How younger investors are feeling now

“I wish I hadn’t invested”

“I regret investing”

“Why didn’t experts see this coming?”

“When will stocks recover?”

The above quotes – extracted from recent conversations with friends and peers – give a sense of how many younger investors are feeling now.

And this is during an investment environment that has been broadly favourable over the past few years, although punctuated by periods of extreme volatility because of Covid-19 and this year, by the war in Ukraine, higher inflation and fears over slowing global growth.

During the pandemic, many investors had the time and resources to invest in stocks and collective funds (Peloton, Zoom, Tesla and tech focussed funds etc.) – often through nascent platforms such as Robinhood, AJ Bell and Freetrade – that did well amid enforced lockdowns and reached stratospheric valuations last year, but suffered when more social habits re-emerged.

Over this time we have also seen great interest in what some may call ‘spicier’ assets. These include certain technology investments, so-called meme stocks (eg, AMC, Blackberry) and cryptocurrencies. Much of the commentary around these assets has been prominent on social media, and many younger investors have gravitated towards them – for their exuberant narratives, their hyper-growth trajectories or for fear of missing out.

But these investments haven’t always performed as investors have expected – or hoped. This helps to explain why so many younger investors are feeling burned now.

Context is important

Many younger investors may now feel investing is not for them. It’s not irrational to believe therefore that simply setting money aside regularly is the best way to build a pot for the future – whether to save for a property deposit, a car or education.

Yet you should also consider the long-term potential of investing in global stock markets. While share prices around the world have tumbled in the past few months, it’s worth looking beyond that timeframe – to 5, 10, 20 years and beyond. This is the best way to get a fuller picture of whether investing might be right for you.

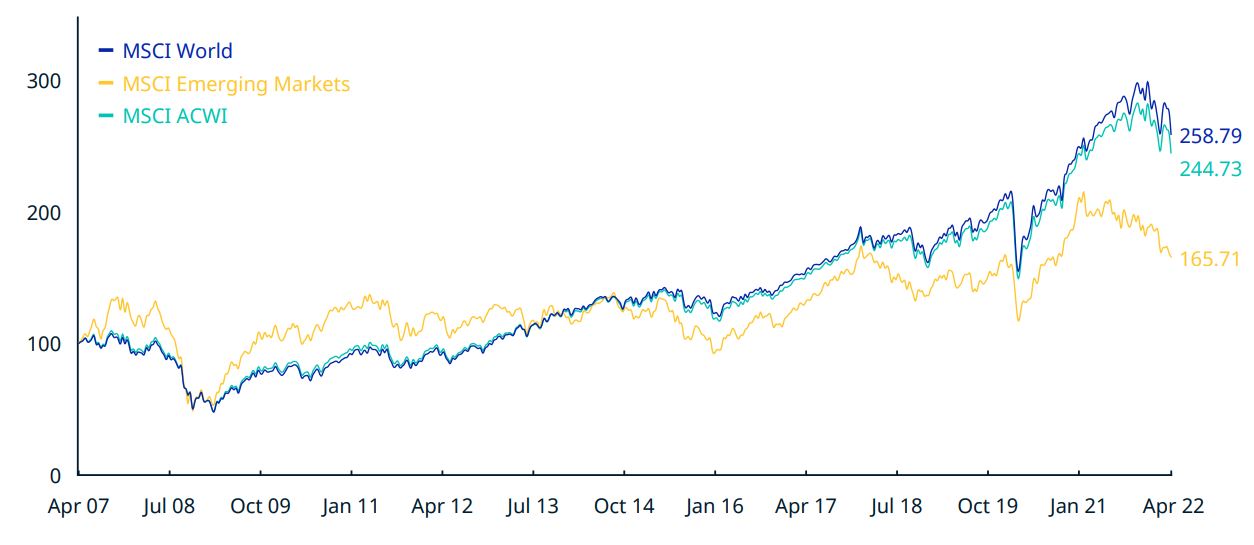

You can see below, for example, how a leading global index (MSCI World) has performed since 2007, just before the Great Financial Crisis, and how it has recovered since, but dipped recently.

Source: MSCI. Cumulative index performance from end April 2007 – end April 2022, gross returns USD.¹

You can see that while the general trend is strongly up, there will be periods when markets do fall – and they can be stressful (some sectors such as tech have fallen even more recently) – but it’s important to invest according to your own objectives, timeframe and how you consider risk.

What to remember

Several key aspects about investing can act as a crucial north star for anyone investing over the long term.

The relationship between your objectives and time horizon – risk must be considered in relation to your goals. You should avoid gambling on short-term wins to pay for something you have targeted to achieve in 3 to 5 years or more. You might get lucky with the timing but if not, you could experience a short-term drawdown leaving your plans in tatters. We as investors know that timing the market is difficult, so time in the market is the most important thing.

When you invest and your holdings immediately go up, that is a great feeling, and it often feels worse when your holdings immediately go down. But over a longer time horizon these tend to iron out, and you can stagger your investment to reduce the impact of large swings in your investment value early on.

Understand that risk needs to be managed – putting all your eggs in one basket is riskier than diversifying your investments by asset class, geography and sector. This links back to your time horizon: if you have a 30-year time horizon then concentrating into one area of high conviction may be more appropriate (though still risky) than for a 1-3 or 5-15 year time horizon. At Netwealth we focus on harvesting returns from a variety of assets across the whole market cycle, and not just when one area is booming.

Stay invested – if you have selected funds or stocks, give them time. Short-term volatility can lead to panicking – often due to psychological biases – so try and keep a cool head and reflect. If the underlying investments seem sound, then be patient. Ask for advice from a professional if you can.

At Netwealth our financial advisers can review your portfolio for free and give you clear information on your situation to help you make your own decision. You can then invest in our actively managed risk adjusted portfolios, managed by a team of experts, so that you don’t have to worry about whether your decisions or process are up to scratch.

Be aware of the costs – some funds and platforms can be more expensive than you think. If your investments are going down, the additional costs can make that worse. Equally, over time, lower costs when your investments are going up can really boost your compound return.

Think about inflation – while inflation now is much higher than the long-term average over recent years, even when, as expected, it reverts back to a much lower level you should still plan for its effects.

Many of these factors above can be addressed by preparing for what you can’t control (such as inflation and market movements) and managing what you can control. By taking this approach you can make a meaningful difference to your long-term financial outcome.

In the short term it is understandable why newer investors may feel put off by the thought of investing, but recognising that ups and downs are a normal part of growing your wealth can help you to see the bigger picture – and act accordingly. Think long term: regular investments from your salary at a rate you can afford in a risk adjusted portfolio is a tried and tested way to build your wealth, enabling you to live the good life.

To find out more about how we can help, or if you need advice tailored to your specific circumstances, please get in touch.

Please note, the value of your investments can go down as well as up.

Our advisers offer restricted advice that relates to Netwealth’s products and services and does not consider the whole market. Netwealth does not provide tax or legal advice and does not advise on transfers of pensions with safeguarded benefits.