- Our annual strategic review for the bedrock of portfolios has focused more exposure to government bonds, reducing corporates

- In equities, our process to deliver diversified exposure has increased allocations in UK smaller companies, but reduced the UK as a whole. Japan has been increased and emerging markets reduced

- We are introducing new trend-following funds to our alternative allocations, alongside gold and commodities

- The long-term outlook for diversified multi-asset portfolios is strong thanks to the repricing of interest rates above inflation expectations.

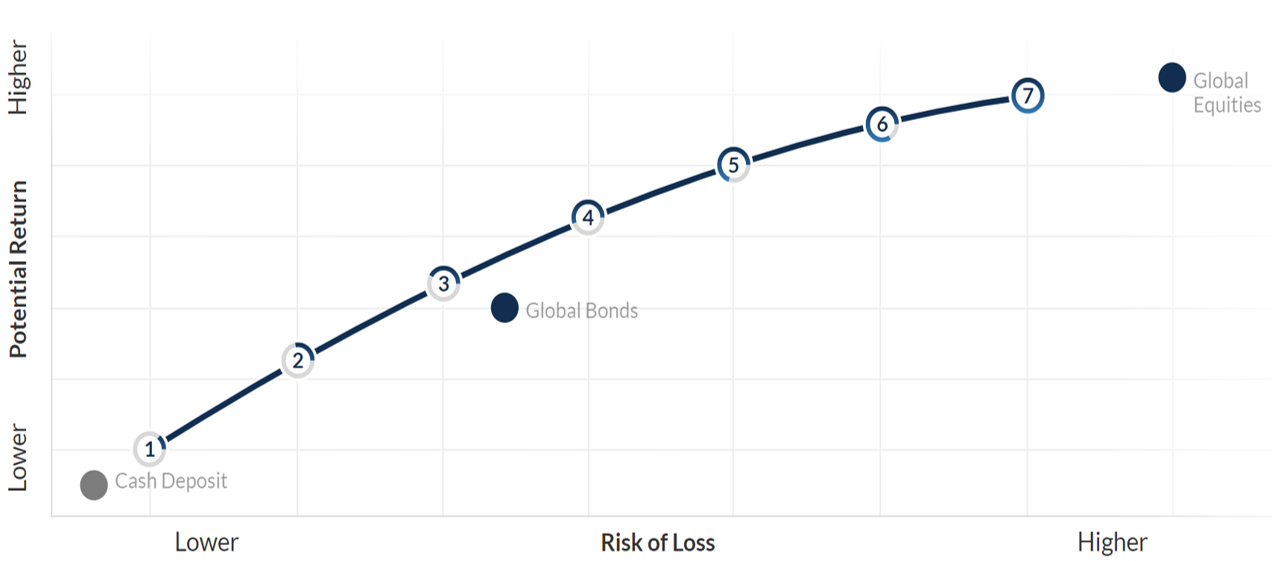

As always, our goal in this exercise is to determine the best mix of assets for each risk level to meet our investment objectives. We focus on future returns and the resilience of portfolios, with a keen eye on efficient implementation.

Source: Netwealth, for illustrative purposes only.

Bonds are back

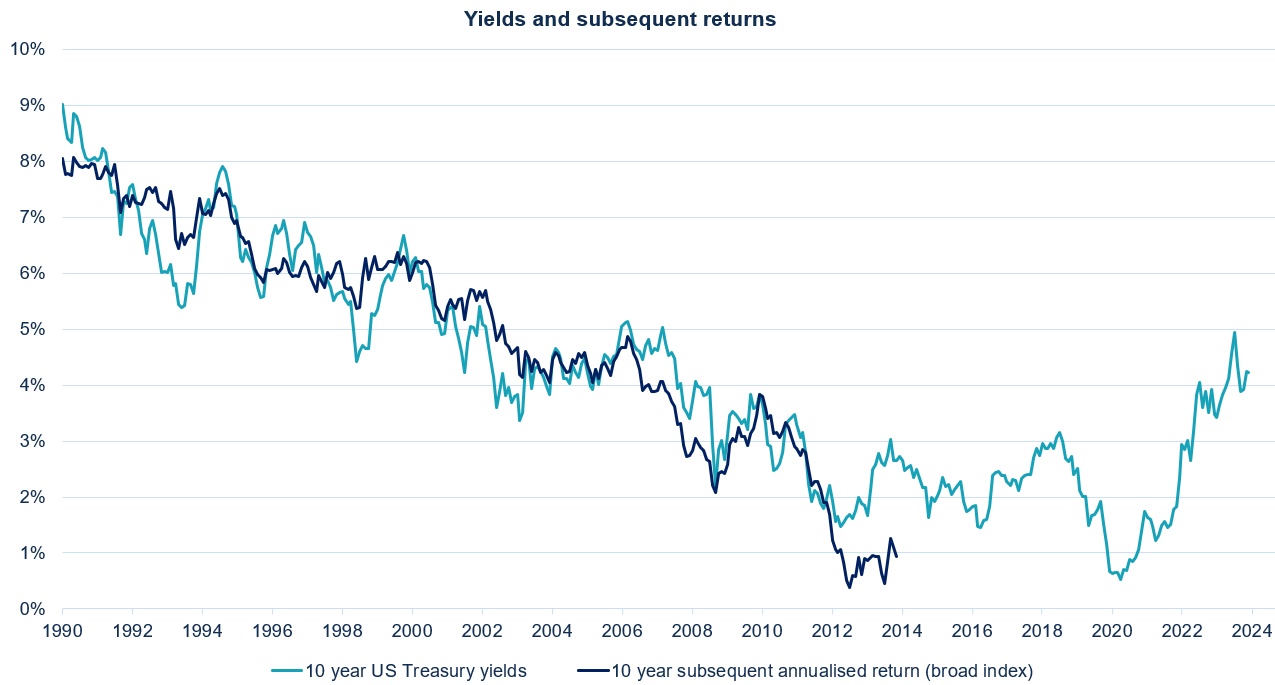

In our view, the outlook for government bonds is much better than in recent years, thanks to improved yields above expected levels of inflation and a view that interest rates will settle at a higher level in the next 10 years than savers have been used to in the past 15, as Gerard Lyons mentions here. We expect fewer surprises from inflation figures over the medium term, so predictable cashflows based on attractive cash rates will be valued by investors, creating a ceiling for bond yields (and a corresponding floor for returns).

While the yields available in corporate bonds have also risen, this has been driven by the underlying interest rate outlook, rather than any increase in the additional yield above gilts and US Treasuries to compensate for default risk. This means that we think they will be less useful from a multi-asset perspective and so we will use this allocation to fund new investments as discussed below.

Source: Bloomberg, with Netwealth calculations.

Equity allocations: explaining the process

In equities, our long-term view for returns is still broadly positive, and similar to last year. Our relative preferences between major equity markets are shaped by contrasting pictures of prospective earnings growth and markedly different valuation levels.

Our starting point for defining our strategic equity market portfolio construction is to divide our allocation into three parts to get a balanced portfolio. First, we set aside 25% of our equity bucket for the UK market, given its relevance to the UK investor base. Excessive macro-economic pessimism here has led to attractive valuations and the market’s defensive characteristics complement other assets nicely. This was so rewarding in the negative global environment of 2022 but a notable drag on returns in the period since.

The remaining 75% weight is initially allocated to international stocks, and split between a naïve market capitalisation-weighted exposure (i.e. allocation to a region simply based on market size) to the major markets (50% of the total), and another allocation to those same markets, but weighted such that each one contributes equally to overall risk (making up the final 25% of equities). The rationale for this approach is to attempt to provide broad exposure to global markets, without being overly dependent on one market “factor” of risk as might be the case for a simpler approach based solely on company or market size.

From this starting point, we further adjust our allocations each year to favour the markets which we feel are most compelling from a long term, forward-looking point of view.

We believe this process has the advantage of being relevant, reliable and repeatable. Importantly, it produces starting strategic equity allocations against which we can manage relative preferences on a more cyclical, shorter-term basis.

We need to talk about US

Like many investors, the US stock market presents us with a real challenge now. The market has been dominated by an increasingly narrow set of very successful companies over the past two years – whose combination of extreme profit growth, increasing size and market focus has overwhelmed the contributions from all other companies.

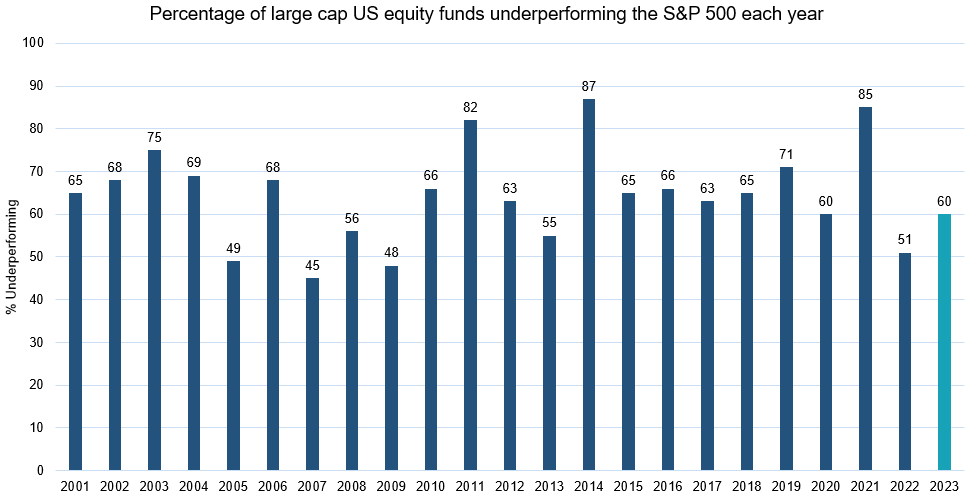

As active asset allocators using primarily passive implementation (by investing in ETFs and other passive funds), our portfolios have been beneficiaries of this move, as once again the universe of active managers has found the index very difficult to beat. This is shown most clearly in the recent S&P SPIVA report, which noted that another difficult year in 2023 means that 4 in 5 active US funds have underperformed the S&P 500 Index over the last three years.¹

Source: S&P Dow Jones Indices LLC, CRSP. Data as of December 2023.

However, as custodians of client capital we are also very conscious of two key risks: first, even though the US market is the biggest, most liquid and investor-centric in the world, it continues to be driven by this one characteristic of fast-growing technology-oriented “mega-cap” companies – we believe strongly that a pure indexing approach would result in too much reliance on these stocks continuing to deliver.

Second, from a strategic point of view we know that valuations have historically been the most important driver of long-term returns, especially when valuation metrics are at extreme levels. In the past decade, marked outperformance has been delivered by a combination of sustained, above-normal profit growth and a willingness to extrapolate this corporate performance too far into the future via higher ratings of each dollar earned. We don’t think talk of bubbles is appropriate (hence the still substantial allocation to the US), but we do think there are some signs of layered optimism that the current environment will need to overcome.

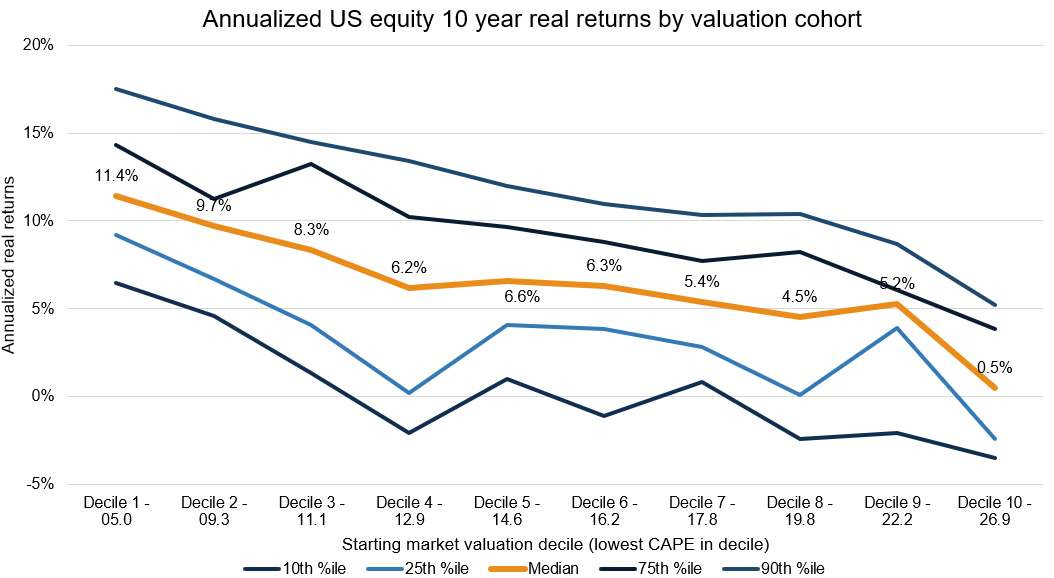

It is always best practise to look at a range of valuation metrics, but let’s take one example of the current environment. According to historic analysis, when valuations are at their most expensive (as they are now), based on Cyclically-Adjusted Price Earnings ratios ( or ‘CAPE’, which looks at long term average profitability to smoothe out the impact of where we might be in the cycle), the outlook is for very muted returns above inflation over ten years.

The current market CAPE of 30.5x is well within that most expensive cohort thanks in part to strong earnings growth over the past ten years. With history as a guide on this metric, a return more than 5% above inflation would be a positive outlier, whereas a return closer to inflation (ie, 0% for the group on the right of the below chart) would be a more normal outcome.

Source: Professor R Shiller (Yale University), Bloomberg with Netwealth calculations.

So for forward looking returns, any failure of companies to deliver anticipated future earnings or a negative change in market mood will dent the outcome for investors buying at these levels. We do not see any immediate signs for eroding investor confidence, but we do think a conservative view will likely be rewarded over time. In contrast, markets outside of the US are broadly expected to deliver less profit growth – with positive surprises creating opportunities for investors willing to adopt a diversified approach.

Over the past year, our conviction in Japanese equities (where we have already had a strong overweight compared to a global index) has grown. This is due to greater recognition of the need for corporate governance reform and attractive stock market and currency valuations. Some of the longer-term challenges facing key emerging markets such as China have resulted in slightly lower allocations.

We still think UK equities offer good opportunities. However, we are changing the mix to focus more exposure on the smaller and medium-sized companies where we see the biggest mis-valuation and therefore the biggest potential gains if some of the pessimism in the UK market passes.

The UK market has undoubtedly been an underperformer in recent years and identifying what could change perception around different markets is always difficult. Yet sympathetic regulatory reform, alongside greater political stability and a predictable inflation backdrop could unlock the latent value. As a result, our allocation to larger FTSE 100 companies is reduced, but our preferred smaller companies ETF allocation is increased.

Upgrading our diversifying assets

We are also investing in a new type of alternative strategy for our portfolios. This sits alongside our existing allocations to gold and broader commodities with a view to improving portfolio diversification across the risk spectrum. As the name suggests, trend following strategies are designed to identify and participate in different financial market trends, and importantly are indifferent to market direction. In this way, we expect them to complement our core exposure to the leading asset classes of equities, bonds and commodities.

Trend-following strategies are particularly effective during periods of strong momentum in markets. They do less well when markets are facing sharp changes in direction or sentiment, either at the top asset allocation level, or in terms of regional and sector preferences.

We are funding this new allocation from our current positions in lower grade bonds such as high yield corporates and emerging market bonds – assets where we see less potential in improving our overall portfolio characteristics.

Please note, the value of your investments can go down as well as up.