Investing via traditional wealth managers can mean paying 1% more every year than with a challenger wealth manager like Netwealth. 1% a year may not sound like a big deal; over time, however, it can become a huge deal.

This difference can help those facing retirement to better maintain their investment targets – ultimately it helps enhance returns in the good times and to offset declines during market downturns.

Be better off if you are facing retirement

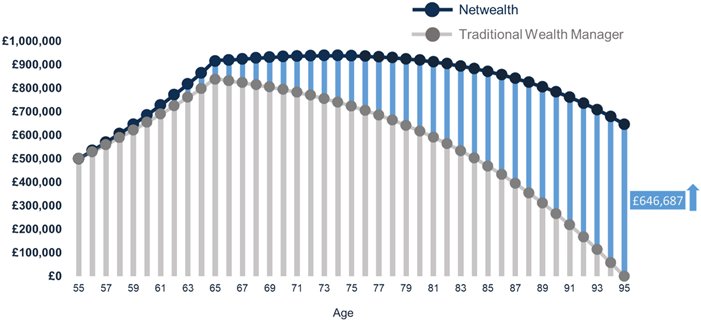

Let’s examine how much better off those nearing retirement can be when they pay 1% less in fees each year.

- Consider a 55-year old investing £500,000 into a pension with a traditional wealth manager. They contribute £1,000 a month until age 65 after which they start to withdraw an annual retirement income of £28,000, adjusted for 2% inflation each year. With investment growth assumed to be 5%, and paying all-in costs of 1.65%, their retirement income lasts until age 95.

- By paying 1% less a year in fees with a firm such as Netwealth, and with the same growth, contributions and withdrawals, their pension pot would still be worth over £600,000 at age 95, hence many more years of retirement income are still available.

Source: Netwealth.

Simulated future performance numbers should not be relied upon as an indicator of future performance.

The significant compounding benefits of lower costs mean that an investment portfolio with 1% lower charges can be so much better prepared for the natural ups and downs of investing – and help those facing retirement to be more confident that they’ll stay on track.

Put another way though, the investor in the example above could afford to increase their withdrawals to £35,000 a year throughout retirement, with the pot still lasting to age 95 – an extraordinary 25% increase in retirement income for a 1% per annum cost saving!

How we maintain lower fees

We invest predominantly through passive funds to ensure high levels of diversification and to help keep costs low. While we focus on passive investments – explained in more detail here – it is by investing strategically across different asset classes and regions that we establish a portfolio mix that gives clients the best chance of meeting their long-term goals.

Using the latest technology also helps us to ensure operational efficiencies and hence keeps costs down – and gives clients greater control and clarity, allowing them to view and administer their accounts much more effectively whenever it suits them.

Lower fees, not a lesser quality service

Challenging the traditional way of managing money doesn’t mean we compromise on quality. Our highly experienced team offers a professional, transparent investment service to help clients and their families achieve their financial goals – at the right price.

Being a challenger also makes us highly adaptive by nature, to respond nimbly when unforeseen events such as the coronavirus occur. This engineered resilience helps us to ensure that clients can plan ahead and look to the future with greater confidence – and potentially have much more in their pocket when they need it most.

Please note, the value of your investments can go down as well as up.