5 ways financial advice can help you avoid costly mistakes

The prospect of soliciting financial advice can seem daunting and many may question whether they need expert advice, or wonder which aspects of advice might benefit them the most. When your circumstances change meaningfully this is often viewed as a catalyst to seek advice, yet certain scenarios can make appropriate help much more pressing.

The value of financial advice

When the economic environment is uncertain you may question paying for a service which might not show immediate returns – but a potentially much better financial outcome could make seeking advice worthwhile.

Analysis by the International Longevity Centre (ILC) shows that those who received professional financial advice over a five-year period received a total boost to their wealth (in pensions and financial assets) of £47,706 after around ten years of working with an adviser. The centre also reported on the non-financial benefits of advice such as better control, and greater peace of mind and security.

One of the ways advice can benefit you is by optimising how you save your surplus income and then how you draw your income, by blending withdrawals from various accounts, all with different tax features.

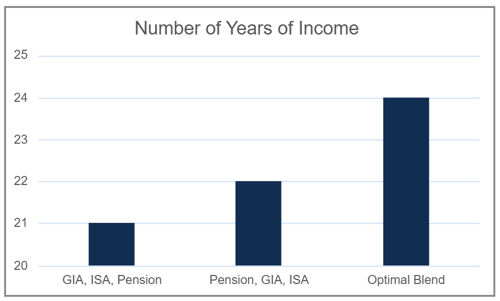

For example, a client with a £1m pension, a £250,000 ISA and £150,000 in a general investment account (GIA) wants to draw £6,000 per month. Using cash flow modelling, we can see that if the sequence of withdrawals was to draw from their GIA and ISA first, and then their pension once those are depleted, their funds would run out in 21 years (at average growth rates of 3.3% after fees and tax). Alternatively, if they took income from their pension first and then the GIA and ISA once the pension was depleted, their funds would run out in 22 years.

However, they would be far better off by implementing a strategy that blends withdrawals in the right proportions from their pension, GIA and ISA at the same time. The optimal blend for this client following our analysis was £60,000 from their pension and the remainder from their GIA first and then their ISA.

This ensured they used up their basic rate tax band, but by taking an additional £10,000 and paying a small amount of higher rate tax initially, it extended the life of the GIA and ISA pots – which delayed the point at which they paid higher rate tax on a greater share of their pension withdrawals.

This strategy depleted their funds over 24 years, giving them two more years of income (equivalent to £144,000 of extra income). By paying some higher rate tax initially rather than only using their basic rate tax band, they extended the life of withdrawals by three more months (equivalent to £18,000 of extra income).

Optimising a withdrawal strategy can give you an income for longer

Source: Netwealth.

While both the financial and less quantifiable impacts can be significant, you should, of course, question whether you need advice at all.

Do you need advice?

A little self-research and expert guidance can help you keep your financial plans on track. For example, we can help you decide whether to invest through an ISA or general investment account, and explore the various levels of risk with you without offering a personal recommendation.

We also think you shouldn’t have to pay to do the simple things – such as making new ISA subscriptions each year. This is advice you probably don’t need, especially when your plans or the composition of your investments haven’t changed. We can automatically transfer funds from your taxable investment to an ISA every year so you remain highly tax efficient.

Our powerful online tools (which you can try for free here without any commitment) also help you plan ahead effectively. You can make various assumptions – changing the figures as you please – based on the amount you invest, your timeframe, inflation level and how much risk you want to take. The projections can give you an extraordinarily clear view of how your potential financial outcome could take shape.

However, there are certain scenarios where financial advice can make a big difference – helping you avoid some of the hassles from managing money effectively, and giving you a meaningful amount more to spend in the years to come.

If you inherit money

An inheritance may come as a surprise and you might not be sure how best to manage the extra money, or how best to put it to work – whether you already have considerable assets or not.

Holding too much cash for whatever reason is never a great idea, as we explain here, and cash savings are generally a poor substitute for investing your money. If you do come into an inheritance you may therefore want specific advice on how to put your funds to use more efficiently.

If you are approaching retirement (or if you have already retired)

If your life is hectic you may not have had the chance to maximise your retirement funds, or to assess whether you could boost your income by paying much less in fees (see the potential tangible impacts here).

How you plan to and can afford to live in retirement depends on your individual circumstances, which often requires a personalised approach to ensure you can still retire comfortably. Retirement planning can be highly complex, and you may need tailored advice to maximise opportunities and avoid the mistakes that retirees often regret. Speaking to that, we conducted a survey that explored what retirees wished they had known before retiring – and you can read their (often surprising) lessons here.

If you are going through a divorce

A divorce can cause considerable emotional and financial disruption – and it may be reassuring to better understand the implications and strategies you can consider, as we explain here. While lawyers are naturally involved during a marriage breakdown you shouldn’t overlook how financial advice could help you emerge on a sounder financial footing.

Expert advisers can help you navigate such aspects of a settlement as pension assets (often neglected) and give you confidence as you construct a financial plan of your own. This video could give you some useful pointers and help you build towards a future with you in control.

If you are leaving money for the next generation

Many of you will be familiar with the concept of the Great Wealth Transfer, where trillions of pounds will be transferred from baby boomers to younger generations over the next three decades. Effectively leaving money for the next generation usually requires considerable forethought: you will need to evaluate when to gift money, and assess how to do so tax efficiently while keeping the best interests of your family in mind.

This free webinar on intergenerational wealth outlines how to make your plans more effective and to maximise their impact, but again, it’s quite complicated, so you may need advice tailored to your situation.

If you have dependant family members

Nobody can anticipate the unexpected but you can prepare appropriately. It’s worth finding out about, for example, how a lasting power of attorney can protect your financial wishes or those of your partner.

Similarly, if the worst happens to you or your spouse, an adviser with knowledge of your affairs can help to smooth any transition, and give you vital consolation if you are feeling overwhelmed.

What to do now

You should think carefully about whether you need financial advice. Chances are, if your needs are reasonably complex, you will likely benefit: from the reassurance of an expert and impartial financial appraisal and the potential boost to your investments.

You may need one-off advice for a specific event, or you may prefer ongoing advice to ensure you optimise your investments and retirement plan. We provide a free no-obligation consultation to help you decide what’s right for you – so please get in touch.

Please note, the value of your investments can go down as well as up.

Our advisers offer restricted advice that relates to Netwealth’s products and services and does not consider the whole market. Netwealth does not provide tax or legal advice and does not advise on transfers of pensions with safeguarded benefits.