How to Prepare for a Longer Life

People are living longer, but can we afford to pay for it?

“Old age is like everything else. To make a success of it, you've got to start young.” This wisdom from former American president Theodore Roosevelt may resonate with more of us as we face retirement – especially as that timeframe is getting longer.

When the first UK state pension was enacted in January 1909, the average life expectancy at birth for a woman was just over 53 (around 50 for a male). Formidable barriers prevented the majority of people from taking advantage of the pension; chiefly, that it was only available to those over 70.

A 30-year-old woman today has a life expectancy of 90 and a 25% chance of reaching 99, according to the Office for National Statistics (ONS). A 30-year-old male has a one-in-four chance of reaching 97. We also increasingly rely on making our way without depending on aid from the state – hence the importance of making sure our own capital and retirement income is resilient.

According to Lynda Gratton and Andrew Scott, authors of The 100-year life, “There is compelling evidence that babies being born today will live considerably more than 100 years.”

So we are living longer, and this trend is expected to continue in future. But many of our financial arrangements are wedded to thinking from the past.

The cost of living continues to rise

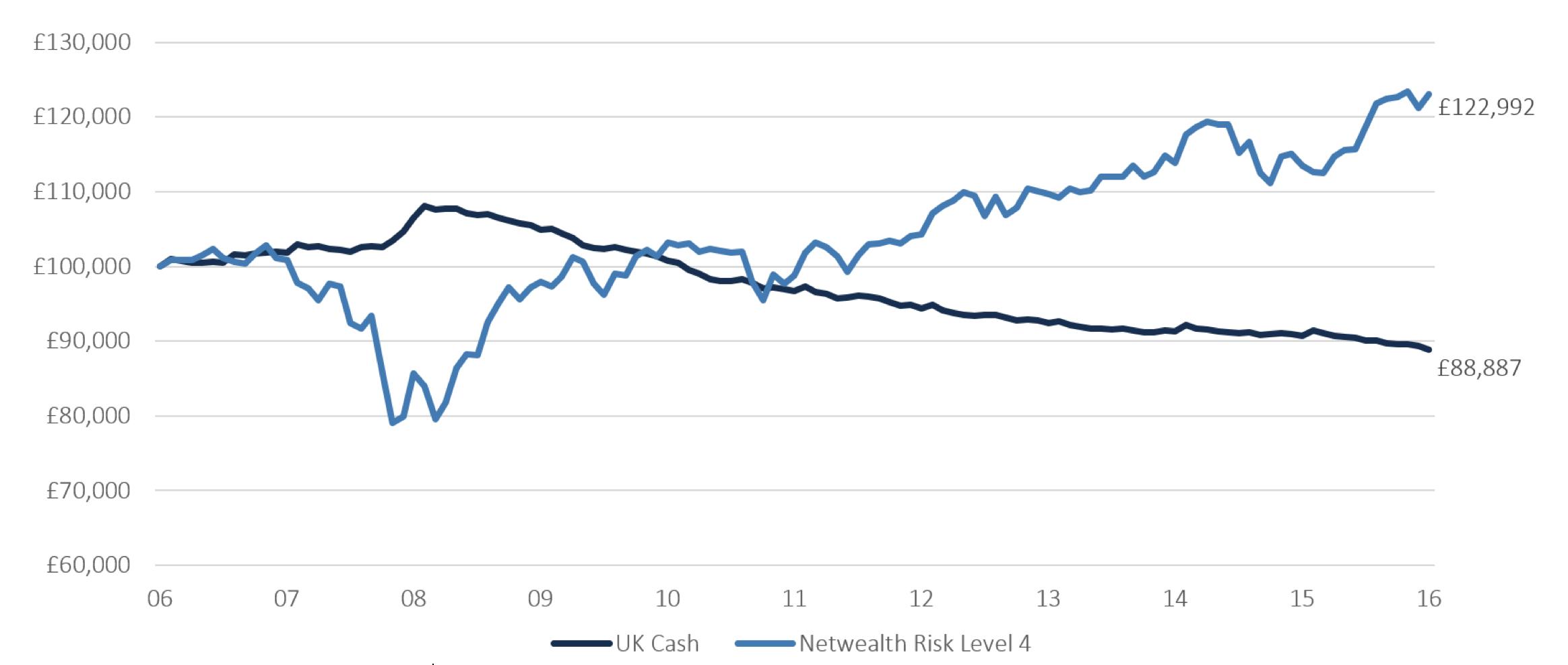

While we can’t predict how much things will cost in future, we can model how inflation depletes a pot of money. For example - as this article illustrates - if you left £100,000 in a bank account in the 10 years to the end of 2016, the effect of retail price inflation means its purchasing power would have fallen to £88,887 after that decade. (The same capital invested in a medium risk portfolio, would have risen to £122,992 after adjusting for inflation.)1

While savings erode over time, a balanced portfolio could be the solution

Source: Bloomberg, Netwealth

Think of the damage that inflation could do to funds which may be needed for longer than you expect.

Regular inflation is one thing, but we should also be mindful of the extra costs that living longer will incur – such as care homes. According to a Telegraph Money report2, and citing analysis by healthcare research specialists LaingBuisson, the average cost of a care home place has almost doubled in two decades, with care fees rising roughly 4.4% a year and in some cases 5.4% a year.

Our own spending (our personal inflation rate) can fluctuate, too, and we need to prepare for the effects of our expenditure rising, then perhaps levelling off or falling, before increasing again. You may find it helpful to factor in potential inflation shocks by modelling for a range of outcomes here.

Steps you can take to make your money last longer

While the cost of living is outside of our influence, and our expenditure could fluctuate, some factors in maximising a retirement pot are easier to control.

Be aware of fees. Paying higher wealth management fees has a surprising but meaningful impact over the long term. See how much more money, and how many more years of a comfortable retirement, you could have just by paying around 1% less in annual fees.

Stay invested. Staying invested over time and not trying to time the market makes a big difference. Research produced by Dalbar Associates - and detailed here - shows that over a 30 year period average US investors “timing the market” would have received annual returns of 3.94% a year. The average annual market return over that timeframe was 10.16%, a tremendous difference if compounded over many years.

Choose ‘suitable’ investments – and risk. Assessing your preferred individual risk tolerance is crucial to achieving your goals. A typical investing maxim recommends that as we get older we should invest in less risky assets. But if you know you may live longer you may be able to afford to take on more risk when you consider your time horizon and personal circumstances.

Consider annuities. Annuities can form an important part of a balanced retirement pot. Even though annuity returns are not what they were, they do offer the security of a guaranteed sum every year, whatever happens to the economy and financial markets.

These are just some of the factors to consider when preparing for a retirement that may last longer than we think. To a great degree, they are aspects of our finances we can influence, and we do well to focus on ‘controlling the controllables’ where possible.

Netwealth’s modelling tools can help you to better understand the impact of living longer and the effects of inflation on your retirement so that you can make better informed decisions about the funds you may need for a longer life.

1 Source: Bloomberg, Netwealth. Return series are calculated as the total return on the UK 1m LIBOR Cash Index, deflated by RPI, for UK Cash. The Netwealth Risk Level 4 return series is the simulated historical performance of the current strategic allocation, net of management fees and underlying fund costs, deflated by RPI. Past performance is no guarantee of future performance.

2 Telegraph Money report ‘Why care costs are spiralling at up to twice inflation’

Please remember that when investing your capital is at risk.