Close to your limit? How the lifetime allowance has changed over time

The lifetime allowance was first introduced in 2006 at £1.5m, after which it increased each year before being reduced between 2012 and 2016. Various levels of Fixed Protection have been available to investors over these years, protecting the level of the LTA in return for certain restrictions such as no further pension contributions.

Since 2016 the LTA has increased each year by inflation, taking it to the current level of £1,073,100. In the March 2021 Budget however, the Chancellor confirmed it would stay at this level until the end of this parliament in 2026.

Changes in the LTA over time

Source: HMRC

If you haven't added to your pension savings since 5 April 2016 you may still be able to apply for Fixed Protection 2016, which will give you a personal lifetime allowance figure of £1,250,000.

You can check your existing protection using your Government Gateway user ID. If you don't have a user ID, you can create one when you check.

Understanding the impact when benefits are taken from your pension

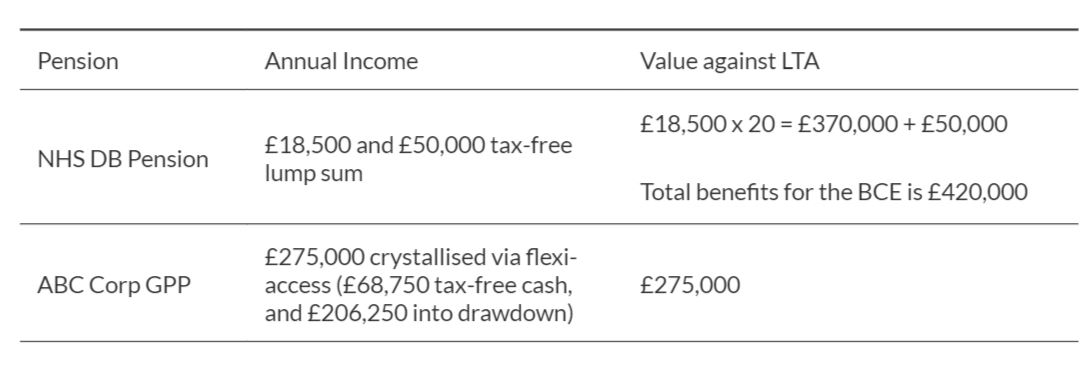

Whenever benefits are taken from a pension, a benefit crystallisation event (BCE) occurs. The value ascribed to a BCE is normally the value of any lump sum paid out plus the value of a pension moved into drawdown to provide future retirement income.

When a defined benefit pension commences there is also a BCE, with the value ascribed calculated as 20 times the initial income plus any pension commencement lump sum (PCLS). Whenever a BCE occurs the value of your pension will be measured against your LTA.

In all, there are thirteen potential circumstances in which a BCE could occur, but the four most commonly incurred BCEs are:

- Payment of a lump sum prior to the age of 75, such as a PCLS or a UFPLS (uncrystallised funds pension lump sum)

- Entering drawdown

- Taking a scheme pension (DB income)

- Reaching the age of 75 with funds that are either in drawdown or uncrystallised.

Example: Calculating the value of your BCEs against the LTA

To help you work out your potential lifetime allowance tax charge, you can register here to use our LTA calculator.

Understanding the LTA tax charge – with examples to help you prepare

The LTA tax charge applies when a BCE occurs and the value ascribed to that BCE exceeds your remaining lifetime allowance.

If you have taken pension benefits in the past and therefore experienced a BCE, then you will have used some of your LTA. This is calculated as the percentage of the LTA, at that time, that was utilised.

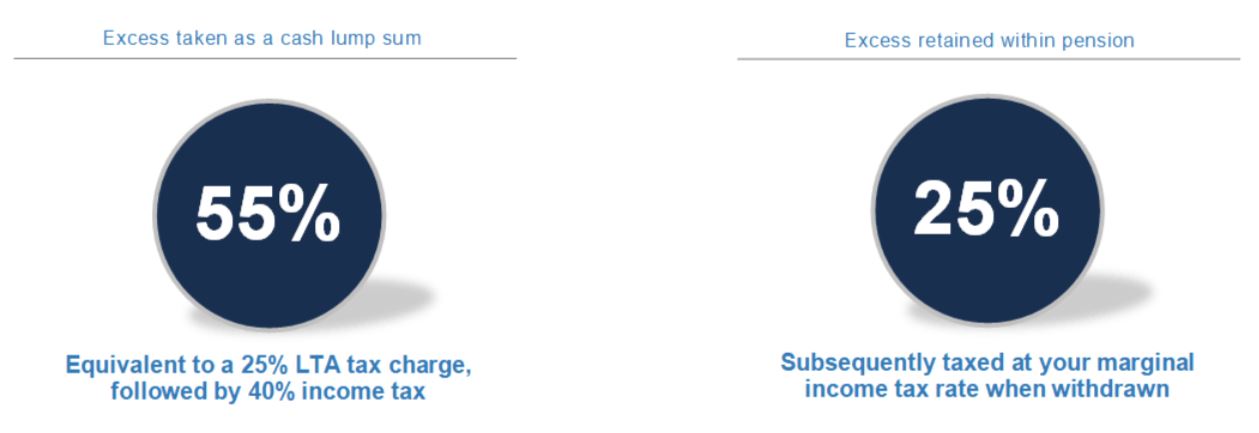

With a defined contribution, also known as a ‘Money Purchase’ pension, it is the sum that exceeds the LTA that is taxed and the level of this tax depends on whether the excess is paid out to you as cash or retained within the pension wrapper.

If you have a defined benefit, also known as a ‘Final Salary’ pension, then the lifetime allowance tax charge is calculated in a similar way to the above. However, how it affects the pension you end up receiving will also depend on your specific pension scheme. If your defined benefit entitlement exceeds the LTA, some schemes give you the option of either taking the excess as a lump sum, subject to the 55% tax charge, or taking a reduced annual pension. However, only one of these two options may be available.

If the defined benefit pension scheme does allow you to take a reduced annual pension, then the amount your pension reduces by also depends on the scheme’s specific rules. This is because although the tax charge is the same in each case at 25% of the excess, different schemes use different commutation factors to work out how much effect this tax charge has on the annual pension you receive.

Example of tax paid

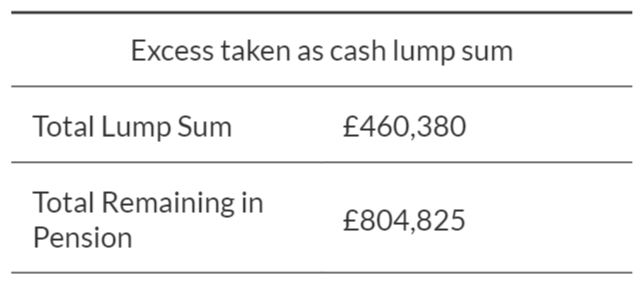

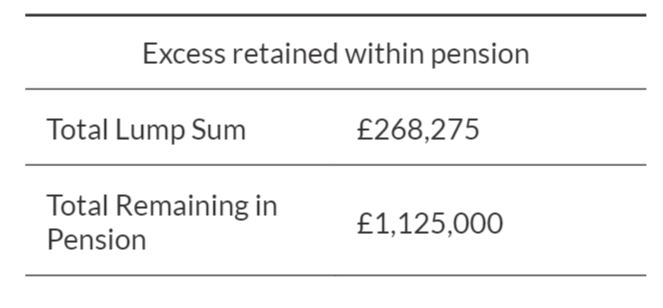

If in the 2022/2023 tax year someone aged 65 crystallised a defined contribution pension worth £1,500,000, they would have exceeded the lifetime allowance by £426,900 (£1,500,000 minus the current LTA of £1,073,100).

Of the £1,073,100 within the LTA, 25% (£268,275) may be taken as a tax-free lump sum. The remaining 75% (£804,825) can stay in the pension for withdrawal at a later date, subject to income tax.

Of the £426,900 that exceeds the LTA, the investor may choose to either receive an additional cash lump sum of £192,105 (£426,900 minus a 55% tax charge), or an additional £320,175 that remains in the pension (£426,900 minus a 25% tax charge) and will be subject to income tax when withdrawn.

We can see the outcome when the excess is taken as a cash lump sum:

Compared to the excess retained within a pension:

Taking this example further we can consider what would happen when the person reaches age 75. At age 75, the funds remaining in the pension are compared to the value in the pension after it was crystallised. If the excess was taken as a cash lump sum then £804,825 would have remained in the pension. If the pension is worth any more than this figure at age 75 then a 25% tax charge applies to the excess.

Between first crystallising the pension and reaching age 75 the investor can withdraw any growth from the pension to ensure they don’t exceed the threshold and become liable to a further LTA tax charge. Whether this is worth doing or not depends on various factors, as we shall look at in more detail below.

How to pick the most appropriate strategy for you

Reducing the value of any LTA tax charge paid is often desired by clients but whether this is the most appropriate strategy depends on your circumstances and objectives.

Pensions are usually outside of an estate for the purposes of inheritance tax, which means that for clients with an estate that already exceeds the inheritance tax nil-rate band (the amount that can be passed on without paying tax), any assets that are moved from a pension environment to a non-pension environment, and then passed on, will have a 40% inheritance tax charge applied to them.

As we looked at above, the LTA tax charge may be as little as 25%, and in some cases therefore, it is worth considering leaving the assets within the pension, knowing that a 25% LTA tax charge will be due – but this is lower than a 40% inheritance tax charge that would otherwise be paid if the funds were taken out of the pension.

Potential strategies to consider when approaching the LTA

You have three main strategies to consider when approaching the LTA.

- Crystallise the entire pension

- Partially crystallise

- Leave the pension untouched

1. Crystallise the entire pension

When might it be appropriate?

- A lump sum or income is required now

- The pension makes up the majority of your overall assets

- Estate planning is not a concern

When you approach or hit the LTA, crystallising 100% of the pension can help reduce the overall tax burden, and it allows you to receive the maximum possible tax-free lump sum.

Between the initial crystallisation and age 75, growth in the crystallised fund can also be withdrawn which can alleviate the need to pay any LTA tax charge.

That said, this strategy could mean bringing lots of capital into your estate so it may not be wise to do so if the capital is not required.

2. Partially crystallise

When might it be appropriate?

- Some lump sum cash is required now

- Estate planning is also important to you

- You wish to continue to grow the pension

If your pension is below the LTA, partial crystallisations can result in a better overall outcome.

After each crystallisation, the funds that remain uncrystallised can continue to grow, which increases the value of the sum that can be taken tax-free at a later date. It also delays bringing funds into your estate for the purposes of inheritance tax.

Lastly, if more funds are taken from the pension in the form of tax-free cash than is actually needed, you may decide to reinvest some of the proceeds in a General Investment Account, which is taxable, and will result in worse net returns compared to remaining invested in the pension.

3. Leave the pension

When might it be appropriate?

- You do not require a lump sum or income from the pension

- You are using the pension for estate planning

- You have sizeable taxable assets to live on

If you wish to use your pension assets to pass on to your beneficiaries, then keeping funds in the pension may offer the best outcome.

Funds that remain invested within the pension continue to grow free of income and capital gains tax and the pension stays outside of your estate for inheritance tax purposes.

This means that the eventual LTA tax charge grows but this LTA tax charge will be 25% – this may therefore be preferable than your beneficiaries paying 40% inheritance tax.

Need some help?

Whatever your circumstances, like many aspects of retirement planning, the lifetime allowance can be complex – and frequently misunderstood – but you do have choices and you can make the most of the opportunities that arise.

If you would like to explore how to maximise your financial potential, our team of expert advisers can assess your circumstances and help to put your mind at rest. Please get in touch.

Please note, the value of your investments can go down as well as up.

Our advisers offer restricted advice that relates to Netwealth’s products and services and does not consider the whole market. Netwealth does not provide tax or legal advice and does not advise on transfers of pensions with safeguarded benefits.