Moving from self-employment to retirement can be a big step – leaving a partnership upon retirement can present specific financial challenges and opportunities. For example, you should receive your capital and undistributed profit share back and this can either come as a lump sum or sometimes be paid back as an annuity over a number of years. So how do you make the most of either outcome?

It is also possible you will benefit from overlap relief. This could compensate you when you leave a partnership for any double taxation you may have been subject to upon joining the partnership due to a mismatch in the partnership’s accounting period and the tax year end.

Like many intricacies of the taxation system, this is a complex area and the outcome will be different for each person. It could result in you having a sizable tax rebate.

Many of you may also be in the habit of allocating cash for the next year’s payments on account. As you will likely have less income in future, this will result in net savings that can be used towards your retirement income needs. Therefore, structuring this income efficiently is crucial to ensure you make the most of your changing circumstances.

Changes present challenges – and opportunities

Retirement is about more than just a change in your financial position – the transition from an intense job within law to a slower pace of life in retirement can be challenging. Many lawyers choose to transition to full retirement over a number of years, carrying out part time work or consulting for long-term clients. This can be a great way to get used to your new lifestyle.

While your career may have been all-consuming for many years it’s important to think about what you will do with your time in retirement. Travelling more, a new hobby, a master’s degree or a combination of all of these may be the right option for you. It is also crucial to think about how to most effectively fund your new lifestyle.

Factors you can control make a big difference

Make your retirement savings work for you and ensure you have the flexibility to deal with the transition into retirement. Perhaps you want more income before the state pension starts. Maybe you need a lump sum to pay down your mortgage. You want the freedom to keep your options open, and the assurance that you can resiliently adapt to whatever circumstances you face.

Cashflow modelling can help you to see what is possible and sustainable – such as, how do you maintain the right mix of liquid and longer-term investments as well as a safety fund? You may also find it helpful to think about the factors in life you can control, and those which are outside of your influence.

For example, you can’t control how long you live, how markets perform or the rate of inflation. But you do have a say over how much you pay in investment fees, whether to use tax wrappers and how diversified you are when investing – factors we explore in detail here. Controlling these ‘controllables’ can make a big difference to your financial outcome, so it is worth paying attention to these factors and make sure you maximise the potential benefits.

Being efficient requires careful consideration

How you draw down from assets can have a big impact on your tax efficiency. While you will likely be paying a lot less tax in retirement than you were when you were working, lowering your average rate of tax can significantly improve your retirement outcomes. This is where the judicious use of tax wrappers comes into play.

For example, you may have potential sources of income from a pension, an ISA and from general investments. Getting the balance right is key, especially as you may live longer than you expect.

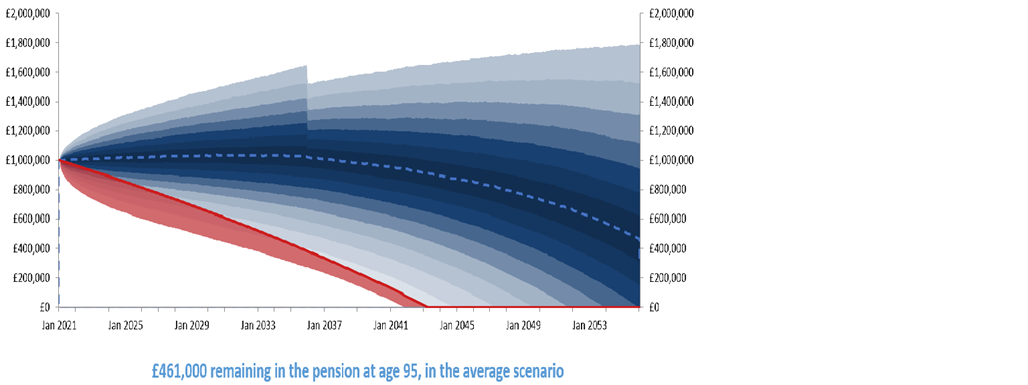

The chart below, for instance, shows the outcome from an individual’s £1m pension fund targeting a net income of £2,750 a month. By drawing from a combination of pension, general investments and then an ISA – and by using all available allowances – the fund meets their income requirements for 35 years. Importantly, in this average growth scenario, £461,000 remains in their pension (and therefore outside of their estate for IHT purposes) to pass on to their family.

Drawing from a combination of pension, general investments and ISA

Source: Netwealth. Assumes a pension pot of £1m at age 60, in a globally diversified portfolio (60% equities, 40% bonds and cash) and making full use of all tax-free allowances.

Simulated future performance numbers should not be relied upon as an indicator of future performance.

By assessing the permutations you can make sure you have enough to live comfortably now, taking inflation into account, while also ensuring your assets are structured efficiently for the next generation.

Gain a clearer picture of your future

We have helped many lawyers to find a retirement approach that is appropriate for their particular needs. In the first instance, you can generate a chart similar to the one above, but personalised to your own specific circumstances, by using our modern planning tools. See if you are on track to meet your goals by changing such variables as your risk level, tax rates, contributions and withdrawals.

Of course, you may need some tailored advice at some stage to help you make the most of tax wrappers, interpret complicated pension rules or to efficiently pass on your wealth. Our professional team is on hand to help you make the most of your money now – and in future.

Please note, the value of your investments can go down as well as up.

Netwealth offers advice restricted to the services provided, and does not provide independent advice across the market. Netwealth does not provide advice in relation to tax, insurance or estate planning.