How Pensions and ISAs from Netwealth Boost Your Retirement Income

As the end of the tax year approaches you may be thinking more about how best to fund your retirement and considering making the most of your tax-free allowances. While pensions are rightly thought of as the most effective way to build a meaningful retirement pot, the benefits of ISAs should also not be ignored in giving you more freedom for your future.

How a pension provides the ultimate retirement boost

It’s hard to beat a pension for doing the heavy lifting in building a comfortable retirement pot. And in the recent Budget the incentives grew even greater. The annual pension allowance – the maximum you can save into a pension every year – will increase from £40,000 to £60,000 (from 6 April 2023) and the lifetime pension allowance (most recently £1.073 million) will be abolished altogether from the 2024/25 tax year.

But it is the tax-free benefits where a pension really shines:

- Tax relief when you pay in

- Tax-free growth and income

- Assets accrued not subject to inheritance tax (crucial for next generation planning).

Now there are also two ways to boost your pension pot further. First, if you act by 5 April (tax year end), and have the funds to spare, you can apply any unused pension allowance from the past three years and use it this year.

You also have the opportunity to boost your state pension. If you have incomplete years of national insurance contributions, you can ‘buy’ extra years to fill gaps going back to 2006.

Use this state pension calculator to see how much you might receive – and then act before 31 July. A small investment now could be enhanced nicely by how much extra you get from the state every year.

The valuable flexibility of an ISA

The tax-free benefits of ISAs can also be a key pillar in securing a comfortable retirement – and give you vital extra flexibility. While there are no tax breaks (unlike a pension) when paying into an ISA (currently up to £20,000 a year), they provide great freedom as you can access your money whenever you wish. Also, any funds withdrawn or taken as an income are completely tax free forever.

With double the allowance a couple could build up a considerable tax-free pot over 20 to 30 years. But remember to use your allowance by 5 April this year as you can’t carry it over if you don’t.

You should also explore how much an ISA can boost a family’s savings over time. By combining the full allowances of adults and children, a family of four could have a portfolio value £100,000 higher after 10 years compared to growing their savings outside of the tax-free wrapper, as we show here.

A smart way of maximising your retirement pot

Pound for pound a pension adds up to a better retirement booster over time. By the power of compounding, saving £100 a month into a pension (topped up to £125 a month as a basic rate taxpayer, with growth of 6% a year), your pot would be worth £122,400 after 30 years. An ISA with the same underlying figures would grow to £98,000. The pension calculation also excludes any employer contributions which could add a sizeable extra sum.

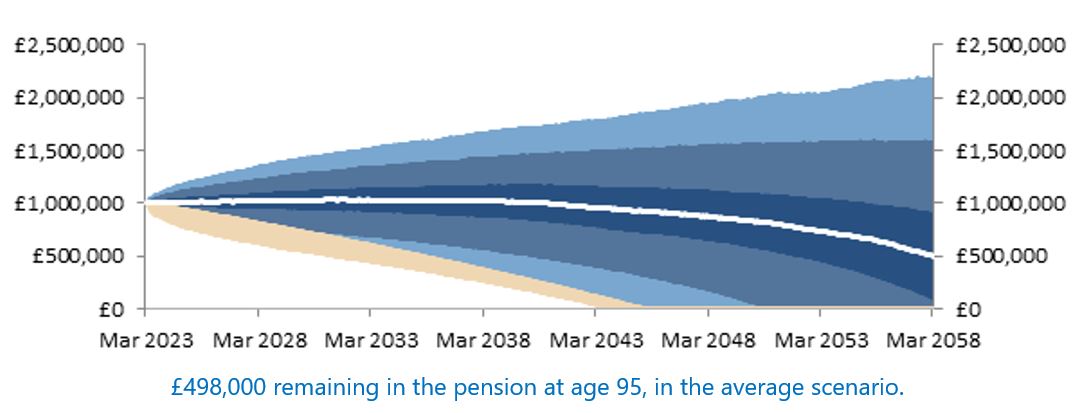

Yet once you build up a retirement pot, how you withdraw funds from it can make a big difference to how long it will last. The case study below helps us project how someone can make the most of their pension and ISA funds in retirement.

By using their allowances and accessing their assets smartly, Jane can release her funds very efficiently, and make them last longer:

- Jane is retired at 60, with a £1m pension in drawdown

- She is aiming for a net income of £2,750 a month

- She invests the 25% tax-free cash allowance in a general investment account (GIA) to support her income

- Each year Jane makes use of her ISA allowance from her GIA

- She invests in a global mix of shares (60%) and bonds and cash (40%) – based on Netwealth’s Risk Level 5 portfolio

- Her main goal is income for her retirement, then to pass on the remainder to her children.

Rather than drawing from her pension first, Jane draws from a combination of her pension and GIA/ISA. The outcome means that, in the average scenario (shown by the dotted line below), she will have £498,000 remaining in her pension at age 95 – which is outside of her estate for IHT purposes and can be passed on to her family tax free.

Drawing from a combination of pension, general investments and ISA

Simulated historic and future performance numbers should not be relied upon as an indicator of future performance.

Source: Netwealth

The above scenario is just an example of how blending can make the most of investments in retirement, and to maximise the benefits for your loved ones after you have passed away.

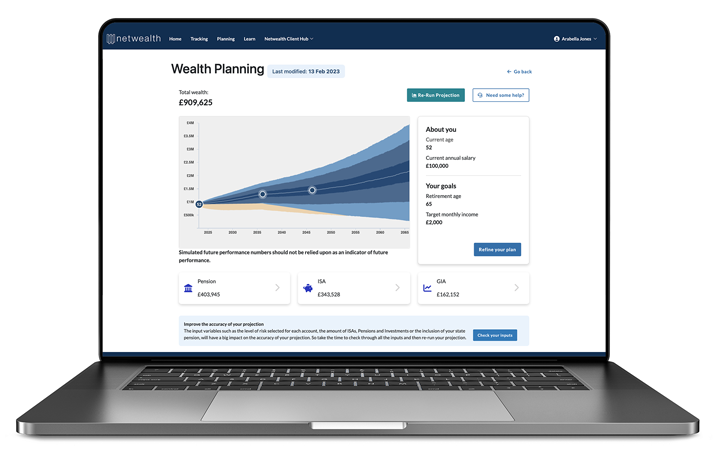

Effortlessly track your pension and ISA assets in one place

It’s not unusual to have different investments and pensions with different providers. Monitoring them all and getting a full picture of your worth at any time can be a challenge. We set up MyNetwealth to help investors easily track their wealth and plan better for their future.

Once you register, this free service helps you make more effective decisions about your wealth. See the daily value of all your investments – from multiple providers – and make detailed projections showing how your funds could grow over time.

These valuable insights help you be more proactive and take more control of your money. They’ll help you assess your circumstances more clearly, highlighting for example, whether you need to put more into your pension or ISA – and what else you could do to achieve your retirement goals.

Please note, the value of your investments can go down as well as up.

Netwealth offers advice restricted to our services and does not provide independent advice across the market. We do not offer advice in relation to tax compliance, personal recommendations with regards to insurance and protection, or advise upon the transfer of defined benefit pensions.