Among the findings, the highlights include:

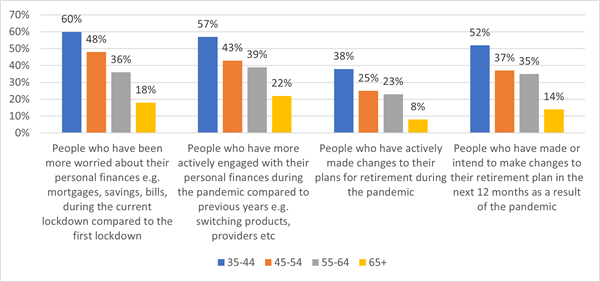

- Working age adults (35-64) are more worried about their finances in the current lockdown than the first (48%), rising to 60% for those aged 35-44

- As a result, those aged 35-64 have been actively engaged with their finances throughout the pandemic – 46% of working adults, compared to 57% aged 35-44

- Concerned about the long-term implications of the crisis, more than a quarter (28%) of adults aged 35-64 have already made changes to their retirement plan, increasing to 38% for those aged 35-44.

The wide-ranging survey, carried out with the research company Censuswide¹, found that almost half (48%) of working age adults in the UK (aged 35-64) have been more worried about their finances during the current lockdown compared to the first.

These concerns are felt most by those at the younger end of the spectrum with 60% of 35-44-year-olds more anxious about their personal finances – including their mortgage, savings and bills – than they were in the lockdown a year ago.

These worries reduce with age: a third (36%) of 55-64-year-olds feel more anxious about their finances during the latest lockdown while only 18% of those aged 65+ express concern.

Concerns have prompted greater financial engagement

According to a recent survey by the Financial Conduct Authority (FCA)², these worries are driven by more than one in three (37%) 35-44-year-olds experiencing a drop in their household income over the last 12 months because of the pandemic.

Combined with the financial pressures associated with this stage of life – including mortgage and bill payments, looking after young children and caring for elderly parents – it is no surprise that the fears of this age group are growing.

In response to these concerns, adults aged 35-44 have taken matters into their own hands. Over half (57%) have more actively engaged with their personal finances, such as reassessing the value of and switching existing financial products and providers. Meanwhile, just 22% of those aged over 65 have done the same.

Younger adults are not just concerned about their immediate financial needs. Those aged 35-44 are most likely to have made changes to their retirement plans as a direct result of the pandemic while more than a third (38%) of this group have already updated their plans due to the impact of Covid-19. This increases to over half (52%) when taking into account those who also plan on making changes within the next 12 months.

Older respondents are less likely to revisit their plans. Only 35% of those surveyed aged 55-64 have made changes to their retirement plans or intend to do so over the course of the next year. This figure drops to just 14% for those aged 65+.

A quest for stability

The most popular changes made by those aged 35-44 focus on achieving greater security and stability in retirement. This is demonstrated by many looking to increase regular contributions to their pension pot (15%), updating their Will (8%) and changing their existing pension product or provider to one that provides better value for money (7%).

Attitudes and actions towards personal finances during the pandemic

Source: Censuswide, Netwealth

“The pandemic has led to increased and often competing financial pressures with many feeling the squeeze more acutely during the latest lockdown,” says Netwealth CEO Charlotte Ransom. “This, combined with the renewed perspective the virus has given many of us, has led to a significant uptick in people thinking more holistically about their futures. It is encouraging that the concerns highlighted have been met with a proactive response from many looking to take control of their financial futures.”

While the COVID-19 pandemic has undoubtedly thrown many people off course with their finances, having a long-term ‘life plan’ is an important tool to help those currently unsure of how they can still achieve key milestones and financial goals over the course of their life.

“We recommend the notion of a ‘life plan’ for all ages,” says Charlotte. “This flexible tool adapts to your changing needs and provides a framework to build long-term financial resilience, taking into account the potential for hostile savings environments over time.”

If would like to know whether you could do better when investing and in retirement our creative planning tools can give you a clearer picture. For example, you can model various scenarios to see if your planned contributions could help you to reach your goals. You can change variables such as tax rates, risk level, contributions and withdrawals to create a useful impression of how your finances could unfold.

And if you would like to know more about how we can specifically help you, we encourage you to get in touch.

Please note, the value of your investments can go down as well as up.

¹Research conducted by Censuswide between 12/02/2021 and 16/02/2021. The survey reached 2,041 UK adults aged 35 and over.

² FCA Financial Lives Survey. Financial Lives 2020 survey: the impact of coronavirus (fca.org.uk)