What is the lifetime allowance?

The lifetime allowance is the overall limit of pension funds you can accrue over your lifetime before an additional tax charge could apply. This applies to both defined contribution and defined benefit schemes, and importantly, the limit includes investment growth, not just the contributions made into your pension over time.

Try our LTA calculator for a clear picture of your own situation

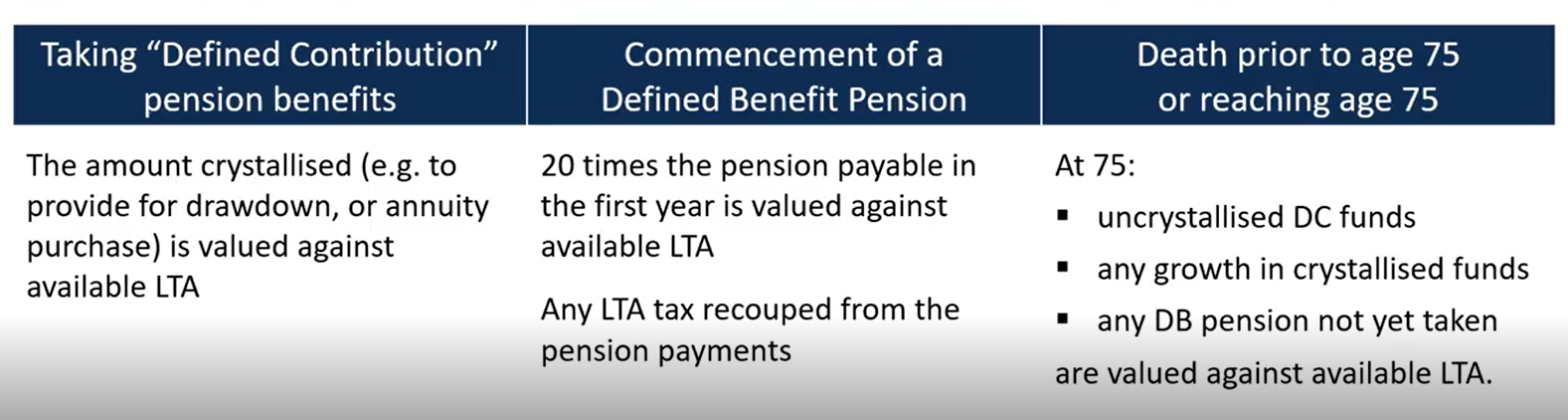

The LTA is currently set at £1,073,100 and has been frozen at this level until 2026. At certain events, known as Benefit Crystallisation Events (BCEs), your pension savings will be tested against the lifetime allowance. There are 13 BCEs in total, and the most common are summarised in the illustration below:

With the LTA level being frozen, more and more people are set to be impacted by the LTA as their pension savings continue to grow – but it’s important to note that you do have options, and a surprising amount of control if you take the right steps to plan effectively.

Planning opportunities you should consider

Everyone’s personal situation is different and subject to your own preferences and objectives, but you should consider both the challenges and the opportunities that the LTA presents. Crucially, think about the wider implications of any LTA planning strategy, from a holistic perspective, rather than in isolation – including any income tax you might pay on crystallised fund withdrawals, potential income tax for beneficiary pensions and inheritance tax considerations.

You should also consider other factors which may affect your LTA position.

- How much do you wish to crystallise? Once you crystallise pension benefits in excess of the LTA you will be charged either 25% on the excess if you plan to take it as income, or 55% if you opt to take it as a lump sum.

- Of course, you don’t have to take your money out – and you have options.

1. Partial crystallisation may make more sense when you are below the LTA, so uncrystallised funds can continue to grow, thereby making better use of the LTA.

2. A full crystallisation strategy can work for those at or around the LTA and seeking to avoid incurring any LTA tax at all (you would also need to withdraw any growth in crystallised funds before age 75 to avoid any LTA tax).

3. Leaving funds uncrystallised may be an option for those with sufficient non-pension assets to provide for their retirement, and are looking to use their pension as an estate planning vehicle.

- Just because you have passed your LTA level, that shouldn’t automatically mean you stop saving through your pension – a pension is very efficient from an inheritance tax point of view. And crucially, if your employer matches your pension contributions, and does not offer cash in lieu, it may make sense to maintain that arrangement as receiving ‘free’ money could outweigh the pain of paying tax on it.

Ultimately, it is often better to pay tax on something than no tax on nothing, so think about your outcome net of tax – which approach will make you better off, based on your personal circumstances and objectives? The calculations and considerations can be rather complex, so it may be worth seeking advice to ensure you maximise your financial potential.

The right tools and advice when you need it

If you register you gain access to a Netwealth specialist who can discuss your specific circumstances and you can also try our useful Lifetime Allowance calculator to help you evaluate how much of an LTA tax charge you might incur. It accounts for numerous variables (including retirement age, current pension value, contributions) and calculates how much over the LTA you may go, before breaking down what you could owe under various taxation scenarios.

You may also find it helpful to watch our webinar on Navigating the Lifetime Allowance. This covers the points above in more detail and offers sound planning considerations to help you aim for a better financial outcome.

As we have outlined in this article, the Lifetime Allowance is complex and multifaceted, but as we have also highlighted, you have choices and opportunities to make the most of your planning arrangements. Our team of expert advisers can help you to maximise your financial potential, so if you want to put your mind at rest, please get in touch.

Please note, the value of your investments can go down as well as up.