Building for the future? Why property is an increasingly shaky foundation for retirement

Assessing how to fund our retirement should be an ongoing consideration. We could be retired for up to 30 years or more and the regulatory and wider environment require close attention. Property is increasingly difficult to rely on to solely fund retirement, so we need to be able to adapt and consider alternatives to ensure we meet our future goals.

The current environment for property investors

High interest rates have made it a very challenging time for buy-to-let investors who fund buying properties with mortgages. It is so tough for landlords that in April, the estate agent Hamptons said that, of those using £100,000 to put a 25% deposit on a new property to generate an income, most people would lose money. This assessment was when interest rates were a full 1% lower than they are now (at 4.25% vs 5.25%).

The austere narrative has been reflected in press coverage throughout the year. “Rising interest rates are just the latest in a litany of woes that are completely upending the economics of the industry,” reported The Telegraph in July.

In June, This is Money said, “Landlords are warning that their finances are on the brink of crisis” and in November the publication stated that, “The number in mortgage arrears has doubled year-on-year thanks to high rates”. Meanwhile, Investors’ Chronicle also reported in November that “the rental sector has still severely shrunk as interest rate spikes, the slashing of landlord tax relief, and the long-term unaffordability of homes have put off would-be landlords.”

While these headlines and stories may sound grim, the narrative arc is undeniable: buy-to-let properties are becoming very expensive for mortgage holders – and for many the sums just don’t add up.

The accumulation of costs

As well as the widely documented impact of soaring interest rates, there are a myriad of associated costs to consider to effectively manage one or more buy-to-let properties.

To begin, you will often pay an arrangement fee, stamp duty legal fees and other associated expenses with buying the property – these will run into thousands of pounds, as will the initial furniture and fittings of any property. Then there are the not inconsiderable yearly outlays such as property management fees, maintenance bills, insurance and allowing for vacancy periods – these can also set you back thousands a year.

So what you must ask is can you meet all these costs and still manage to make a profit (which is taxed), consistently, year-on-year, and enough to justify the trouble and stress?

No wonder Hamptons estimate that half a million landlords are expected to sell up in the next five years – many because of changes to taxation and regulation and because they don’t want the hassle.

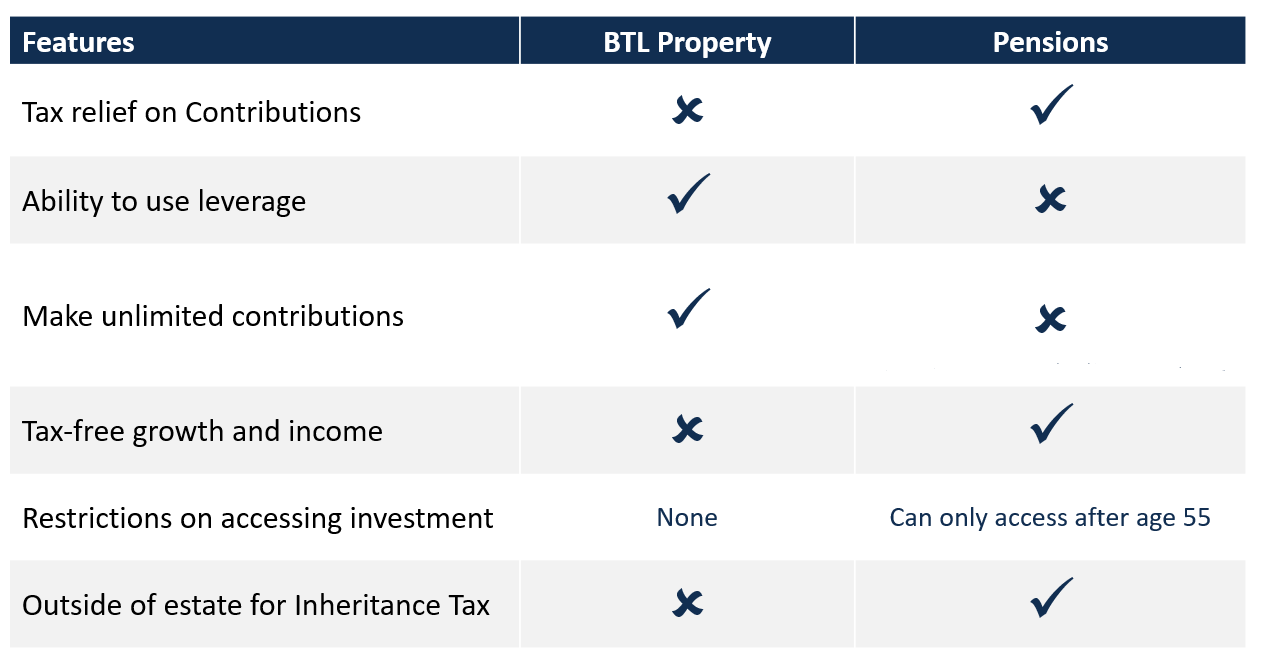

The differences at a glance: property and pensions

The main alternative to funding retirement in the UK is through a pension, with many choosing a mix of both. So it is first worth looking at the differences between the two – and the trade-offs you may have to make to reach your objectives.

Property affords investors a great deal of freedom: you can use leverage, invest as much as you like and access your investment no matter what stage you are at in life.

While you have the freedom to populate your pension with a wide diversity of assets it is the tax advantages of pensions that are most compelling: tax relief when you pay in, tax-free growth and income, and the assets accrued are not subject to inheritance tax.

Yet there are constraints for both assets – you can only contribute up to £60,000 to a pension each year and while you can sell a property whenever you wish, it might be impractical to do so quickly and for the right price.

So to make the most of your retirement fund, understanding the intricacies of each asset and the interplay between them will help you to maximise the opportunities from both.

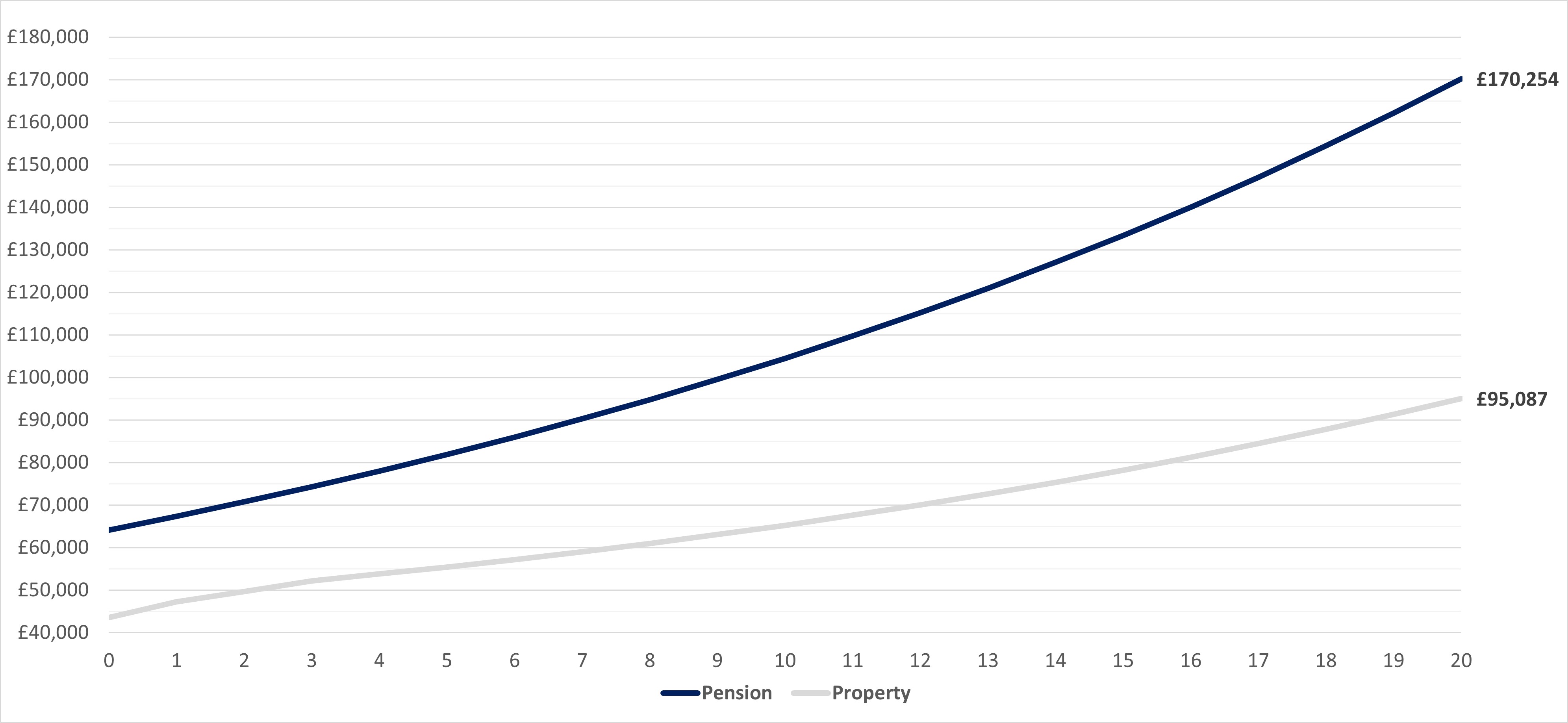

Comparing property vs pensions as retirement options

Unless capital growth on property is high, it is unlikely to do as well as a pension. Of course, the investment environment for both property and pensions is likely to change over time, but the analysis below – and the assumptions – is a reflection of where we are now.

Assumptions:

Pension

- £55,000 net contribution means a gross contribution of £91,667

- Growth in the pension of 5.0% net per annum.

- On the final winding up of pension, 25% is tax-free, and the remaining 75% is taxed at 40%.

Property

- £55,000 is used as follows:

- £46,371 for deposit (25% of property worth £185,485)

- £6,774 for stamp duty

- £1,855 (1%) for purchase fees (solicitors, surveys, furniture)

- Gross rental yield – 5%

- Mortgage interest rate – 5% (current best buy figure)

- Letting costs – 15% of rent (letting agent, maintenance, insurance, void periods etc)

- Capital growth on property – 2%

- Cost of selling property – 1.5% (estate agents and solicitors)

- Income tax rate on rent – 40%

- Capital gains tax rate on sale proceeds – 28%

Source: Netwealth. Values shown assume that relevant taxes are paid to crystallise the investment.

What the numbers above don’t cover are the differences in ongoing administration required for properties and pensions. Properties will normally require more active management even if you have a letting agent in place as you take on new tenants, carry out maintenance and re-mortgage over time.

The implications upon death can also be quite different. For a property investment you will benefit from an uplift to the base cost for the property at death so no CGT will be due.

However, the property will fall within your estate and so potentially be subject to IHT at 40%. The money in a pension would go to the beneficiaries without them having to pay inheritance tax and depending on their age at death, there could be no tax to pay when taking the funds from the pension.

Working out how long your pension could last

How much can I draw from my pension is one of the most common questions we get asked. People generally understand they need to be invested for their future, but it can be difficult to assess how much an investment portfolio will generate. How long will it last? What happens if my circumstances change? Can I see the effects of different permutations and how that might affect my outcome?

Our powerful online tools give investors a clearer view of how their future might unfold. You can make projections based on your target monthly income (eg, £2,000), while also taking into account inflation (eg, 3%) and for how long you may need your money to last (eg, 25 years).

The free tools can help you to model various scenarios to see if your planned contributions could help you to reach your goals. You can change variables such as tax rates, risk level, contributions and withdrawals to help you decide if you need to adjust your plans, or whether your objectives are realistic.

Summary

Choosing property or a pension to fund your retirement is not as straightforward as it may appear. Your individual circumstances and preferences will always have a big part to play in your selection.

Yet the case for property alone to pay for your extra years is looking increasingly shaky. We know that both property and equity investments tend to trend up over time, but at what cost? We often talk about how just a 1% difference in fees when investing can significantly affect your outcome, a fact that is even more relevant now as the higher cost of living persists.

Whatever you choose, the path you take will require some thoughtful analysis and examination of the various permutations – but given enough time, the effort could make a meaningful difference to your future.

Please get in touch with us at any time and let our experts guide you or give you the specific advice you need – with a tailored analysis of your situation – to help you and your family make the most of your retirement.

Netwealth offers advice restricted to our services and does not provide independent advice across the market. We do not offer advice in relation to tax compliance, personal recommendations with regards to insurance and protection, or advise upon the transfer of defined benefit pensions. Please note, the value of your investments can go down as well as up.