It’s understandable to be wary of investing when there is so much uncertainty, but holding too much of our wealth in cash – like in a Cash ISA, or bank account – could pose challenges later.

Holding cash can make perfect sense, especially for short-term money management and easy access – but to efficiently grow our money over the long term, we should think carefully about how to allocate our funds effectively.

The ISA season often prompts investors to think about what to do with their savings. But we’re clearly not doing enough: the latest figures from HMRC show that in the 2019-2020 tax year, Cash ISAs accounted for 75% of ISA accounts funded in the year and four times as many new subscribers chose cash ISAs compared to stocks and shares ISAs1.

Why does this matter?

Moneyfacts figures show that the best rate for a fixed 1-year cash ISA is 1.35%2. The average rate is somewhat lower, with easy access cash ISAs offering 0.77%. The most recent inflation figure (January 2022) showed that the Consumer Prices Index rose 5.5% over a year according to the Office for National Statistics.

Even if inflation reverts to its recent long-term average of 2% in the next year or so – not by any means guaranteed – you can still see that cash savers have a big problem. Over time, the imbalance between the cost of living and what you may typically receive in a Cash ISA will play havoc with your long-term pot.

Leave your money nestled in a bank account and you won’t fare any better.

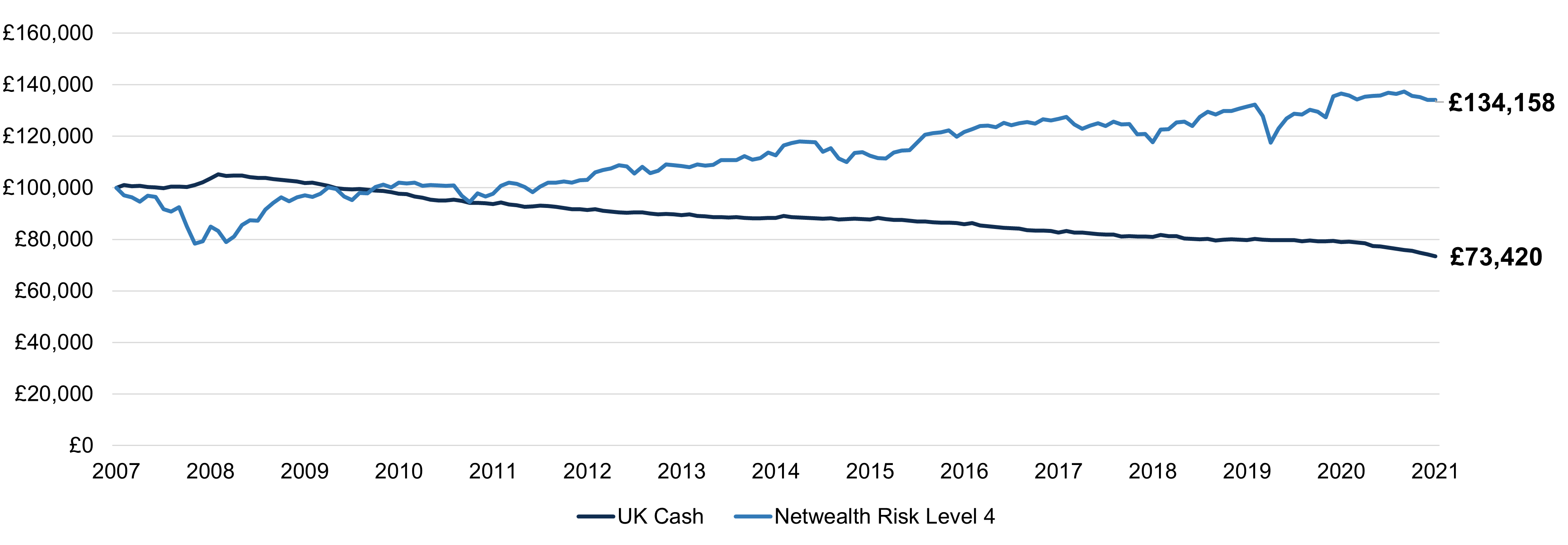

Let’s take the period from the end of 2007 to the end of 2021, a time of strong growth for the stock market overall, but also involving a considerable decline. If you had left your nominal £100,000 lounging in a bank account its actual purchasing power – after retail price inflation – would have slumped to £73,420.

By investing in a balanced portfolio on the other hand, such as Netwealth’s medium risk portfolio (Risk Level 4), your capital would have risen to £134,158 over the same period.

While savings erode over time, a balanced portfolio could be the solution

Simulated past performance is no guide to future performance.

Source: Bloomberg, Netwealth calculations. Return series are calculated as the total return on the UK 1m LIBOR Cash Index, deflated by RPI, for UK Cash. The Netwealth Risk Level 4 return series is the simulated historical performance of the current strategic allocation, net of management fees and underlying fund costs, deflated by RPI.

Since the end of 1984 global equities have returned in excess of 9% annually3. And while the level of future returns is not guaranteed, it is clear that by taking some risk – aiming to capture some of the long-term growth of equities – gives you a much better chance of protecting against the effects of inflation compared to cash.

How you can mitigate the effects of inflation

Of course, not everyone is comfortable taking risk, even if they intuitively know it is the right thing to do to protect their money over the long term. This is why using professionals to invest on your behalf can help you get started with more confidence.

"We give investors a choice of seven diversified portfolios with different risk levels," says Iain Barnes, Netwealth’s head of portfolio management. "This means that investors can choose from very low risk, which invests mainly in high quality, often short-dated bond funds, to a portfolio that is concentrated in growth assets like equities – with various mixes of investments, and therefore levels of risk, in portfolios between these two poles."

Because you can tailor risk levels to suit your preferences, choosing to invest, therefore, is not a binary choice of yes or no. To avoid the depletion of your funds due to inflation, a low-cost, diversified portfolio managed for you could be an ideal option for your long-term investing needs.

If you would like to know more about how we can help, please get in touch.

Please note, the value of your investments can go down as well as up.

Sources:

1 HMRC ISA statistics, June 2021.

2 Moneyfacts March 2022 ISA figures.

3 MSCI World Total Return Index denominated in GBP, for the period 31-Dec-1984 to 31-Dec-2021.