eroding its long‑term growth base. Externally, evolving US tariff policies have added friction to its export‑dependent economy. Meanwhile a narrowing technological lead, rigid labour markets and reduced cost advantage have chipped away at competitiveness with China. By June, consensus expectations for 2025 GDP growth had fallen to as low as 0.8%, the first time outside of a crisis that growth was forecast below 1% in any given year.

Chart 2 – Development of growth expectations for 2025 since the start of last year

Source: Bloomberg, as of 19th September 2025

The turning point came with the June 2025 presidential election. This delivered a decisive win for Liberal candidate Lee Jae‑Myung and gave his Democratic Party unified control of both the presidency and the National Assembly. The political reset ended years of legislative deadlock and lifted a major source of uncertainty. While progressive in policy stance, the new administration appears acutely aware of the economic challenges and is signalling a pragmatic, pro‑growth approach. The new alignment has raised expectations for fiscal stimulus, corporate governance reform and a renewed focus on economic growth.

Macroeconomics and policy backdrop

With growth prospects languishing, Korea’s recovery will require a meaningful policy push on both the fiscal and monetary fronts. Inflation remains subdued (1.7% in August), comfortably below the Bank of Korea’s 2% target, giving policymakers scope to maintain an accommodative stance by lowering interest rates. The central bank is expected to cut rates again by the year end and continue into 2026, aided by cooling domestic price pressures and additional disinflationary forces from China. This monetary easing is reinforced by the US Federal Reserve’s own cutting cycle, creating a supportive backdrop for EM assets more broadly, as long as the US economy can avoid a recession.

On the fiscal side, the new government’s progressive stance makes increased public spending a near‑certainty. However, the emphasis is likely to be on measures that directly lift economic growth rather than purely on social transfers (regular payments made by the state). Planned initiatives include investment in artificial intelligence and advanced technology to address productivity challenges, funding for green energy projects, and expanded childcare subsidies to improve labour force participation. These will be paired with a stronger social safety net to complement labour market reforms aimed at increasing flexibility.

For now, debt levels and the budget deficit remain relatively low, giving the government room to act. The longer‑term challenge lies in demographics. With more than 20% of the population already over the age of 65, Korea is entering “super‑aged” territory, which will steadily increase demands on public finances in the years ahead.

Corporate fundamentals

The government is advancing shareholder‑friendly reforms to narrow the long‑standing “Korea discount” in the equity market which is attributed to the dominance of large family‑controlled chaebol (conglomerates of affiliated companies under common family ownership, such as Samsung Group and Hyundai Motor Group). Its “value‑up” programme targets greater transparency, stronger minority shareholder rights and more efficient capital allocation.

Earnings expectations for 2025 have been revised higher, supported by policy momentum and improving prospects in key industries. In technology, the memory sector offers notable upside as global AI demand accelerates.

Labour reforms, including more flexible hours, performance‑based pay and childcare subsidies, aim to lift productivity and help offset demographic pressures. Together, these shifts strengthen the case for a market re‑rating as both domestic and global investors reassess Korea’s growth and return potential.

Recent performance and valuations

The June election proved to be the catalyst for a sharp turnaround in Korean equities. Since then, as the chart below illustrates, Korea has been the standout performer in EM, decisively outperforming major peers.

Chart 3 – Korea outperformance since election catalyst

Source: Bloomberg, as of 19th September 2025 in GBP terms

This surge has been accompanied by a re‑rating in valuations, but the market still trades at a wide discount relative to EM peers. Korean equities have historically traded at around a 13% discount to the broader EM index, suggesting that each dollar earned by Korean companies is valued 13% lower than in comparable markets, for all the reasons listed above. That gap widened to as much as 35% following the political turmoil, climaxing with the impeachment. The political stability brought by the presidential election triggered a narrowing of the discount, which sits around 21% today, yet it remains well above the long‑term average.

Chart 4 – Korea valuation discount to MSCI EM over time

Source: Bloomberg, as of 19th September 2025

By contrast, India and Taiwan, the largest EM components outside of China, are trading at historically high multiples – they are expensive. This relative valuation gap, combined with improving fundamentals, leaves room for further catch‑up.

Behaviourals – assessing positioning, sentiment and trend

Investors viewed Korea extremely unfavourably in the months leading up to the June election. Political turmoil and policy paralysis drove sentiment and positioning to very low levels, with foreign investors net sellers for nine consecutive months. This was the worst streak on record and saw a total of $30 billion leave the market. Technical indicators at the time reflected this capitulation, with the market registering as deeply oversold – and therefore potentially good value.

The election acted as a clear turning point. Since then, price action has been strong and Korea has outperformed, supported by improving sentiment, earnings momentum and diminished political risk. Although only a fraction of the capital that left has so far returned, the shift marks an important change in direction and suggests the recovery in positioning has room to continue.

We remain confident that this reversal trend can extend as investors regain confidence in the market. At the same time, we will continue to monitor positioning data and price action closely for signs that the rebound becomes stretched in the short term.

Summary: uncovering the nuances that can drive performance

Emerging markets are not a single story. They are a collection of distinct economies, each moving to its own rhythm. Treating them as one block risks missing the nuances that can drive performance. A granular approach analysing the most important constituents allows us to look past the index, focus on the most compelling opportunities, and sidestep areas where risks outweigh rewards.

South Korea’s recent shift is a clear example of why this matters. A change in political direction, credible reform momentum and a valuation backdrop that still offers room for re‑rating have combined to create an attractive entry point. This is the type of opportunity that broad EM exposure alone would have diluted.

In a diverse and fast‑moving asset class, actively allocating at the country level allows us to respond quickly to catalysts as they emerge. It also enables us to capture idiosyncratic upside and manage risk with greater precision.

If you want to find out more about our investment approach, and how we can help you to achieve your goals, please get in touch.

Please note, the value of your investments can go down as well as up.