Consider the perils of the breakaway

The combative grit of the lone cyclist scooting away from the pack is a wondrous sight. Yet the odds are rarely in their favour. A study by Frontier Economics found that in a small breakaway group the probability of victory for each rider is just 2.5% – or only 0.5% on a flat stage.

Similarly, investors who focus on a single stock or a small batch of investments may find their faith is also misplaced over the long run. This is why diversification is so important, and why we must not be tempted to gamble on the latest ‘hot’ stock, even if its performance temporarily leaves others by the roadside.

Staying in the saddle

It’s not uncommon for riders to take a tumble in a race or having to abandon it due to exhaustion, injury or for technical reasons. In 2020, 30 from 176 contestants departed the Tour de France prematurely (up from 21 in 2019). Even on day one of the 2021 three-week event, four riders had to go home after two major pileups.

Investors may also be tempted to sit on the sidelines if things are not going their way. But it pays to be persistent and to stay invested, even if that makes for an uncomfortable ride every now and then. Overconfidence can lead investors to believe they have the skills to time the market and to trade excessively, which is usually a costly mistake.

Persistence can reap big dividends on the bike, too… or off it. During the 2016 Tour Chris Froome famously ran up a section of Mont Ventoux when his bicycle was wrecked in a crash with a motorcycle. Although unconventional, after a jury inquiry he was allowed to keep the same time as two of his rivals.

Froome’s tenacity helped him to go on to win the Tour that year.

The impact of marginal gains

British Cycling (the UK’s governing body for professional cyclists) hasn’t always enjoyed such a celebrated presence on the world stage. After a century of mediocre results, it wasn’t until 2003 that it started to make meaningful gains, aided by the hiring of David Brailsford as its new performance director.

Brailsford’s method appeared simple but was very effective. His stated strategy was to aim for a tiny margin of improvement in everything they did – they found that even a 1% improvement in overlooked and unexpected areas could produce significant results.

The approach paid off: at the 2008 Olympic Games the British Cycling team won 60% of the gold medals, they increased their haul at the 2012 games in London, and the same year Bradley Wiggins became the first British cyclist to win the Tour de France. The British team claimed five Tour victories in six years – all of which could be attributed to Brailsford’s laser-focus on 1% gains.

Although it must be said, that while the outcomes still stand, the nature of the approach – and the rigidity of its adherence to sportsmanship – has been severely questioned in court and by the public in the years since.

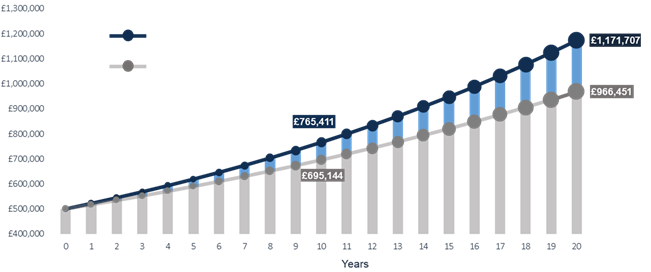

Nonetheless, this outsized impact from a seemingly miniscule effect is no anomaly, and can be evidenced in the world of investing, too. For example, a 1% difference in overall fees (between 0.65% and 1.65%) has a significant impact over time – boosting a £500,000 portfolio by around £70,000 in 10 years and by over £205,000 in 20 years.

Source: Netwealth. Assumes initial sum of £500k, growth of 5% a year, and a difference in fees of 0.65% vs 1.65%.

Simulated future performance numbers should not be relied upon as an indicator of future performance.

It’s all about the team

While only a tiny fraction of riders win tours and gain widespread recognition for their achievements, a formidable team is required to support the potential victors. For example, each of the 23 teams in the 2021 Tour de France has eight cyclists. Most of these (known as domestiques) typically serve their team leader and must do whatever it takes – providing wind cover, shielding them from rivals, fetching supplies etc – to ensure their principal contender has the best chance of success.

Even greater numbers are marshalled behind the scenes to keep the show on the road, although this may be trimmed when racing during the pandemic. A typical team may otherwise have: 4 coaches, 4 mechanics, 2 hospitality staff members, 1 director of cycling, 1 transportation and booking manager, 1 osteopath, 1 communications manager, 1 doctor, 1 chef, and 5 caretakers.

Expertly managing money for clients requires a similarly synchronised and finely-tuned team. From portfolio managers who strategically invest capital, to client services who ensure client requests are efficiently actioned, to the advisers who help clients to effectively meet their goals. And not forgetting the tech team who ensure we are engineered to adapt to all situations – during times of lockdown and when we can pedal more freely.

While happy clients meeting their objectives is our measure of success, we also place a lot of import on our ability to consistently outperform over what sometimes can be quite difficult terrain.

Try a Tour

We can summon other fairly obvious parallels between the Tour de France and investing – the inevitable peaks and troughs, facing headwinds, gaining and losing momentum, the apparent safety of the pack and so on.

Yet some will question why invest at all, if the object of their personal pursuit is to simply reach the finish relatively unscathed. We often refer to the destructive effects of inflation as a rationale for being invested and to explain why for many people it is simply not good enough to leave their money declining in a savings account.

But when it comes to achieving your personal goals through investing we can also refer to a Bradley Wiggins quote, “There is nothing more we like than someone saying it can’t be done.”

So even if you are wary about investing, but value the potential of a highly professional and efficient team – whose focus is to help you triumph – why not take a Tour?

Please note, the value of your investments can go down as well as up.