Advances in tech capabilities have fuelled many modern conversations, from Nick Bostrom’s pioneering exploration of artificial intelligence (AI) potential in Superintelligence, to the musings of philosopher David Chalmers who posits that virtual reality is “genuine reality”, every bit as real as life in the real world.

There is regularly a disconnect between the reality and what some claim tech can do. In the financial domain, for example, especially Fintech, the term AI is often liberally applied. But under the hood we may typically find advances in machine learning and swifter processing power, rather than a progression that deserves the full AI tag – so we should be careful in asserting that technology alone is enough to bring about the meaningful change that investors often need.

Squaring technology with investor benefits

There have been many technological developments in the financial world already – from high frequency trading to the blockchain. And because there are so many different ways now to access investment markets, such as trading apps like Robinhood, it can be a challenge to think about how the market behaves relative to underlying economics.

Regulators are also in a tricky spot. Not all of the developments have been beneficial for investors, so it is important to be on top of the latest trends and to be aware of the broader pitfalls in the wider environment.

For us, technology has an impact on all three components of what we think are important for private investor returns.

- Understanding what broader technology means for market performance – how can your investment engine perform and adapt.

- What it means for overall costs – we spend a lot of time making sure we invest as efficiently as possible and technology has greatly helped us to make quicker and better informed decisions.

- Improving transparency – helping individuals understand the different options available to them, whether through a trading platform or in terms of your personal finances and trying to navigate the best way to make your investments more tax efficient.

How much do we trust tech alone?

We can devise an interesting parallel between managing people’s wealth using AI and autonomous driving in vehicles. We can obviously see huge potential: there is great scope for using AI when driving, for example, especially for safety reasons. However, some research indicates that when people are asked about how they feel when in a car that drives itself, they are very wary.

Essentially that is how people feel about their wealth, too – they are not very comfortable now with their wealth being managed by computer algorithm, they want to know there is a team of people making the important decisions. Potentially that team is being helped by technology, but they feel reassured when a human is at the wheel.

This is why we don’t relate to the term ‘robo’ adviser, a popular expression a few years ago when a clutch of new providers – many tech enabled – came to the market. In many instances robos were trying to solve the advice shortfall, because the cost of providing advice is high, and they tried to reduce those costs using technology.

To date the successes have been limited, and the results have been quite simple, chiefly helping people who have non-complex needs. Robos have also come and gone that have tried to benefit people when investing, again with varied success, but we prefer to think of tech as an additional tool rather than the main anchor to help people achieve their individual – often highly complicated – goals.

How we use tech to streamline the wealth management process

It’s important to reiterate, that just like the investment side of the business, it is the combination of the judicious use of tech alongside deeply experienced human advisers that brings the best outcomes for clients.

We therefore see tech as an enabler – to bring about efficiencies in portfolio management and data management, and this is then coupled with human oversight and decision making. From a planning perspective tech enhances the work we do in several ways.

Technology allows us to model for the factors we can’t control, such as inflation, market returns and longevity, and better understand their impacts using various ‘what if’ scenarios. Tech also helps us to get the maximum benefit from the factors we can control – and therefore should be optimising for – such as time in the market, being properly diversified and ensure we are as efficient as possible from a tax and costs perspective.

Overall, then, technology affords us greater ability to control the controllables and to model for and understand the impact of the uncontrollables on our financial plans. Especially important today is the ability of tech to act as a deflationary force and drive down costs, savings we can pass on to clients.

Enhancing the client experience

Tech also allows us as a company to enhance the experience for clients. It can help drive transparency, give better access to information and produce illuminating visualisations, and help to automate certain sensible planning steps such as topping up ISAs every year and harvesting capital gains.

Anyone can see just how useful our technology can be by registering for free and by then using the powerful tools to get a much clearer view of how your own financial situation could evolve.

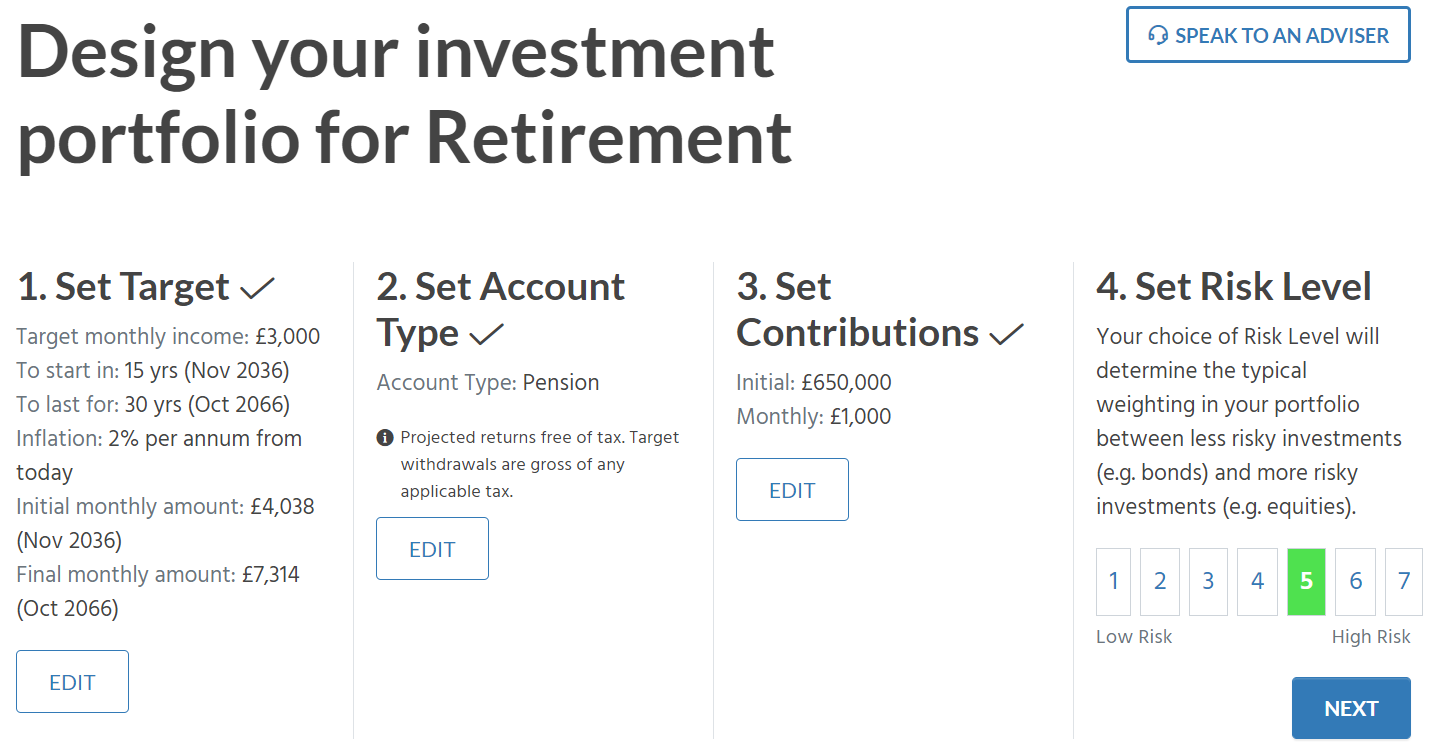

For example, we can highlight a potential retirement projection by assuming an investor:

- Has a target monthly income of £3,000

- Is aged 50 and wishes to retire in 15 years, then plans a 30-year retirement

- Faces inflation of 2% per annum (their initial monthly income will actually be £4,038 to allow for this)

- Invests in a pension account with an initial sum of £650,000 and monthly contributions of £1,000

- Chooses risk level 5 (very close to the traditional 60/40 account of equities and bonds)

Our modelling tool shows how these inputs look:

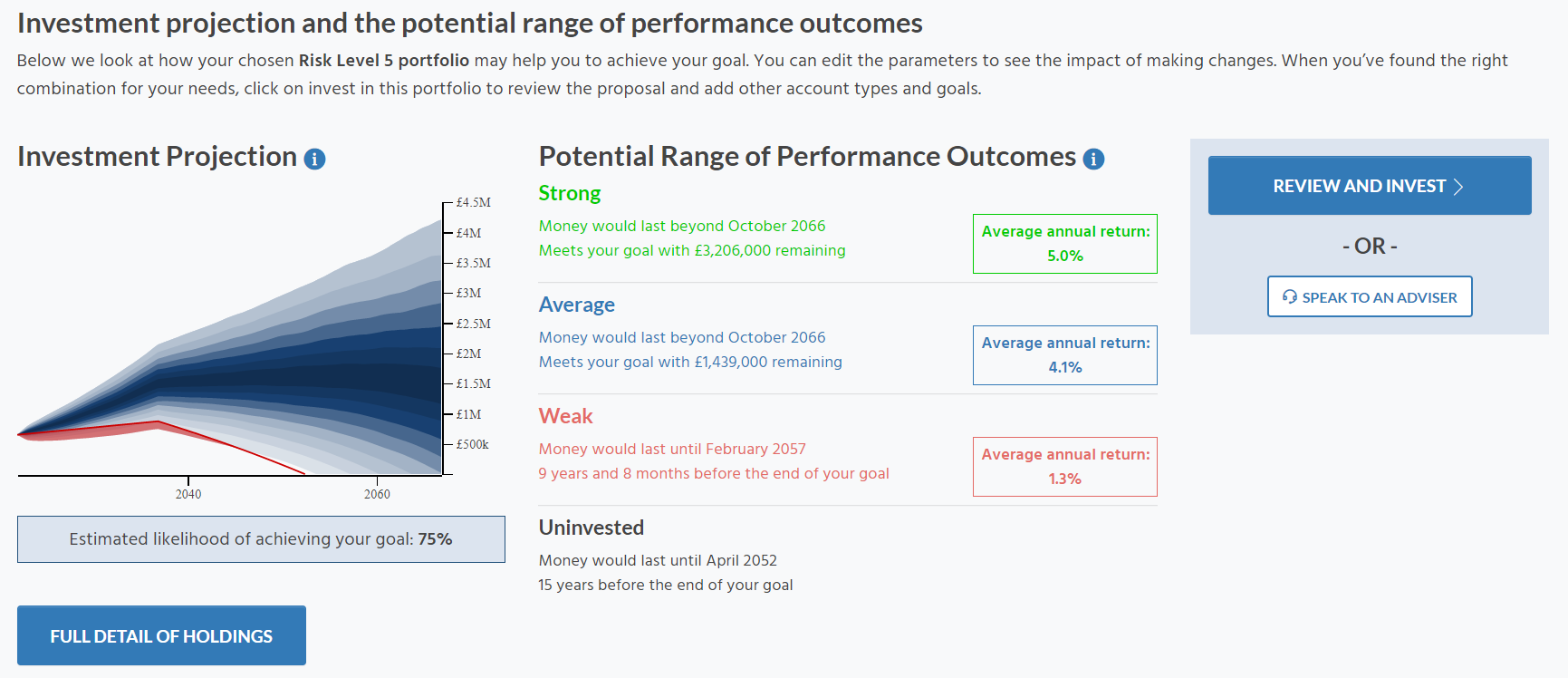

And when we run the simulation we can see what the potential outcomes might be:

Simulated future performance numbers should not be relied upon as an indicator of future performance.

The screenshot above displays a range of potential outcomes, depending on how well the investments perform. Yet even if we project an average annual return of 4.1% (net of fees), their money would last beyond October 2066 by a comfortable margin. Tellingly, if the money is not invested at all we can see it would be depleted 15 years before the end of their goal.

This above simulation is based on the figures in the assumptions above, but they can be changed with ease. Maybe you plan to retire at 70, would like to allow for 3% inflation, have £500,000 to invest, and choose a higher risk level. You can calculate that outcome, and numerous other variations, effortlessly.

The important thing to note is that each scenario can be tailored exactly towards your circumstances – using an ISA or JISA, pension or general investment account. The underlying technology gives us the power to offer this personalised visibility around your investments.

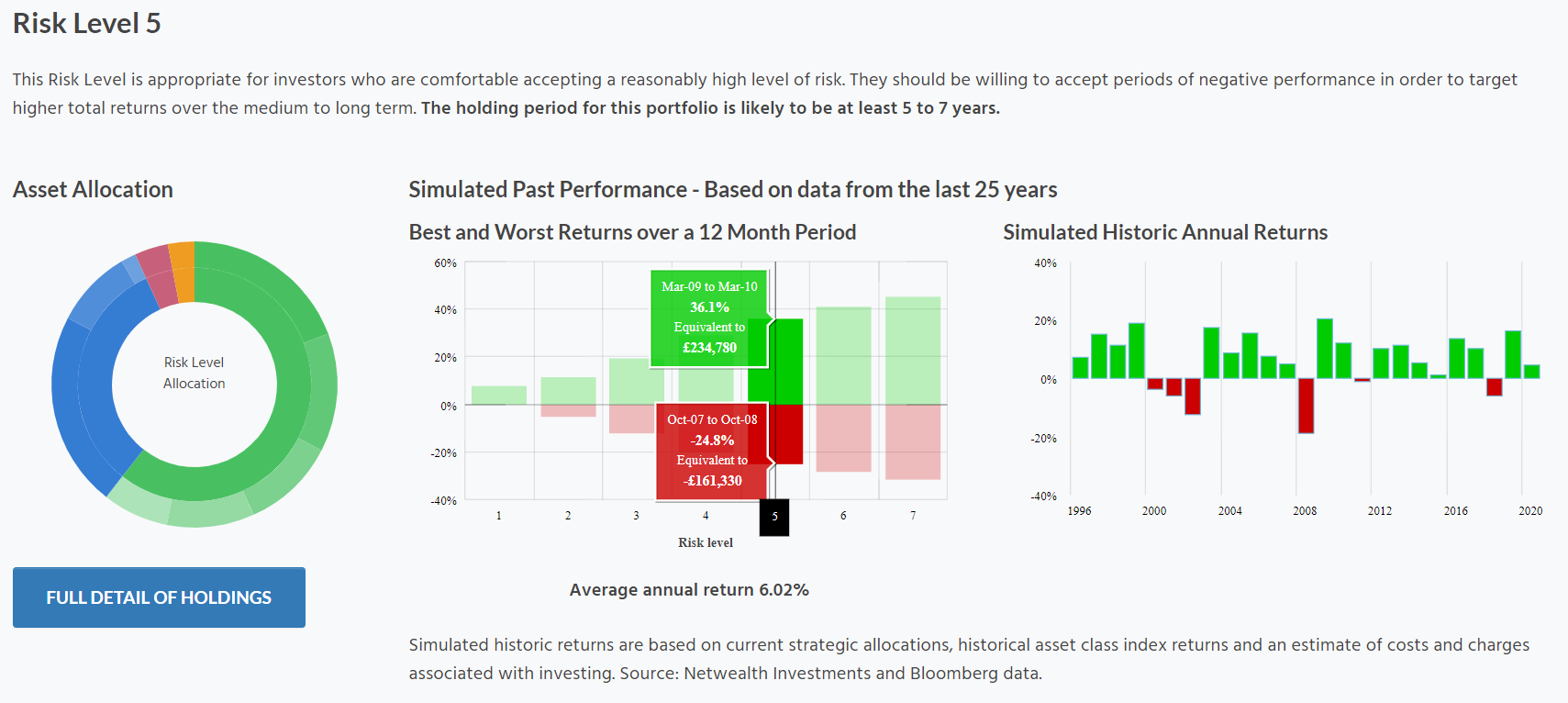

You can easily delve deeper. For example, when you are choosing your risk level you can get a much clearer idea of how a portfolio like this would have performed over time – and a better awareness of the impact of risk.

Simulated historic performance numbers should not be relied upon as an indicator of future performance.

You can also gain transparency in exactly where we invest. When you click on the Full Detail of Holdings button above this is an example of what you will see:

By clicking on any of the assets in the tool (we have expanded High Grade Corporate Bonds here) you can see exactly which funds or ETFs we invest in on your behalf, and the percentage of your overall pot we allocate to that investment.

You have freedom to ask relevant questions and do much more – for whatever your financial plans may be. You can track all your accounts easily, look at the value and composition of your holdings in real time, segment holdings by sector and region and even run your portfolio through different scenarios. For example, you can see how your portfolio would have performed during historic events such as the SARS outbreak or the Lehman collapse.

All of this investment interrogation and analysis is made possible by the kind of technology that any investor with Netwealth can have at their fingertips now.

Time for a change for the better?

Real technological revolutions are rare. But when they come along – like the jet engine and the smartphone – they can change our lives. Yet we probably won’t know for some time whether AI will surpass the sublime intuition of the human brain, or whether a hike in the metaverse will match the splendour of a real-world excursion.

What we do know is that better tech can help us all: firms like Netwealth can work more efficiently (while passing on the cost benefits to you) and you get more control and transparency, and an altogether more rewarding investment experience.

Allow us to help you change how you invest, and see if you could make a meaningful difference to your life, too. If you would like to know more, please get in touch.

Please note, the value of your investments can go down as well as up.