Preparing for the challenges

In September last year we wrote about the benefits and potential challenges associated with the new Consumer Duty, which is being introduced by our regulator the Financial Conduct Authority (FCA) from 31 July this year – in respect of currently available products and services.

Many firms have been considering vulnerable customers and revaluating their approach, given the high standards that the FCA is now setting. After all, the term ‘vulnerable’ appears over 100 times in the Consumer Duty guidance.

For several years the FCA has defined a vulnerable customer as "Someone who, due to their personal circumstances, is especially susceptible to harm, particularly when a firm is not acting with appropriate levels of care.” This definition has been adopted to a greater or lesser extent across the industry.

The new Consumer Duty goes further, identifying four key drivers of vulnerability that regulated firms will be expected to address:

- Health – physical or mental difficulties that may impair a person’s ability to interact

- Life events – such as bereavement, loss of employment or sudden caring responsibilities

- Resilience – matters effecting a person’s ability to cope with unexpected financial or particularly emotional situations

- Capability – limited understanding and/or confidence when making financial decisions

We applaud the FCA’s determination to ensure that vulnerable customers benefit from an improved standard of service, and that inclusivity becomes a key driver for positive change. Financial institutions will need to focus on how best to identify people who may be vulnerable and adapt how they interact and provide support. In many cases a tailored approach will be required that is based on the specific circumstances of the individual.

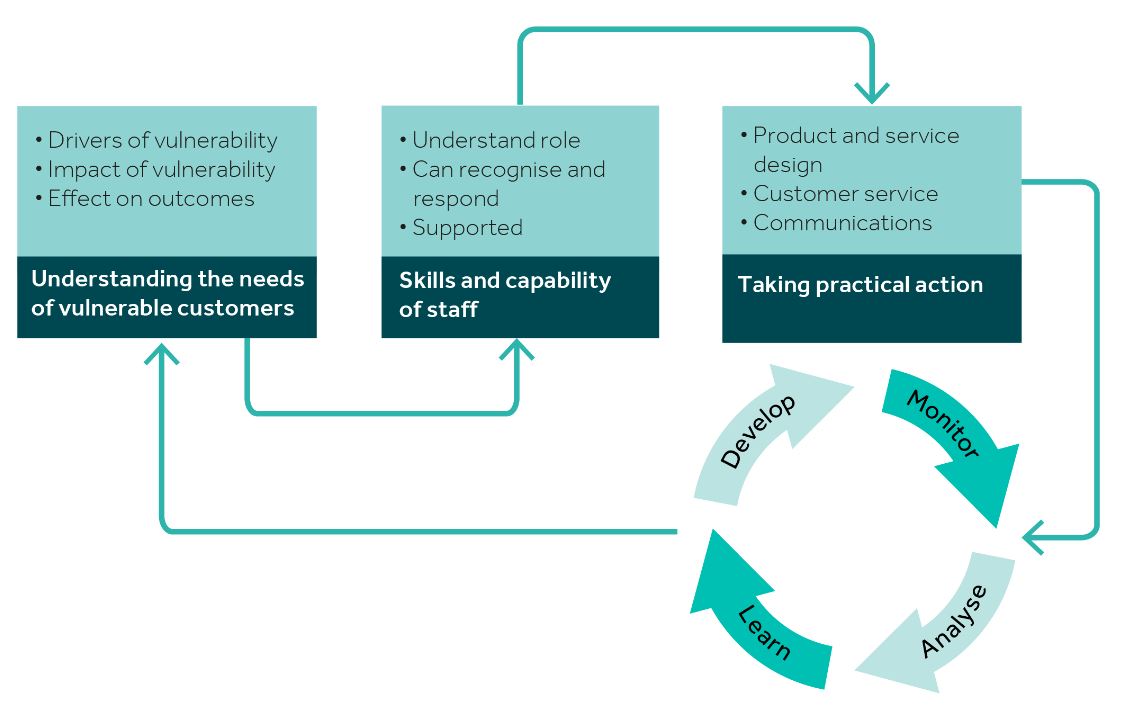

Achieving good outcomes for vulnerable customers

Source: Financial Conduct Authority

One key factor is that vulnerability should not necessarily be viewed as a permanent state. It can often be transient and in in many cases situational, affecting different people at different times in different ways. Our view is that it is our responsibility to be sensitive to the changing needs of our clients and all who interact with our services.

A robust approach

While the Consumer Duty of course prompted a review of our approach to key focus areas, such as communications and client service, we were delighted to find that our existing policies and procedures were in the main sufficiently robust to comply with the expected standards.

Netwealth staff are acutely aware of the need to support vulnerable people, across all relevant business areas. From client-facing staff within our client service and advisory teams, to our portfolio management, marketing, design and product teams, everyone receives thought-provoking training in how they can work to ensure our technology and services deliver the best experience to as many people as possible.

Enabling better decisions

As an example of how we can help with capability as a vulnerability driver in particular, we have recently launched MyNetwealth. This is a free service that allows any investor, regardless of their level of experience or understanding, to view and track all their wealth – from multiple providers – in one place.

Our easy-to-use planning tools can then help you to create a financial plan, taking into account future expenditure and your intended retirement date. You can clearly visualise whether your wealth is on track to achieve your goals or whether you may need to make changes to your plan.

MyNetwealth also gives you access to numerous articles, webinars and guides to help raise your confidence in making the key financial decisions we all have to make. For extra support, you can talk directly to a member of the Netwealth advisory team online or by video call.

We believe that insights and tools like these are crucial to improving consumer understanding of their wealth. Valuable sources of information help you form a stronger connection with your money, to better cope with anxiety and to demystify wealth management. If you’d like to find out more about the Consumer Duty and its approach to vulnerable customers, you can find the finalised FCA guidance here.

Please note, the value of your investments can go down as well as up.